Lighter’s TGE is getting very close. If the 2020 to 2021 cycle was defined by the narrative of “Ethereum killers,” today the crypto investor community is watching a new storyline unfold: the “Hyperliquid killer.”

Earlier, when Aster reached TGE, people immediately started comparing Aster to Hyperliquid. Even though that battle has not been settled, the market is now seeing investors begin to compare Lighter with Hyperliquid.

So who is actually the leader in the Perp DEX segment?

How do Hyperliquid and Lighter differ in operating model and architecture?

A good way to answer that question is to compare the design philosophy behind the two platforms. Their architecture choices are not just technical details. They shape who the product fits, how liquidity forms, and what the long term upside can look like.

Hyperliquid: A purpose built L1 for orderbook trading and margin

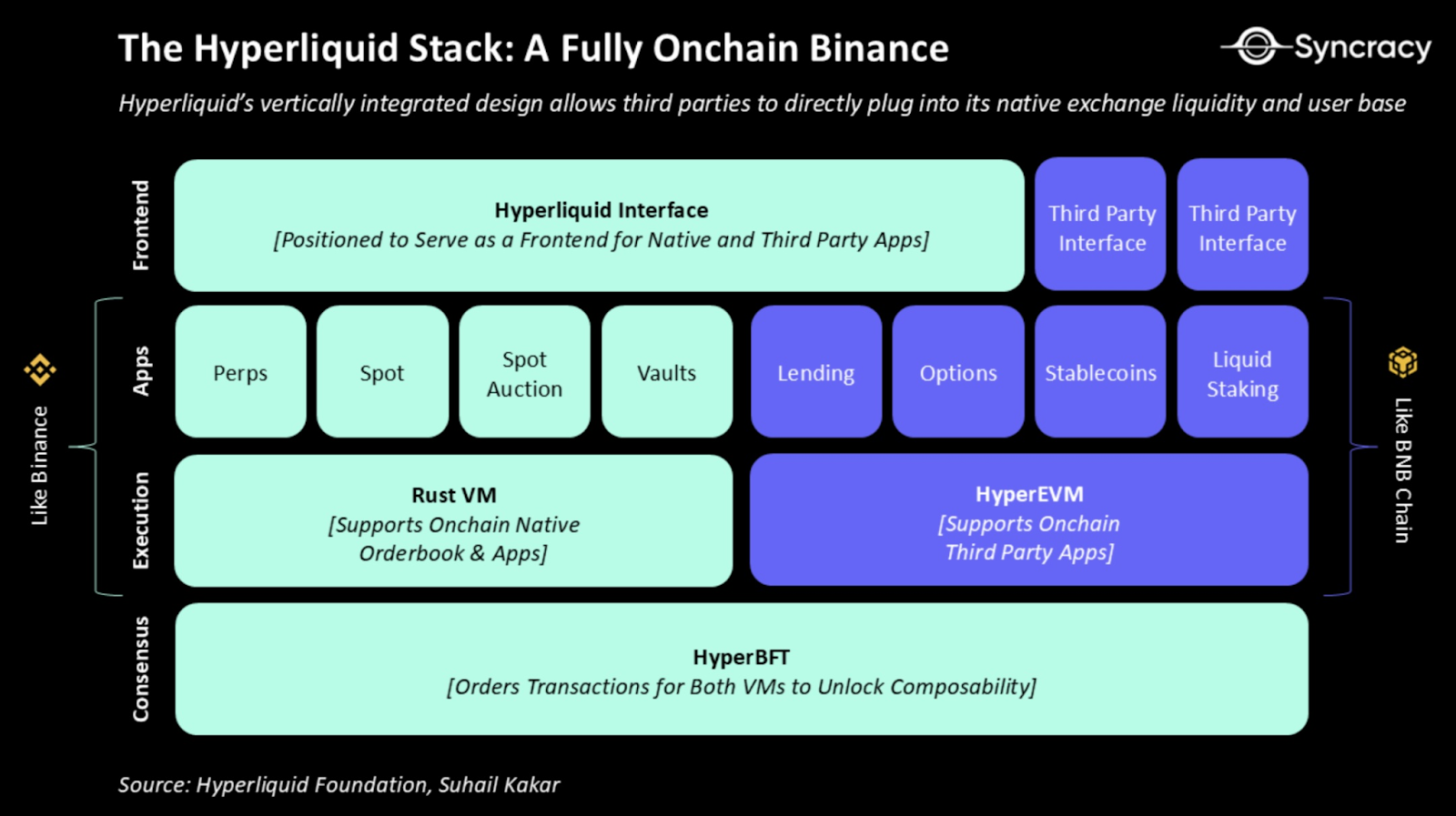

Hyperliquid is not a perp DEX deployed on someone else’s Layer 1 or Layer 2. It is a specialized Layer 1 designed for financial trading. Its structure is built around two layers:

- HyperCore: The closed layer that handles the core trading stack such as orders, perps, spot, funding, and liquidations. The goal is a CEX like experience with fast finality and deep liquidity

- HyperEVM: The open layer where developers can deploy EVM applications such as lending, AMMs, LSD, and vault strategies. This is the flexible layer that expands the platform’s composability.

