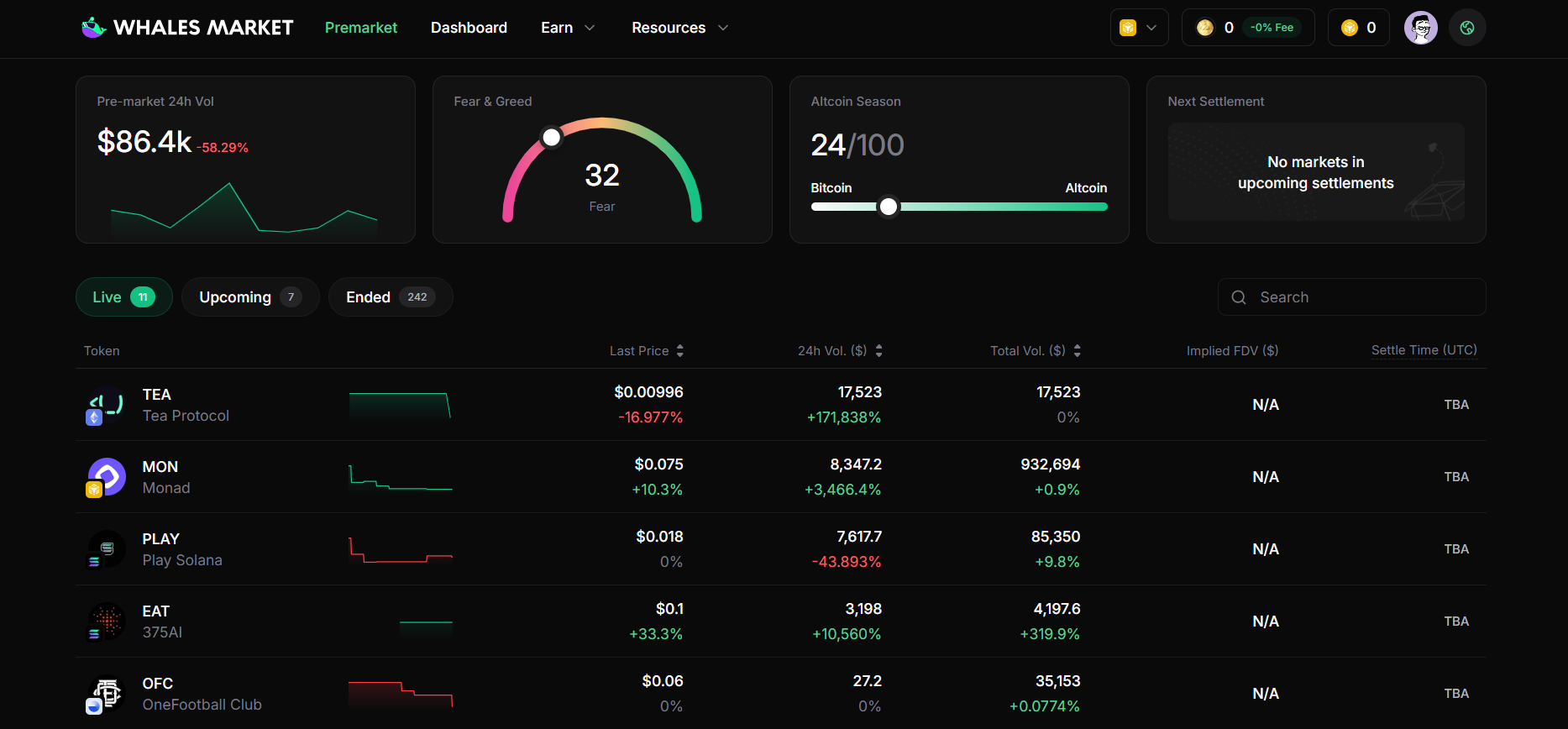

Here is a quick guide to trading tea Protocol ($TEA) on Whales Market. It is the leading pre-market DEX platform for pre-TGE tokens and allocations, with more than $300M in trading volume.

What is tea Protocol?

tea Protocol is a decentralized technology framework protocol that allows developers & maintainers of open source code to receive rewards for their contributions.

