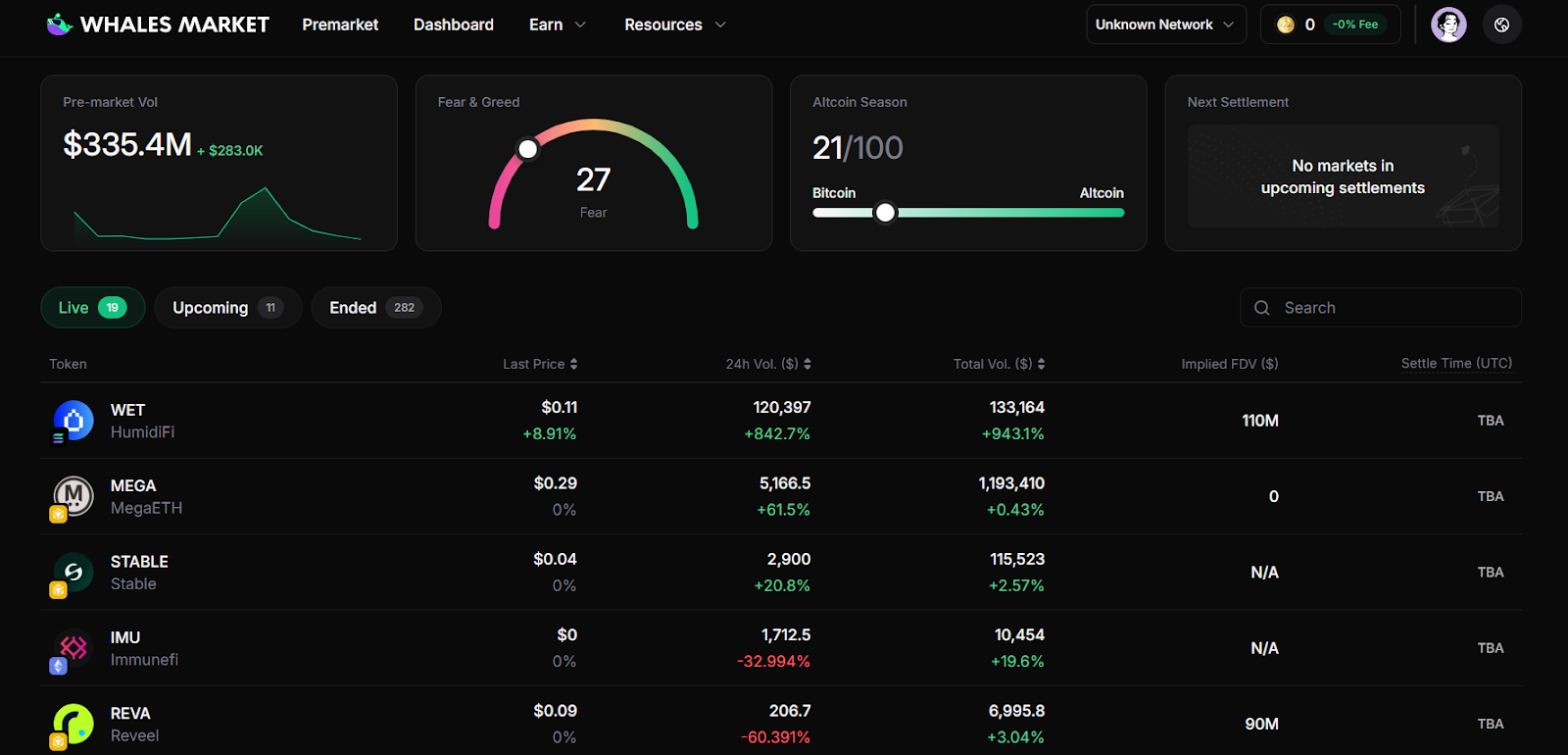

Here is a quick guide to trading Lighter ($LIT) on Whales Market. It is the leading pre-market DEX platform for pre-TGE tokens and allocations, with more than $300M in trading volume.

What is Lighter?