These two layers are different, but they both produce blocks on the same chain. As a result, DeFi apps on HyperEVM can read data from HyperCore in a consistent way, while HyperCore does not get slowed down by complex smart contract execution.

Put simply, HyperCore provides the engine, liquidity, and trading data, while HyperEVM provides the application layer that uses and restructures that capital.

Lighter: ZK-rollup on Ethereum

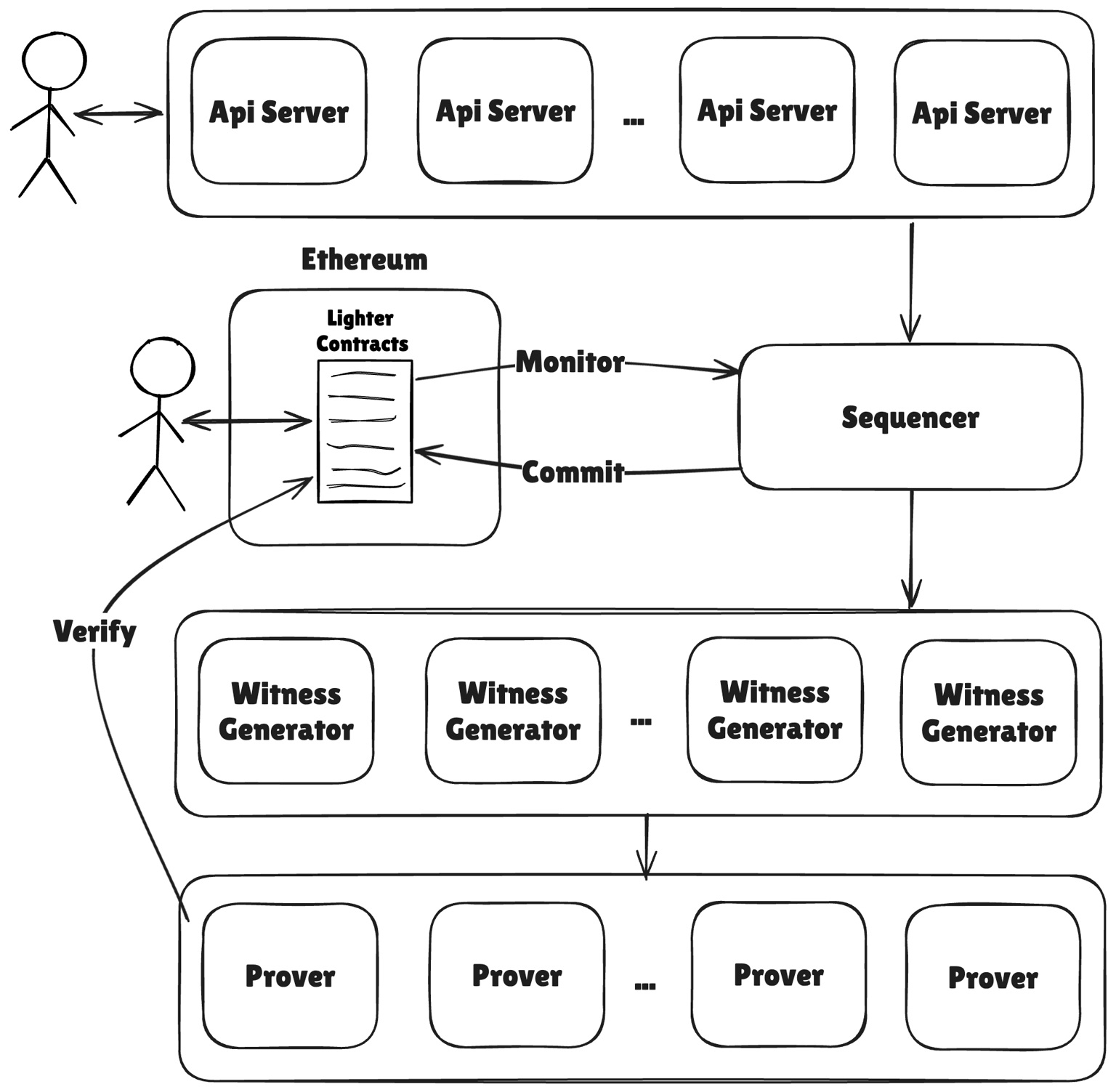

Lighter is a decentralized perpetual futures exchange that runs on a purpose-built zero-knowledge rollup connected to Ethereum. It relies on custom ZK circuits to produce cryptographic proofs for key actions like order matching and liquidations, then settles the final state on Ethereum.

This design lets Lighter handle tens of thousands of orders per second with millisecond-level latency, while keeping every trade verifiable and provably fair onchain.

Instead of a monolithic approach, Lighter uses a more modular structure that separates key components.

- Lighter Core is the verifiable compute engine. It executes user signed transactions deterministically through specialized ZK circuits for order matching and liquidations.

- Sequencer orders transactions in FIFO order from the mempool, provides soft finality, executes operations, and produces data for the Prover and Indexer. It also integrates with oracles to update prices.

- Prover generates SNARK proofs for batched transactions using custom circuits to verify state transitions, signatures, margins, and order validity.

