Although the NFT market is no longer active as it once was, OpenSea’s upcoming TGE is still worth paying attention to. Not just to see how a well-funded project handles an airdrop, but more importantly to understand what direction OpenSea plans to take next and how the token will be used to support its ecosystem.

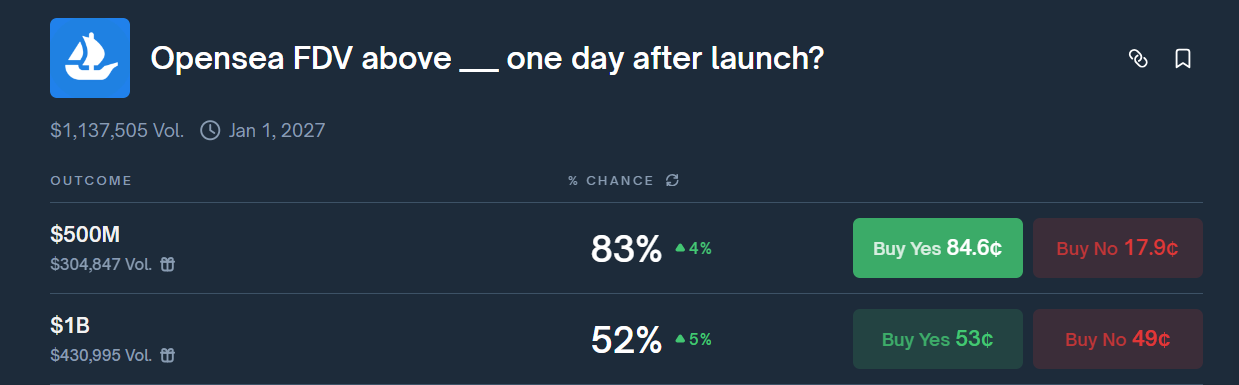

At the same time, market expectations are already forming. There are active Polymarket markets predicting OpenSea’s fully diluted valuation one day after launch, offering a clear snapshot of how participants are pricing this event ahead of time.

OpenSea Overview

OpenSea is a marketplace for NFTs where users can create, trade, and auction digital items such as art, in-game assets & name services. Founded in 2017, it started out on Ethereum and later added support for multiple blockchains.