The project is tasked with solving the Nebraska problem for developers, keeping open source software running smoothly, anytime, anywhere. The platform enhances the security of the software supply chain by rewarding OSS (open source) projects based on their impact in the ecosystem.

Components of tea Protocol

Open Source Software

OSS (open source software) is software with public source code, allowing anyone to study, change and improve it for their own purposes or to create other software.

Although OSS software is important, it is limited in recognizing the contributions of developers. Therefore, tea Protocol was built to solve the above problem.

Users

Users are supporters and contributors to the development of OSS software. They can participate in the network as follows:

- Choose the appropriate OSS according to your needs: OSS model, total number of users staking, yield level received, teaRank level...

- Stake the types of tea protocol tokens supported.

- Receive yield or stTEA tokens for governance in the protocol.

$TEA Token Information

$TEA Key Metrics

Here is the information of $TEA

- Token Name: tea Protocol

- Ticker: $TEA

- Token Type: Governance-Balanced Token

- Total Supply: 100B $TEA

- Contract address (CA): TBA

$TEA Use Case

- Gas Token: TEA is consumed for gas on every transaction on Tea Network

- Staking & Slashing: Various protocol roles will involve staking TEA.

- Incentive Alignment: TEA is still staked to signal support for projects

$TEA Listing

Here are important details revealed to $TEA:

- Listing time: TBA

- Confirmed CEX Listings: TBA

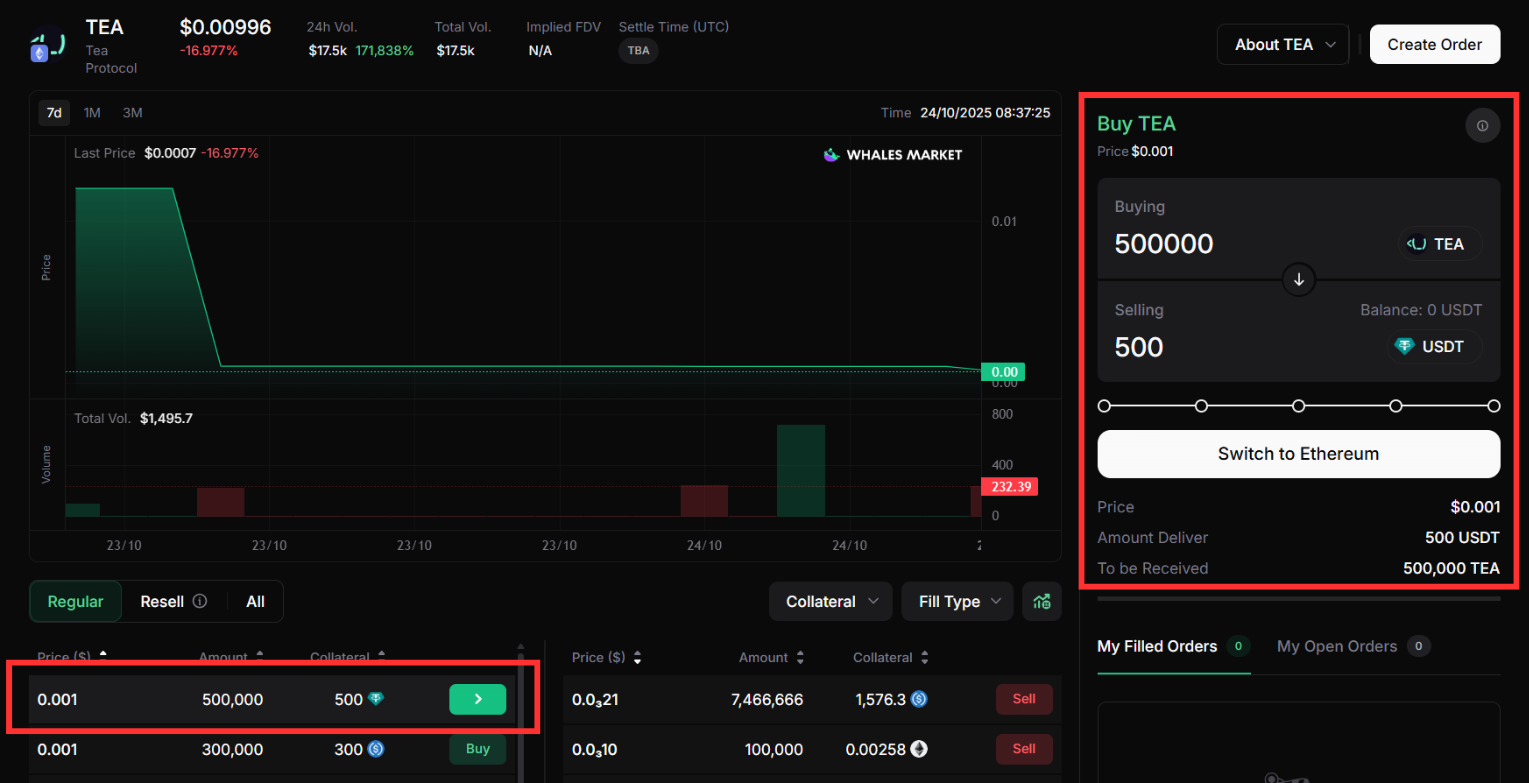

- Pre-market Price (Whales Market): $0.00996

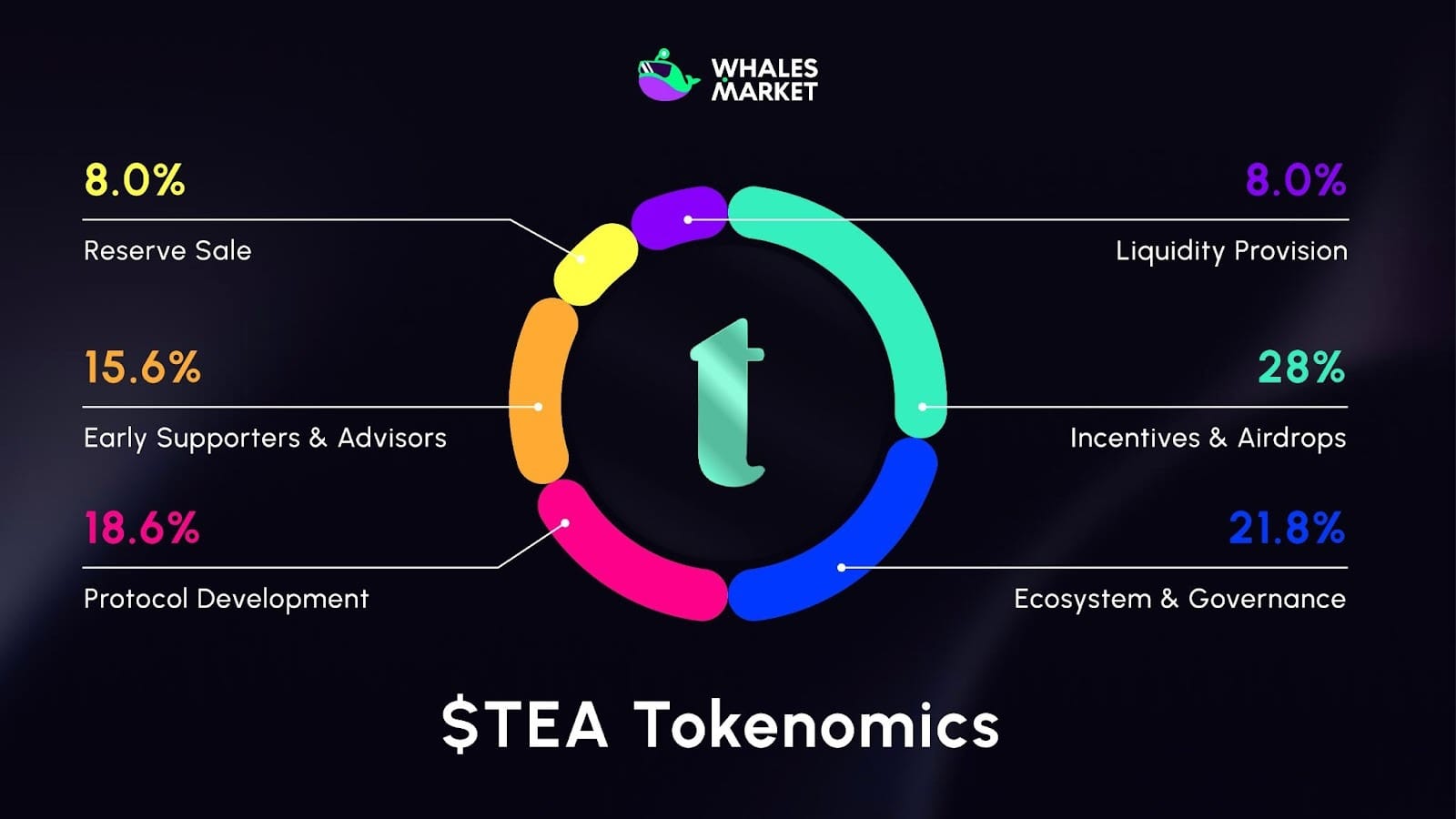

tea Protocol Tokenomics & Fundraising

Tokenomics

- Total Supply: 100B $TEA

- $TEA Allocation:

- Incentives & Airdrops: 28.0%

- Ecosystem & Governance: 21.8%

- Protocol Development: 18.6%

- Early Supporters & Advisors: 15.6%

- Reserve Sale: 8.0%

- Liquidity Provision: 8.0%

How to trade $TEA on Whales Market

Here’s how to trade tea Protocol ($TEA) step by step:

Step 1: Join Whales Market

Join Whales Market Website, connect wallet and choose “TEA token”