- In addition, although the docs do not mention “LighterEVM” directly, the system has an equivalent component in the form of general smart contracts on Ethereum. These contracts function as the onchain layer of an app specific L2 rollup and enable EVM compatible integrations that support DeFi composability.

The workflow on Lighter can be described as follows

- Users submit orders through an API.

- The Sequencer processes the orders and commits to Ethereum.

- The Witness or Prover produces the proof.

- The Ethereum verification contract updates state, and users can verify independently.

Lighter vs Hyperliquid: Design Philosophy

Similarities

Overall, both Lighter and Hyperliquid aim to solve the core problems of DeFi perp trading: High matching speed that feels CEX like, deep liquidity, composability with other DeFi apps, and onchain security without sacrificing decentralization.

Both use a two layer or modular architecture to separate core trading functions such as order matching, liquidation, and funding from general purpose DeFi.

- On Hyperliquid, HyperCore handles pure trading such as perps, spot, and margin, while HyperEVM expands the system with smart contracts such as Lending, AMMs, and vaults.

- On Lighter, Lighter Core focuses on verifiable compute for orders and liquidations through ZK circuits, and it uses an Order Book Tree to enforce price time priority.

There are also several other shared points between the two projects:

- DeFi Composability: both encourage builders to deploy apps on top. HyperEVM provides an open environment for LSD or LST and structured products, while Lighter leverages Ethereum to support universal cross margin.

- Security:both ensure trades are executed deterministically to avoid forks or reorgs. Hyperliquid uses a custom consensus system, while Lighter uses ZK proofs to verify state transitions.

- Revenue: a large share of activity and revenue comes from perp and spot orderbook trading, margin management, funding rates, and liquidations.

Differences

The biggest differences are the base layer, the degree of modularity, and dependence on Ethereum. Hyperliquid is an independent L1 that controls its own consensus and state, while Lighter is an app specific ZK L2 rollup anchored on Ethereum.

- Modular Vs Monolithic: Hyperliquid separates HyperCore and HyperEVM, but all execution still happens on the single Hyperliquid chain. With Lighter, the system is fully modular because it splits the flow into multiple components across distinct stages.

- Integration: Hyperliquid is not anchored to Ethereum and interacts less directly with it, relying on internal validators to run its system. Lighter anchors proofs and state on Ethereum mainnet, which means it depends on Ethereum fees and congestion.

- Performance & Costs: Hyperliquid can be more expensive in fees due to full onchain execution, while Lighter reduces costs through offchain matching and only verifies proofs onchain.

- Cross-Chain: Hyperliquid needs proxies or bridges for cross chain transfers. Lighter natively supports Ethereum assets without needing complex bridging.

Overall, Hyperliquid fits an independent open financial system, while Lighter prioritizes integration with Ethereum to leverage Ethereum liquidity and security.

Of course, no structure is a guaranteed winner. Each design has its own tradeoffs, and projects built around what they believe is correct for long term development.

This is similar to the ongoing debate about whether Solana or Ethereum is the better L1. Overall, the market needs both, and each design serves a different user demand.

What is the current state of Hyperliquid vs Lighter?

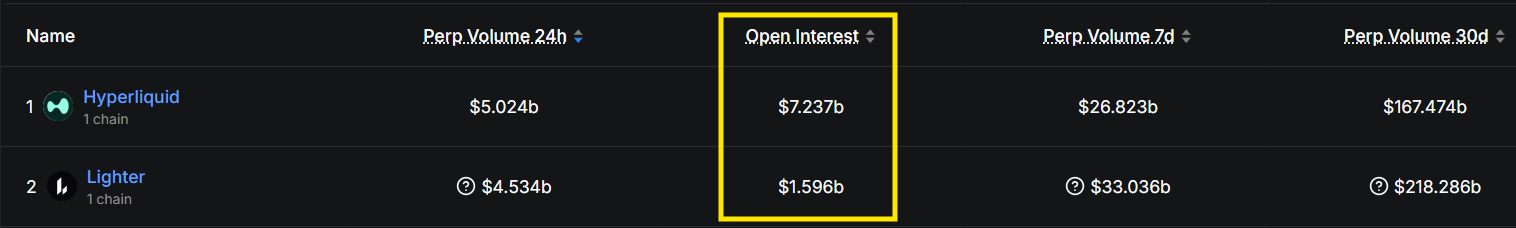

Trading Volume

- 24h: Hyperliquid leads ($5.024B vs $4.534B)

- 7d: Lighter leads ($33.036B vs $26.823B)

- 30d: Lighter leads ($218.286B vs $167.474B)

Looking only at trading volume, users might think Lighter is winning. However, if evaluated more carefully, the truth may be on the other side:

- Hyperliquid’s open interest is about 4.5x higher than Lighter’s.

- Lighter’s volume is still being distorted by airdrop hunting. Only after the airdrop actually happens will the market be able to judge how many traders use Lighter for real demand.

In addition, higher OI on Hyperliquid indicates:

- Deeper liquidity: There is more capital available to match orders, which helps traders open or close large positions without causing large slippage. This makes the platform more attractive to institutional traders or whales, because they can trade large sizes without moving the market too aggressively.

