MegaETH is being discussed as one of the most ambitious Layer 2 projects today, with a bold promise of “real-time” blockchain performance, near-instant transaction processing, and throughput that far exceeds most competitors.

However, the most important question for traders is not about technology, but about valuation: how will the market price MegaETH right after the token goes live? Will this be another familiar multi-billion-dollar FDV launch for a new-generation Layer 2, or just a short-lived spike before sell pressure takes over?

This article breaks down the answer using data, comparable case studies, and probabilities from Polymarket.

MegaETH Overview

MegaETH is a Layer 2 solution built on Ethereum, designed to achieve “real-time” performance by processing transactions as they arrive, rather than batching them into blocks like traditional blockchains.

Key technology highlights:

- Block time: 10 milliseconds, hundreds of times faster than Arbitrum or Optimism (around 2 seconds per block)

- Target throughput: 100,000 TPS, far above most existing Layer 2 networks

- EVM-compatible: Developers can deploy Solidity smart contracts without changing existing code

- Data availability: Powered by EigenDA, providing roughly 800x more capacity than Ethereum L1

MegaETH positions itself as a bridge between Web2-level performance and Web3-level trust, enabling DeFi, gaming, and high-frequency trading applications to run as smoothly as centralized apps.

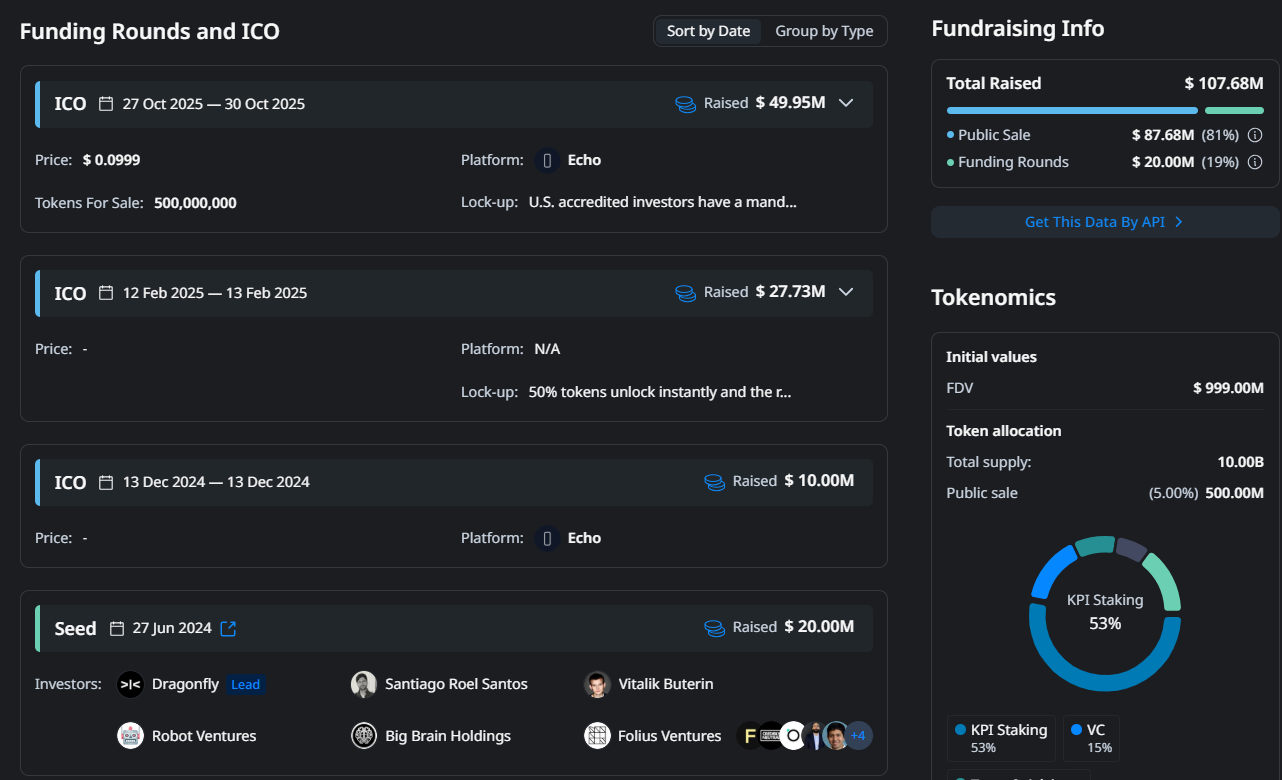

From a funding perspective, MegaETH has raised approximately $107.68M across multiple rounds:

- Seed round: $20M in June 2024, led by Dragonfly Capital

- Public sale: $49.95M in October 2025 for 500M MEGA tokens (5% of total supply)

- Other ICO rounds: $27.73M and $10M

The investor lineup includes Vitalik Buterin as an angel investor, along with Robot Ventures, Figment Capital, Big Brain Holdings, and other well-known names in the space.

