The recent 1 billion dollar funding round from Kalshi sent shockwaves through the market, reinforcing its position at the forefront of the prediction market wave. This rapid growth has led many to believe that early users could be in line for unique opportunities ahead. If you want to get started the right way, here is a clear step-by-step guide on how to make predictions on Kalshi.

What is Kalshi?

Kalshi is the first CFTC-regulated event contract trading platform in the United States. Founded in 2018 by MIT alumni Tarek Mansour and Luana Lopes Lara, the platform stands apart by holding a full Designated Contract Market (DCM) license from the CFTC. This regulatory status provides users with a higher level of transparency, oversight, and security compared to other prediction platforms.

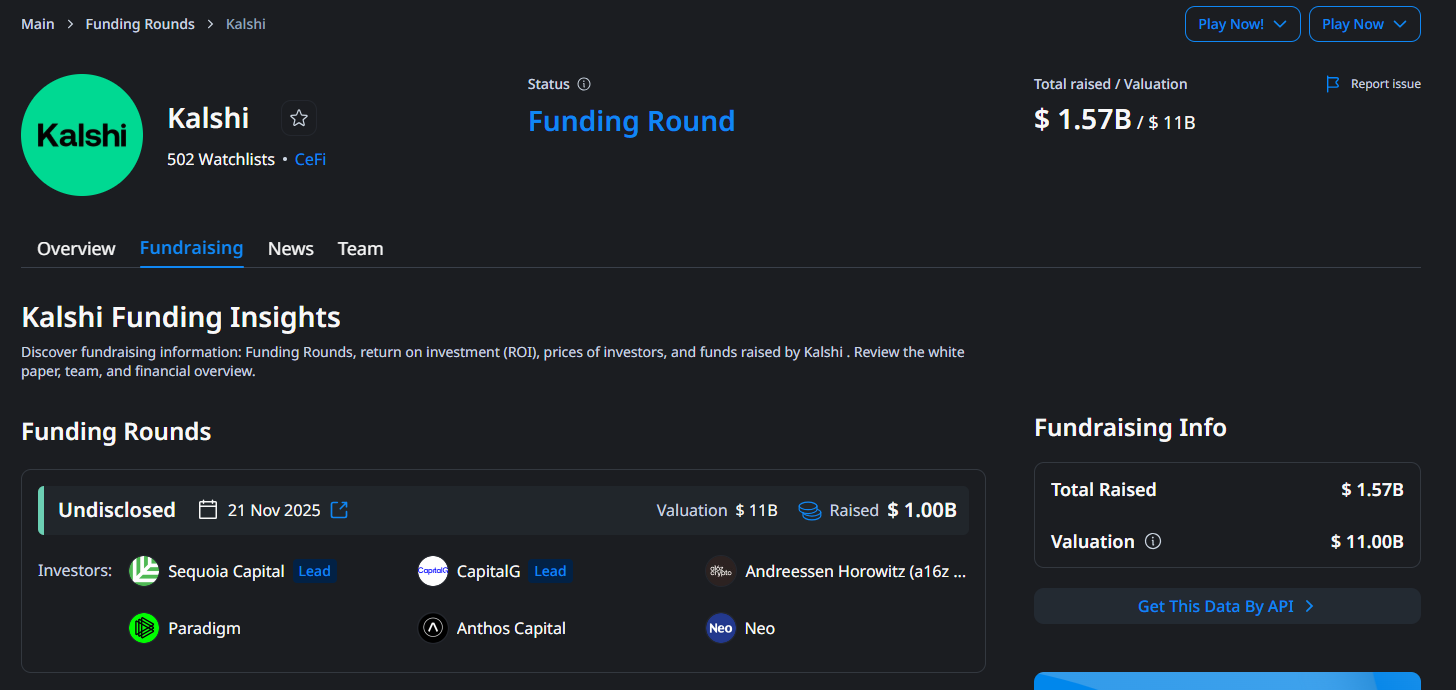

As of November 2025, Kalshi has processed more than $17B in cumulative betting volume. The platform has now raised $1.57B at an $11B valuation. Its most notable milestone is the recent $1B round, led by Sequoia Capital and CapitalG with participation from a16z and Paradigm.

How Kalshi Works

- Yes/No Contracts: Each market asks a yes-or-no question about a future event. For example: "Will Bitcoin reach $200,000 before December 31, 2025?" You buy either "Yes" or "No" contracts based on your prediction.

- Price as Probability: Contract prices range from $0.01 to $0.99. Prices reflect the market's assessed probability. If "Yes" trades at 72 cent, the market assigns a 72% probability to that outcome.

- Settlement: Winning contracts pay out $1 per contract. Losing contracts become worthless. Example: Buy at 72 cent, if you win you profit 28 cent per contract.

- Result Verification: Kalshi uses Source Agencies to verify outcomes. These are official agencies that publish the data. For crypto, the platform uses CF Benchmarks' Real-Time Index. This ensures prices accurately reflect the market. Being CFTC-regulated means Kalshi faces legal consequences for any misconduct. This creates a reliability advantage.

- Trading Fees: Kalshi charges variable fees, typically under 2% per contract. For a $100 trade, fees cap at around $1.74. There are no membership fees or ACH deposit/withdrawal fees. Some markets have maker fees for providing liquidity.