- Higher Market Interest: Higher OI also reflects more traders holding positions on the venue. It is often more associated with organic activity than wash trading, because wash trades increase volume but do not increase OI.

- High OI can lead to more stable funding rates and fewer sudden price shocks, helping the platform sustain volume over time. For example, if high OI is paired with stable volume, it suggests a healthier ecosystem with real participants.

If evaluating trading volume and OI together, Hyperliquid appears to be winning in becoming the preferred destination for users..

Revenue

It is easy to see that Hyperliquid’s revenue is significantly stronger than Lighter’s. This revenue difference will also strongly influence how each project evolves from here:

- In the latest AMA, the Lighter team revealed that it will implement buybacks for the token $LIT. That sounds bullish, but investors still need to wait for the full tokenomics details to evaluate the real impact of buybacks on $LIT.

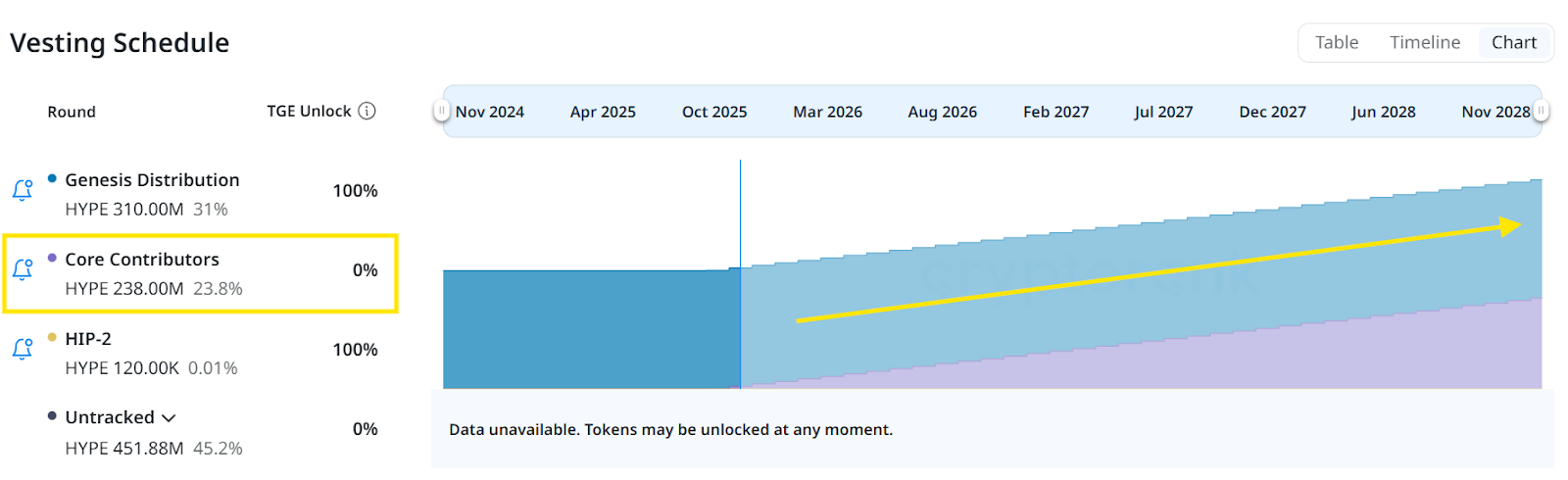

- Hyperliquid’s buyback has been effective because the project did not face selling pressure from VCs during roughly the first year after TGE, it had a large airdrop, revenue was many times higher than Lighter’s, the market entered a bull phase, and 99% of revenue was used to buy $HYPE.

- For Lighter, it is reaching TGE in a less favorable market context. Investors were heavily impacted by the black swan on 10/10. Revenue is lower than Hyperliquid’s, and that revenue may also be strongly affected after the project’s airdrop allocation of 25% ends.

- At the moment, by the end of 2025, Lighter is still mainly reliant on its perp DEX with zero fees, with revenue coming from liquidations, funding, and premium accounts at about $119M annualized. It has not yet rolled out major DeFi integrations or new models to diversify revenue.

- Meanwhile, Hyperliquid’s revenue is not only limited to the perp DEX itself. It is also indirectly supported by the ecosystem around builder codes and HyperEVM, which increases total volume through composability.

However, Hyperliquid will also face a long unlock schedule for core contributors over the next 2 years. Each month, about $200 to $300M worth of $HYPE will be unlocked into the market. No matter how optimistic someone is, this is still an extremely large unlock amount, and it is very difficult for any buyback program to absorb it.

This does not even include the scenario of a bear market, where trading demand would also decline sharply.

Overall, both Hyperliquid and Lighter will face their own difficulties in generating revenue in the coming period. This will affect buyback programs for both platforms, and therefore directly impact $LIT and $HYPE.

Hyperliquid’s Competitive Advantages

After understanding the similarities and differences in architecture and the current operating situation, let's clarify the competitive advantages of each project.