Compared to other Layer 2 projects, this is a relatively strong funding profile and serves as an important reference point for estimating MegaETH’s FDV.

Current Performance of MegaETH

As of December 17, 2025, MegaETH is operating in a mainnet beta phase, known as “Frontier”, which prioritizes developers and early adopters.

For this reason, it is necessary to examine MegaETH’s testnet performance to extract meaningful insights. All current data reflects experimental usage rather than real production conditions on mainnet.

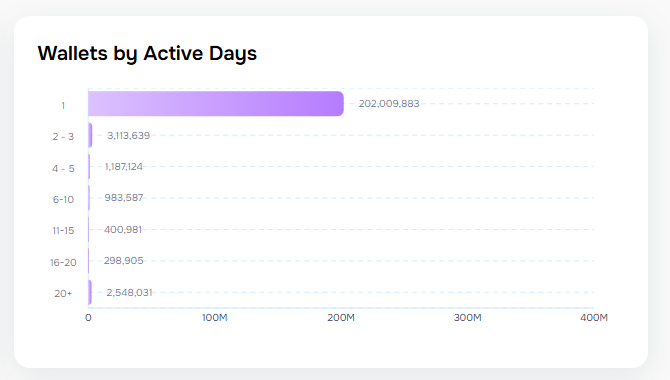

According to LayerHub data (updated November 2025), MegaETH’s testnet processed approximately 6.75B transactions from 210M active wallets within nearly 9 months since its launch in March 2025. On the surface, these figures look highly impressive. The issue lies in how they are interpreted.

A deeper look at user behavior reveals a clear pattern. Over 95% of wallets executed fewer than 5 transactions, and roughly 95% were active for only one day. To reach the top 10% of users, only 4 transactions and at least 2 active days were required.

This suggests that most users were not long-term participants, but rather short-term visitors who claimed faucet tokens, performed minimal activity for potential airdrop eligibility, and then left.

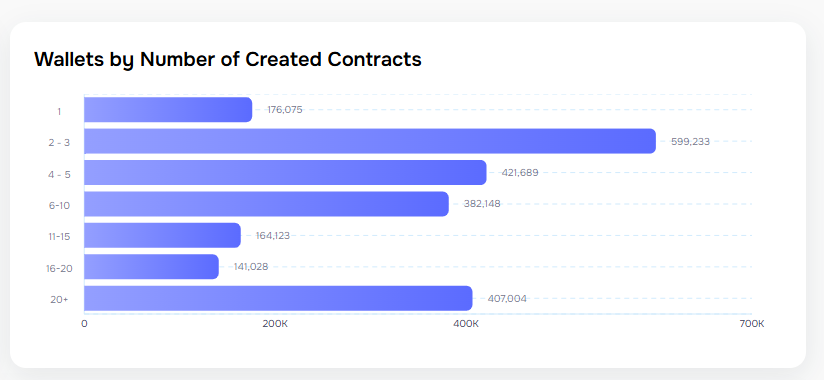

On the developer side, contract creation activity is highly uneven. While a large number of wallets have created at least one smart contract, the majority only deployed a small number of contracts, typically one to three.

A much smaller subset of wallets accounts for heavy contract creation, with 20 or more contracts deployed. This suggests that development activity is concentrated among a limited group of builders, and that broad, organic ecosystem growth has not yet fully taken shape.

Taken together, the data paints a familiar picture seen in many high-airdrop-expectation testnets: high volume in quantity, but low quality in engagement. In other words, headline numbers alone do not reflect how users are actually interacting with the network.

