As the first appchain built on Starknet, Paradex represents the derivatives trading vertical while simultaneously acting as the first large-scale, real-world stress test of Starknet’s appchain model.

Alongside fundamental analysis and valuation comparisons with other perp DEXs, this article also incorporates Polymarket odds analysis to reflect market expectations and implied probabilities for Paradex’s FDV levels on the first day after listing.

Paradex Overview

Paradex Definition

Paradex is a decentralized crypto derivatives exchange focused on perpetual futures trading. It is built on Starknet technology, utilizes STARK-based ZK proofs, and is considered the first appchain within the Starknet ecosystem.

Paradex was incubated by @tradeparadigm, the largest institutional liquidity network in crypto options. Paradigm processes over $1B in daily trading volume, with more than $520B in lifetime volume, representing around 30% of the global crypto options market.

This incubation model allowed Paradex to avoid raising venture capital while giving the team direct access to industry expertise, technical infrastructure, and capital, enabling them to focus entirely on building a high-quality product.

In addition, Paradex offers several distinctive features:

- Zero fees.

- More than 250 trading markets.

- Privacy Perps make orders, positions, trades, and account states fully private. Only the account owner, via authenticated RPC, and the Paradex operator can access this information.

Paradex Current Performance

Unlike newer perp DEX platforms such as Extended, Lighter, or Variational, Paradex has been operational since October 2023. This was a period before Hyperliquid caused major market disruption or Aster ignited the late-2025 Perp DEX wave.

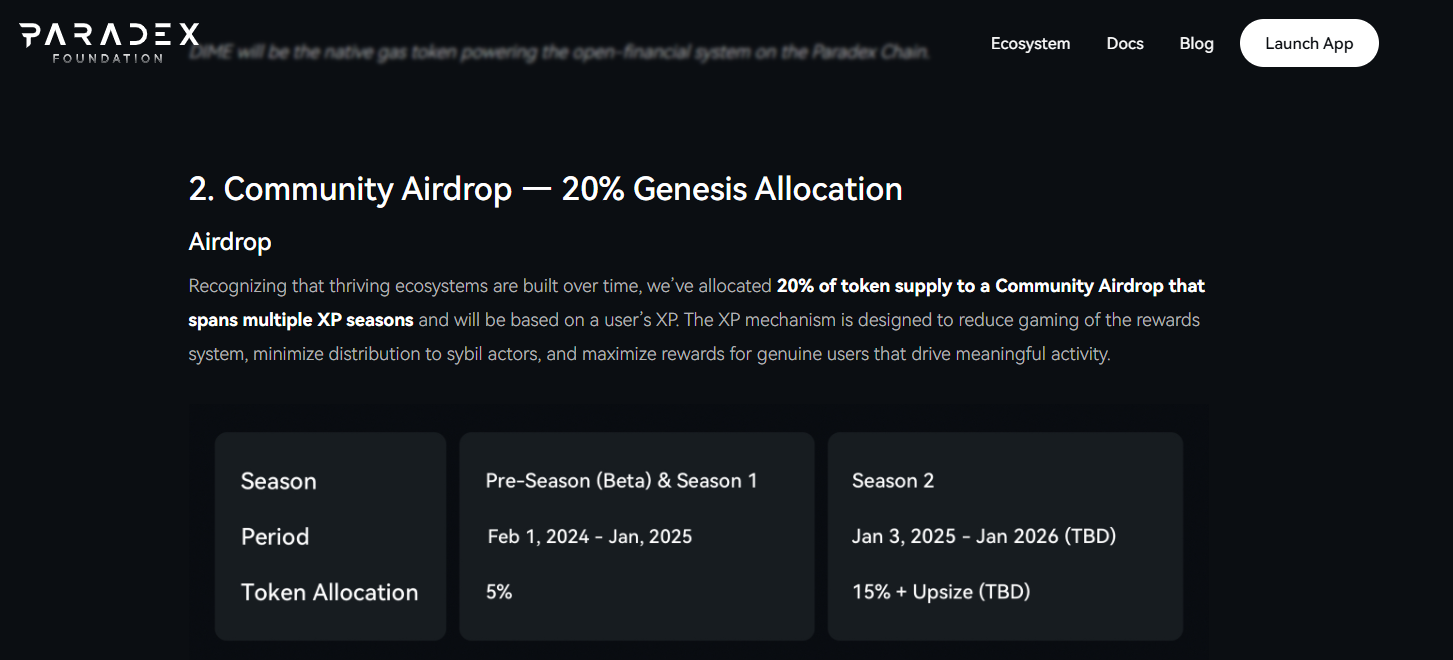

Paradex has launched two main airdrop seasons:

- Pre-Season (Beta) and Season 1: From February 1, 2024 to January 2, 2025, distributing approximately 100M XP, equivalent to about 5% of the total $DIME supply.

