Alongside Monad, Base & Farcaster, Flying Tulip is another project to keep an eye on, especially because it introduces meaningful improvements in both its operating model and fundraising mechanism.

With guidance from Andre Cronje and a target raise up to $1B, the key question is how high FT could go at the time of TGE?

What is Flying Tulip ?

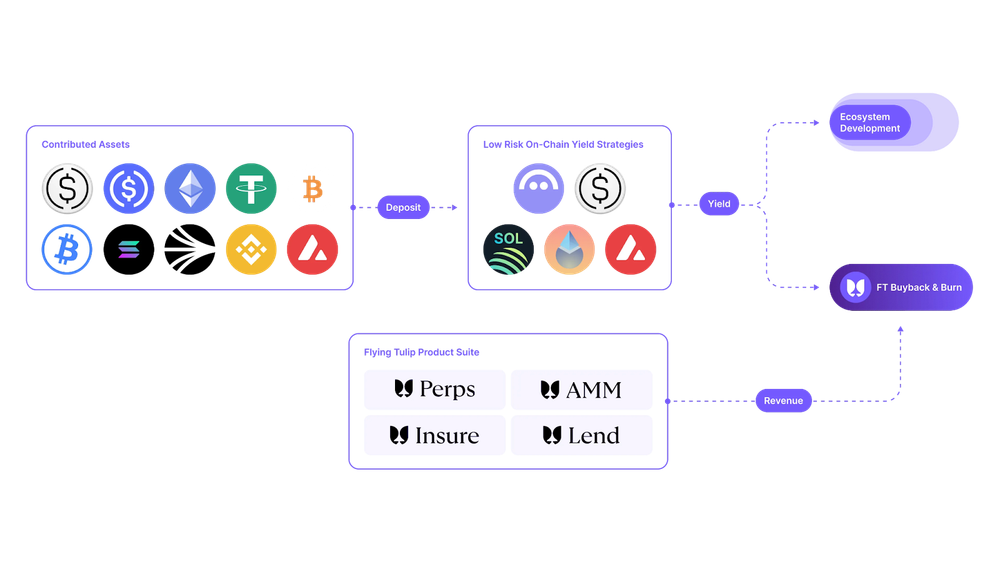

Flying Tulip is a new DeFi protocol led by Andre Cronje, the mind behind Yearn Finance and Sonic. This time, he is taking a very different path. Instead of depending on outside investors, Flying Tulip is built around real yield, driven by actual protocol revenue, and that shift is already drawing serious attention across DeFi.

Guided by the motto “Better Yield, Better UX,” Flying Tulip aims to tackle DeFi’s fragmentation problem by building an ecosystem that is more efficient, more capital-efficient, and safer for both retail users and institutions.

What makes Flying Tulip unique

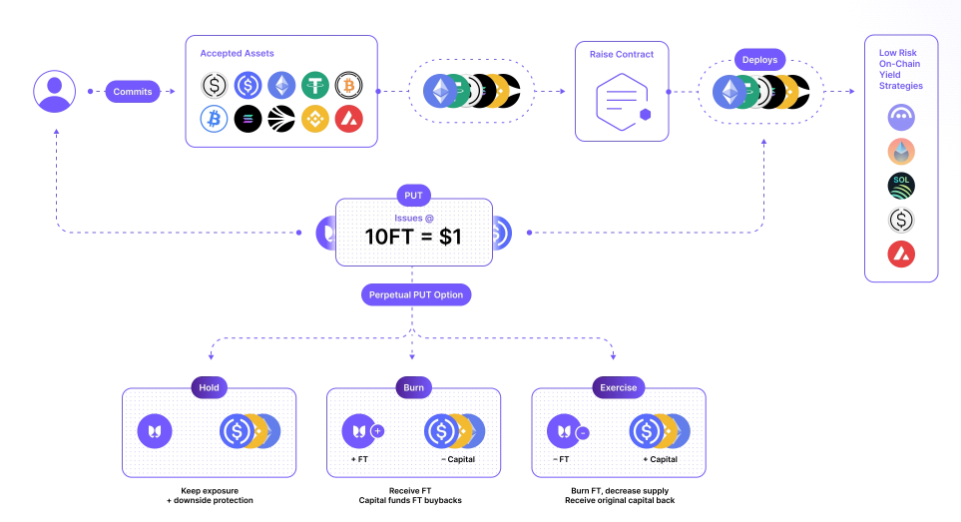

At the core of Flying Tulip’s FT token lies a Perpetual Put structure, where a form of “perpetual put option” is built directly into the token design. When users join the fundraising, they do not simply receive $FT in their wallet. Instead, FT tokens are wrapped inside a special NFT that represents the right to reclaim their initial capital at any time.

