MetaMask, one of the earliest and most iconic products in the crypto market. As a project that appeared very early and became symbolic of the industry, the MetaMask TGE is an event many users are waiting for, especially those who have used the product’s features since its early days.

MetaMask Overview

MetaMask Wallet Definition

MetaMask is a self-custody crypto wallet that enables users to store and manage digital assets while interacting directly with blockchain-based applications through a standard web interface. It was introduced in 2016 by ConsenSys, a blockchain software firm founded by Ethereum co-founder Joseph Lubin. Since then, MetaMask Wallet has expanded its user base to more than 30M monthly active users.

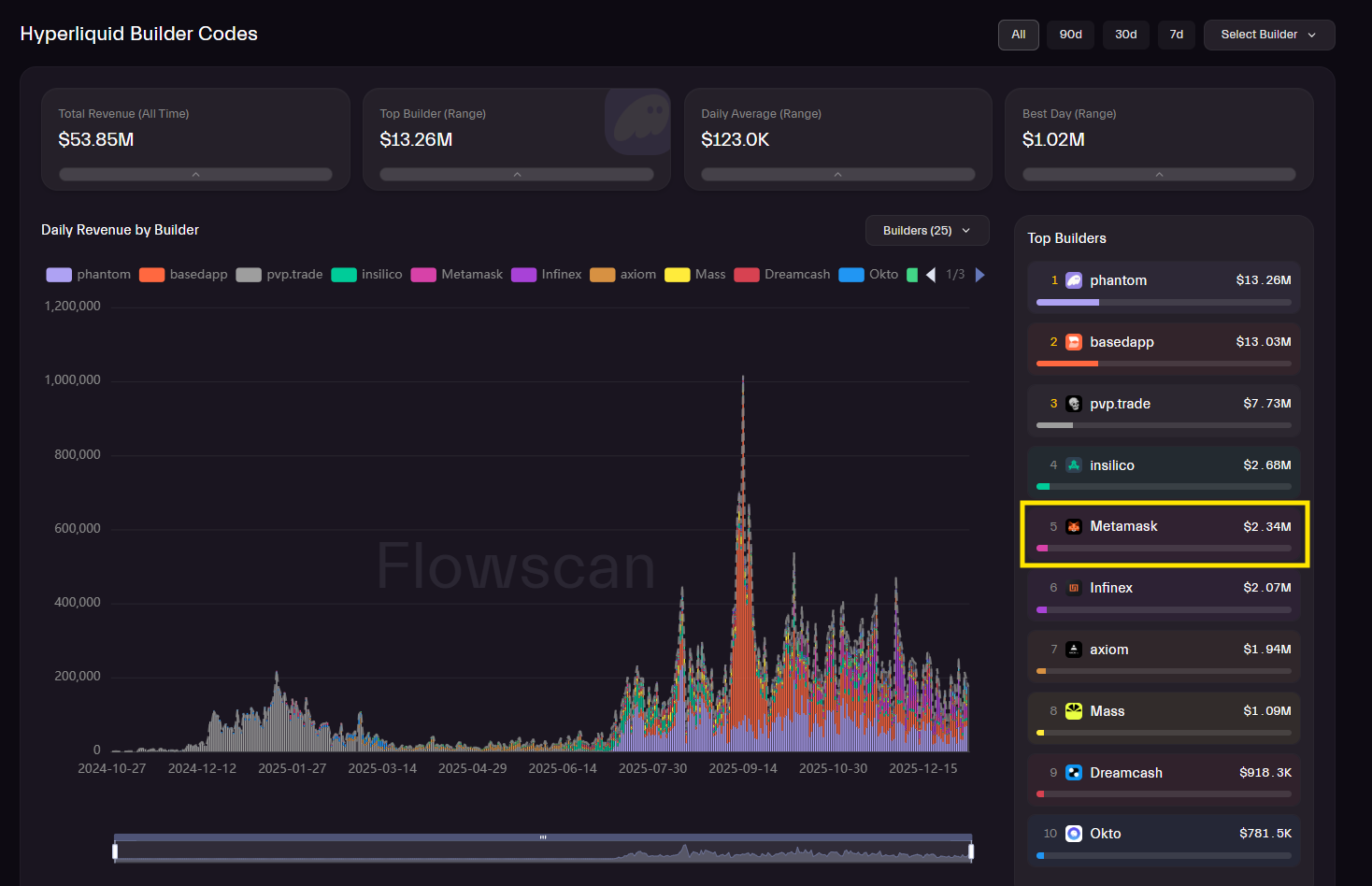

In 2025, MetaMask introduced several notable integrations, including perpetual futures trading via Hyperliquid, native prediction markets through Polymarket, and social login onboarding that allows users to create wallets using Google or Apple ID.

