Opinion is emerging as a real challenger in the prediction market race, capturing 40.4% weekly market share in November 2025, surpassing both Polymarket and Kalshi. Backed by YZi Labs (formerly Binance Labs), Opinion is not positioning itself as a typical prediction market, but rather as the first global macro-economic trading infrastructure.

This article analyzes Opinion’s fundamentals and valuation comparisons with industry peers, combined with probability data from prediction markets to reflect market expectations for Opinion’s FDV immediately after listing.

Opinion Overview

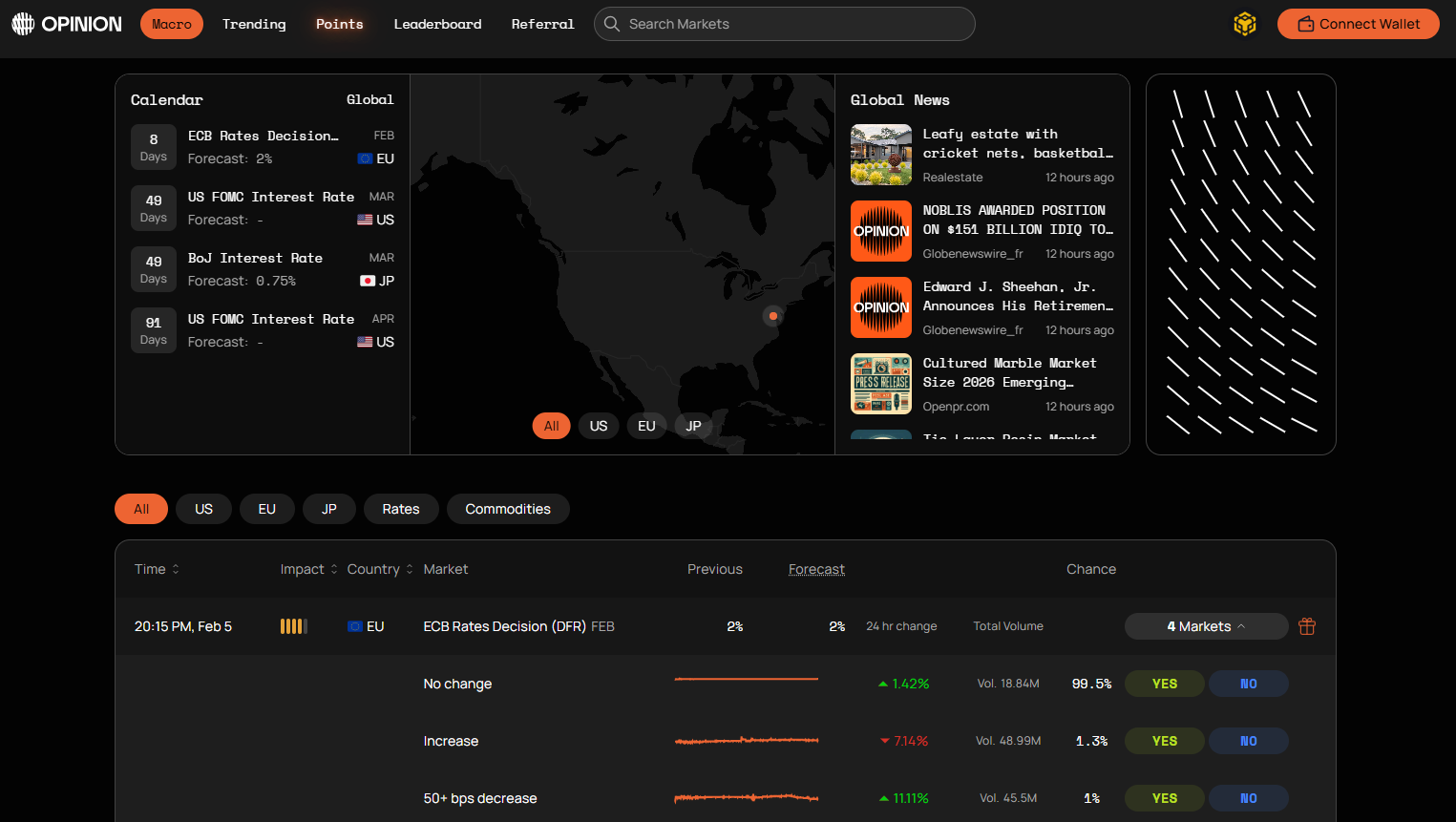

Opinion, formerly known as O.LAB, is a decentralized prediction market exchange that allows users to create, trade, and provide liquidity for prediction markets using any ERC-20 token.

Opinion is developed by Opinion Labs, whose founding team has experience at major institutions such as Citadel, JP Morgan, McKinsey, Amazon, and ByteDance. This background brings deep expertise in algorithmic trading alongside the ability to build large-scale consumer applications.

Key differences between Opinion and other platforms include:

- CLOB Architecture: Instead of using AMMs like most prediction markets, Opinion adopts a Central Limit Order Book (CLOB) architecture similar to traditional financial exchanges. This enables more accurate price discovery and tighter spreads.