While the FT tokens remain locked inside this NFT, the holder can always redeem the full original amount, paid back in the same asset they deposited, without any expiry date or extra conditions.

Once the holder decides to unwrap the NFT so the FT tokens can be traded or sold on the open market, this redemption right disappears immediately.

For Example:

- An investor deposits 1,000 USDC and receives 10,000 FT, implying an entry price of 0.1 USDC per FT.

- If the market price later falls to 0.05 USDC per FT, the investor can redeem the NFT and withdraw the full 1,000 USDC, while the associated FT is burned.

- If the price instead climbs to 0.5 USDC per FT, the investor may unwrap the NFT and sell the FT on the market for 5,000 USDC, but from that moment on, the put protection no longer exists.

This setup gives holders confidence that their initial capital is always protected at par value as long as it remains in NFT form. Because the NFT itself is transferable, the embedded redemption right can also be traded freely between different participants.

Read more: Flying Tulip - Is Andre Cronje’s DeFi Masterpiece Truly Perfect?

What will $FT reach upon listing?

Comparison With Other Projects Method

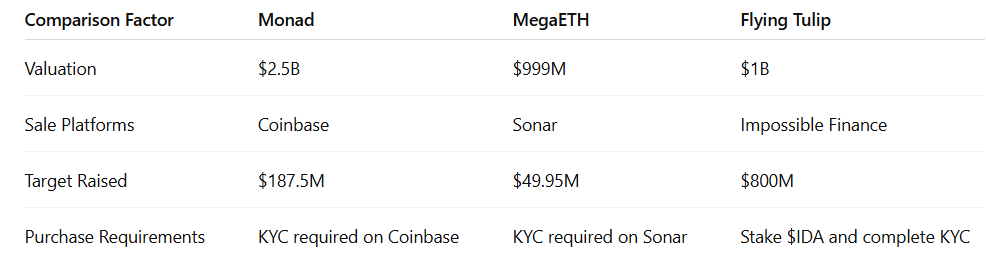

When comparing Flying Tulip with other community-driven public sales, Monad and MegaETH are two of the closest benchmarks.

Let’s look at a few key funding mechanics:

MegaETH successfully raised an oversubscribed 27.8x sale with total commitments reaching $1.39B. Monad is also on track to hit its $187M target, although the pace of oversubscription has not been as strong as the community initially expected.

A reasonable explanation is that many users faced difficulties completing KYC on Coinbase, which slowed participation.

Flying Tulip, on the other hand, has an advantage: investors are allowed to redeem their initial capital. This structure makes the likelihood of successfully raising $800M more plausible.