These additions highlight MetaMask’s strategy to expand beyond simple swaps and transfers, diversify revenue streams, and position itself as a more comprehensive on-chain platform rather than just a wallet.

MetaMask Current Performance

Let's compare operational metrics between MetaMask and Phantom. Both are considered OG products in the market, with similar brand value, product structure, and long term positioning.

Phantom, one of MetaMask’s leading competitors today, is also considered to have strong product structure and long-term potential. This comparison helps users form a more reasonable valuation framework for MetaMask.

Revenue:

- Revenue (Annualized): MetaMask $45.9M vs Phantom $107.6M, Phantom 2.3x higher.

- Revenue (30d/7d /24h): Phantom higher by 2.3x / 3.5x / 6.1x.

- Cumulative Revenue: MetaMask $180M vs Phantom $517M, Phantom 2.9x.

DEX/Swap Volume:

- 30d Volume: MetaMask $363M vs Phantom ~$20B annualized, Phantom much higher.

- Cumulative Volume: MetaMask $8.8B; Phantom not disclosed but ~90% of revenue from swaps.

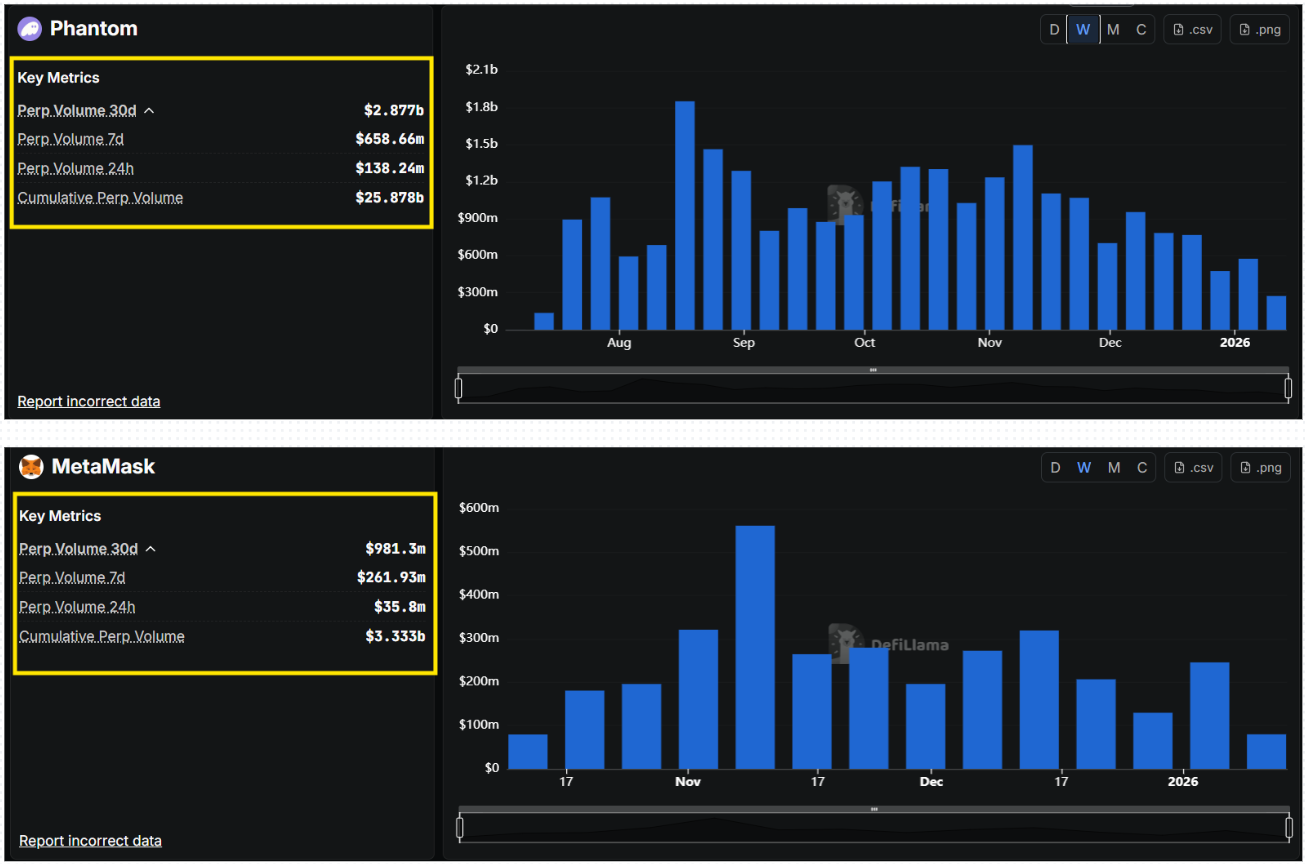

Perp Volume:

- 30d: $981M vs $2.9B, Phantom 3x

- 7d: $262M vs $659M, Phantom 2.5x

- 24h: $36M vs $138M, Phantom 3.8x

- Cumulative: $3.3B vs $25.9B, Phantom 7.8x

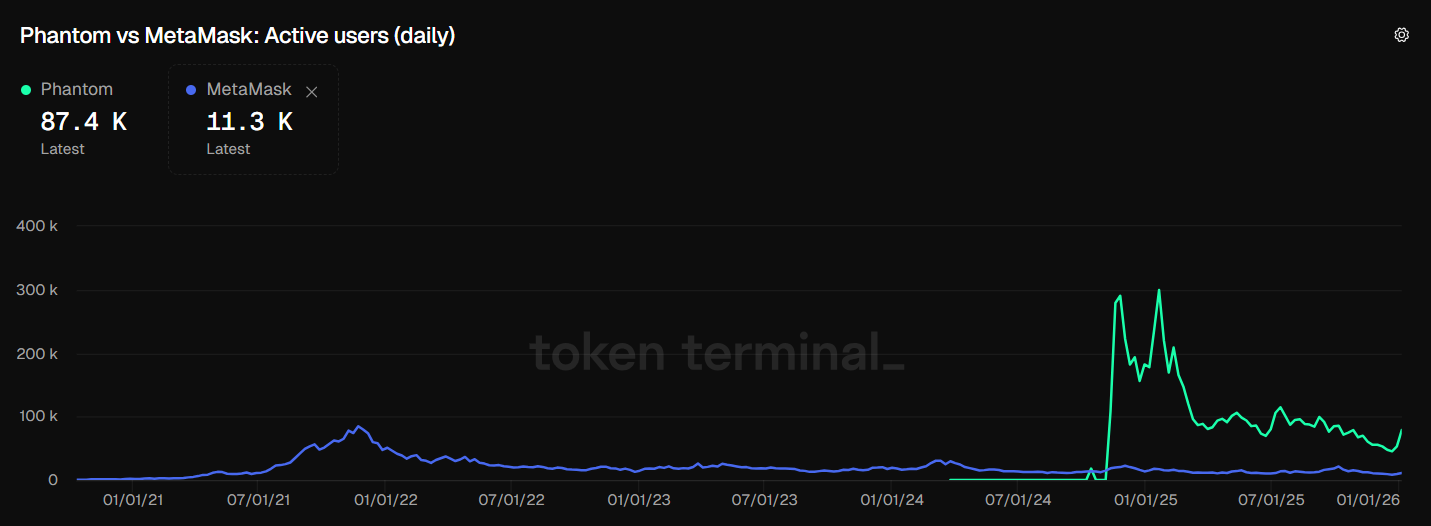

From both a revenue and volume perspective, Phantom is clearly outperforming MetaMask, even though both projects are running incentive programs related to airdrops.

