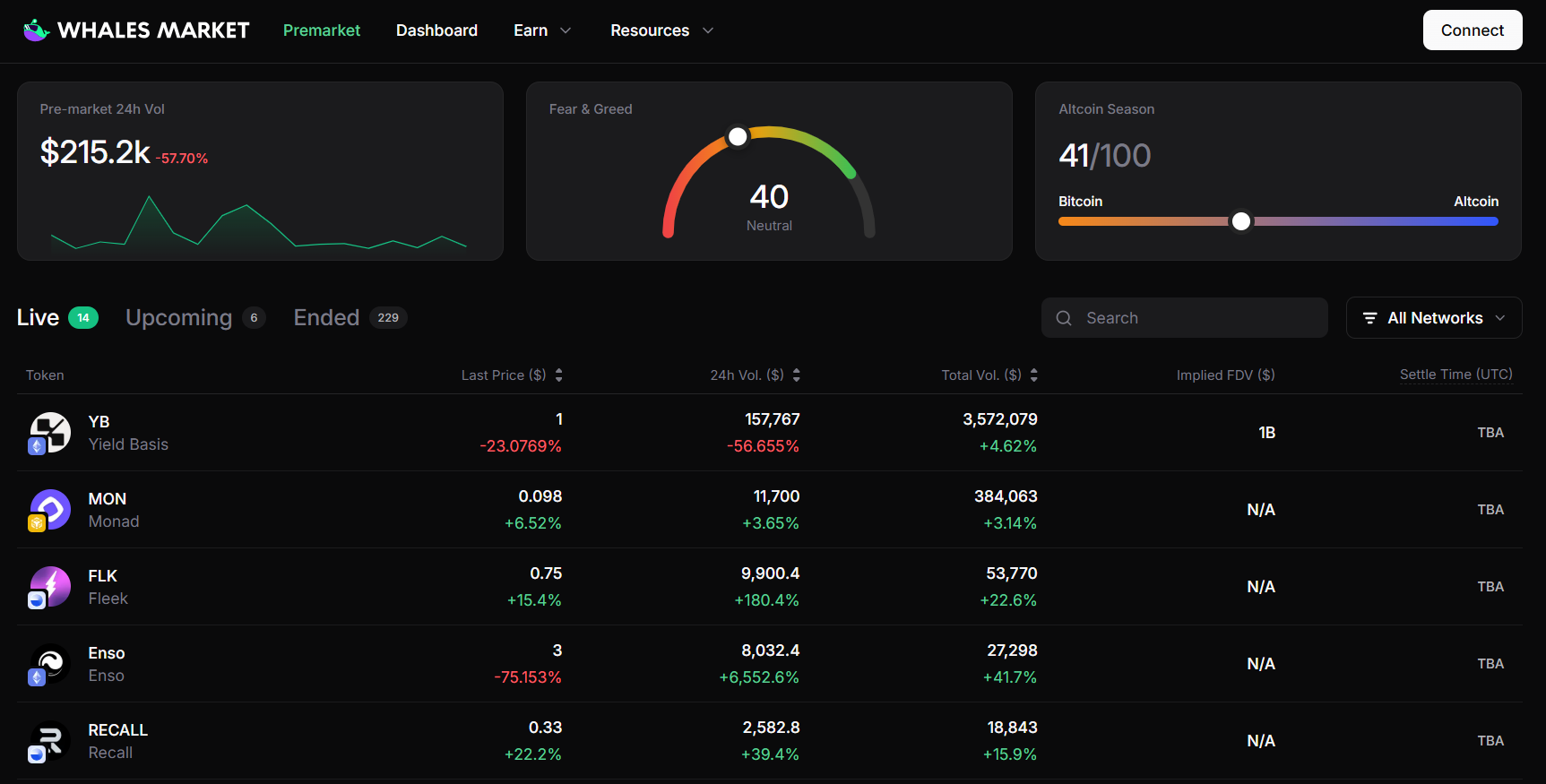

Here is a quick guide to trading YieldBasis ($YB) on Whales Market. It is the leading pre-market DEX platform for pre-TGE tokens and allocations, with more than $300M in trading volume.

What is YieldBasis?

YieldBasis is a decentralized finance (DeFi) protocol launched by Michael Egorov, founder of Curve Finance, to solve the problem of impermanent loss in liquidity pools.