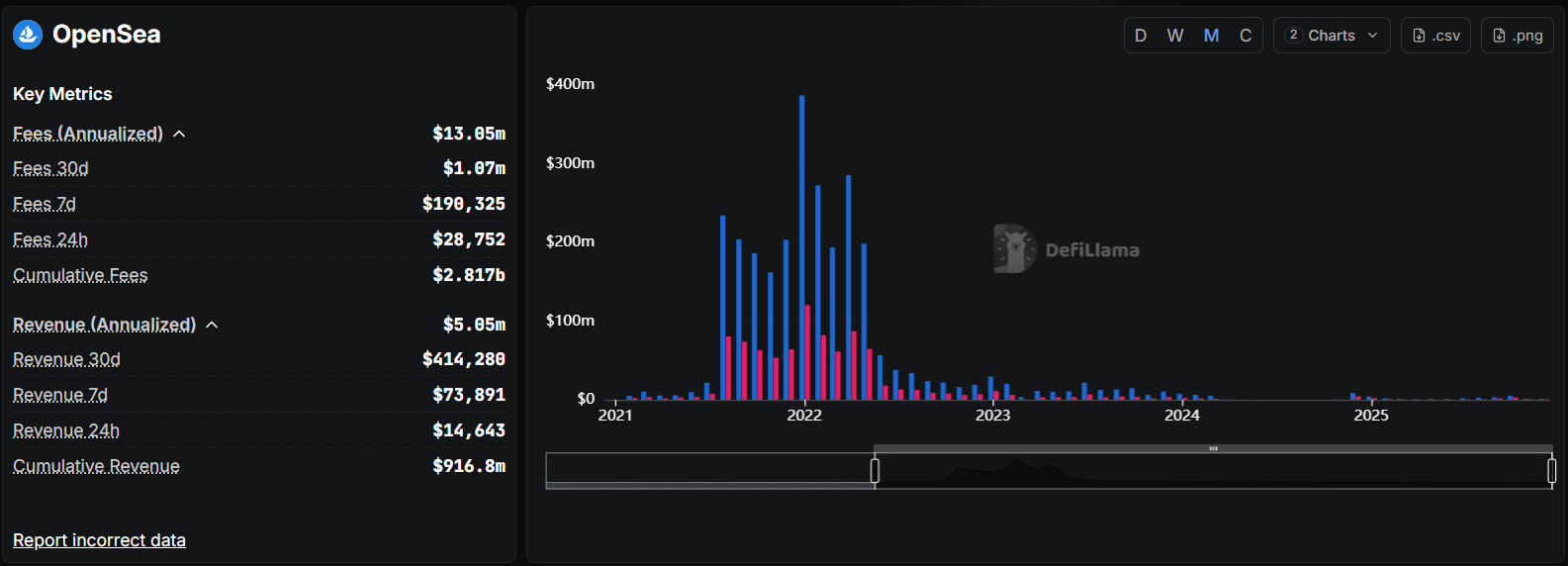

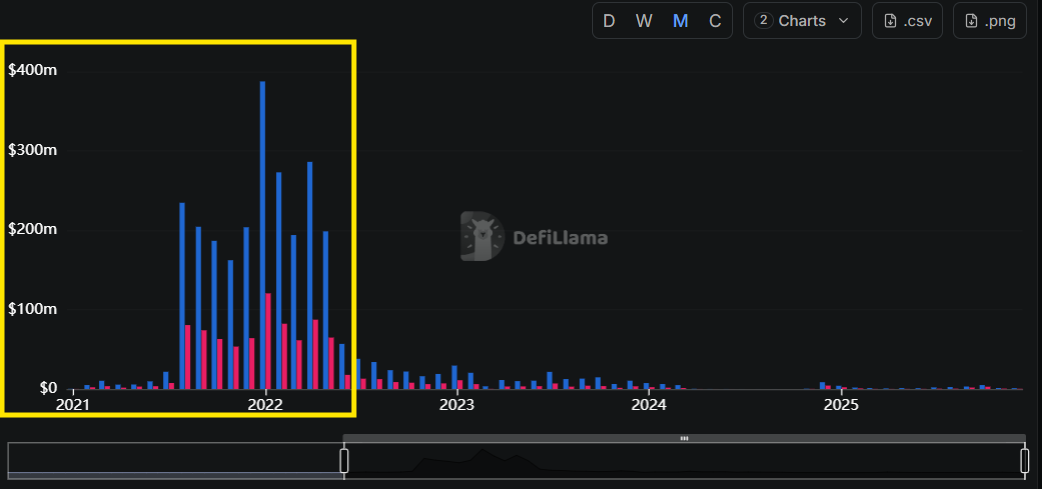

After the 2021 to 2022 cycle, it is easy to see that OpenSea’s fees and revenue declined sharply. In 2024 to 2025, fees and revenue fell so low that users could barely observe them without zooming in.

This not only reflects how much the NFT market has cooled down, but also acts as a warning for the platform. If OpenSea wants to keep operating and stay relevant, it needs to change.

