Meteora has officially announced that it will launch $MET on October 23rd, and the community is closely watching what the initial price of $MET could be. With excitement building, let’s analyze the fundamentals, risks, and market comparisons to predict $MET’s potential value at TGE.

What is Meteora?

Meteora is a decentralized exchange (DEX) on the Solana ecosystem, best known for its Dynamic Liquidity Market Maker (DLMM), Alpha Vaults, and dynamic fee mechanism, which optimize yield for liquidity providers.

Recently, Meteora confirmed that $MET will TGE on October 23, 2025.

What is Meteora ($MET) Airdrop Mechanism?

Users can now check their allocation through Meteora’s official checker. For detailed instructions on how to verify and claim your $MET airdrop, kindly check this step-by-step guide.

The future will be tokenized.

— Meteora (@MeteoraAG) October 16, 2025

Every asset, every market, on-chain and it all begins with liquidity.

With MET, we’re building the backbone of this tokenized future.

The rails, the liquidity, and the army that powers every market.

Checker is now live.https://t.co/MTBtwCpanb pic.twitter.com/64jIcBXpvN

$MET will serve as the governance token for Meteora, used to incentivize liquidity providers, stakers, and distribute protocol revenue.

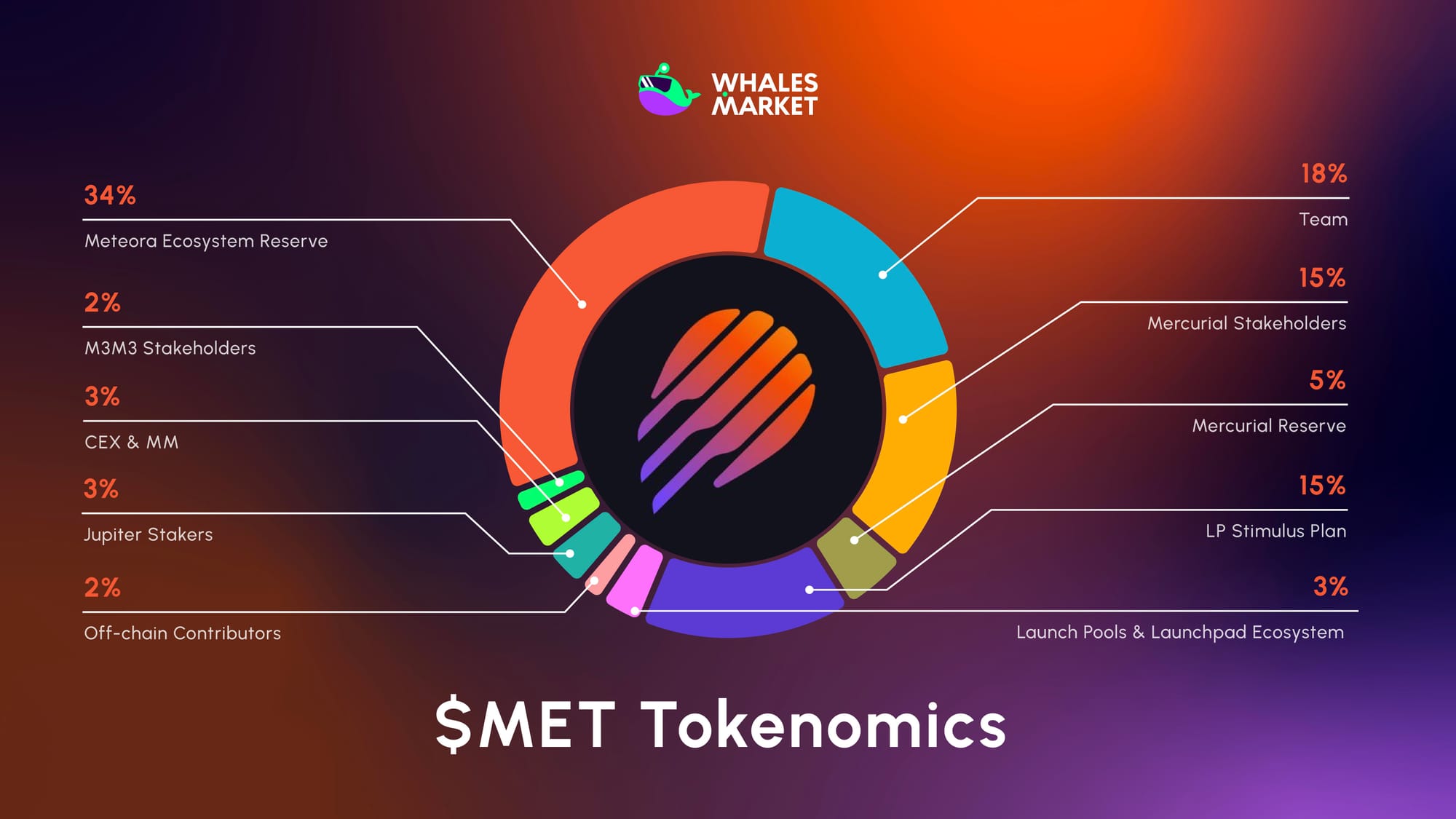

Circulating Supply (48%):

- Mercurial Stakeholders: 15%

- LP Stimulus Plan: 15%

- Mercurial Reserve: 5%

- Launch Pools & Launchpad Ecosystem: 3%

- Jupiter Stakers: 3%

- CEX & MM: 3%

- Off-chain Contributors: 2%

- M3M3 Stakeholders: 2%

Non-Circulating Supply (52%):

- Meteora Ecosystem Reserve: 34%

- Team: 18%

The $MET airdrop is allocated across multiple categories to reward active participants in the Meteora ecosystem:

LP Stimulus Plan (15% of total supply):

- Total allocation for community airdrop through points system

- Season 1: Points earned from liquidity provision until June 30, 2025 (snapshot date)

- Season 2: Points earned from July 1, 2025 onwards

- 1,000 points earned per $1 in trading fees generated from liquidity positions

- Eligible activities: Providing liquidity in DLMM and DAMM v2 pools

- All 3,800 Season 1 appeals were approved for fair distribution

Liquidity Distributor NFT (10% of total supply):

- 3% automatically allocated to JUP (Jupiter) stakers

- 7% available to community on first-come, first-served basis

- Registration deadline: October 19, 2025 at 3:00 PM UTC (23:00 UTC+8)

- Participants receive LP positions in the MET/USDC launch pool

- Earn trading fees from day one of MET trading

- Wide price range ($500M - $7.5B FDV) to minimize divergence loss

Eligibility Criteria:

- Active liquidity providers in Meteora's DLMM and DAMM v2 pools

- Users who generated trading fees through their LP positions

- Participants in Meteora's vaults and dynamic fee-sharing mechanisms

- Jupiter (JUP) stakers automatically opted into Liquidity Distributor.

After releasing its tokenomics, Meteora received overwhelmingly positive community feedback. All have been praised by the community for fairness and sustainability. Many investors believe this alignment could lead to a strong post-TGE performance.

What will $MET reach upon listing?

Compared with Raydium ($RAY), Meteora is currently behind in metrics like Total Value Locked (TVL) and revenue, but it outperforms Orca ($ORCA). Based on fundamentals and current market dynamics, $MET could aim for an FDV similar to $RAY and sustain a sideways range above $ORCA.