The protocol uses a precision 2x leverage system to continuously rebalance positions, allowing liquidity providers (LPs) to earn stable yields on assets like Bitcoin without being affected by price volatility.

How does YieldBasis work?

Continuous 2x Leverage

YieldBasis integrates a built-in continuous 2x leverage mechanism, allowing liquidity providers and traders to gain amplified exposure to Bitcoin without needing to manage leverage manually. This system dynamically maintains equilibrium, so positions automatically adjust in line with real-time Bitcoin price movements. As a result, users can benefit from higher potential returns while avoiding the complexity and risks of traditional leverage management.

Position Rebalancing

To further protect liquidity providers, the protocol implements automated position rebalancing. This means liquidity is continuously adjusted to hedge against market volatility and minimize the effects of impermanent loss. By actively rebalancing positions, YieldBasis ensures that liquidity providers retain more stable yields, even in highly volatile market conditions.

$YB Information

$YB Key Metrics

Here is the information of YB token

- Token Name: YieldBasis

- Ticker: $YB

- Token Type: TBA

- Total Supply: 1B $YB

- Contract address (CA): TBA

YB Token Use Case

Currently, YieldBasis has not announced any official use case of $YB for the project. Whales Market will update immediately when the official YieldBasis website announces.

$YB Listing

Here are important details revealed to $YB:

- Listing time: TBA

- Confirmed CEX Listings: TBA

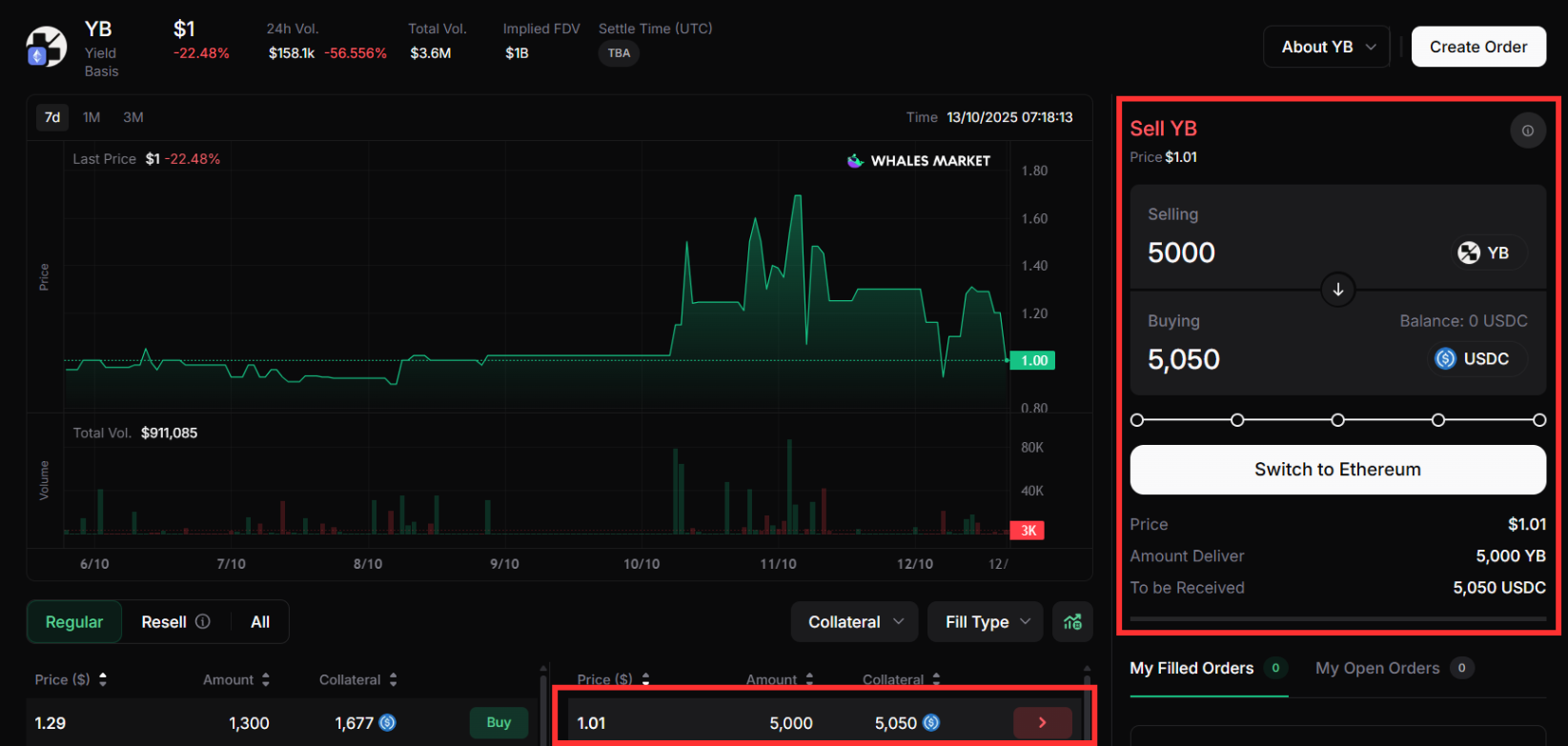

- Pre-market Price (Whales Market): $1

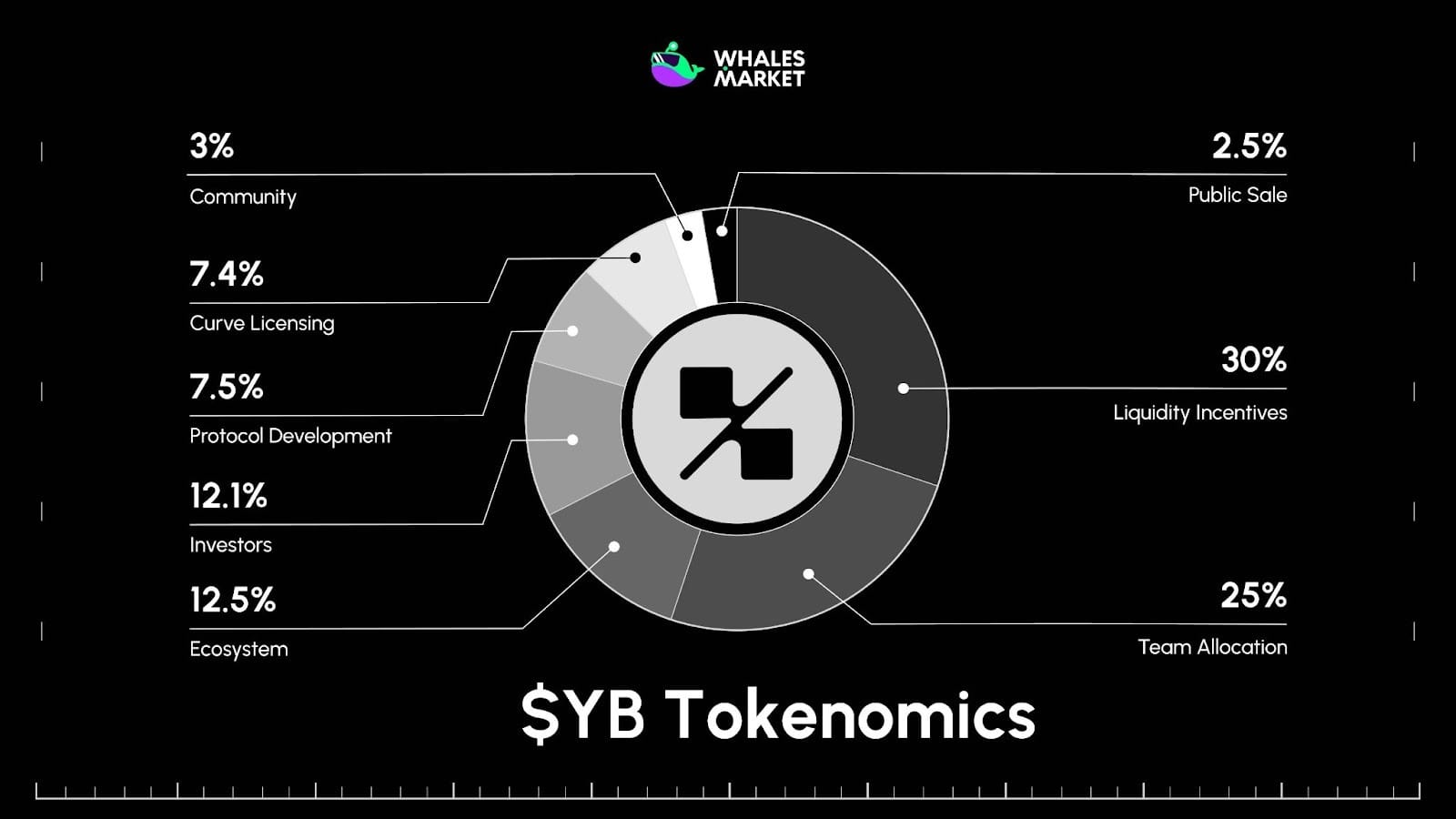

$YB Tokenomics

- Total Supply: 1B $YB

- Token Allocation:

- Liquidity Incentives: 30%

- Team: 25%

- Ecosystem Reserve: 12.5%

- Investors: 12.1%

- Public Sale: 2.5%

- Community: 3%

- Protocol Development: 7.5%