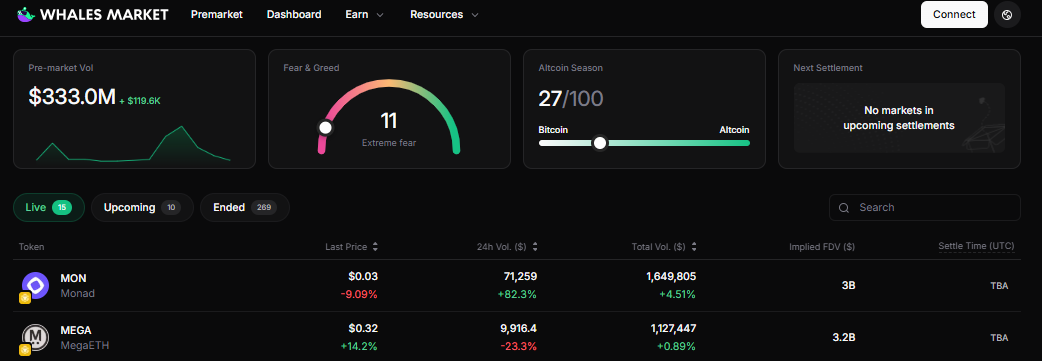

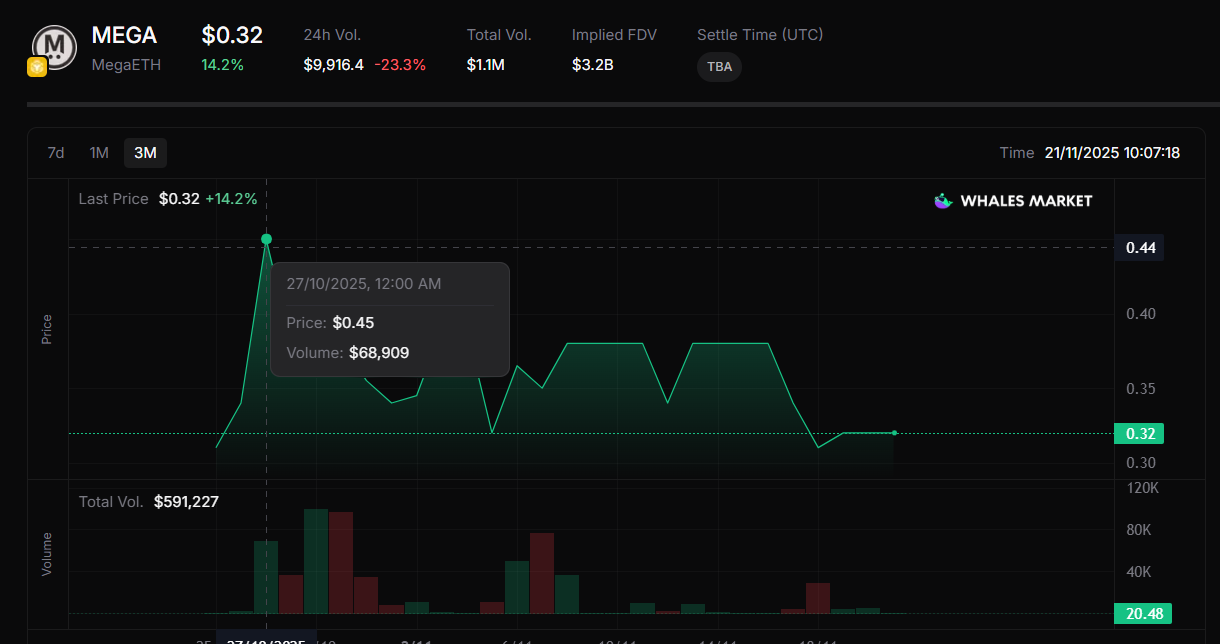

Based on pre-market data from Whales Market as of November 22th, the following reference points apply:

- MegaETH raised at a $999M FDV and is currently trading around a $3.2B valuation in pre-market.

- Monad raised at a FDV of roughly $2.5B and is trading around a $3B valuation pre-market.

With Flying Tulip raising at a $1B FDV, the project’s expected valuation could reasonably fall in the $2B to $3B range.

FT sells out completely

In reality, there are very few projects on the market operating in the same niche as Flying Tulip, which makes it difficult to find proper benchmarks or build a reasonable valuation. This article should therefore be viewed only as a reference.

What makes Flying Tulip difficult to value lies in how the project operates. Although its model shows many improvements on paper, it must be tested once real capital begins flowing through the ecosystem in order to evaluate its effectiveness.

Since Flying Tulip’s fundraising mechanism is quite unique, it will directly affect the valuation at the time of TGE.

- The FT token will unlock 100% at TGE. If $1B is raised and all 10B FT tokens are sold, the initial circulating supply of FT will be 10B. The project has not yet provided a solution for the possibility of unsold tokens, although the likelihood of selling out is high because investors can redeem the token at a 1:1 ratio with their initial deposit at any time. This gives participants a sense of security.

- $200M has already been raised from VCs. The remaining $800M will be sold to retail investors through Impossible Finance and CoinList.

To be precise, there are 2 scenarios that may affect the price of FT at TGE.

If 100% of FT is sold, the market cap or FDV will remain close to $2B-$3B. This valuation will likely be relatively stable for the following reasons.

- First, most investors who buy FT understand the project’s mechanism and know that their initial capital is protected. At minimum, they will not take a loss and only need time to generate returns through the Foundation’s strategy.

- Second, in the early phase, Flying Tulip has very few incentives to stimulate secondary market activity for FT.As a result, the market cap is likely to trade above $2B. The project will not yet be generating unexpected or massive revenue that could attract secondary market investors and create strong buy demand.

Unless unexpected events or information appear between now and TGE, if everything remains the same and Flying Tulip successfully sells 100% of its FT tokens, a valuation above $2B at TGE is relatively likely

FT does not sell out

If FT is not sold out, the project’s valuation will correspond directly to the number of tokens sold. For example:

- If 50% of FT is sold, the FDV would be around $1B - $1.5B

- If 70% is sold, which would correspond to around $1.4B - $1.9B, or 80%, which would correspond to around $1.6B - $2.2B.

Note: These examples are written in the context that the project has not announced how it will handle the situation if the full 10B FT tokens are not sold.