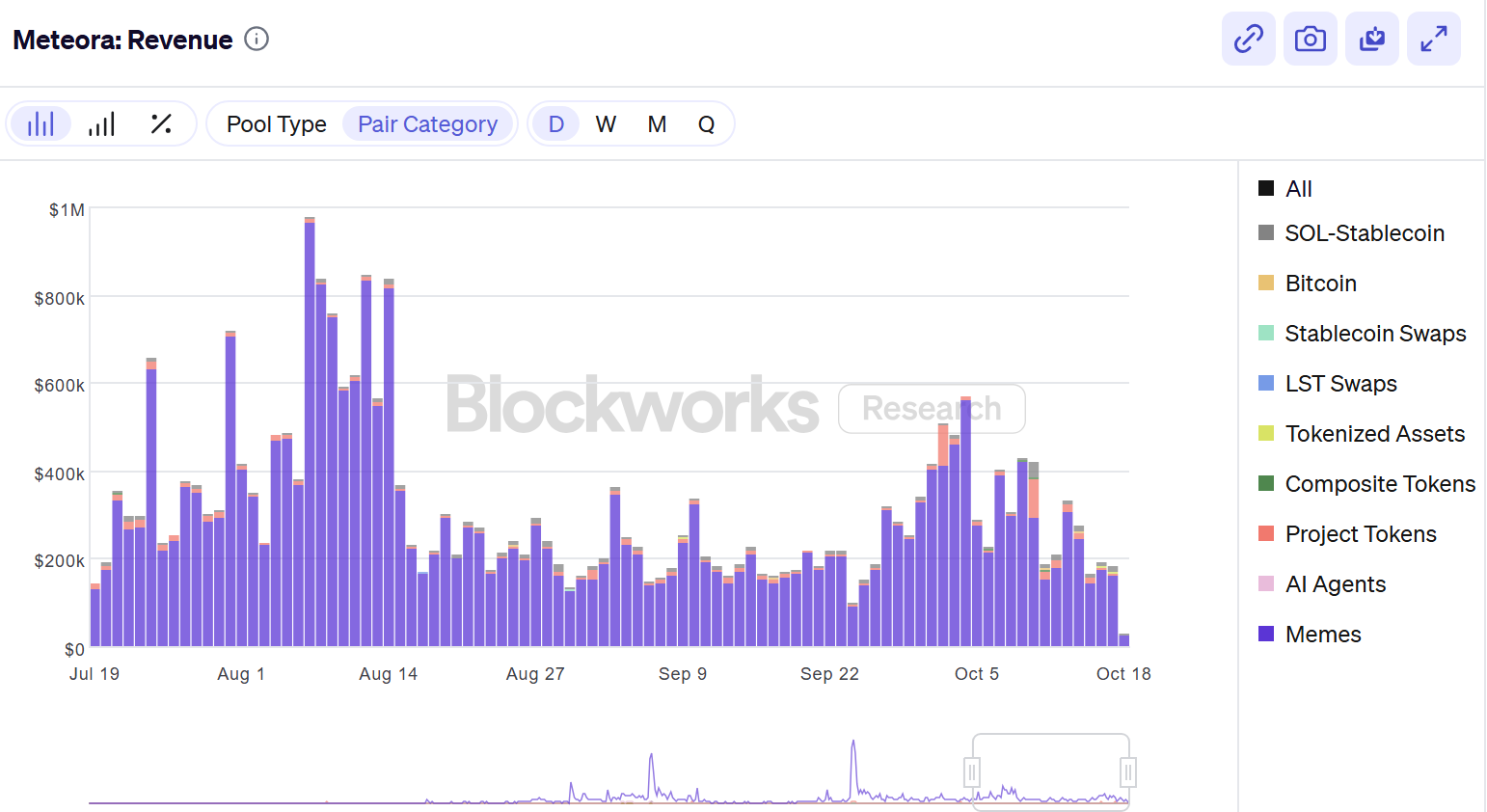

In the past 30 days, Meteora has posted impressive stats:

- Achieved $31.5B in total trading volume

- Generated $8.33M in monthly revenue (mostly from memecoins)