- Curve Licensing: 7.4%

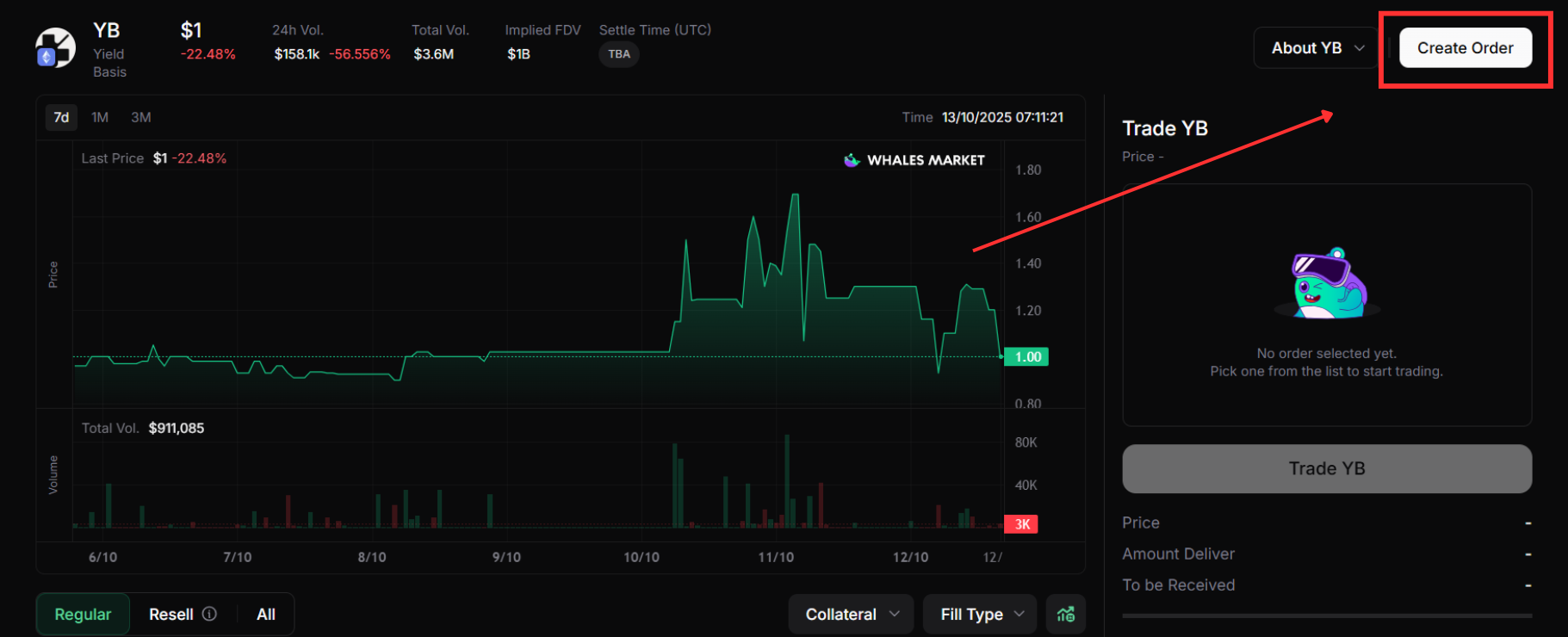

How to trade $YB on Whales Market

Here’s how to trade Yieldbasis ($YB) step by step:

Step 1: Join Whales Market

Join Whales Market Website, connect wallet and choose “YB token”

Step 2: Create Order

If you want to buy $YB before listing, or sell your token allocation at your preferred price, simply click “Create Order” button on the platform.