MetaMask’s daily active users are also significantly lower than Phantom’s. As a result, users may partially rely on the gap between these metrics to forecast MetaMask’s potential valuation.

However, it is important to note that these figures only reflect DEX aggregator usage and not total wallet users.

What will MetaMask’s FDV be one day after launch?

What is a reasonable valuation for MetaMask?

To estimate a reasonable FDV for MetaMask, Phantom can be used as a benchmark. The comparison is based on the Price-to-Sales (P/S) ratio, a common valuation metric that measures how much investors are willing to pay for each dollar of annual revenue.

- Price-to-Sales (P/S) is calculated as valuation divided by annual revenue and is widely used for revenue-generating crypto products.

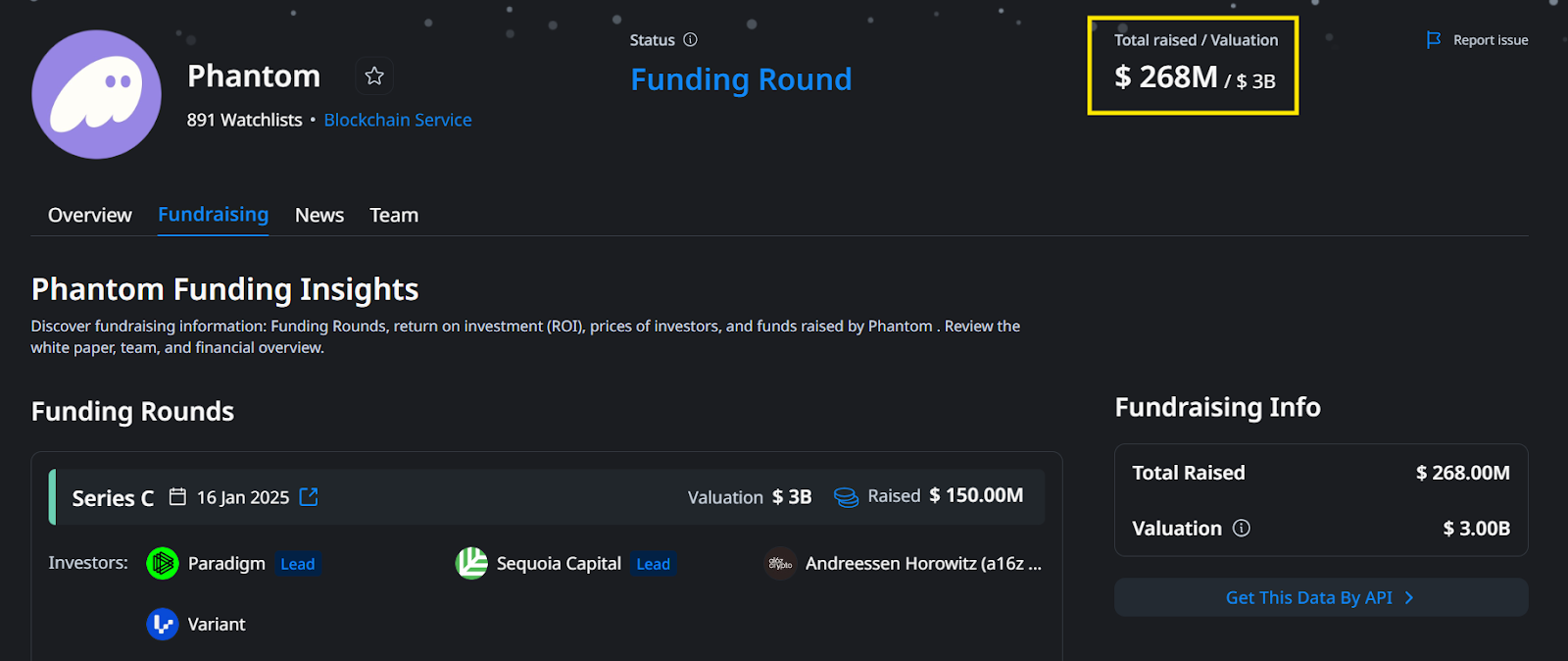

- According to CryptoRank, based on a $3B valuation and $107.6M in revenue, Phantom’s P/S ratio is approximately 27.9x. Historically, Coinbase has traded at a 12x to 15x P/S ratio.