- Season 2: From March 1, 2025 to TBD, expected to end in late January 2026. Total XP is projected to reach approximately 350M, equivalent to about 15% of the total $DIME supply.

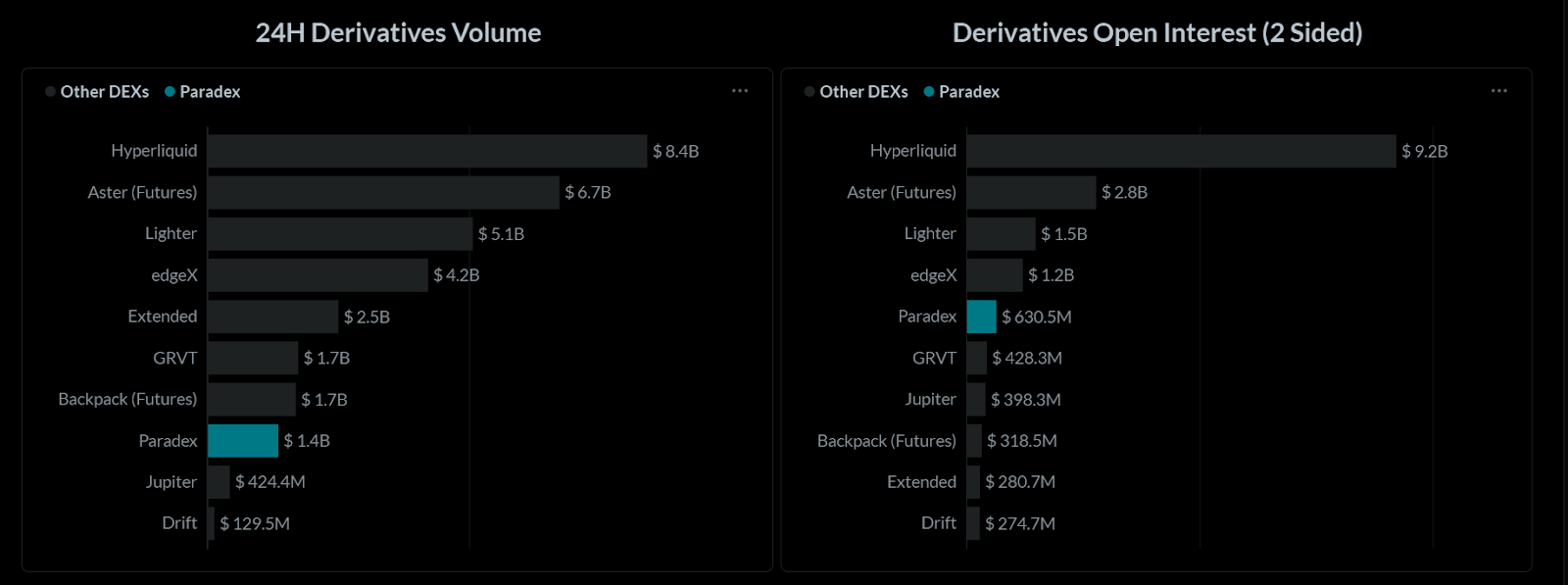

When comparing trading volume, Paradex significantly lags behind leading perp DEXs in the market:

- Lighter recorded $764B in Q4 volume, 9.8x higher than Paradex.

- Aster recorded $695B in Q4 volume, 8.9x higher than Paradex.

- EdgeX recorded $412B in Q4 volume, 5.3x higher than Paradex.

- Extended recorded $77B, Reya $75B, Pacifica $71B, and GRVT $99B in Q4 volume.