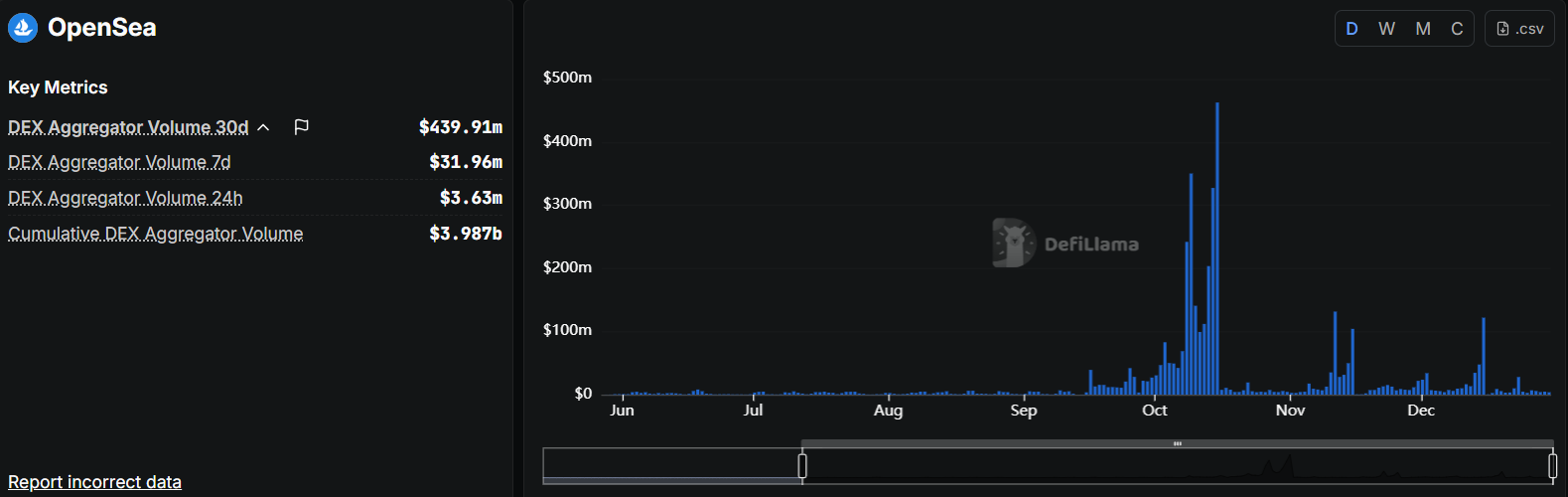

OpenSea has also developed a new product: a DEX Aggregator. This feature was first introduced on 13/2/2025, when OpenSea announced OS2, including the ability to swap tokens across multiple blockchains.

This also suggests OpenSea is actively trying to shift its development direction, and the $SEA will likely be a key lever to push that transition.

Other reference information users can look at includes:

- Total raised: $425.15M

- Cumulative Revenue: $916.8M

- DEX volume 30 days: $439.91M

What will OpenSea FDV be one day after launch?

Sell Pressure at OpenSea’s TGE

The project has not published detailed tokenomics yet, but it has revealed some important confirmed information that traders can use as reference:

- TGE in Q1 2026.

- 50% of the supply will go to the community, and more than half of this share will be issued through initial claims (OG and rewards participants are accounted for separately).

- 50% of the revenue at launch will be used to purchase $SEA (buyback).

Based on this, it implies roughly 25% of the total $SEA supply could be allocated to OG users, rewards or voyages participants, and platform activities.

That 25% has a high chance of being sold quickly when the project reaches TGE. Why?

- First, the market could be in a bear phase, and holding cash instead of altcoins is a common mindset.

- Second, OpenSea still does not have a clearly proven direction after the NFT market cooled down. There is little reason to hold a token from a project if its product no longer has strong product market fit.

- Third, after a long waiting period, whether someone is a real user or an airdrop hunter, many people will want a cash payout in a context where 2025 has been a difficult year for investors. USD can feel more suitable than a platform token.

Another important point is that most activity on OpenSea during 2021 to 2022 came from real demand from users and investors, rather than airdrop farming.

As a result, the token distribution is more likely to end up in the hands of retail users rather than being heavily controlled by the project team, unlike some platforms that farm their own airdrops to manage supply at TGE. This can create very strong sales pressure at the time of launch.

FDV comparison with competitors

Magic Eden

Magic Eden can be considered a direct competitor to OpenSea, and it is a reasonable project to use as a comparison.