- Opinion AI: A decentralized AI-powered oracle is used to create markets and resolve outcomes. When a user creates a market, the AI converts a simple prompt into a detailed prediction contract, including event descriptions, settlement conditions, expiration dates, and reference data sources.

- Focus on Macro Markets: Opinion focuses on macro-economic events such as Federal Reserve rate decisions, CPI releases, and employment data. This allows traders to gain direct exposure to macro events rather than trading proxies like BTC or equities.

Learn more: Why Is Opinion Getting So Much Attention?

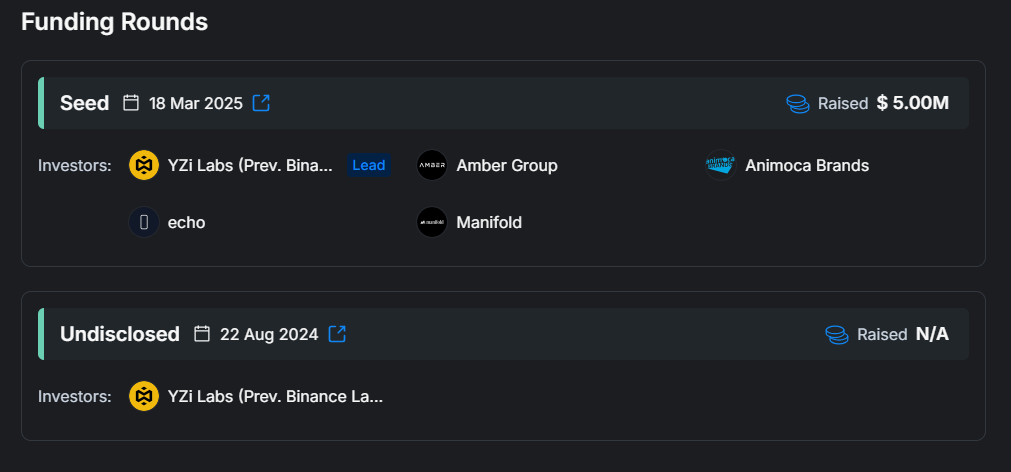

Opinion has completed the following funding rounds:

- Round 1 (August 2024): Undisclosed. Lead investor: YZi Labs (Binance Labs).

- Seed Round (March 2025): $5M. Lead investor: YZi Labs.

Notable investors include Animoca Ventures, Amber Group, Manifold, and Echo Community. CZ (Changpeng Zhao) has publicly confirmed that YZi Labs is a minority investor in Opinion.

Current Performance of Opinion

Opinion launched its mainnet on October 24, 2025, on BNB Chain and quickly delivered strong performance metrics. It became the third prediction market in history, after Polymarket and Kalshi, to lead weekly trading volume since April 2024, when total industry weekly volume first exceeded $20M.