MegaETH Market Cap (FDV) One Day After Launch

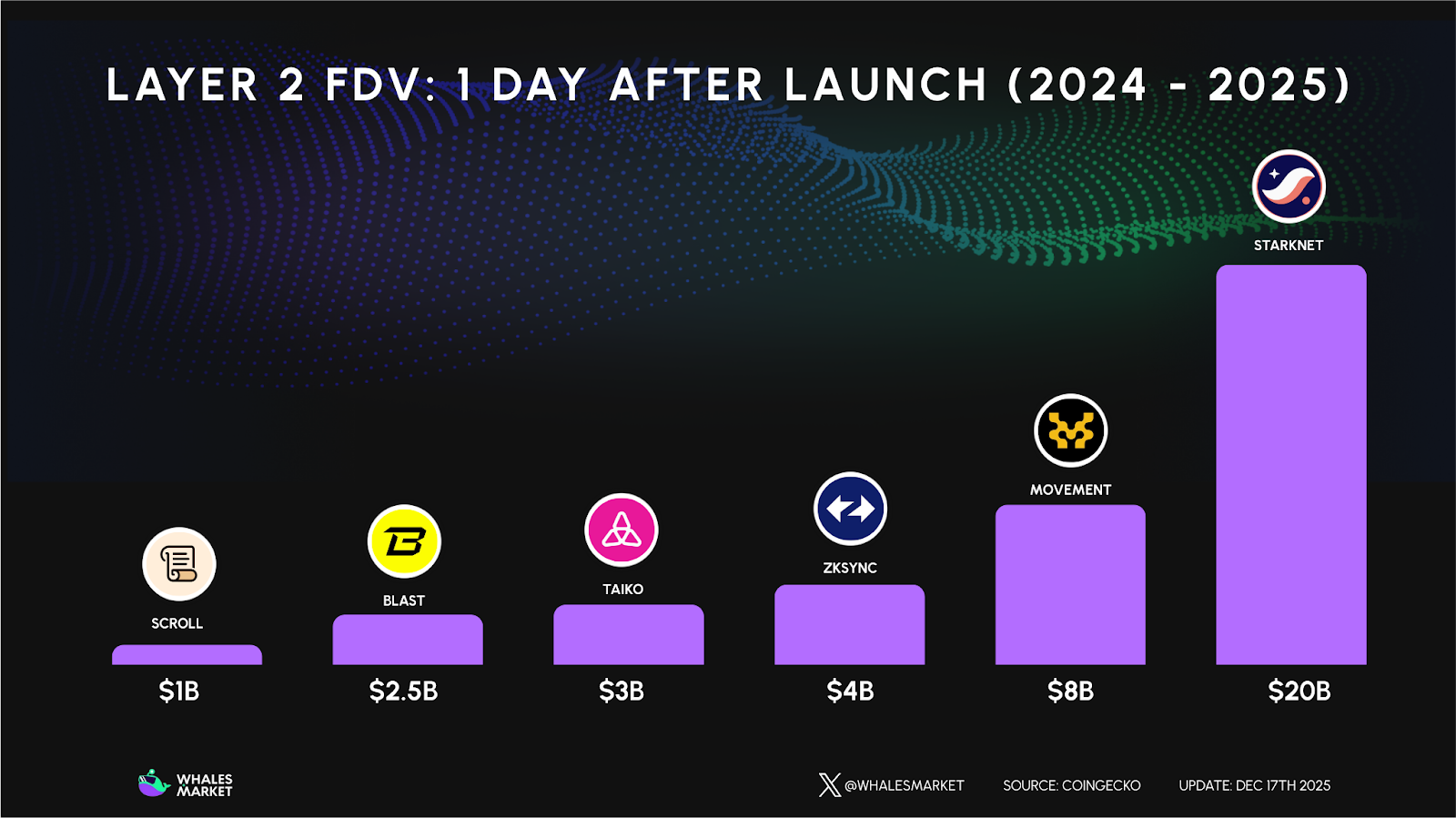

To estimate MegaETH’s FDV after TGE, the most practical approach is to look at Layer 2 projects launched during 2024–2025. These projects share similar market conditions, narratives, and investor behavior.