- According to CryptoRank, Magic Eden successfully raised $159.5M.

- 12.5% of the token supply was unlocked for the airdrop at TGE.

- Magic Eden was once one of the leading marketplaces for the Runes and Bitcoin Ordinals trends.

At launch, Magic Eden reached an FDV of around $5B, then one day later it traded more steadily around $3.6B to $3.3B. This can be viewed as a useful reference level for OpenSea.

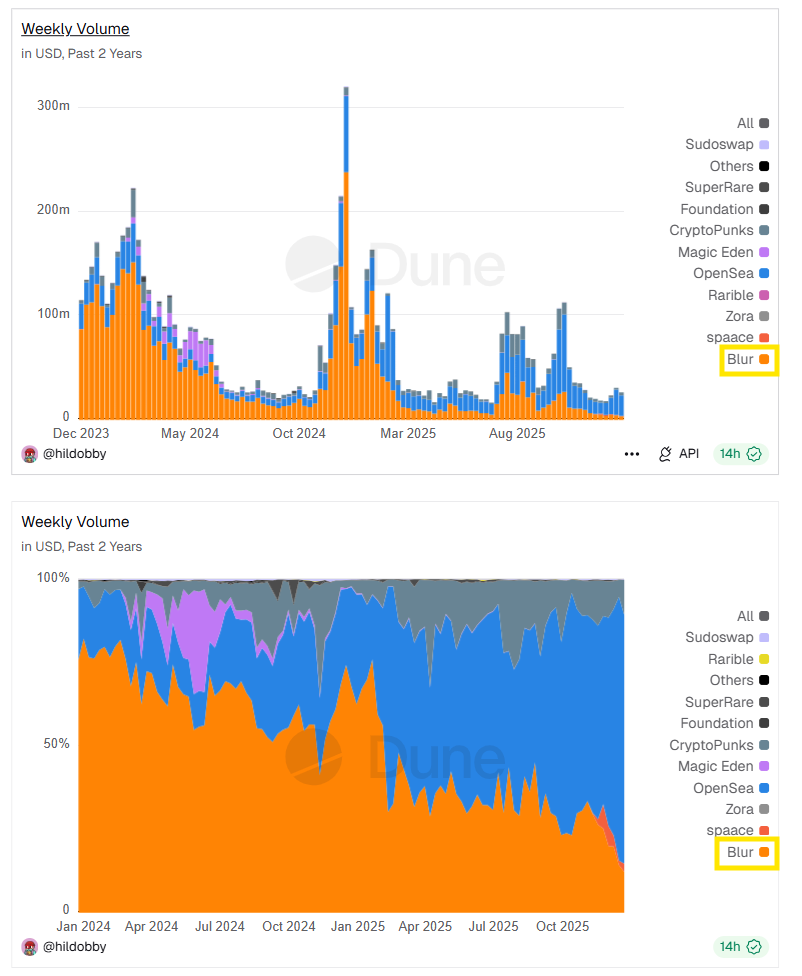

Blur

Blur is another strong reference point. The project was the number one NFT marketplace throughout 2023 and into mid to late 2025. This highlights how effective Blur’s multi-season airdrop strategy was compared with OpenSea or Magic Eden.

According to CryptoFundrasing, the project raised $51M from major funds such as Paradigm and Ledger.

At the time of TGE, Blur traded around $3B to $3.2B in FDV and allocated 12.5% of tokens for the airdrop.

Polymarket Odds Analysis

If we look at past competitor valuations, OpenSea’s revenue and fees, its fundraising, and its brand, then if OpenSea’s FDV is below $1B, it would suggest only one thing: the NFT sector has very poor sentiment from the community.

Even with its historical fee and revenue base, OpenSea has not run any clearly visible incentive program to stimulate user activity.

- FDV above $500M is likely not difficult for OpenSea to reach, and this still appears to be a market with relatively attractive risk and reward.