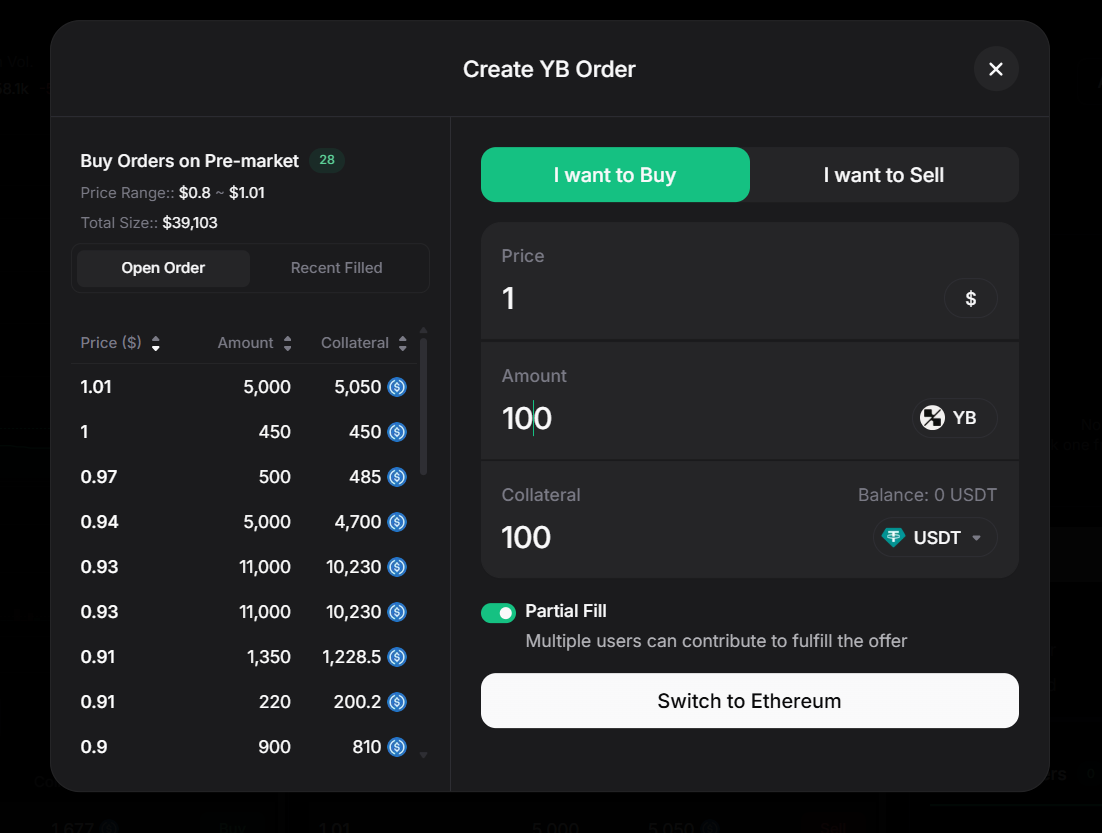

Step 3: Set Price & Amount

To place an order, simply choose between “WANT TO BUY” or “WANT TO SELL”, then select the method by which your order will be filled. To confirm, you’ll need to deposit collateral equal to the value of your order.

Step 4: Confirm Order

To proceed, deposit your collateral and sign the transaction through your wallet. The collateral will remain locked until the Settlement phase if your order is filled. This ensures fairness and trustless execution between all parties.

You can cancel your order and receive your collateral back as long as it hasn’t been filled. Or you can resell your position via Resell Position.