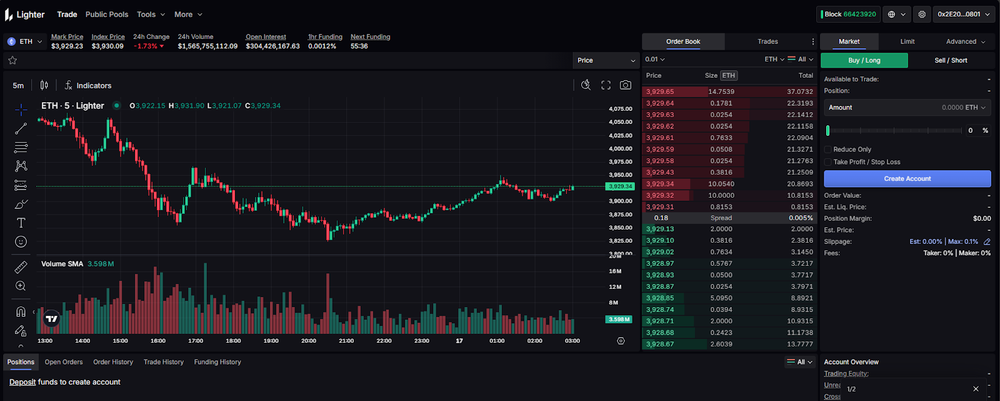

Lighter is a decentralized perpetual futures exchange built on a custom zero-knowledge rollup for Ethereum. The platform bridges centralized and decentralized trading by delivering CEX-level speed and liquidity while maintaining full transparency and self-custody through cryptographic proofs.

Lighter uses custom ZK circuits to generate cryptographic proofs for all operations including order matching and liquidations, with final settlement occurring on the Ethereum blockchain. This approach enables the platform to process tens of thousands of orders per second with millisecond latency, while ensuring every trade is provably fair and verifiable onchain.

The protocol distinguishes itself through its zero-fee model for retail traders, making perpetual futures trading more accessible while charging competitive fees only to institutional API and high-frequency trading flows.

How does Lighter work?

Lighter operates as a zero-knowledge rollup on top of Ethereum, optimized for speed, throughput and scale. The platform's architecture consists of several key components that work together to deliver high-performance decentralized trading:

- Custom ZK Circuits: Transactions are verified with cryptographic proofs, ensuring correctness, fairness, and resistance to manipulation.

- Verifiable Order Matching: Trades follow price–time priority and are provably fair, with all executions publicly verifiable on Ethereum.

- Automated Risk Management: A built-in risk engine monitors margins and auto-liquidates risky positions, supported by insurance funds to maintain stability.

- Ethereum Settlement Layer: Proofs and state changes settle on Ethereum, guaranteeing self-custody and secure withdrawals even if the L2 goes offline.

- Liquidity Pools (LLP): Users can provide liquidity via public pools, earn yield from trading activity, and use LLP tokens across DeFi for composability.

Lighter Token Information

Lighter Token Key Metrics

Here is what we know about Lighter's token structure:

- Token Name: TBA (To Be Announced)

- Ticker: TBA

- Token Type: TBA

- Total Supply: TBA

- Contract address (CA): TBA

Lighter Token Use Case

Currently, Lighter has not announced any official use case for the project token. However, based on similar perpetual DEX models, potential use cases may include trading fee discounts, governance rights, staking rewards, and insurance fund contributions.

Whales Market will update immediately when the official Lighter website announces token utility details.

Lighter Token Listing

Here are important details revealed about Lighter's token:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): $3