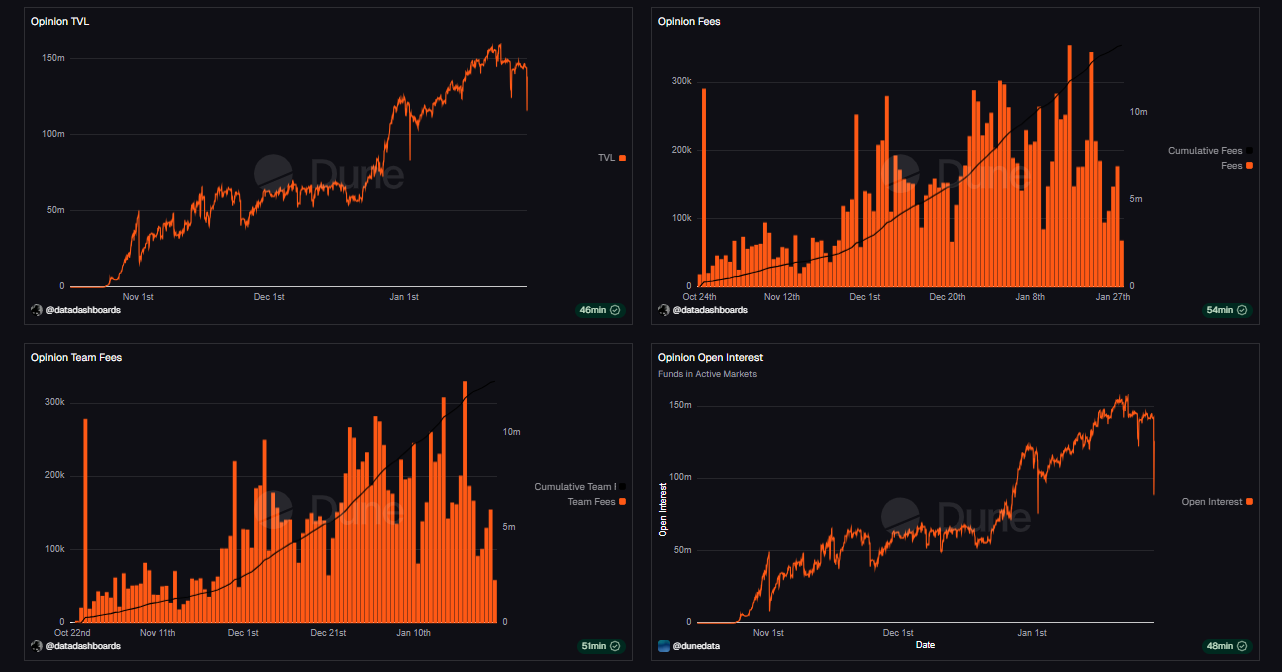

According to Dune Analytics data updated in January 2026, Opinion has continued to reach new milestones:

- Open interest: $140M+ (new ATH, top 3 across the industry).

- TVL: $143M.

- Weekly volume peak: $1.6B+ (exceeding Polymarket).

- Weekly fees: $1M–$1.74M.

- Market share on peak days: 60%+ of the prediction market sector.

Prediction Market TVL Comparison (January 2026)

- Polymarket: ~$380M.

- Opinion: ~$155M (ranked #2).

- Predict Fun: ~$22.5M.

Read More: How to get Opinion ($OPN) Airdrop?

What Is a Reasonable FDV for Opinion?