- At this valuation, investors are effectively paying around $28 for every $1 of annual Phantom revenue.

- This P/S multiple provides a useful reference point when applying a similar valuation framework to MetaMask’s FDV.

However, one important consideration is that Phantom’s valuation was raised during a bull market, when sentiment toward crypto projects was quite optimistic.

If MetaMask launches under current market conditions, valuations should be approached more conservatively, depending on operational performance and broader market context.

Although MetaMask did not raise capital in the same way as Phantom, it possesses several major advantages:

- ConsenSys advantage: Valued at $7B, potentially $10B or higher post IPO, with Linea contributing scalability. Unlike Phantom, which is independent but backed by a16z and Sequoia, MetaMask benefits from ConsenSys resources such as grants and partnerships including Mastercard.

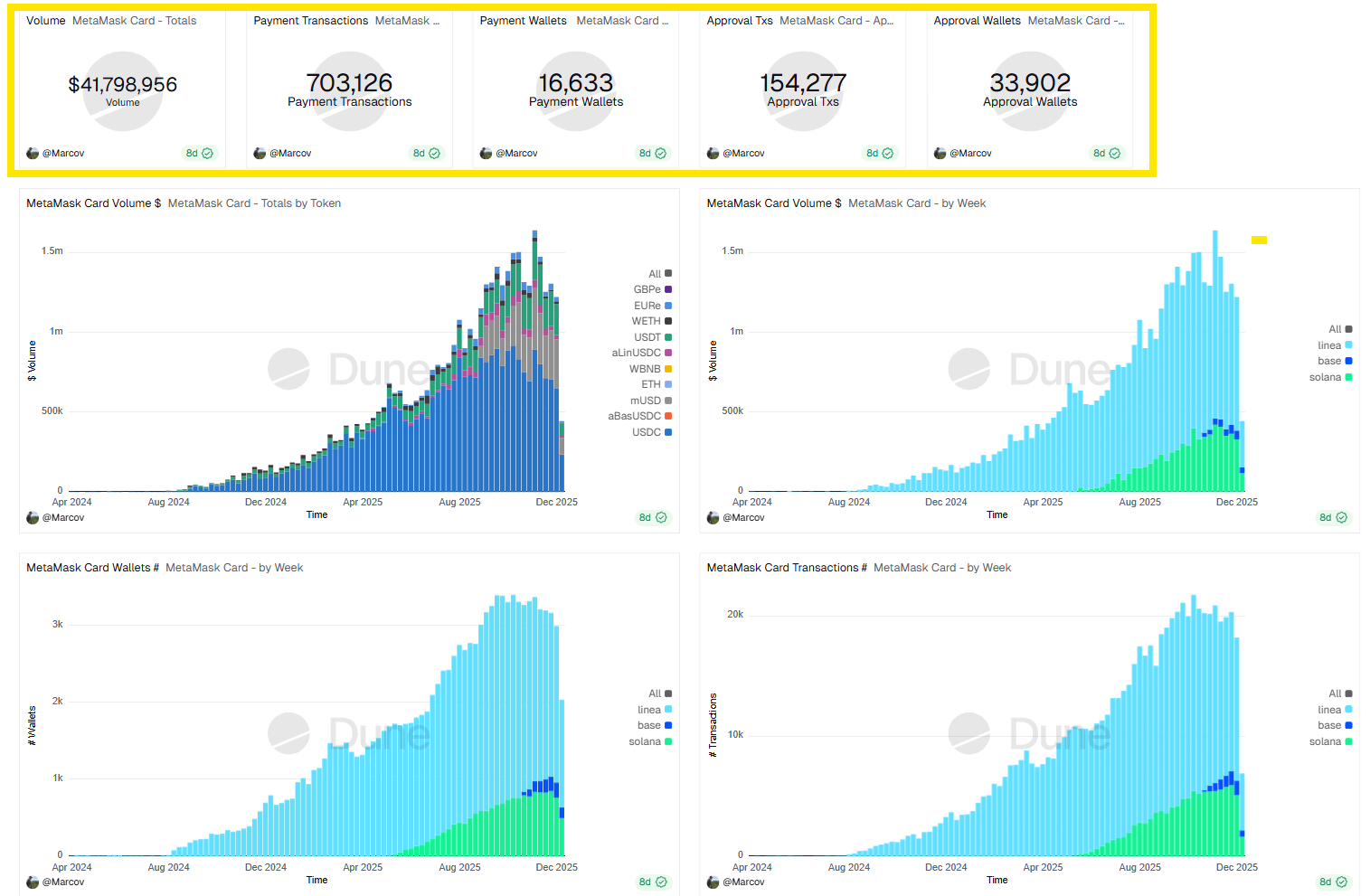

- MetaMask Card: MetaMask has entered the Neobank race with its card product. Metrics such as volume, transactions, and user growth are developing steadily. Daily volume is comparable to leading products such as EtherFi.

- Ecosystem: Phantom benefited significantly from the memecoin boom on Solana during 2024 and 2025, which amplified its growth. MetaMask’s trajectory will likely follow the development of Linea, Ethereum, and EVM chains, while Solana remains more tightly associated with Phantom.

