The crypto market is entering a new cycle, where the game no longer revolves around free airdrops. Investors are no longer waiting for luck, they are actively seeking early profit opportunities.

In this context, the trading zone for tokens before listing like pre-market has become the “underground arena” for those who can read money flow signals. When the Fully Diluted Valuation (FDV) on pre-market is lower than the FDV set for the upcoming raise, buying pressure can surge almost instantly.

Airdrop Era is Ending

Airdrops were once the golden strategy for building communities. Projects distributed free tokens, hoping recipients would become loyal users and spread the brand. This model triggered explosive waves of attention, Discord servers packed with people, X buzzing with shill posts, and TVL skyrocketing in just days.

However, as the market matured, the impact started to fade. Airdrops became so common that they diluted real community value, with most participants showing up only for quick profits.

Instead of nurturing real users, projects unintentionally fed a group of “reward miners” ready to dump their rewards at TGE. As a result, many tokens ended up becoming exit liquidity, with capital flowing out instead of circulating back to grow the ecosystem.

To solve this, a new trend emerged: Public Sale.

Rather than giving away tokens, projects sell them early to the community. This makes participants feel they are truly investing in value, while projects gain more sustainable capital inflow.

Key shifts in this fundraising model include:

- From free to paid: Users must invest real money, but in return, gain early access at preferential prices.

- From hype to valuation: Communities now care more about FDV, tokenomics, and project fundamentals rather than just following trends.

- From short-term to long-term: Investors tend to hold because they believe in the project’s intrinsic value, not just to dump after TGE.

Here are some notable examples:

- $PUMP raised nearly $600M at a $4B valuation. Even after post-TGE adjustments, early buyers still earned around 75% profit.

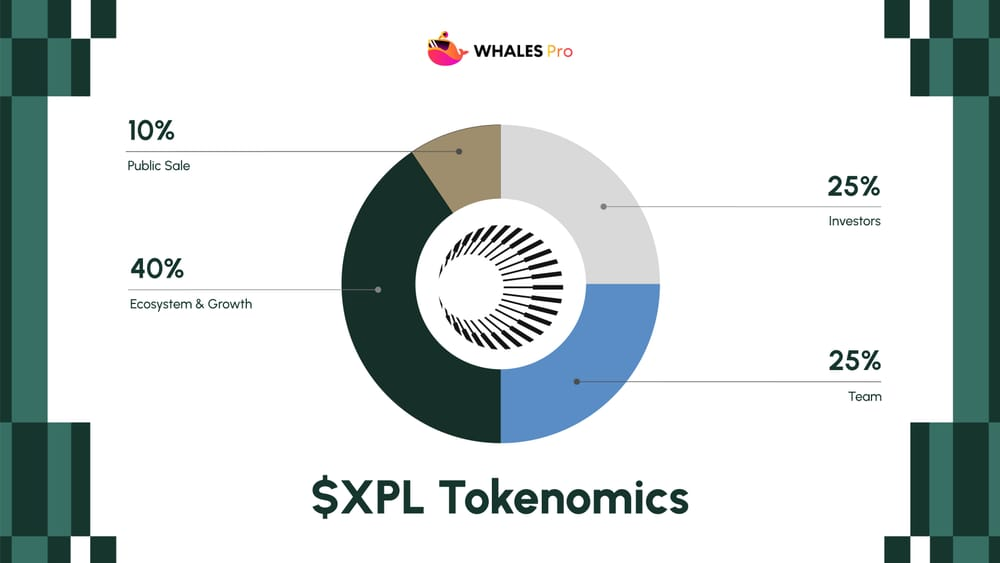

- $XPL launched its IDO at an FDV of $500M, which later surged to $15B after TGE. In addition, participants received airdrops worth over $10,000.

These cases show that Public Sales don’t just replace airdrops, it open a new era where valuation and investor psychology define the TGE market. And that shift has paved the way for the rise of the pre-market, where the real value game begins.

The Rise of Pre-Market: Where Capital Moves Before ICO

As Public Sales became the trend, investors could stopped waiting for official launches. A layer emerged, where tokens trade even before TGE, pre-market like a buffer zone between expectation and reality. Trader, who understand money flow could move ahead and capture profits before the market opens.