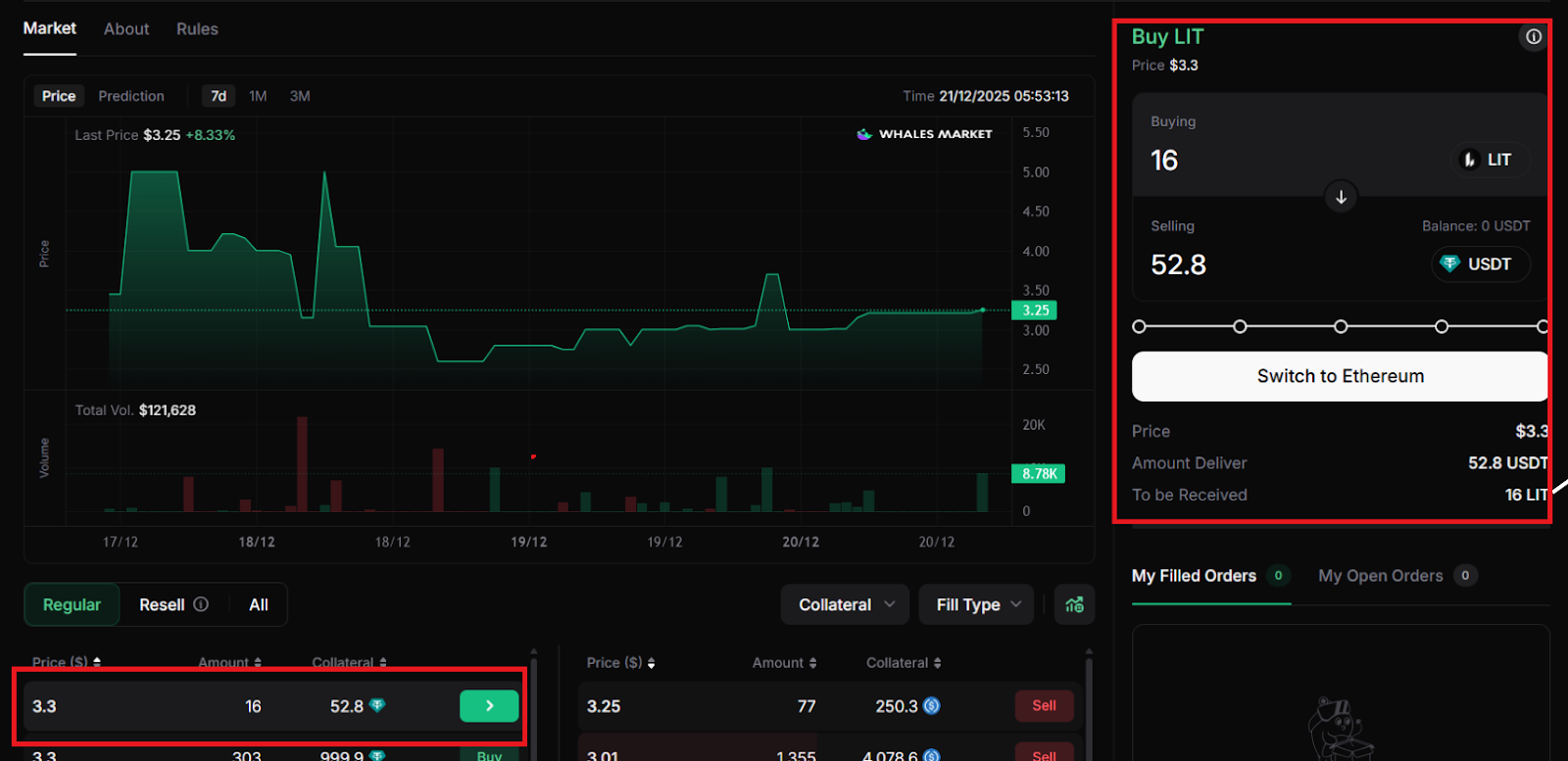

How to trade $LIT on Whales Market

Here’s how to trade Lighter ($LIT) step by step:

Step 1: Join Whales Market

Join Whales Market Website, connect wallet and choose “LIT token”

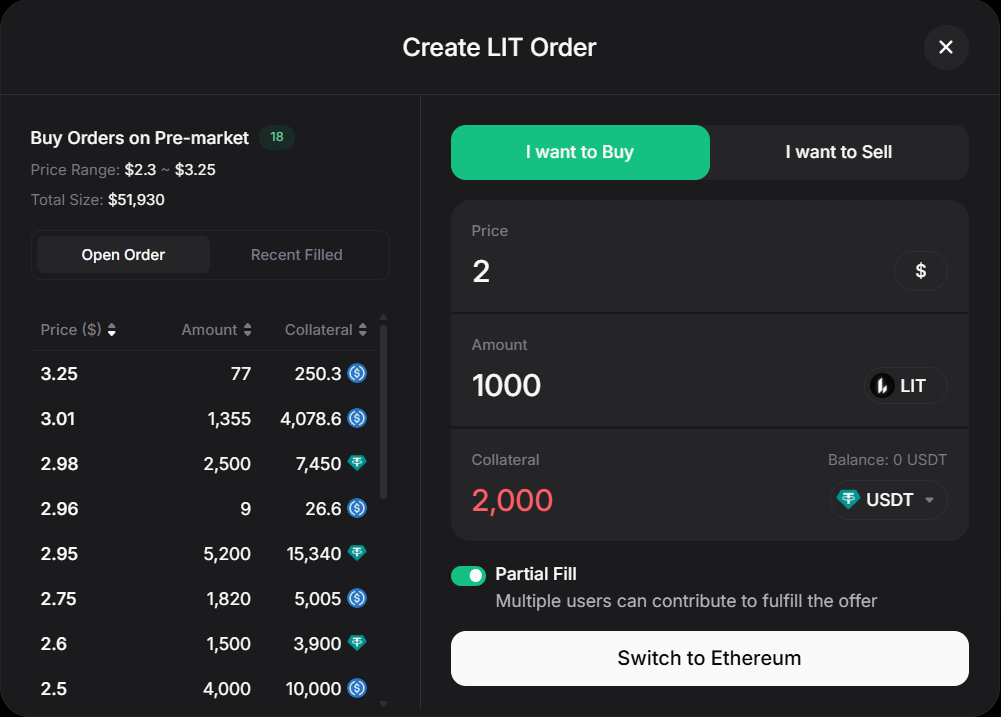

Step 2: Create Order

If you want to buy $LIT before listing, or sell your token allocation at your preferred price, simply click “Create Order” button on the platform.