Comparable Case Studies

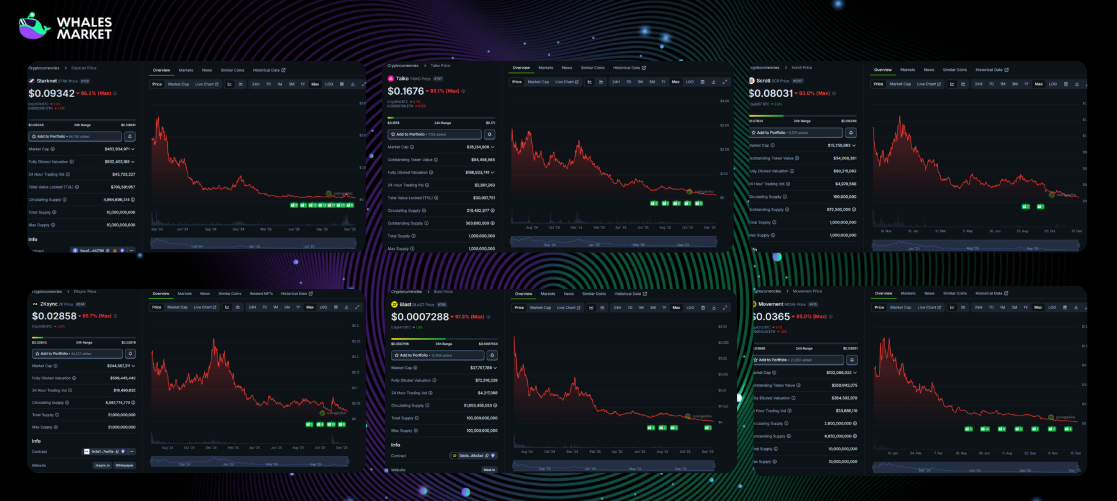

- Starknet is a textbook example of an overhyped TGE. The project raised over $282.5M and launched in February 2024 with STRK opening around $1.90. Within the same day, price spiked to $5, implying nearly $50B FDV, before collapsing to around $2 within hours. After 24 hours, FDV stabilized near $20B. Over the following months, STRK continued to decline and currently sits around $1B FDV, down more than 95% from its peak.

- zkSync launched roughly four months after Starknet with a much more conservative approach. Despite raising $458M, the highest in the group, zkSync TGE’d at around $4.7B FDV. After one day, FDV hovered near $4B. This suggests the market learned from Starknet and began pricing new Layer 2 launches more realistically. Long-term, ZK has also lost over 90% of its peak value.

- Taiko, a zkEVM Layer 2, raised a modest $37.5M. Pre-market pricing suggested a $7B FDV, but the actual TGE opened around $3.27 per token, or roughly $3.3B FDV. After one day, FDV dropped to $2.5–3B. Today, Taiko’s FDV is around $200M, down more than 90% from launch.

- Blast followed a different strategy. The project raised only $20M but attracted billions in TVL through yield incentives. BLAST TGE’d at $0.02, implying $2B FDV, and rose about 20% on day one to $2.4B. Expectations of $5B+ did not materialize. Currently, Blast has declined more than 92% from its peak.

- Scroll took the most conservative launch approach. With $80M in funding, SCR TGE’d at $1.1, corresponding to $1.1B FDV. After one day, FDV dipped slightly to $1B. While this reduced early volatility, the token still trended down over subsequent months to the $0.30–0.40 range.

- Movement is the most recent and surprising case. With only $41.4M raised, MOVE launched in December 2024 and immediately reached $8–10B FDV. The token was listed simultaneously on Binance, Coinbase, OKX, and Upbit, driving strong FOMO. After 24 hours, FDV remained near $8B. Over time, MOVE collapsed more than 97% to its all-time low.