The HyperCore ecosystem

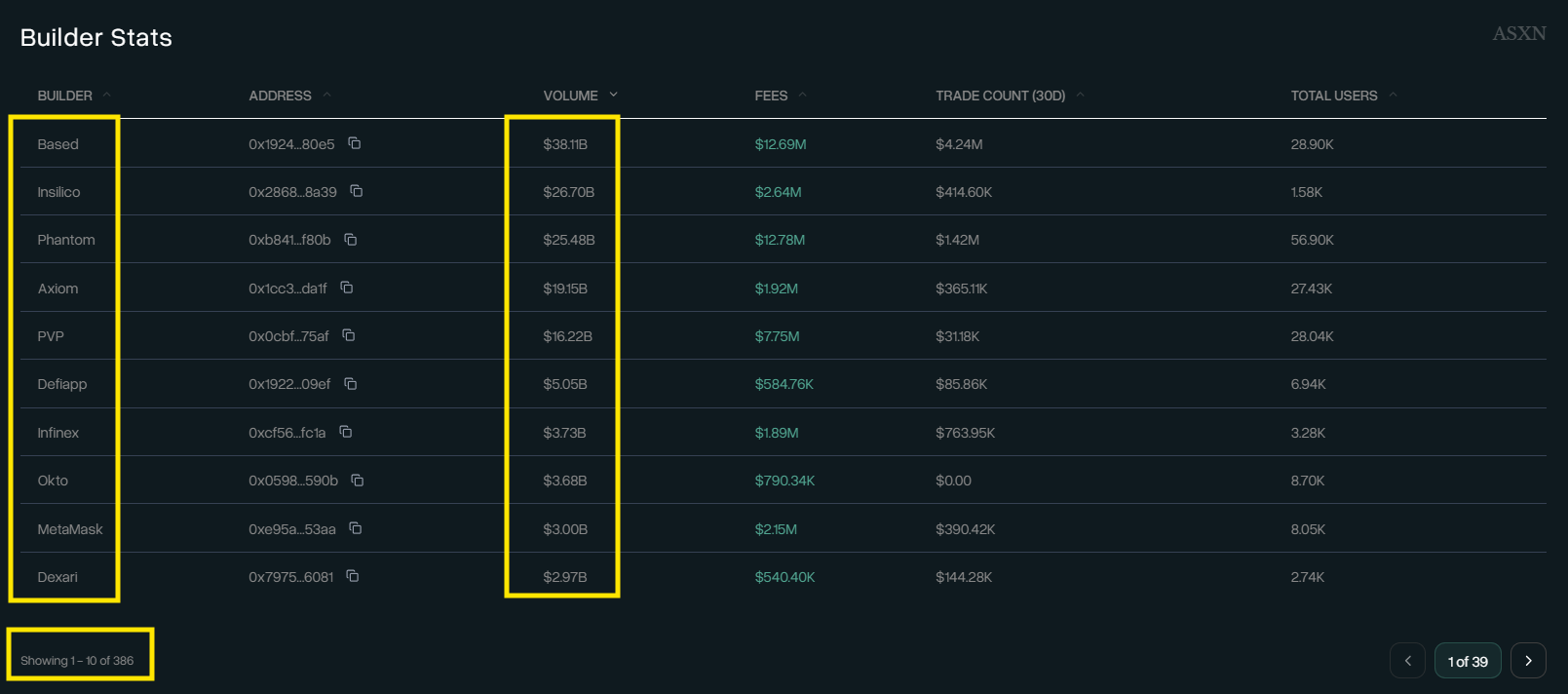

Hyperliquid is not just a DEX that operates alone. It also developed builder codes, an onchain attribution mechanism that allows third parties to build custom frontends and interfaces on top of the project’s liquidity layer, while earning a percentage of fees from the orders they route for users.

HyperCore is still the operational center of the entire Hyperliquid system. After HIP-3, HyperCore’s role expanded clearly. It moved from being a trading engine serving a single exchange into infrastructure shared by multiple perp DEXs deployed permissionlessly by builders.