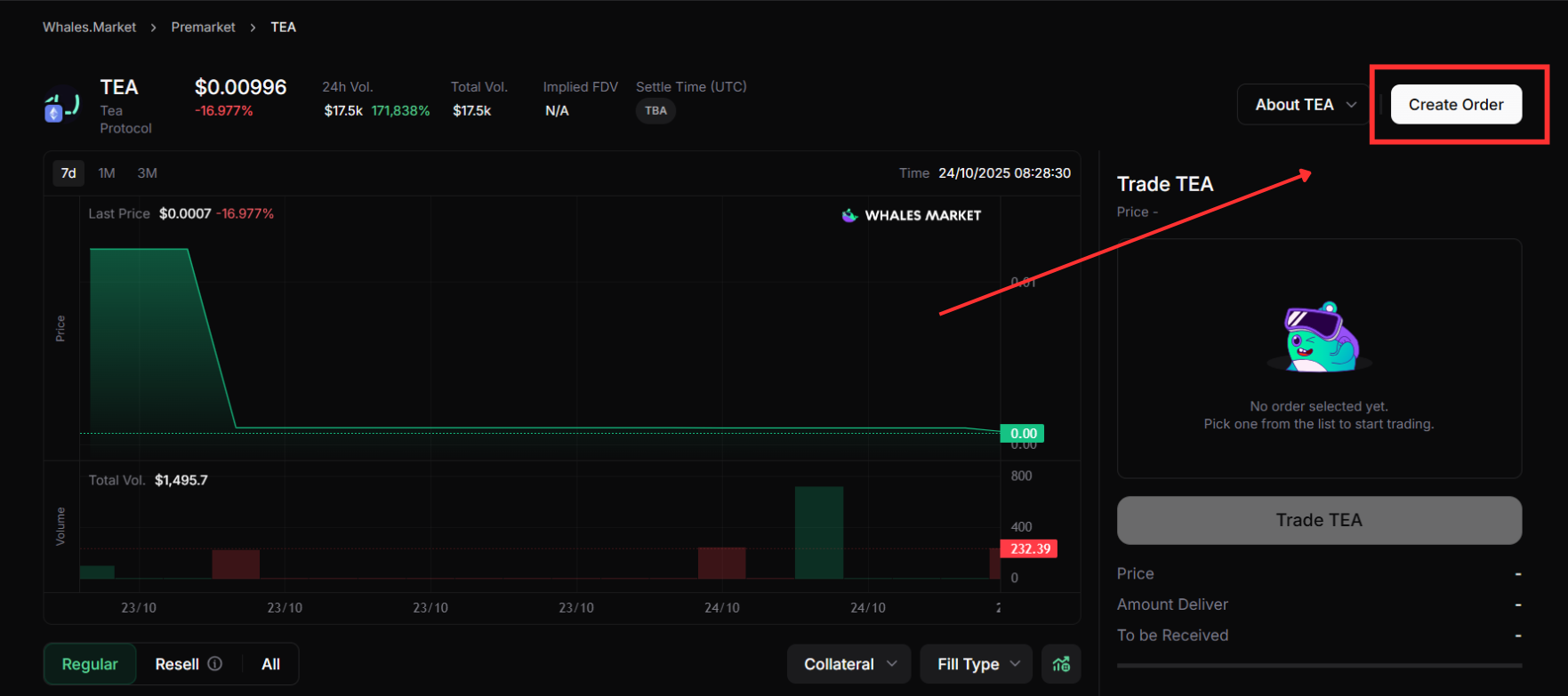

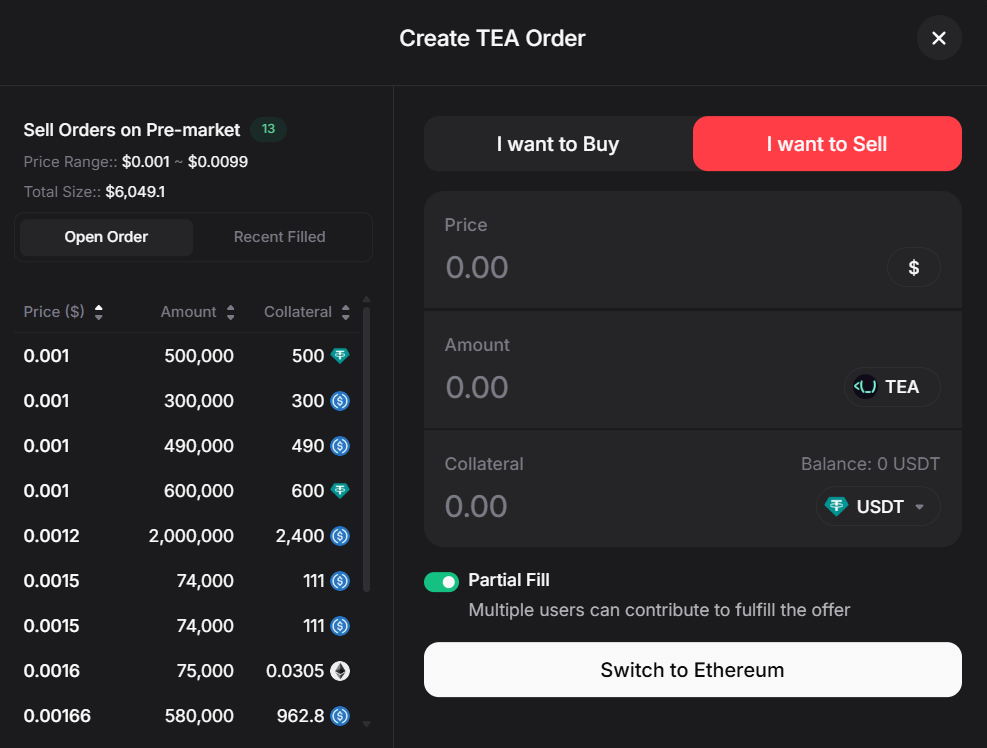

Step 2: Create Order

If you want to buy $TEA before listing, or sell your token allocation at your preferred price, simply click “Create Order” button on the platform.

Step 3: Set Price & Amount

To place an order, simply choose between “WANT TO BUY” or “WANT TO SELL”, then select the method by which your order will be filled. To confirm, you’ll need to deposit collateral equal to the value of your order.

Step 4: Confirm Order

To proceed, deposit your collateral and sign the transaction through your wallet. The collateral will remain locked until the Settlement phase if your order is filled. This ensures fairness and trustless execution between all parties.

You can cancel your order and receive your collateral back as long as it hasn’t been filled. Or you can resell your position via Resell Position.