In summary, using Phantom’s $107.6M annualized revenue, which is 2.3x higher than MetaMask’s $45.9M:

- Base case: MetaMask FDV of approximately $1.2B to $1.5B, assuming Linea TGE at $1.7B with a 10% airdrop allocation.

- Bull case: MetaMask FDV of approximately $1.6B to $2.2B, MetaMask is assumed to generate meaningfully higher revenue than today, driven by improved sentiment, higher on-chain activity, and stronger monetization from new product integrations

- Bear case: MetaMask FDV of approximately $600M to $800M, weaker market sentiment and limited revenue growth, resulting in MetaMask trading at a discount to Phantom’s valuation multiple.

These scenarios aim to clearly show how different revenue and market assumptions translate into FDV outcomes, rather than presenting valuation ranges without underlying justification.

Polymarket Odds Analysis

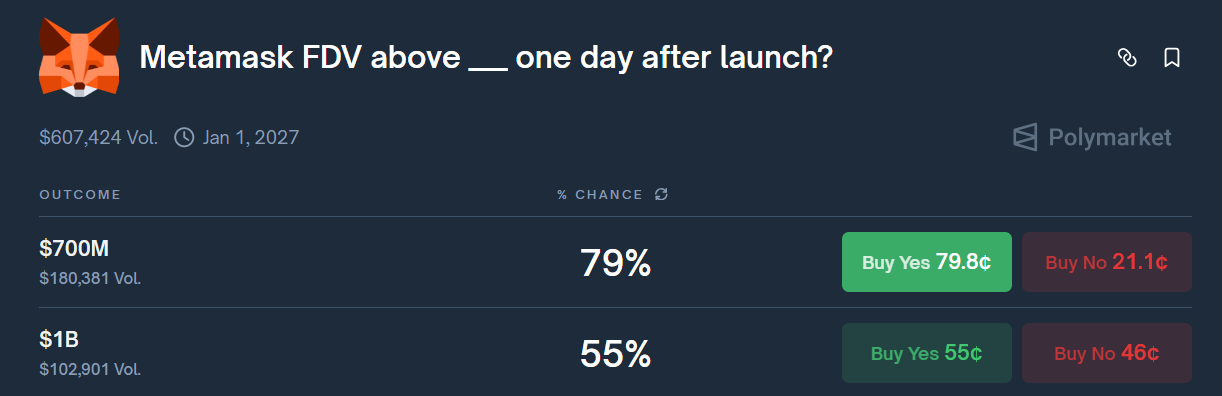

Based on the analysis above, let us examine Polymarket odds to understand current market expectations for MetaMask.

Overall, as of January 8, 2026, the market shows strong conviction toward a valuation above $700M, with a 79% probability and approximately $180K in volume. However, valuations above $1B show hesitation, with only a 55% probability.

- Combining market pricing with the analysis above, positions above $700M align closely with the bear case and offer approximately 20% upside with relatively low risk.