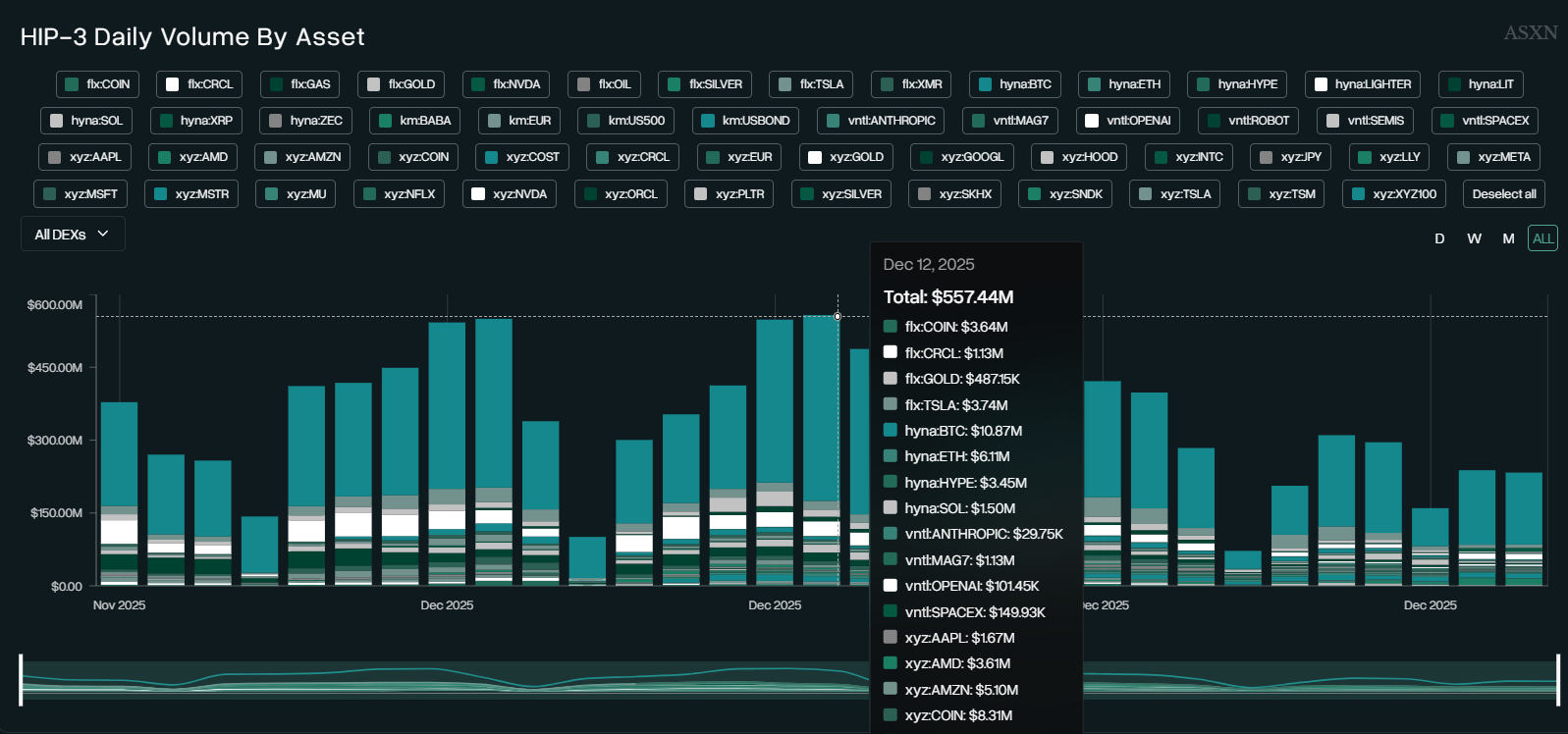

Beyond core perp markets such as BTC, ETH, and SOL, HyperCore also saw strong expansion into TradFi assets through HIP-3, including NVDA, TSLA, GOOGL, META, and MSFT.

On some days, equity perps market volume even reached more than $500M. Total HIP-3 OI exceeded $200M per day, cumulative volume was more than $10B, and accumulated fees were more than $1.6M.

HIP-3 is a 10/2025 upgrade that lets anyone launch new perp markets on Hyperliquid without core team approval. It introduces Growth Mode, cutting fees by 90%+ for new markets to boost adoption and composability, with the long-term aim of turning Hyperliquid into an “everything exchange” by attracting builders and growing volume and TVL.

For many days, these assets led all of HIP-3 in volume and attracted a large number of new traders. A key difference of HyperCore is its ability to expand markets without increasing system risk. Even though deployers and builders can customize oracle sources or risk parameters:

- HyperCore always isolates failure at the market level.

- Prevents risk from spreading into other markets.

- Maintains a unified margin engine and liquidation system, and protects the integrity of system state.

As a result, the HIP-3 ecosystem can experiment with dozens of new assets without impacting traditional perp markets.