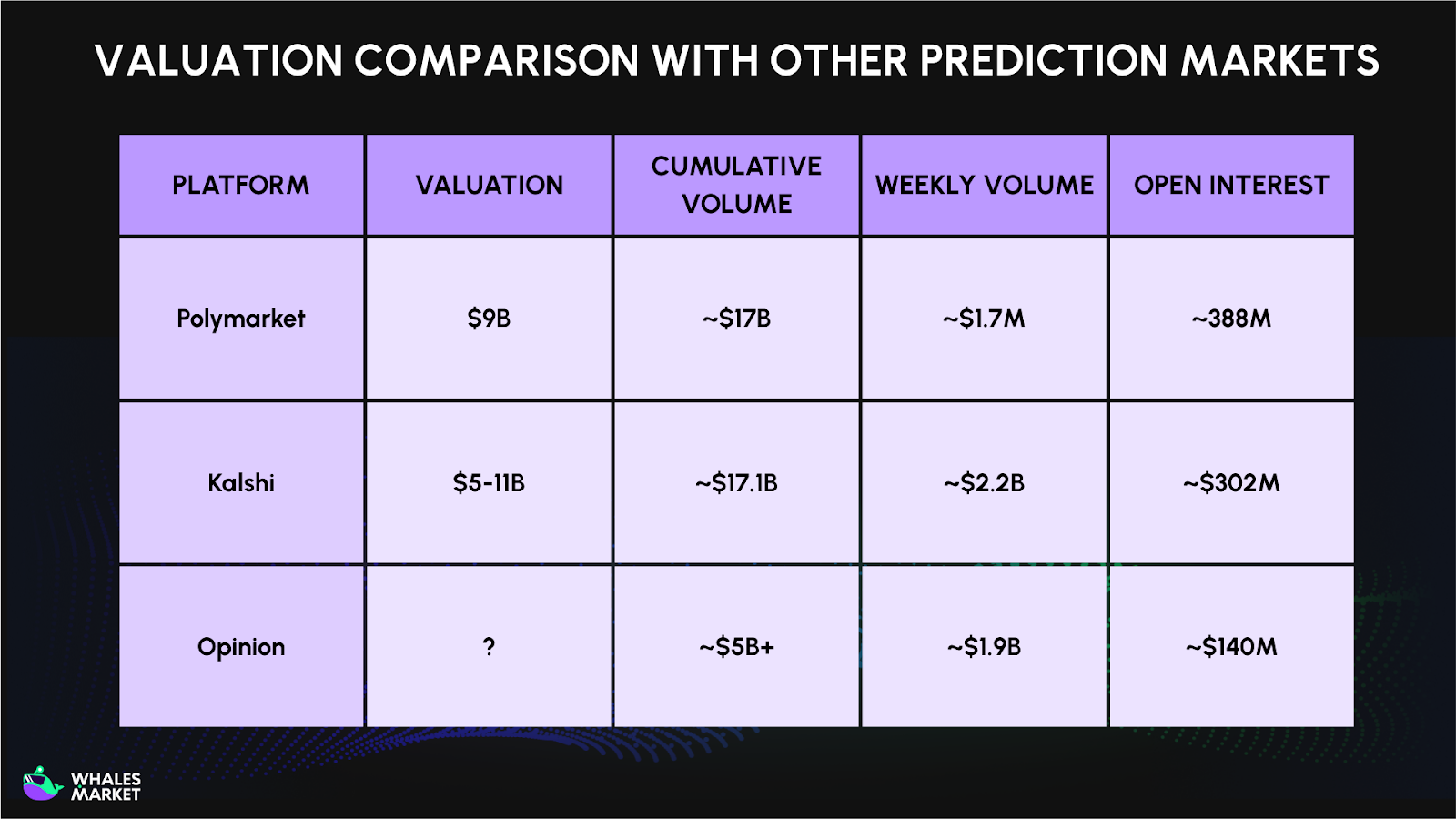

Valuation comparison with other Prediction Markets

For a more grounded assessment of Opinion’s valuation, comparing its core metrics with established prediction market platforms provides useful context.

Opinion’s fundamentals remain strong across multiple dimensions. The platform has demonstrated weekly trading volumes comparable to Polymarket and Kalshi, confirming its ability to compete at the top tier of the prediction market sector.

At the same time, open interest has expanded rapidly, rising from $60.9M in November 2025 to over $140M by January 2026, a 126% increase in just two months, which signals strong capital retention.