- Maintained a stable TVL, mainly supported by SOL & stablecoins pair

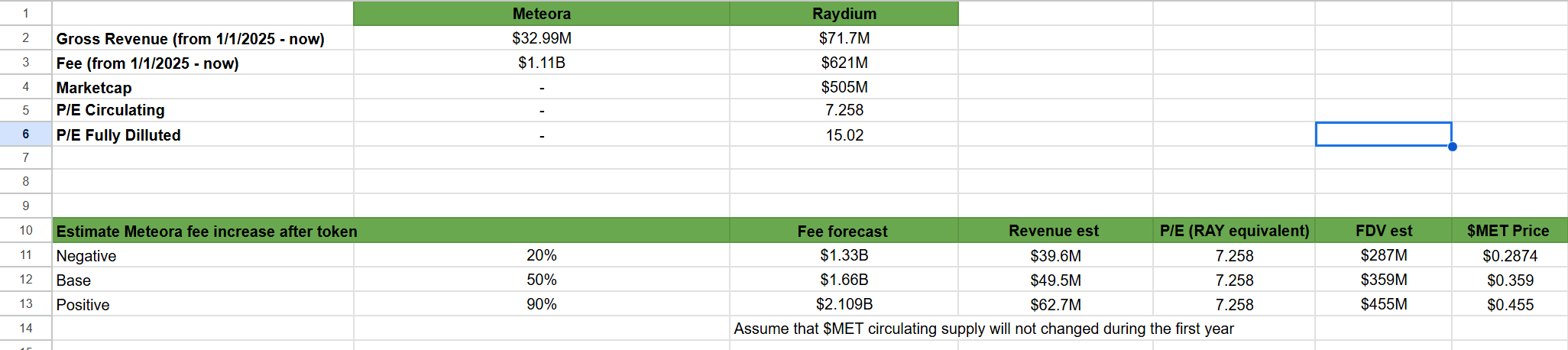

Revenue-Based Valuation

Using revenue and growth metrics similar to Raydium, could estimate $MET’s fair value based on comparable fundamentals.

- TVL and revenue between Raydium and Meteora are closely aligned.

- Both projects show steady trading volumes.

- The valuation assumes market efficiency and excludes subjective factors such as VC strength or market maker influence.

Two valuation approaches are proposed, based on the following assumptions:

- The market price of RAY accurately reflected the project's value (Market Efficiency).

- The valuation does not account for unquantifiable factors, such as the strength of investors, the development team, or market makers.

By applying Raydium’s P/E ratio, profit could estimate:

Applying Raydium’s growth trajectory and profitability margins as a reference, $MET’s projected prices under this model are approximately $0.287, $0.359, and $0.455, which align closely with its expected launch range around $0.5.

Note: These predictions are not official and may vary based on real-time market conditions.

Market Sentiment Method

According to Whales Market, $MET’s pre-market price sits at $0.94, corresponding to an FDV of approximately $940M. Pre-market price often reflects real investor sentiment ahead of TGE, so we’ll breakdown three potential market scenarios.

Bear Case

After the crash on October 10th, total crypto market capitalization dropped to $3.3T before gradually recovering. Over $20B in positions were liquidated, dampening investor confidence.

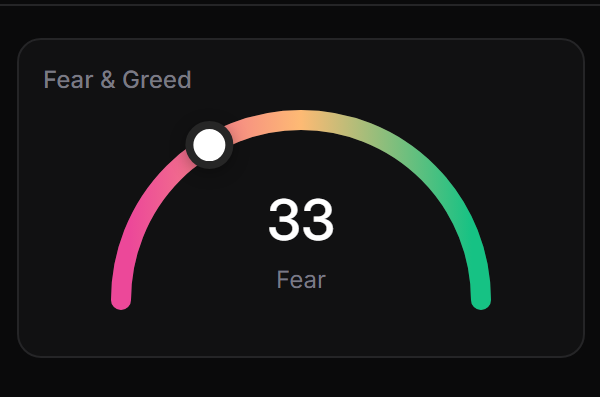

Some projects have delayed their TGEs to late Q4 due to unfavorable conditions. The Fear and Greed Index hovering between 25 and 35 indicates a cautious market.