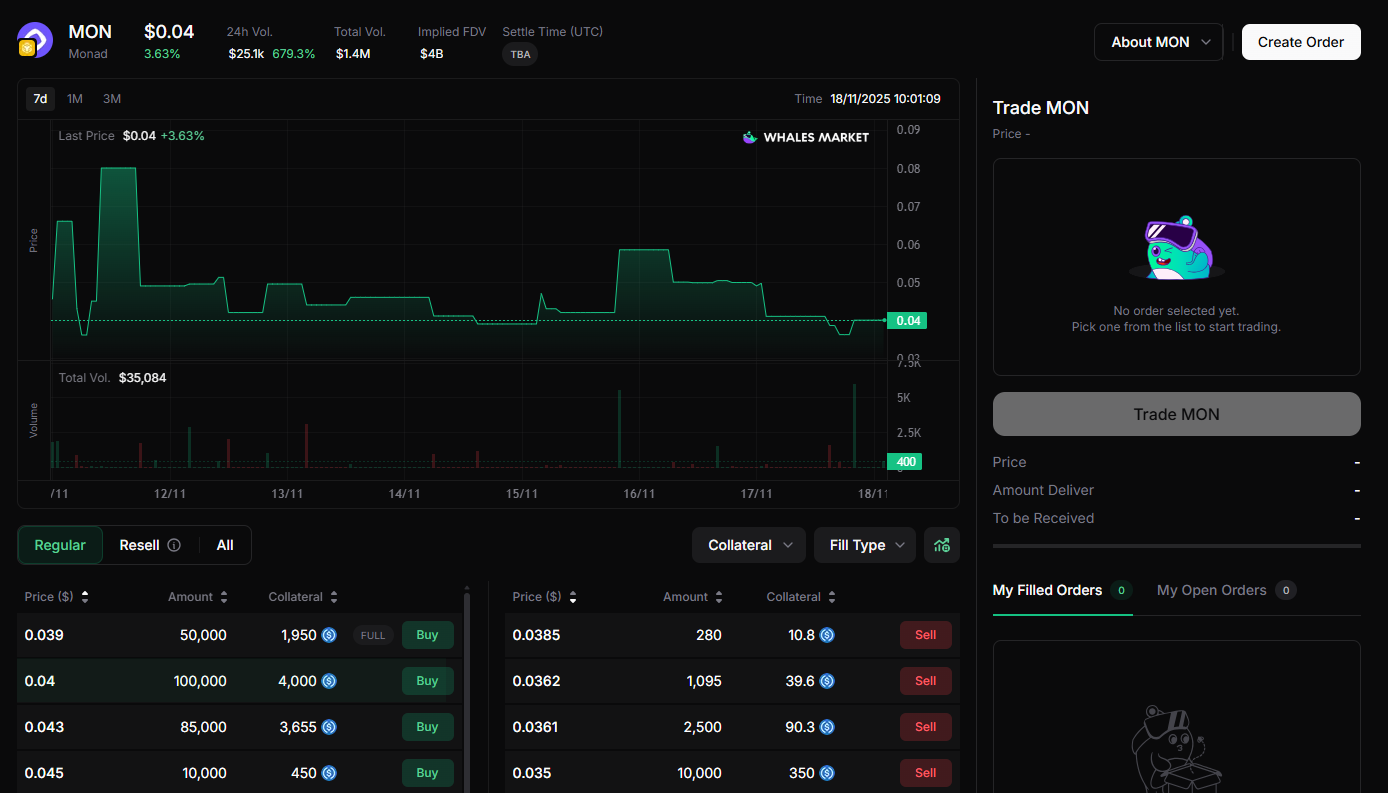

Pre-market activity largely revolves around FDV (Fully Diluted Valuation), which represents the project’s total value if every token were unlocked. When projects announce their raise, investors immediately compare the FDV on pre-market with the one at the upcoming funding round.

If the pre-market FDV is noticeably higher, traders often treat it as an arbitrage play. For example, imagine user secure their $1,000 allocation in the Public Sale at a $1B FDV, but the same token is trading on the pre-market at a $2B FDV. In that case, they could lock in profits even before the token officially launches.

The pre-market mechanism can be broken into three steps:

- Early Valuation: Investors assess the FDV currently trading on pre-market.

- FDV Comparison: They compare it with the project’s official FDV to spot value gaps.

- Capital Reaction: When the gap is large enough, capital rushes into pre-market to capture the upside.

This makes pre-market not just an early trading zone, but also the market’s valuation radar.