Step 3: Set Price & Amount

To place an order, simply choose between “WANT TO BUY” or “WANT TO SELL”, then select the method by which your order will be filled. To confirm, you’ll need to deposit collateral equal to the value of your order.

Step 4: Confirm Order

To proceed, deposit your collateral and sign the transaction through your wallet. The collateral will remain locked until the Settlement phase if your order is filled. This ensures fairness and trustless execution between all parties.

You can cancel your order and receive your collateral back as long as it hasn’t been filled. Or you can resell your position via Resell Position.

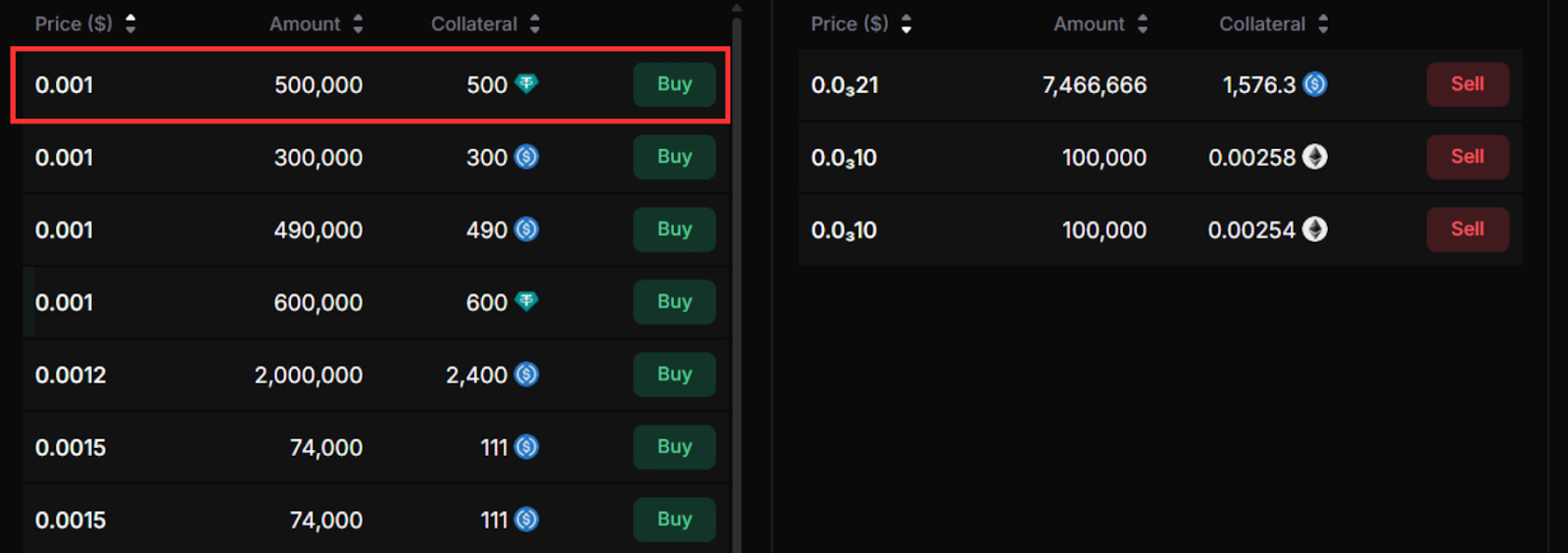

Step 5: Order Goes Public

Once created, your order will be visible on the platform. If you selected “WANT TO BUY”, it will appear under the Sell tab, and if you chose “WANT TO SELL”, it will be listed in the Buy tab. From there, other users can view and fill your order.

Step 6: Buy or Sell Available Orders

If you find a good deal from another user, simply select the order, deposit your collateral, and you’re all set.

Step 7: Settlement Phase

At the time of TGE (or CEX listing), the Settlement Phase begins. Sellers are given a 4-hour window to transfer tokens to buyers. Failure to settle within this timeframe results in the loss of their collateral, which is then transferred to the buyer.

Conclusion

Lighter represents an advancement in decentralized perpetual futures trading, combining custom zero-knowledge rollup technology with Ethereum settlement to deliver verifiable, high-performance onchain trading.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of Lighter?

The native token of Lighter is $LIT, used to facilitate coordination across the ecosystem.

2. What is Lighter ($LIT) pre-market price?

Currently, $LIT is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

3. What is the price of Lighter ($LIT) today?

While Lighter ($LIT) hasn't been listed yet, users can trade $LIT pre-market on Whales Market before the TGE. Here you can trade $LIT before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. How can I trade $LIT before official listing?

You can buy or sell pre-TGE $LIT on Whales Market by creating or filling orders with collateral-based settlement.

5. What is the $LIT allocation?

Currently, Lighter has not announced any official tokenomics for the project. Whales Market will update immediately when the official Lighter website announces token utility details.