If bearish momentum persists, $MET may trade below $1, likely between $0.6 and $0.8 post-listing.

Base Case

As of late October, the market has shown signs of recovery following corrections on October 10 and October 17. Notably, SOL has rebounded to around $190 from its earlier drop to the $170 zone.

Since Meteora is a Solana-native project, checking SOL’s performance can help gauge sentiment. If the market remains stable, $MET is expected to trade near its pre-market range between $0.9 and $1.3, equivalent to an FDV of $900M to $1.3B.

Bull Case

Technical indicators suggest a bullish:

- Stablecoin dominance shows a bearish RSI divergence (Day chart).

- Total market capitalization displays a bullish divergence (Day chart), an early sign of recovery.

If the broader market rallies near the $MET launch date, the token could ride that momentum and trade between $1.4 and $1.7, reflecting an FDV of $1.4B to $1.7B.

What are the Factors could Influencing $MET Price at TGE?

Market Sentiment

While the crypto market is recovering, it remains fragile. A delay in momentum or an untimely launch could limit $MET’s upside. However, if Solana continues to strengthen, Meteora will likely benefit, especially since it is one of Solana’s leading DEX platforms.

Investor optimism has grown following the creation of a $1.65B Solana fund by Galaxy Digital, Multicoin Capital, and Jump Crypto, which could indirectly support $MET’s performance.

Overall, the crypto market is still on the road to recovery, but if the bear market returns or Solana severe network issues, $MET's FDV could be lower than expected.

Utilities & Tokenomic

$MET is expected to serve as a governance and utility token provide strong intrinsic value. Liquidity providers can add $MET pair to boost, and governance rights allow the community to shape future features such as L2 integrations or features deployment.

Community sentiment has been overwhelmingly positive, with little controversy around its tokenomics. This confidence minimizes short-term risk and builds long-term credibility for $MET’s ecosystem.

Airdrop & Community Reaction

Airdrops are always a double-edged sword. Since $MET’s circulating supply is relatively high and largely community-owned, concerns about post-TGE selling pressure are valid.

However, 77% of Liquidity Distributor NFTs have already registered, meaning many participants will receive MET/USDC liquidity positions instead of direct MET tokens. This mechanism helps reduce immediate sell at launch. Also, the community shows its belief in this project through their activity.

☄️You are not Bullish enough on $MET.☄️

— Lochie (@lochiejarvis201) October 17, 2025

The Liquidity Distributor NFT is 77.7% full.

This is a lot more bullish than you may think.

It means people aren't will to swap their met for USDC at a starting price of $0.50, despite the fact the DAMMv2 pool will generate insane fees.… pic.twitter.com/6EDGOHkrLV

Conclusion

$MET is shaping up to be one of Solana’s most anticipated launches in 2025. With solid fundamentals, strong community engagement, and fair tokenomics, Meteora is well-positioned for a successful TGE itself.

Although short-term volatility is possible due to airdrop dynamics, long-term prospects look promising as Solana’s ecosystem continues to thrive.

FAQs

Q1: What is Meteora ($MET)?

Meteora is a decentralized exchange (DEX) on the Solana ecosystem, best known for its Dynamic Liquidity Market Maker (DLMM), Alpha Vaults, and dynamic fee mechanism, which optimize yield for liquidity providers.

Q2: When was $MET launched?

The $MET will officially launch on October 23rd 2025.

Q3: What is the price of $MET today?

While Meteora ($MET) hasn't been listed yet, users can trade $MET pre-market on Whales Market before the TGE. Here, you can buy more $MET or sell to take profit before it is officially listed on CEXs like Binance or Bybit.

Q4: What is pre-market price of $MET?

Currently, $MET is trading on Whales Market at $0.94. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

Q5: How to check $MET allocation?

Users can check their allocation through Meteora’s official checker. For detailed instructions kindly check this step-by-step guide.