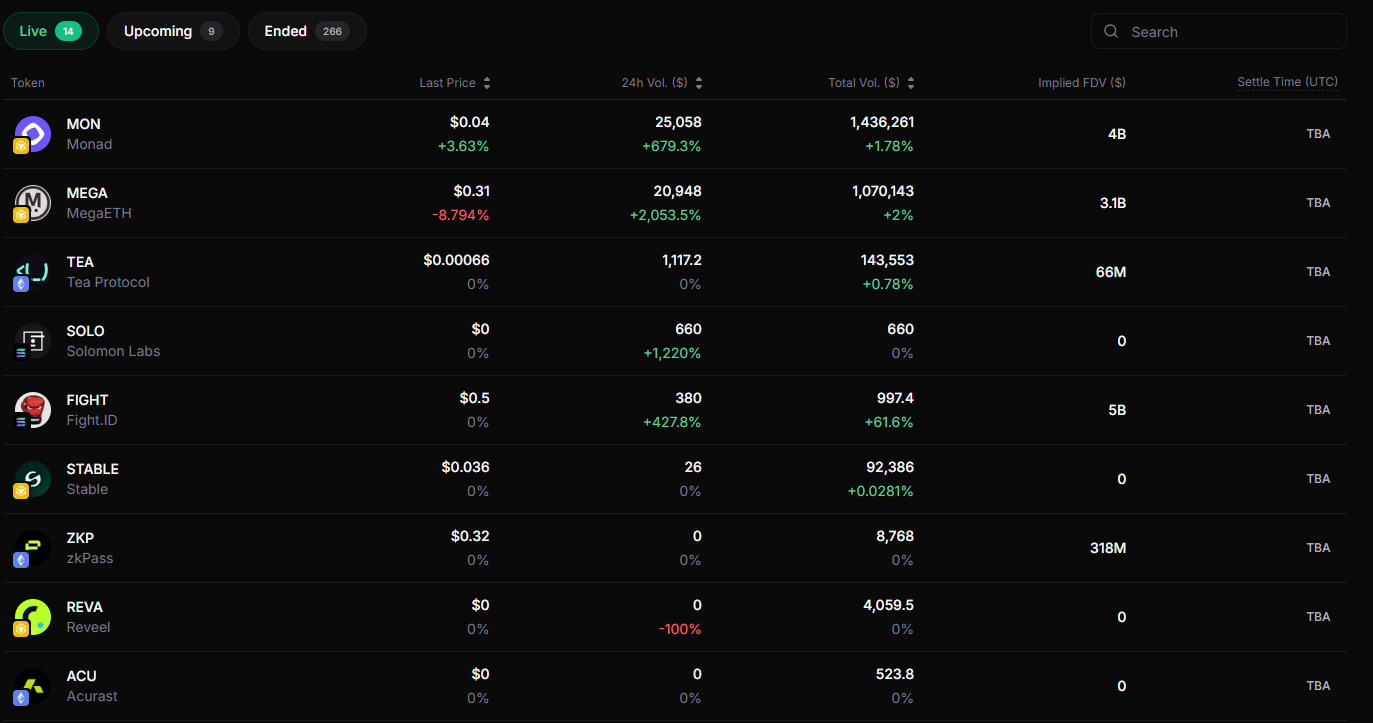

Within this ecosystem, Whales Market stands out for bringing transparency to the pre-TGE phase. Instead of risky, opaque OTC deals, Whales Market provides clear data on price, liquidity, and trading volume, allowing investors to see the full picture.

Those who closely track this data can detect early money flow signals, knowing which projects are heating up and which are losing traction.

Two ICO projects currently capturing the market’s full attention are MegaETH and Monad:

- MegaETH raised $50M at a valuation of around $900–999M, with the offering oversubscribed by 25 times.

- Monad is preparing to raise $187.5M at a $2.5B valuation, even though its product has not officially launched.

To better reflect the market’s expectations for these two projects, one can look at their valuations on Whales Market:

These examples clearly illustrate how today’s market places early bets on valuation rather than waiting for the token launch. As a result, the pre-market has become more than just a trading space, it now serves as an early indicator of confidence and expectation.

That said, pre-market remains a high-risk playground. Liquidity can be unstable, data may lack depth, and prices often fluctuate sharply once TGE happens. Yet, in this uncertainty lies the real alpha, those who can read FDV dynamics and understand market behavior often find rewards unavailable to slower players.

Conclusion

The pre-market is more than an early-stage trading arena, it’s a new indicator of market confidence. As capital begins to move based on data and valuation rather than hype, this evolution marks a shift toward greater transparency and efficiency in the crypto landscape.

FAQs

Q1. How is pre-market different from traditional IDO/ICO?

Pre-market takes place before TGE, where investors can freely trade unlisted tokens, while ICOs and IDOs are official sale rounds organized directly by the project.

Q2. Why is pre-market gaining more investor interest?

Because it allows tokens to be purchased at lower valuations than ICO levels, creating high profit potential if the FDV rises after TGE.

Q3. What are the biggest risks of joining the pre-market?

Low liquidity, high price volatility, and limited reliable information about project progress can lead to losses once TGE occurs.

Q4. Does pre-market activity affect token launch prices?

Yes. When pre-market demand is too strong, the token price at TGE can spike sharply and correct afterward. Conversely, a weak pre-market may reduce investor excitement.

Q5. How can investors start trading on the pre-market?

Investors can join trusted platforms specializing in pre-TGE token trading, with Whales Market currently being the most widely used option.

Q6. How does Whales Market operate in the pre-market?

Whales Market connects buyers and sellers of unlisted tokens, displaying real-time FDV, trading volume, and prices, making the market more transparent and data-driven.