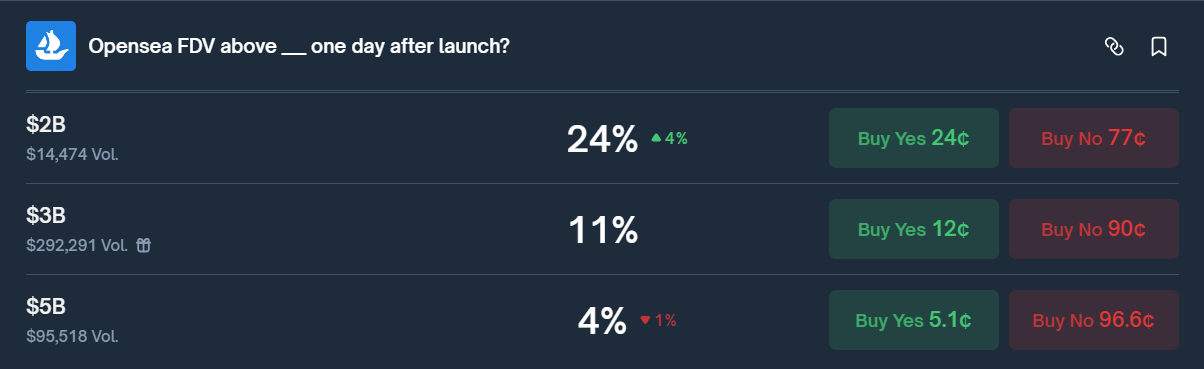

- FDV above $1B shows hesitation from the market. Lighter recently maintained FDV above $2B even with 25% allocated to an airdrop.

Because of that, these can be seen as opportunities: based on OpenSea’s fundamentals, it is reasonable to expect FDV above $1B. However, overall negative sentiment in the market, and especially in NFTs, likely pushes the odds to look clearly bearish.

- FDV above $5B is very difficult in the current market. Attention has been shifting toward prediction markets, RWA, and Perp DEXs, so valuing an NFT project at this FDV level looks unlikely.

- FDV above $3B could happen as an initial FDV, but one day after launch it does not look attractive given potential sell pressure from roughly 25% user-side allocation.

- For FDV above $2B, users can treat it as a hedge versus the FDV above $1B outcome, and it may make more sense with a small size.

Overall, OpenSea does not have major FUD related to the team or the product. The current odds in the market are likely heavily influenced by negative sentiment toward the NFT sector.

Polymarket odds could continue to change due to:

- The market improved again in Q1.

- Clearer tokenomics.

- More products released close to TGE, for example OpenSea’s own prediction market.

Conclusion

Overall, based on fundamentals, OpenSea looks undervalued if only 52% of the market believes it will have FDV above $1B after launch. This likely comes from negative views toward NFTs among investors.

Polymarket odds may change if the project releases more products and positions the NFT marketplace as only one branch within a broader OpenSea ecosystem.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. Why are Polymarket prediction markets useful for OpenSea analysis?

Polymarket markets provide real-time insight into how traders collectively price OpenSea’s launch risk, sentiment, and potential FDV outcomes.

Q2. How does Polymarket relate to the OpenSea TGE?

Polymarket currently hosts prediction markets on OpenSea’s FDV one day after launch, allowing traders to express expectations and hedge positions around OpenSea’s valuation.

Q3. What do Polymarket odds say about OpenSea’s FDV after launch?

Polymarket odds suggest mixed sentiment, with the market cautious about OpenSea reaching higher FDV levels due to weak NFT sector sentiment despite strong fundamentals.

Q4. How much sell pressure could OpenSea face at TGE?

Based on disclosed information, around 25% of the $SEA supply may reach users early, which could create significant sell pressure at OpenSea’s TGE.

Q5. How does OpenSea compare to Magic Eden and Blur?

Compared to Magic Eden and Blur, OpenSea has stronger brand recognition and higher cumulative revenue, but faces similar challenges around airdrop-driven sell pressure and post-launch FDV stability.