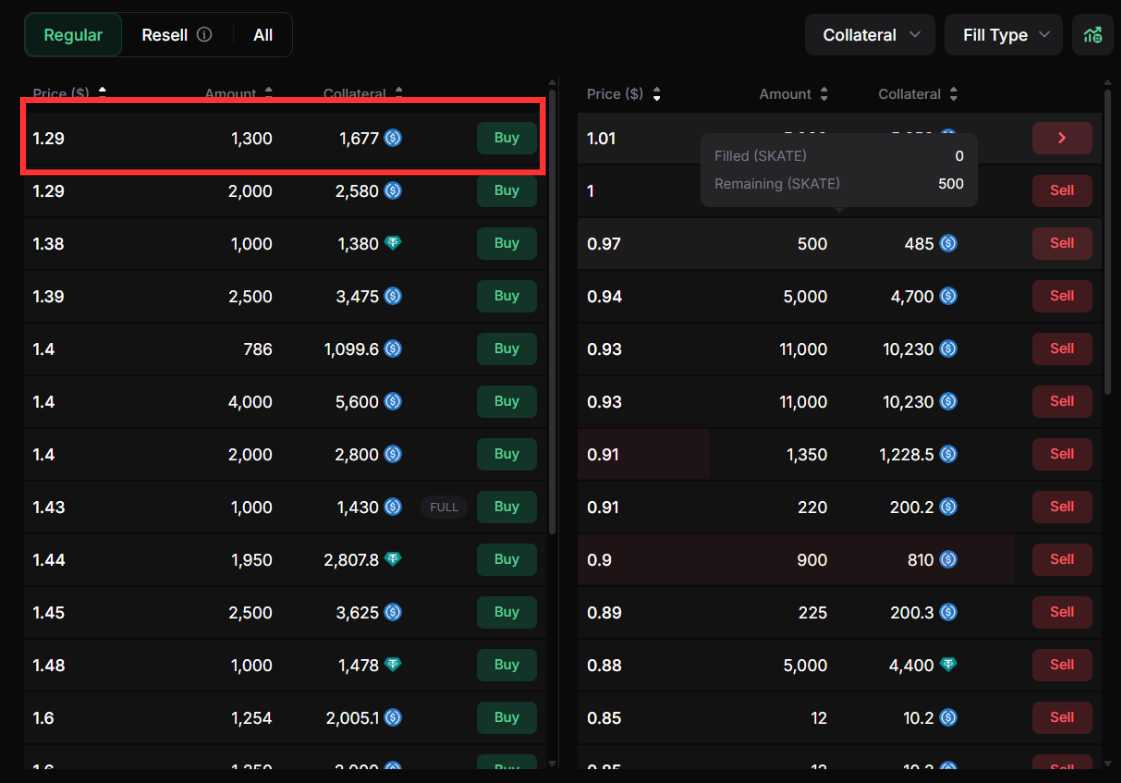

Step 5: Order Goes Public

Once created, your order will be visible on the platform. If you selected “WANT TO BUY”, it will appear under the Sell tab, and if you chose “WANT TO SELL”, it will be listed in the Buy tab. From there, other users can view and fill your order.

Step 6: Buy or Sell Available Orders

If you find a good deal from another user, simply select the order, deposit your collateral, and you’re all set.

Step 7: Settlement Phase

At the time of TGE (or CEX listing), the Settlement Phase begins. Sellers are given a 4-hour window to transfer tokens to buyers. Failure to settle within this timeframe results in the loss of their collateral, which is then transferred to the buyer.

Conclusion

YieldBasis emerges as a promising DeFi protocol designed to tackle one of the biggest challenges in liquidity provision, including impermanent loss and volatile returns. With its continuous 2x leverage and automated position rebalancing, the protocol offers liquidity providers a more stable and predictable yield, even in highly volatile markets like Bitcoin.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of YieldBasis?

The native token of YieldBasis is $YB, used to facilitate coordination across the ecosystem.

2. What is YieldBasis ($YB) pre-market price?

Currently, $YB is trading at $1 on Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

3. What is the price of YieldBasis ($YB) today?

While YieldBasis ($YB) hasn't been listed yet, users can trade $YB pre-market at $1 on Whales Market before the TGE. Here you can trade $YB before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. What is YieldBasis?

YieldBasis Protocol ($YB) is a decentralized finance (DeFi) protocol to solve the problem of impermanent loss in liquidity pools.

5. How much has YieldBasis ($YB) raised?

According to CryptoRank , YieldBasis has raised a total of $10M in 3 funding rounds.

6. What is $YB allocation?

$YB Allocation includes 30% for Liquidity Incentives, 25% for Team, 12.5% for Ecosystem Reserve, 12.1% for Investors, 2.5% Public Sale, 3% for Community, 7.5% for Protocol Development and 7.4% for Curve Licensing.