Meanwhile, Paradex recorded approximately $78B in Q4 volume. This serves as an important reference point for valuation comparisons and for estimating a reasonable FDV for Paradex

Additional metrics for reference include:

- Total fees generated: $26.8M.

- Total users: 65,863.

- Lifetime volume: $221.4B.

- TVL: $223.6M.

What will Paradex’s FDV be one day after launch?

What is a reasonable valuation for Paradex?

Based on the volume figures above, it is useful to examine the valuations of other perp DEXs currently on the market:

- Reya conducted a public sale at an FDV of $150M and had previously raised $16M from multiple investment funds.

- Lighter is currently valued at an FDV of approximately $2.1B. Shortly after TGE, its FDV was around $2.7B.

- Aster currently has an FDV of approximately $5.8B.

For other projects, valuation data from VC rounds has not been disclosed, leaving no clear reference figures.

Overall, Paradex should not be valued as low as Reya at its public sale stage, given that its fee generation, lifetime volume, and backers are far from insignificant. However, it also cannot approach Lighter or Aster in valuation due to significantly weaker volume, branding, and backer strength.

When comparing valuation using the Volume/FDV ratio:

- Lighter has a Volume/FDV ratio of approximately 364x.

- Aster has a Volume/FDV ratio of approximately 120x.

The market appears to price perp leaders within a 120x to 360x Volume to FDV range. Applying this framework to Paradex yields the following scenarios:

- Bear case: Volume/FDV ratio of 300x, implying an FDV of approximately $260M.

- Base case: Volume/FDV ratio of 200x, implying an FDV of approximately $390M.

- Bull case: Volume/FDV ratio of 150x, implying an FDV of approximately $520M.

These figures are for reference only. Beyond fundamentals, hype, sentiment, and the development team’s strategy can significantly impact project valuation at TGE.

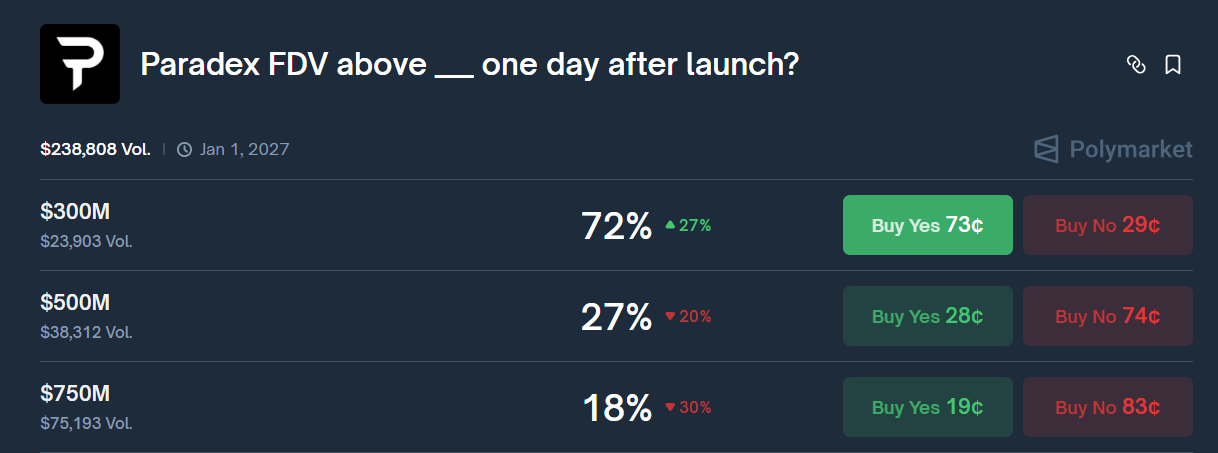

Polymarket Odds Analysis

Based on the scenarios above, Paradex is more likely to be listed with an FDV in the $400-700M range at TGE for the following reasons:

- Sentiment around perp DEXs has cooled significantly after Lighter’s TGE. Many users believe that airdrop hunting for projects launched after Lighter will resemble the post-Arbitrum phase of Layer 2 projects.

- Paradex allocates 20% of its total token supply to airdrops. Given that the campaign has been running since early 2024, this creates substantial pressure after more than 2 years of operation.