From a competitive standpoint, Keyrock characterizes 2026 as a “three-horse race” between Polymarket, Kalshi, and Opinion, reinforcing Opinion’s top-three positioning. This outlook is further strengthened by strong institutional backing from YZi Labs, managing a $10B+ portfolio, alongside Animoca Ventures and Amber Group, lending substantial credibility to Opinion’s long-term prospects.

Valuation Based on TVL Multiple

As of January 29, 2026, according to data from DefiLlama, and using Polymarket as a reference with approximately $380M in TVL and a $9B valuation:

- Polymarket Valuation/TVL ratio: ~23x.

- Applying this ratio to Opinion’s: $143M TVL suggests an FDV of ~$3B.

However, Polymarket benefits from stronger brand recognition, a much larger user base, clearer regulatory pathways, and higher cumulative volume ($17B vs $5B+). Opinion is still early, having launched just over three months ago, and must demonstrate long-term sustainability to justify a similar ratio.

Valuation Based on Valuation-to-Volume Ratio

Using Kalshi as a benchmark with an $11B valuation and ~$17.1B cumulative volume:

- Kalshi Valuation/Volume ratio: 0.6x.

- Applying this ratio to Opinion’s: $5B+ volume also implies an FDV of around ~$3B.

From a valuation-to-volume perspective, Opinion’s implied ~$3B FDV appears reasonable relative to Kalshi. However, despite strong early volume traction, first-day FDV is likely discounted due to launch-stage uncertainty and undisclosed tokenomics.