The HyperEVM ecosystem

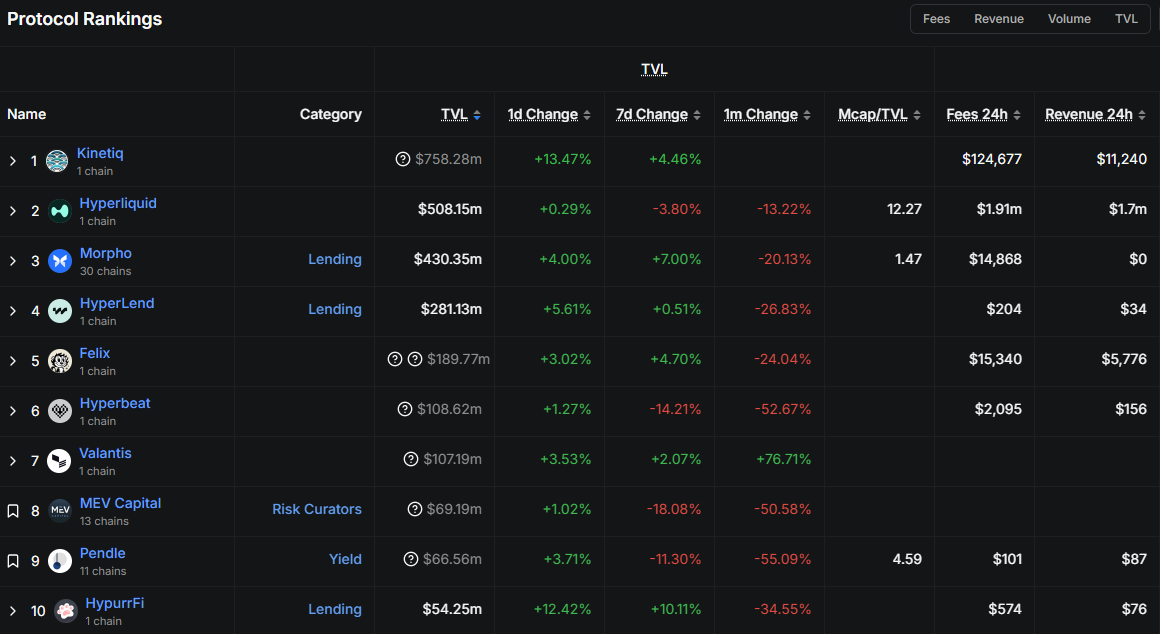

HyperEVM expands the ecosystem by allowing builders to deploy smart contracts that interact directly with HyperCore liquidity. This is the DeFi layer that makes Hyperliquid not only a perp DEX but also an onchain financial market where capital can circulate across protocols.

Capital can move and interact between HyperEVM and HyperCore in the following ways.

Lending

In lending, HyperCore provides perp data such as prices, positions, and funding rates, which lending protocols like HyperLend and Felix can use to automate liquidations and hedging.

For example: A trader borrows USDC from HyperLend to leverage perps on HyperCore. If the position turns against them, the contract can automatically hedge by reading real time prices from HyperCore and executing short positions.

Liquid Staking

In liquid staking, HyperCore provides staking data and perp liquidity that supports LST protocols such as Kinetiq and Hyperbeat at $178M.

For example:

- Users stake $HYPE on HyperCore.

- Receive kHYPE or stHYPE on HyperEVM.

- Use it as collateral to borrow capital.

- Trade perps using data from HyperCore to optimize yield.

HyperCore ensures real time data for auto rebalancing. This data is native, onchain, and internally generated directly from Hyperliquid’s trading system.

This creates a difference that few other L1s can match. Typically, other L1 ecosystems must:

- Fetch data through oracle calls.

- Oracles are offchain and external sources. They collect data from the real world such as crypto prices, FX rates, and commodities, then push it onchain through feeders or decentralized networks.

- This requires trust in oracle providers, and data can be manipulated if feeders are attacked.

That is why HyperEVM carries a larger advantage by pulling data directly from HyperCore, and builders in the ecosystem benefit from it.

To summarize:

- HyperCore with HIP-3 helps Hyperliquid onboard more builders, strengthening liquidity and revenue. Through buybacks, $HYPE benefits from this.

- HyperEVM’s role is to retain capital, create more tools for builders and traders to build and participate in markets on Hyperliquid, which in turn reinforces revenue for Hyperliquid and creates value for $HYPE.

Lighter’s Competitive Advantages

At the moment, Lighter is still relatively new, but the platform has its own advantages that Hyperliquid does not have.