Scenario 1: Opportunity with Lower Risk

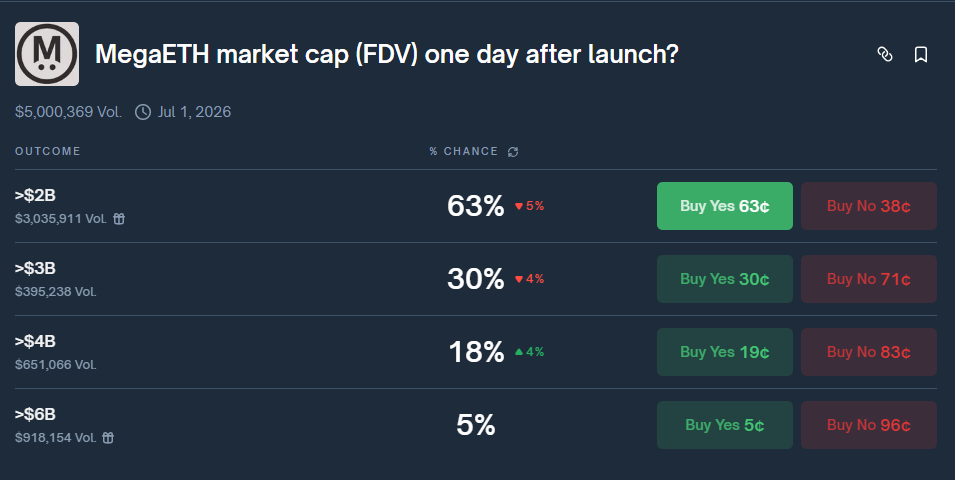

Overall, the probability of MegaETH reaching FDV above $2B one day after launch appears relatively high. This view is supported by two main factors.

First, the public sale floor implies a valuation of approximately $999M, creating a meaningful downside buffer. Second, pre-market trading consistently reflects valuations near $3B, indicating that the market has already accepted a multi-billion-dollar FDV scenario.

More importantly, demand stands out as a key differentiator. The public sale was oversubscribed 27.8x, with approximately $1.39B in bids for a $50M cap, far exceeding demand seen in most recent Layer 2 launches. This significantly reduces the risk of failure at lower FDV levels.

As a result, FDV around $2B can be viewed as the base case: high probability, limited upside, and lower risk compared to higher valuation brackets.

Scenario 2: Opportunity with Higher2B Risk

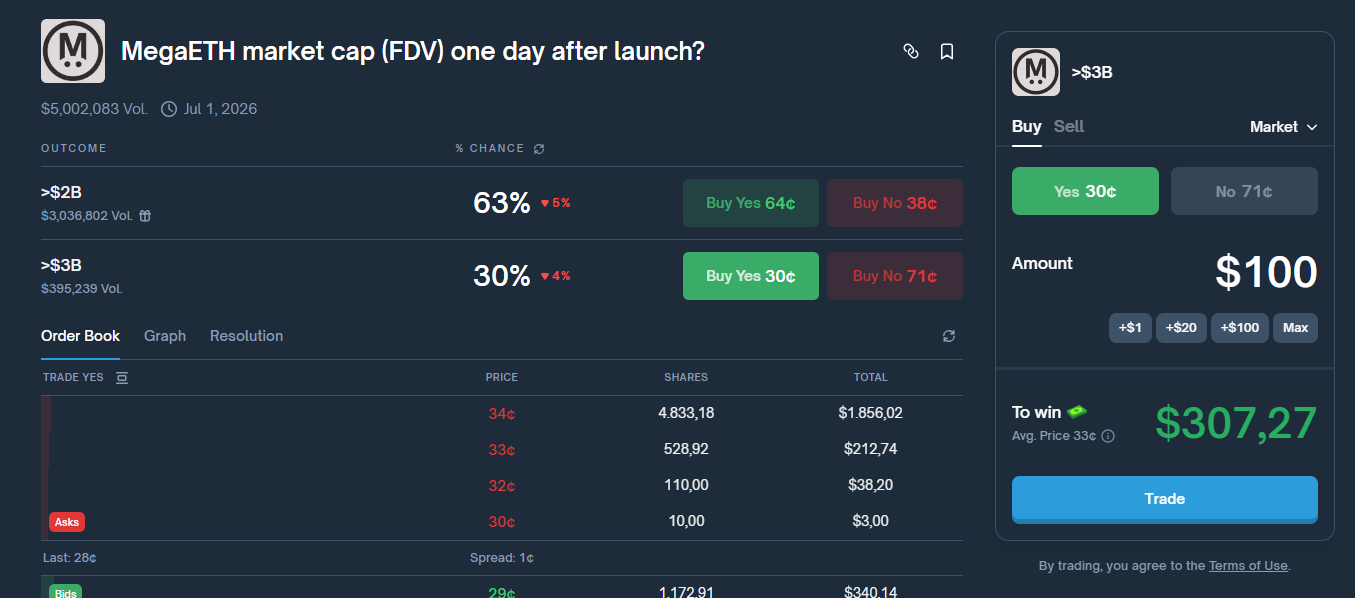

The second scenario focuses on FDV levels above $3B, which offer greater upside but involve more uncertainty.

- FDV above $3B becomes possible if the launch executes smoothly, liquidity is sufficient, and no major market shock occurs around TGE. Projects such as Taiko or Monad have traded in this range after launch despite weaker demand than MegaETH. However, sustaining this level requires positive sentiment and disciplined early trading.