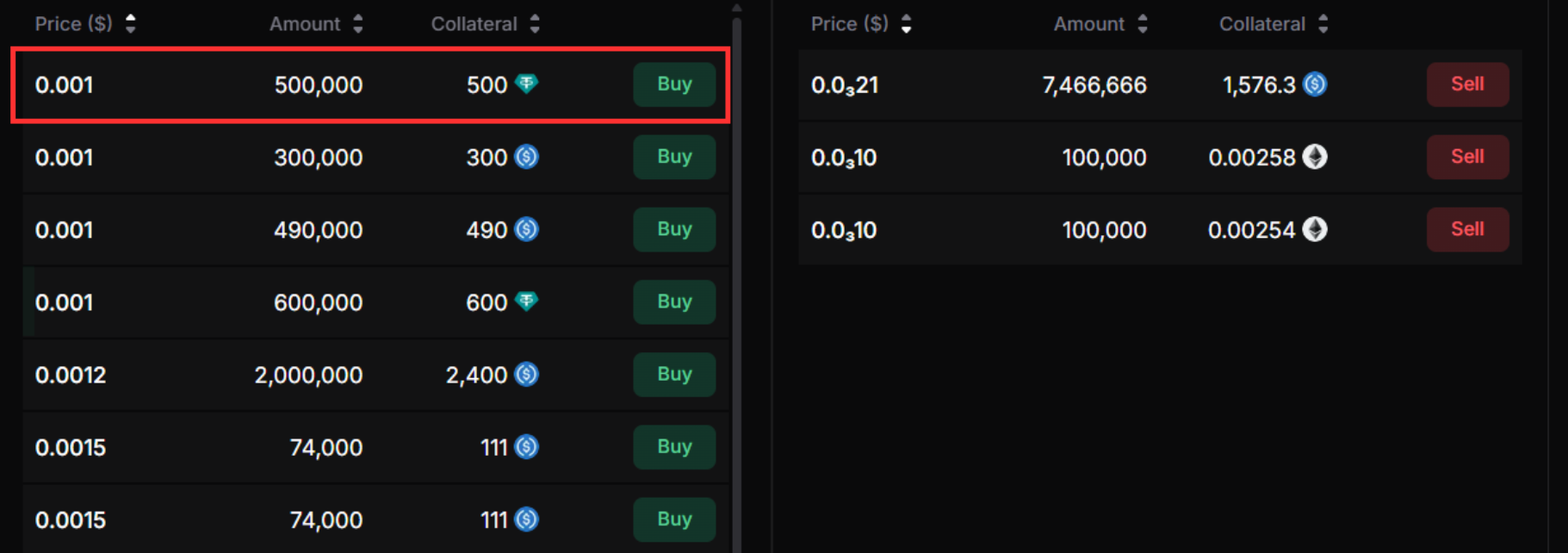

Step 5: Order Goes Public

Once created, your order will be visible on the platform. If you selected “WANT TO BUY”, it will appear under the Sell tab, and if you chose “WANT TO SELL”, it will be listed in the Buy tab. From there, other users can view and fill your order.

Step 6: Buy or Sell Available Orders

If you find a good deal from another user, simply select the order, deposit your collateral, and you’re all set.

Step 7: Settlement Phase

At the time of TGE (or CEX listing), the Settlement Phase begins. Sellers are given a 4-hour window to transfer tokens to buyers. Failure to settle within this timeframe results in the loss of their collateral, which is then transferred to the buyer.

Conclusion

tea Protocol represents a groundbreaking step toward empowering open-source developers by creating a decentralized system that rewards real contributions. With strong backing from Binance Labs and a clear roadmap leading to Mainnet and beyond, tea aims to redefine how OSS projects are valued and sustained.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of tea Protocol?

The native token of tea Protocol is $TEA, used to facilitate coordination across the ecosystem.

2. What is tea Protocol ($TEA) pre-market price?

Currently, $TEA is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

3. What is the price of tea Protocol ($TEA) today?

While tea Protocol ($TEA) hasn't been listed yet, users can trade $TEA pre-market on Whales Market before the TGE. Here you can trade $TEA before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. What is tea Protocol?

Tea Protocol is a decentralized technology framework protocol that allows developers and maintainers of open source code to receive rewards for their contributions.

5. How can I trade $TEA before official listing?

You can buy or sell pre-TGE $TEA on Whales Market by creating or filling orders with collateral-based settlement.

6. What is $TEA allocation?

The $TEA token is distributed as follows: 28% for incentives and airdrops, 21.8% for ecosystem and governance, 18.6% for protocol development, 15.6% for early supporters and advisors, and 8% each for reserve sale and liquidity provision.