- For valuations above $1B, outcomes depend heavily on the percentage of tokens allocated to airdrops. There is limited incentive for users to hold the MetaMask token, as it functions largely as a bonus for long term product usage. A large airdrop allocation would likely create sell pressure and push valuation below $1B.

- As a result, betting against a $1B valuation is relatively reasonable. If tokenomics allocate a high percentage to airdrops, downside risk below $1B increases, creating potential profit opportunities for this trade.

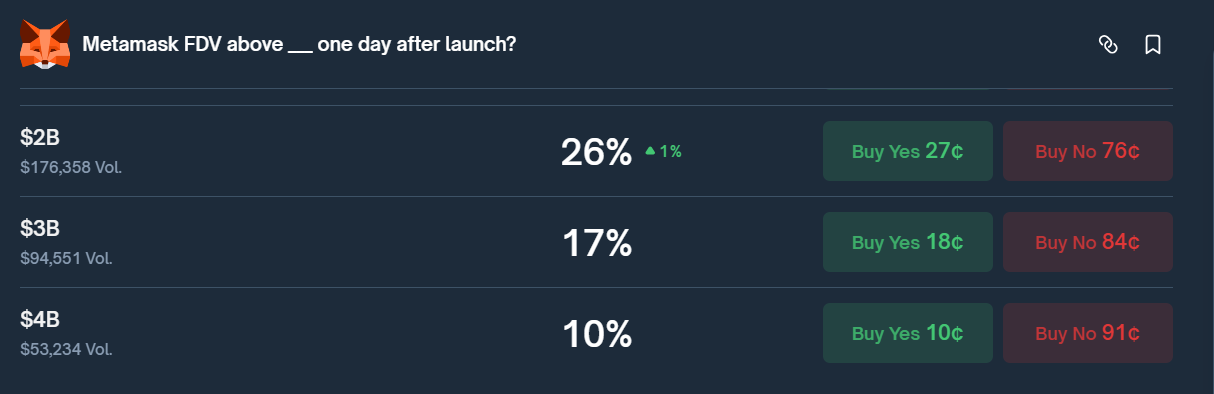

Market pricing MetaMask above $2B currently presents a very low risk reward profile.

- In a bear market, projects are difficult to hype, and crypto markets are increasingly mature, with revenue playing a major role in valuation.

- Linea, ConsenSys’s Layer 2, launched with an FDV of approximately $1.7B.

- Recent launches such as Lighter reached an FDV of approximately $2.4B despite significantly stronger sentiment, volume, and revenue than MetaMask.

Therefore, betting against valuations above $2B can be considered low risk with acceptable returns. MetaMask is most likely to trade around the $1B range, depending on airdrop allocation.

Conclusion

Wallet infrastructure remains a highly promising sector, but intense competition and limited hype make extreme valuations difficult to justify.

MetaMask markets on Polymarket currently offer attractive risk reward opportunities. Users should take time to conduct thorough research before the market identifies mispricing and adjusts valuations accordingly.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. How does Polymarket influence MetaMask price prediction?

Polymarket reflects real time market sentiment, allowing traders to express expectations about MetaMask FDV through on-chain prediction markets rather than traditional price forecasts.

Q2. Is Polymarket a reliable indicator for MetaMask FDV after TGE?

Polymarket odds are not guarantees, but they provide a useful signal by aggregating trader conviction around specific MetaMask valuation ranges.

Q3. What metrics matter most for MetaMask price prediction models?

Revenue growth, swap volume, perpetual trading activity, and airdrop allocation tend to have a stronger impact than headline user counts.

Q4. Why do MetaMask price predictions differ from Phantom comparisons?

Phantom benefited from Solana ecosystem momentum, while MetaMask price prediction is more closely tied to Ethereum, Linea, and broader EVM adoption.

Q5. Can Polymarket odds be used for short term MetaMask trading strategies?

Yes. Polymarket allows traders to position around specific FDV thresholds, making it useful for pre TGE and immediate post launch MetaMask price prediction strategies.

Q6. What is the biggest risk factor in MetaMask price prediction?

Tokenomics design, especially airdrop percentage, is the largest uncertainty and can heavily influence short term MetaMask FDV outcomes.