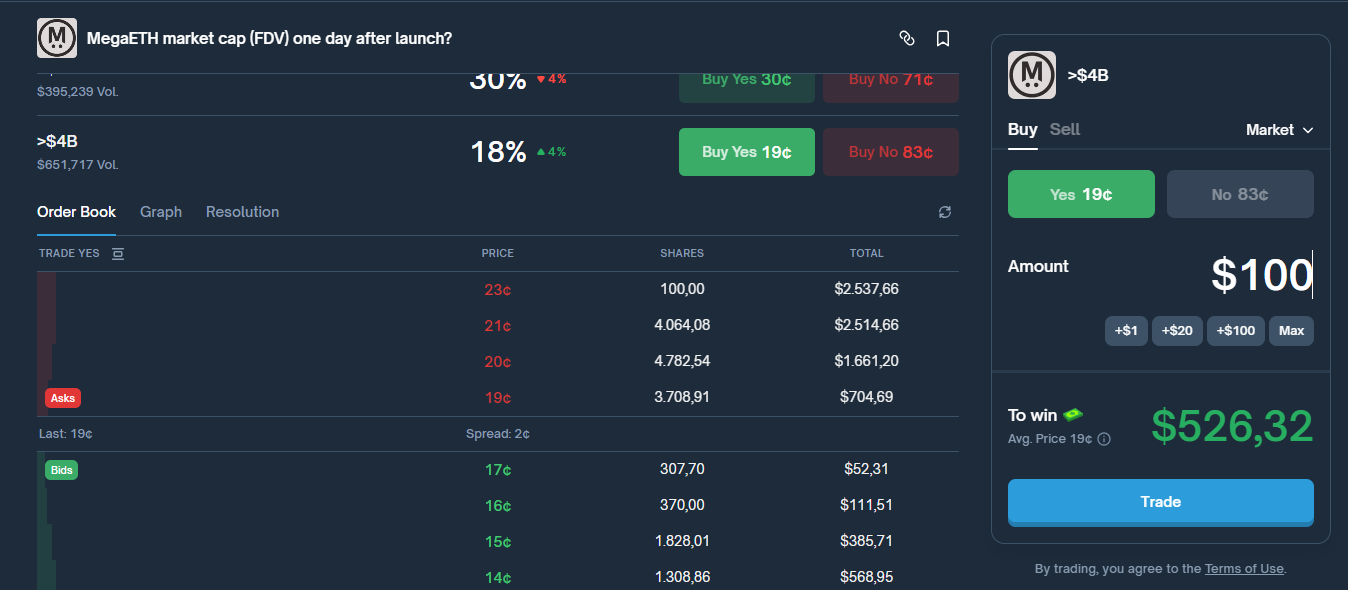

- FDV above $4B typically depends on strong catalysts or short-term FOMO, similar to the Movement case. While sharp spikes are possible in the first hours, history shows these levels are difficult to maintain without exceptional market conditions or strict supply controls.

A key pattern cannot be ignored: most new Layer 2 tokens experience severe declines after TGE. Starknet, zkSync, Taiko, Blast, and Movement all dropped more than 90% from their peaks. This indicates that regardless of day-one FDV, airdrop sell pressure and unlock schedules remain structural risks.

This scenario requires users to accept high volatility and trade-off probability for higher upside.