Analyzing Odds for Opinion FDV on Whales Prediction

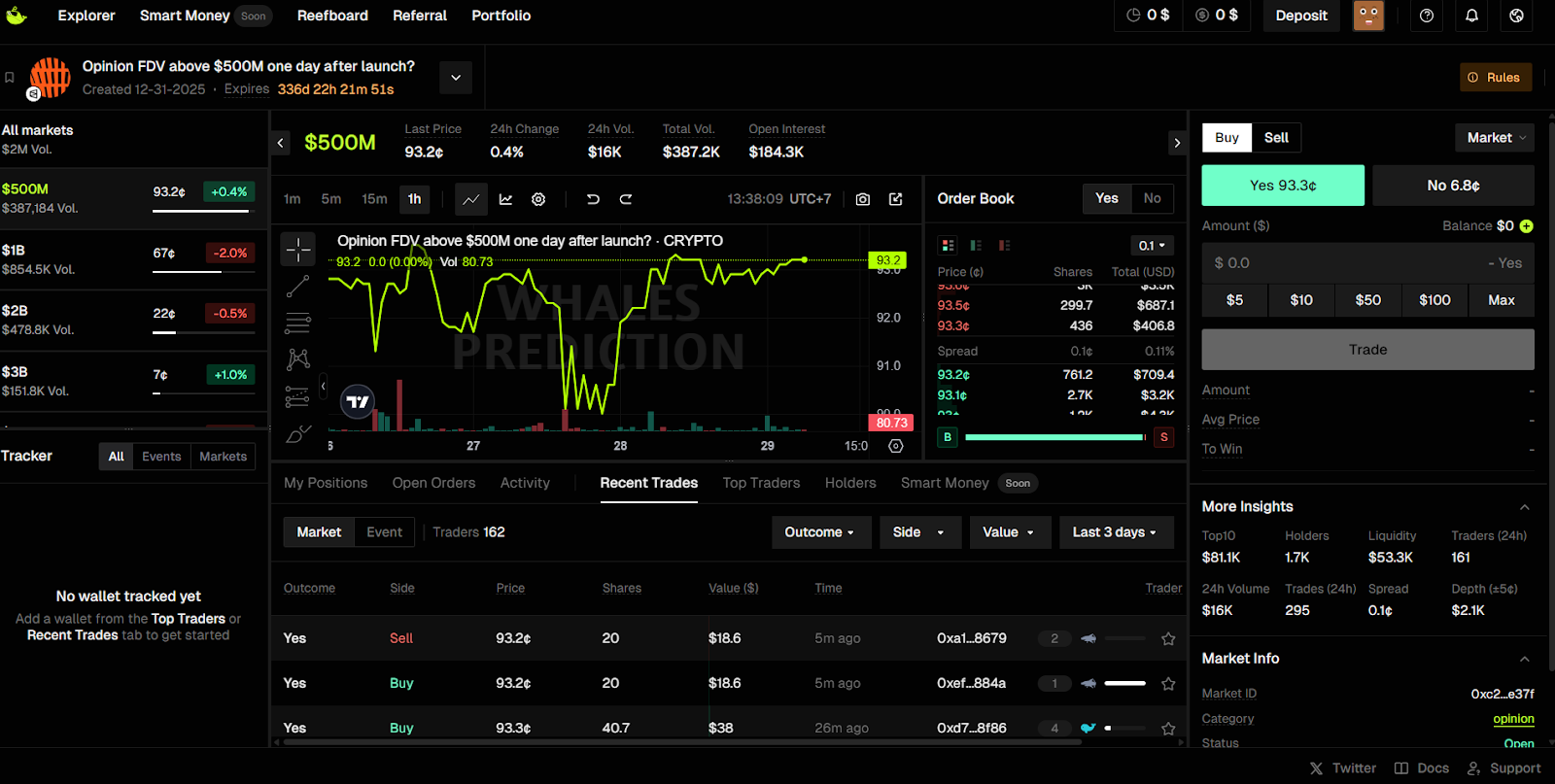

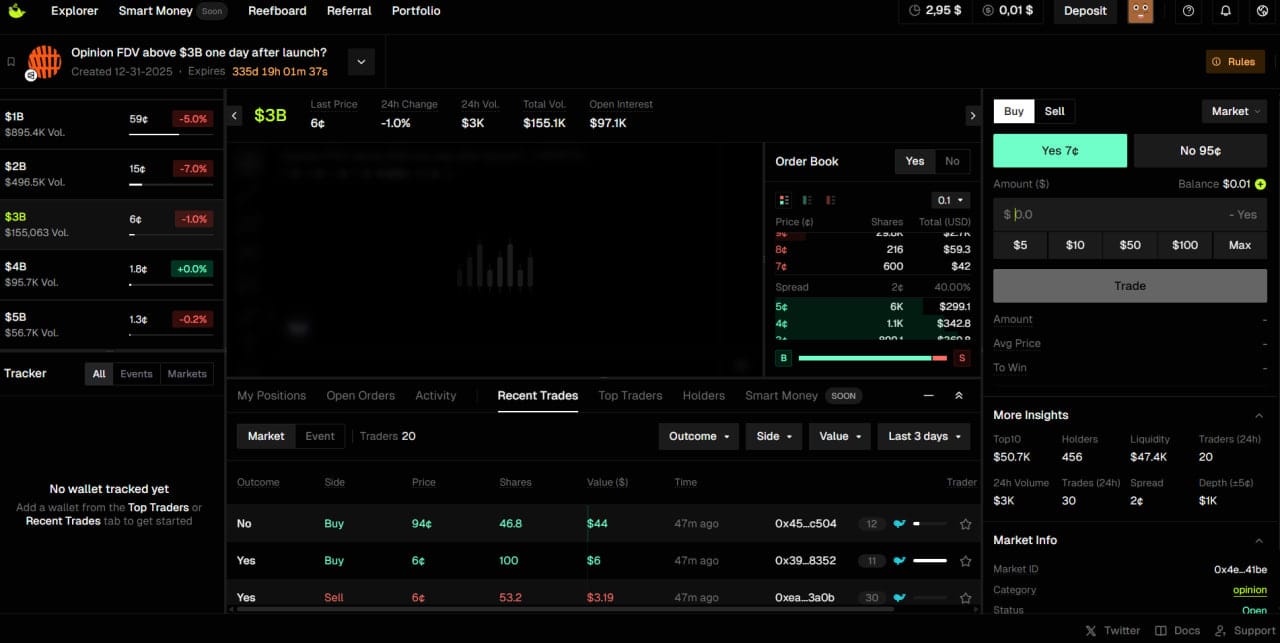

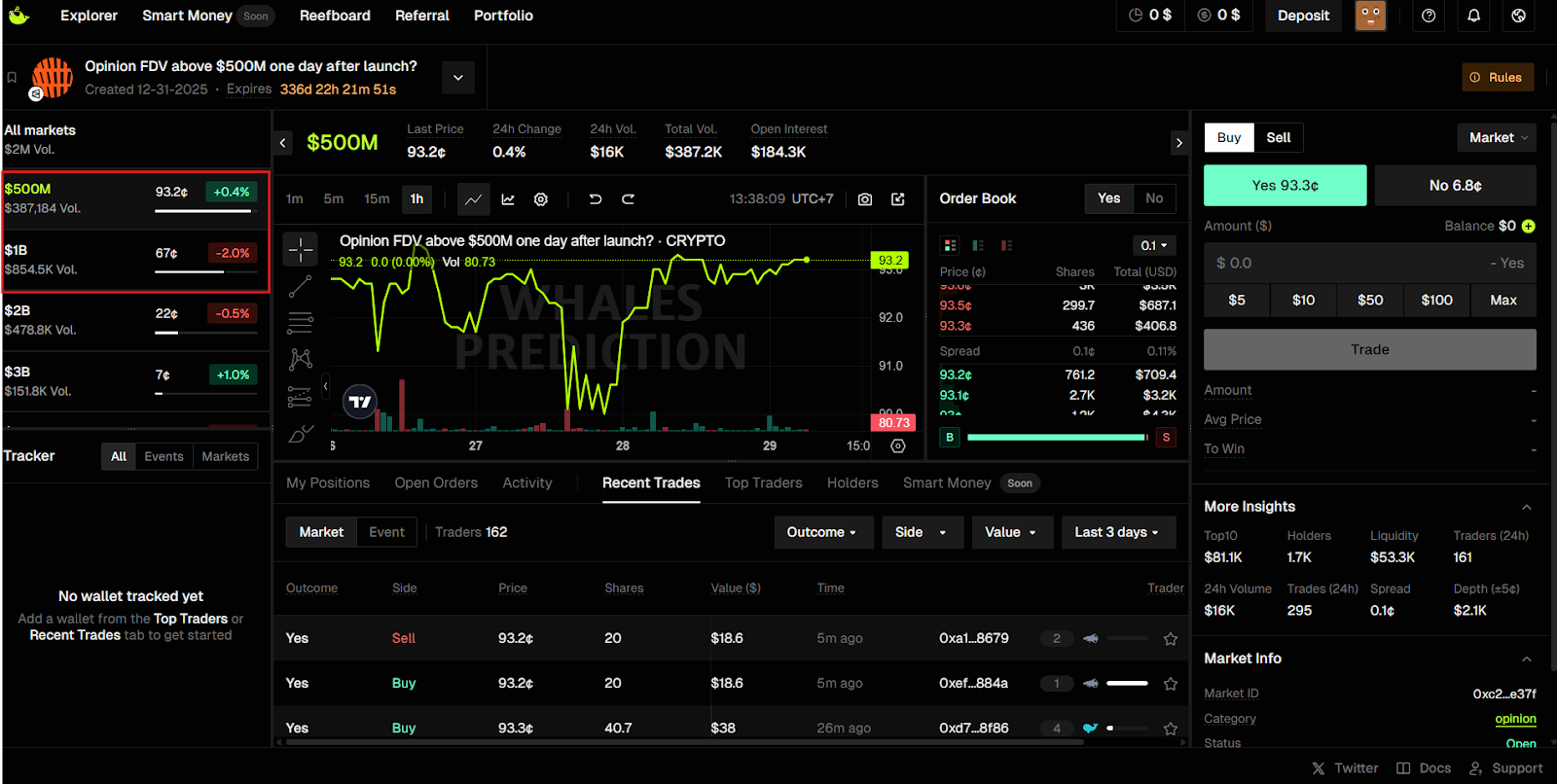

Based on the event “Opinion FDV above ___ one day after launch?” on Whales Prediction (a prediction market trading aggregator), several key signals can be observed from how FDV levels are priced.