Zero Fees Model

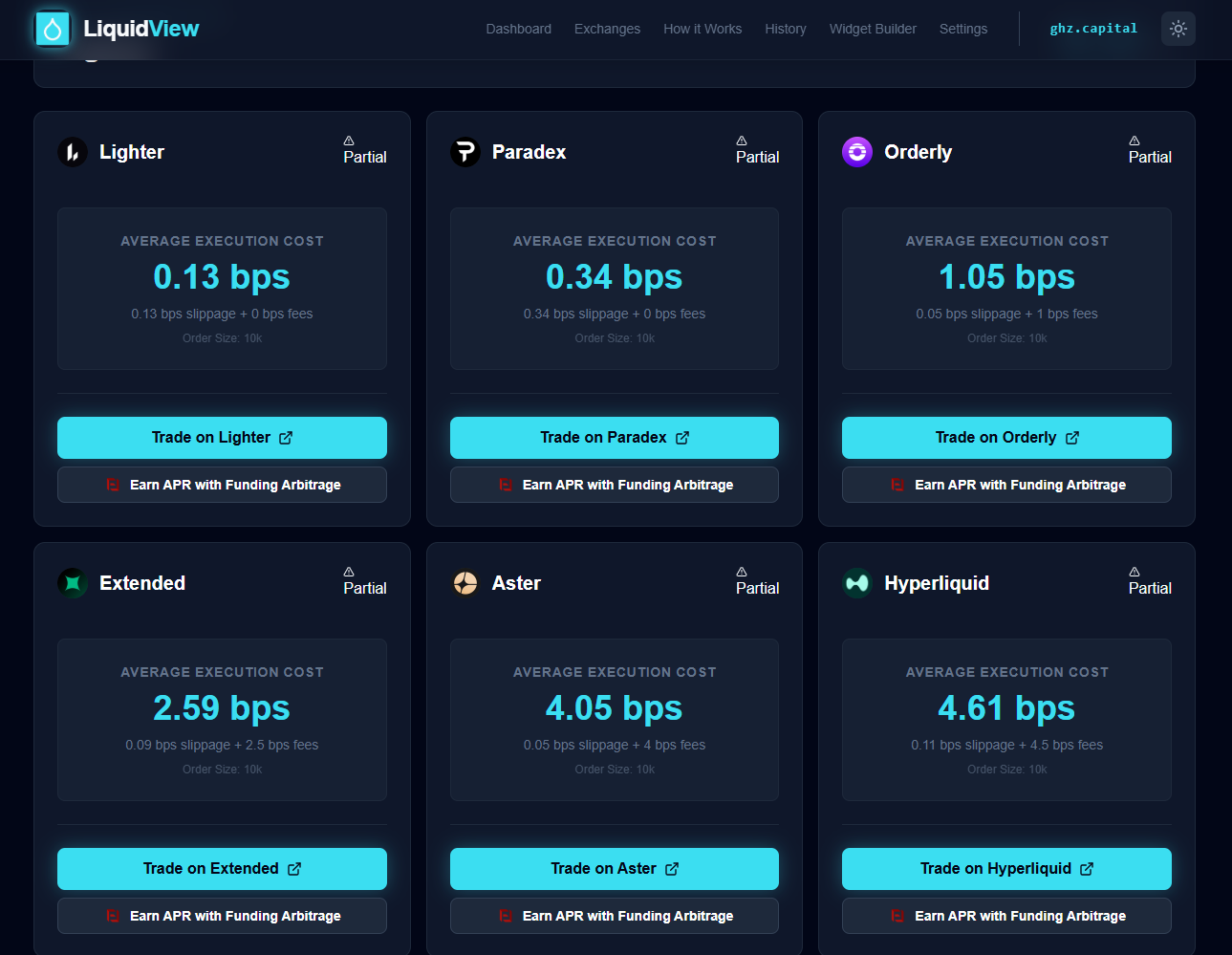

Based on the dashboard data from LiquidView, described as a real time execution cost analysis tool for perp DEXs, Lighter stands out with a stronger fee advantage versus competitors, especially Hyperliquid.

Specifically, for an order size of $10K, Lighter has an average execution cost of 0.13 bps, coming entirely from slippage at 0.13 bps, with fees at 0 bps.

This makes Lighter the cheapest option among the platforms listed, helping attract cost sensitive traders such as scalpers or high frequency traders.

In a direct comparison with Hyperliquid at 4.61 bps, including 0.11 bps slippage and 4.5 bps fees, Lighter is about 35x cheaper in total cost due to its zero fee model with no maker or taker fees.

This advantage not only reduces the burden on users but also supports higher volume. Lighter often leads daily perp volume, creating a potential flywheel that deepens liquidity over time.

However, Lighter’s low slippage at 0.13 bps suggests good liquidity today, but it still needs monitoring if volume drops after incentive programs such as points farming.

Deep integration with the Ethereum ecosystem

As a ZK L2 anchored on Ethereum, Lighter inherits Ethereum security because proofs are verified onchain. It supports universal cross margin, allowing the reuse of assets from Aave, Uniswap, or Ethereum stablecoins without complex bridges.

Hyperliquid is a standalone L1. Its composability is limited to its internal ecosystem via HyperEVM. It requires bridges for cross chain transfers and does not leverage Ethereum’s massive liquidity base at about $100B plus total TVL.

This makes Lighter more attractive to Ethereum native builders, even though Hyperliquid is strong in internal composability.

Conclusion

Hyperliquid is still leading the Perp DEX market, backed by a stronger ecosystem and a clearer business model. That edge shows up in its operating metrics, especially after the airdrop.

Lighter has clear strengths, but it likely needs more time to catch up, particularly while current numbers are still skewed by airdrop-driven activity.

Longer term, token unlocks and potential sell pressure are key risks, and if Lighter keeps a zero-fee model, revenue may be too limited to absorb that pressure on $LIT.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What problem are Hyperliquid and Lighter trying to solve in perp trading?

They both aim to deliver CEX-like speed and deep liquidity while keeping execution verifiable onchain. The difference is mainly how they structure the base layer and tradeoffs around cost, modularity, and settlement.

Q2. Why does Open Interest often matter more than volume when comparing perp venues?

Volume can be inflated by short-term incentives or high churn activity, while Open Interest reflects how much risk traders are actually holding on the venue. Higher OI typically signals deeper committed liquidity and more sustained participation.

Q3. How do HyperCore and HyperEVM split responsibilities on Hyperliquid?

HyperCore focuses on the core trading stack such as perps, spot orderbook, margin, funding, and liquidations. HyperEVM is the EVM layer where developers can deploy apps like lending, AMMs, and vault strategies.

Q4. How can Lighter offer low costs while still anchoring to Ethereum?

Lighter batches execution through a modular pipeline and verifies state transitions via ZK proofs on Ethereum. This reduces onchain workload versus matching directly on a general-purpose execution environment.

Q5. What are the main tradeoffs of anchoring to Ethereum for an app-specific rollup?

Anchoring can improve settlement guarantees and composability with Ethereum assets, but it also introduces dependence on Ethereum fees and congestion. Operationally, it also creates a multi-component pipeline that must run smoothly.