A special characteristic of Flying Tulip that keeps the FDV closely tied to the amount of tokens sold is the following.

- The project commits to protecting losing participants through a perpetual put option.

- Secondary market investors can already see the model and the project’s revenue, estimated at $40M - $50M per year.

- To validate the system’s effectiveness and understand how capital circulates to generate revenue, investors will need to wait for a relatively long period before making further investment decisions.

➥ The clarity and transparency across all stages allow investors to estimate the broader picture more easily.

It is also important to note that buying FT on the secondary market, such as on a DEX or exchange after TGE, does not include the right to redeem the token for the original principal.

This right belongs only to primary participants who buy directly from the project. If users withdraw the token to trade freely or buy it second-hand, the redeem right is forfeited. This creates a dual-layer structure for the token:

- Primary buyers have downside protection.

- Secondary buyers only have normal market exposure.

This further reinforces why Flying Tulip’s valuation seems tightly linked to the number of FT tokens sold.

Market Sentiment Method

Bull Case (FDV $3B - $5B)

In the bull scenario, Flying Tulip could trade in the $3B - $5B+ FDV range at TGE, which would be around two to four times the raise price.

The main driver here is the perpetual put option, which effectively sets a valuation floor near $1B FDV and reduces the risk of aggressive token dumping.

On top of that, if the broader market continues to recover, sentiment will likely support higher valuations. For reference, before BTC dropped to $84K, MegaETH was trading around a $4.5B FDV when BTC was at $114K.

Base Case (FDV $1.5B - $3B)

In the base case, Flying Tulip’s FDV stays roughly in the $1.5B ~ $3B range, holding close to the raised valuation. The protection mechanism helps keep the price anchored around $1B, since investors are not forced into a loss and can wait for real revenue to come in.

This behavior would be broadly consistent with how $MON (Monad) and $MEGA (MegaETH) have traded when BTC was moving sideways around the $100K area.

Bear Case ($900M - $1.5B FDV)

In the bear scenario, FDV could compress into the $900M - $1.5B range. If market conditions turn negative, it is very plausible that a meaningful share of investors choose to redeem and take back their principal at TGE.

That dynamic can create selling pressure, and even if there is no panic, simply failing to hit the full raise target could weigh on sentiment and lead to a lower realized valuation for the project.

Readmore: Is Andre Cronje’s DeFi Masterpiece Truly Perfect?

Factors Influencing the $FT Price at TGE

Although Flying Tulip’s mechanism is clear and makes buying or selling at TGE less appealing, there are still several factors that could influence the FT price and should not be ignored.

Market Conditions and Investor Sentiment

If market conditions are poor, investor sentiment may become defensive. In this scenario, several factors may cause participants to redeem immediately at TGE, including:

- Concerns about security risks in DeFi.

- Concerns about contagion from failing DATs (since Flying Tulip allows ETH, AVAX, and SOL to be used to participate, and these are the primary assets used by DATs in this cycle, so their prices could drop significantly compared to when investors deposited to buy FT).

- Preference to hold cash for other opportunities in a bear market instead of waiting for Flying Tulip’s entire system to operate and buy back tokens.