As a result, a reasonable strategy for Paradex would be:

- Buy YES above $300M at odds of 72%.

- Buy NO above $750M at odds of 27%.

- The $500M level sits in an awkward middle ground. It is neither clearly bearish nor bullish, making it difficult to extract profit at such a neutral FDV level.

Note: The strategy above assumes Paradex will stabilize at an average FDV of approximately $400-500M, equivalent to being valued at roughly 4x lower than Lighter, after absorbing the 20% airdrop sell pressure.

Users may adjust this strategy based on their own analysis and expectations for Paradex’s FDV.

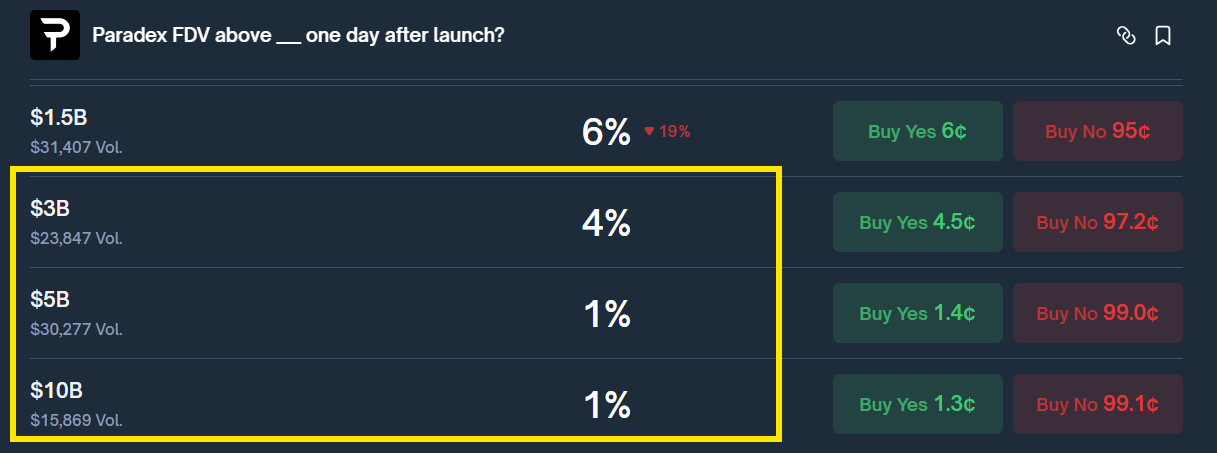

FDV levels above $1.5B are already partially priced in by the market. With 20% airdrop-related sell pressure, it would be difficult for Paradex to maintain an FDV above $1.5B one day after TGE.

FDV targets above $3B are extremely unlikely. Even Lighter did not sustain valuations above $3B immediately after its TGE. These outcomes can therefore be considered low-risk positions.

Conclusion

Based on volume, fees, user count, and TVL, as well as relative valuation comparisons with other perp DEXs, Paradex is a fundamentally solid project with a complete product and strong backing. However, it lacks sufficient momentum to be valued as a market leader like Lighter or Aster at TGE.

A reasonable FDV for Paradex on its first day of trading is most likely in the $400-500M range. This reflects a balance between stable fundamentals and significant sell pressure from the 20% airdrop allocation after more than 2 years of operation.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. How does Polymarket help estimate Paradex price prediction?

Polymarket provides real-time market odds based on user positions, offering a probabilistic view of expected FDV ranges for Paradex rather than a single fixed valuation.

Q2. Why is Paradex price prediction different from other perp DEXs?

Paradex is the first appchain on Starknet, which adds an infrastructure narrative on top of standard perp DEX fundamentals such as volume, fees, and users.

Q3. Can Polymarket odds be considered accurate for FDV forecasting?

Polymarket odds reflect collective market sentiment and risk appetite, not guaranteed outcomes, but they are useful for gauging consensus expectations.

Q4. What factors most influence Paradex price prediction after TGE?

Key factors include trading volume, airdrop sell pressure, overall perp DEX sentiment, and how the market prices Starknet appchain risk.

Q5. Is Paradex price prediction more sentiment-driven or fundamental-driven?

In the short term after TGE, sentiment and airdrop dynamics dominate, while fundamentals become more relevant over a longer timeframe.