As of January 29, 2026, the market shows strong consensus around lower FDV ranges:

- FDV above $500M: Priced at 93%, effectively viewed as near-certain. Based on the analysis, this level appears easily achievable.

- FDV above $1B: Assigned a 67% probability with the highest trading volume at $853K, suggesting this is the baseline expectation for most traders.

- FDV above $2B: Probability drops sharply to 22%, reflecting clear hesitation about reaching this valuation.

- Higher levels discounted rapidly: $3B at 7%, $4B at 1.8%, and $5B at just 1%, indicating no expectation of an explosive first-day valuation.

Why Is the Market Cautious Above $3B FDV?

Market caution above the $3B FDV threshold is well-grounded. Opinion Labs has not yet announced its tokenomics, including revenue distribution, buyback mechanisms, or a clear value-accrual model for the token, leaving investors without visibility on long-term capture.

Even if such catalysts exist, they typically take time to materialize and are unlikely to be disclosed immediately after TGE. In addition, first-day FDV is often pressured by selling from airdrop recipients and early users, while longer-term revenue narratives require time to be priced in.

Finally, part of Opinion’s recent volume has been driven by OPN Points incentives, prompting the market to wait for confirmation that trading activity can sustain organically post-TGE.

As a result, factors that could drive FDV significantly higher are typically not priced into the first 24 hours.

Trading Strategies for Opinion FDV event on Whales Prediction

From a practical standpoint, the $500M–$1B range appears relatively safe for conservative positions:

- Buy YES “Above $500M” (93%): Low risk, low return (~10%). Suitable for conservative bets that Opinion avoids a major post-listing dump.

- Buy YES “Above $1B” (67%): A more attractive risk-reward “sweet spot.” Opinion has demonstrated strong traction with #2 TVL in the sector and backing from YZi Labs.

FDV levels above $3B may be considered with smaller allocations if the following assumptions hold:

- Opinion receives strong support from the Binance ecosystem.

- A buyback mechanism is announced shortly after TGE.

- The prediction market sector enters a strong uptrend.

- There is no significant sell-off from airdrop recipients.

Conclusion

Overall, despite Opinion’s strong fundamentals in market share, volume, and open interest, the market’s FDV expectations one day after launch remain realistic. The $500M–$1B range reflects a balanced view between proven traction and unresolved factors such as tokenomics, buybacks, and short-term sell pressure following TGE.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Whales Market is not responsible for any investment decisions.

FAQs

Q1: When is FDV volatility risk the highest?

The highest volatility typically occurs within 24–72 hours after TGE, when sell pressure from airdrop recipients and early users emerges. This period is when the market adjusts expectations before forming a more stable price range.

Q2: What could change FDV expectations after the first day?

Announcements related to tokenomics, buyback mechanisms, revenue sharing, or major partnerships can quickly shift expectations. If strong catalysts appear early, the market may reprice Opinion beyond currently discounted levels.

Q3: What advantages does Opinion have over Polymarket beyond market share?

Beyond market share, Opinion stands out through fast market creation and resolution powered by AI oracles, combined with a macro-focused strategy. This approach supports broader and more flexible market expansion over time.

Q4: What does Whales Prediction indicate about short-term expectations?

Probabilities on Whales Prediction show consensus around a $500M–$1B FDV, reflecting realistic expectations. The market recognizes Opinion’s strong foundation but remains cautious about pricing in long-term catalysts on day one.

Q5: Where can users bet directly on this FDV outcome?

Markets predicting Opinion’s FDV immediately after listing are currently available on Whales Prediction, which closely reflects real-time market expectations through probabilities, trading volume, and trader behavior.