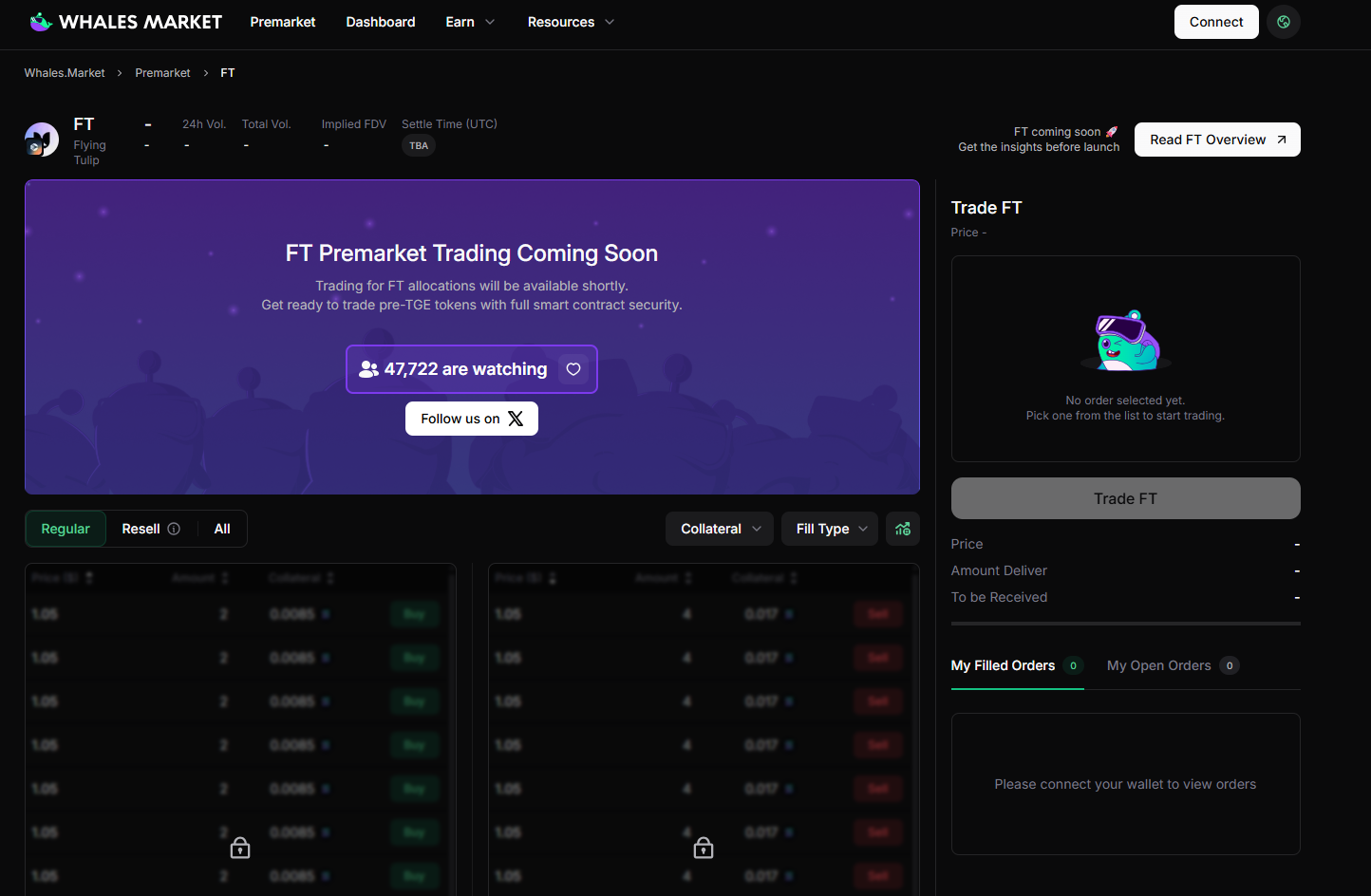

Pre- Market Data

FT is expected to trade early on Whales Market. If the price on Whales Market exceeds the $3B - $5B implied valuation due to liquidity or insider information, sell pressure may appear. In this case, using the full token supply multiplied by this price to infer an initial fair valuation will no longer be accurate.

Users may use this data as a reference point and take profit if possible, especially as the crypto market appears to be entering a bear phase if the 4-year cycle remains intact.

Read more: Is 4 years cycle over?

Conclusion

This article aims to give readers a clearer idea of Flying Tulip’s valuation after TGE. In the short term, FT’s price may not fluctuate significantly, although the long-term story is completely different.

The project must successfully manage and deploy the enormous amount of capital exactly as it has presented to the community.

FAQs

Q1. What is Flying Tulip in simple terms?

Flying Tulip is a crypto project that combines a new fundraising model with a structured downside protection mechanism, targeting up to $1B raised and tying its FT token value closely to the amount actually sold.

Q2. How does FT’s fundraising and unlock model work?

FT is designed to unlock 100% at TGE. If $1B is fully raised and all 10B FT are sold, the initial circulating supply will be 10B tokens. Primary buyers can redeem FT at a 1:1 ratio against their original deposit, which helps protect their principal.

Q3. Why is it difficult to value FT before launch?

There are very few comparable projects in the same niche, and Flying Tulip’s model still needs to be tested with real capital flows. Until the system runs and generates observable revenue, any valuation is mostly a reference estimate..

Q4. How are primary buyers different from secondary buyers?

Primary buyers who purchase directly from the project can redeem FT for their original capital. Once tokens are moved to trade freely or bought on the secondary market, that redeem right is lost. Secondary buyers only have normal price exposure without downside protection.

Q5. What is $FT pre-market price?

$FT is listing upcoming on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300M in volume, no middlemen, trustless and on-chain.

Q6. What is the price of FT token today?

While $FT hasn't been listed yet, users could trade $FT pre-market soon on Whales Market before the TGE. Here you can trade $FT before the asset gets listed on leading CEXes like Binance, Bybit or OKX.