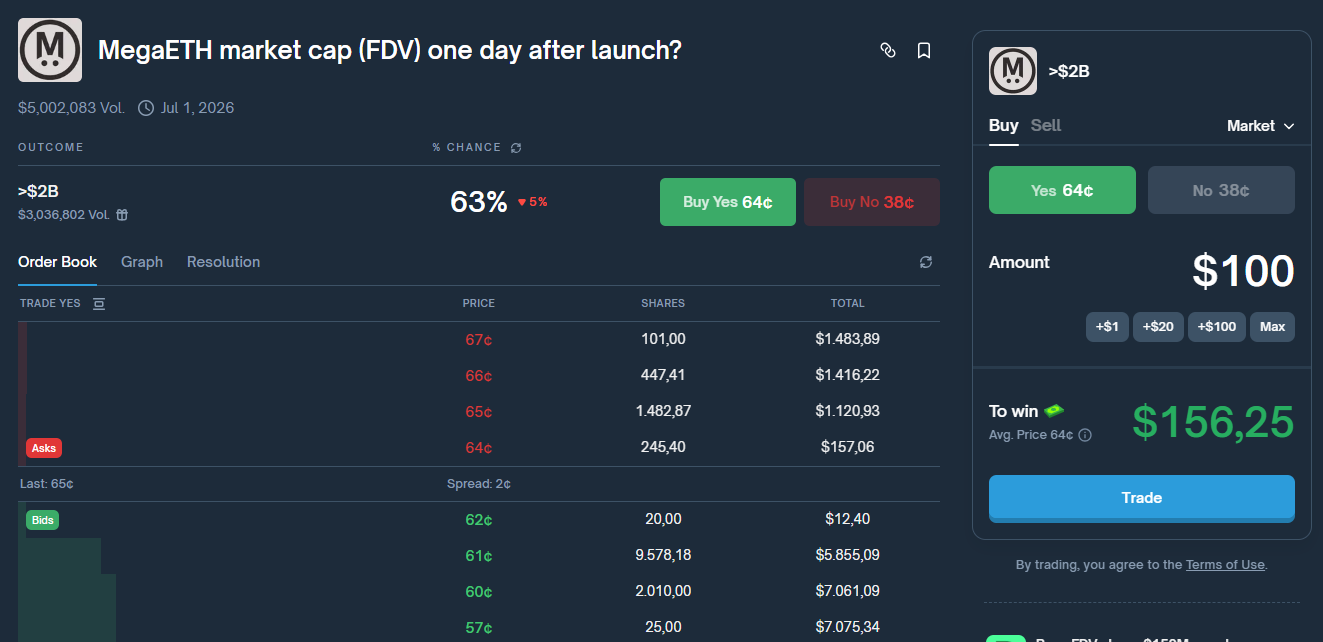

Polymarket Data

Polymarket data reinforces this framework. The probability of MegaETH exceeding $2B FDV after one day is currently priced at 63%, the highest among all brackets. The $3B level is assigned around 30%, while $4B drops to 18%, and extreme outcomes such as $6B+ are nearly dismissed at approximately 5%.

This aligns well with the analysis above: $2B represents a relatively “safe” valuation zone, while higher levels offer upside at significantly higher risk and dependency on short-term sentiment.

Notes Before Placing a Bet

Despite positive probabilities for the $2B scenario, several risks remain:

- The Layer 2 space is increasingly crowded, while Ethereum L1 continues to improve performance and user experience

- The broader market may be entering an early downtrend, reducing appetite for holding new tokens

- MegaETH currently has very few real users, with most activity driven by testnet participation and airdrop farming

- The ecosystem lacks standout applications generating organic demand

For these reasons, FDV below $2B remains a realistic possibility. Additionally, there is no official confirmation regarding mainnet or TGE timing, so further research is recommended before placing a bet.

Conclusion

MegaETH combines strong technology with exceptional early demand, making FDV around $2B one day after launch the most reasonable and highest-probability outcome based on historical data and Polymarket pricing. However, market conditions, Layer 2 competition, and the lack of real users remain key risks.

For traders, this is not a guaranteed bet, but a balance between probability and upside. Lower FDV brackets favor safety, while higher brackets suit those willing to accept significant volatility.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. Why is predicting MegaETH’s FDV within the first 24 hours after TGE important for traders?

Because this period experiences the highest volatility, driven by FOMO, early liquidity, and sell pressure, creating both rapid opportunities and risks.

Q2. Which factors most strongly influence whether MegaETH reaches certain FDV levels on day one?

Public sale floor, pre-market pricing, overall market sentiment, and airdrop-related sell pressure play the largest roles.

Q3. Why is the $2B FDV level often considered the base case for MegaETH?

Because it is supported by the public sale floor and currently carries the highest probability on Polymarket.

Q4. Under what conditions could MegaETH’s FDV exceed $3B within the first day?

If the launch is smooth, liquidity is strong, and short-term FOMO appears in a stable market environment.

Q5. What risks could push MegaETH’s FDV below market expectations after TGE?

A broader market downturn, heavy airdrop selling, and the absence of strong short-term catalysts.

Q6. How should traders approach FDV prediction markets for MegaETH on Polymarket?

By defining acceptable risk levels, avoiding emotional FOMO, and selecting FDV brackets aligned with short-term trading strategies.