How to Deposit and Withdraw Funds

Deposit Funds

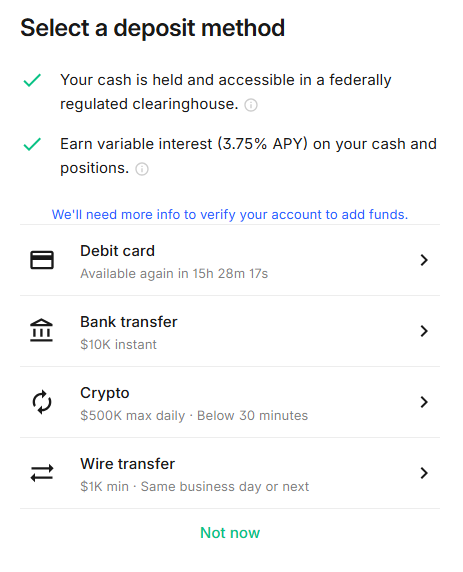

The minimum deposit is just $1. Kalshi accepts various payment methods.

- Via Bank Transfer (ACH): Access the "Transfers" tab, select "Deposit to Kalshi". Then choose "Bank Transfer" as your method. Enter the amount you want to deposit (maximum $10,000 per transaction). Processing takes 3-5 business days. First deposit: $100 available immediately. Subsequent deposits: $250 available immediately.

- Via Debit Card: Select "Debit Card", enter your card information. Funds are deposited instantly. There's a 2% fee for each debit card deposit. Limit is $2,500 per 24 hours.

- Via Crypto (USDC): Kalshi partners with Zero Hash to process crypto transactions. Only accepts USDC, not BTC, ETH or SOL. Follow Zero Hash instructions to transfer USDC. Funds are available within minutes after successful deposit.

Withdraw Funds

Access the "Transfers" tab, select "Withdraw from Kalshi". Then choose your preferred withdrawal method.

- Withdraw to Bank: Select "Bank Transfer", choose your linked account. There's a $2 fee per withdrawal.

- Withdraw via Debit: Select "Debit Card" as withdrawal method. Usually instant but may require security verification.

- Withdraw via Crypto: Select "Crypto", follow Zero Hash instructions. Funds arrive in your wallet within 30 minutes. Crypto withdrawal limit is $2,500/day. Fees vary by amount and are disclosed before transaction.

Important Note: Newly deposited funds have security hold periods. Debit card: 3 days before withdrawal eligible.

How to Make Predictions on Kalshi

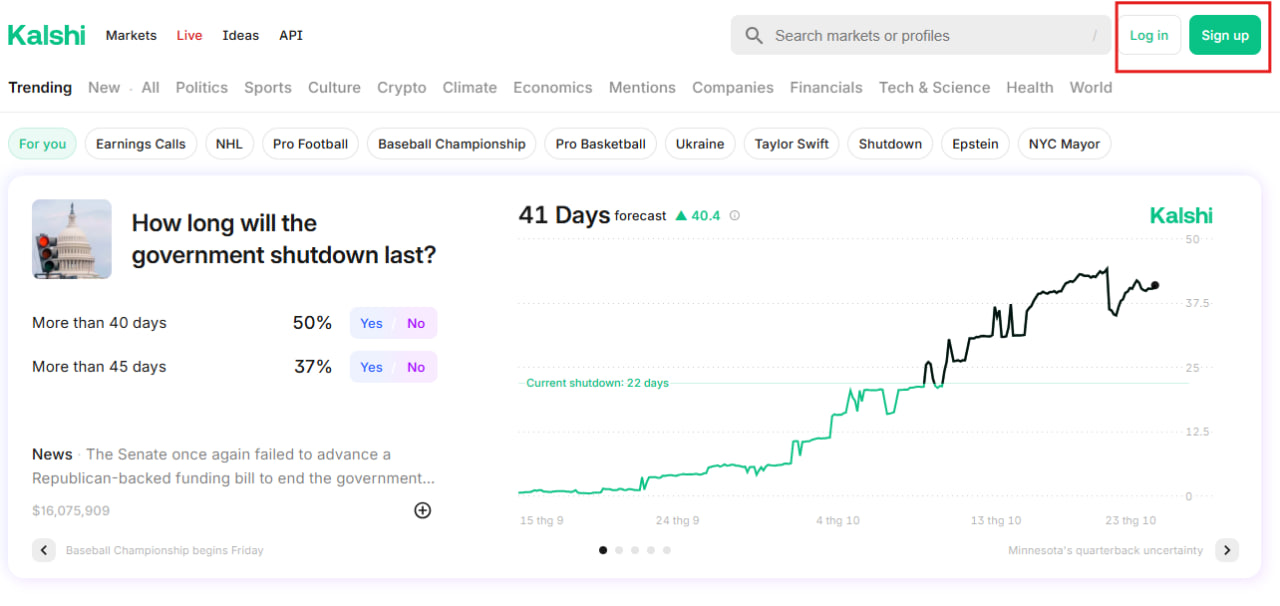

Step 1: Set Up Your Account

Visit the Kalshi website, click "Sign Up". Provide basic information: name, email, phone number.

Verify your identity using ID (driver's license or passport). This is required due to CFTC KYC regulations.

Deposit a minimum of $1 to start trading. You can trade from $0.01.

Step 2: Choose Events to Predict

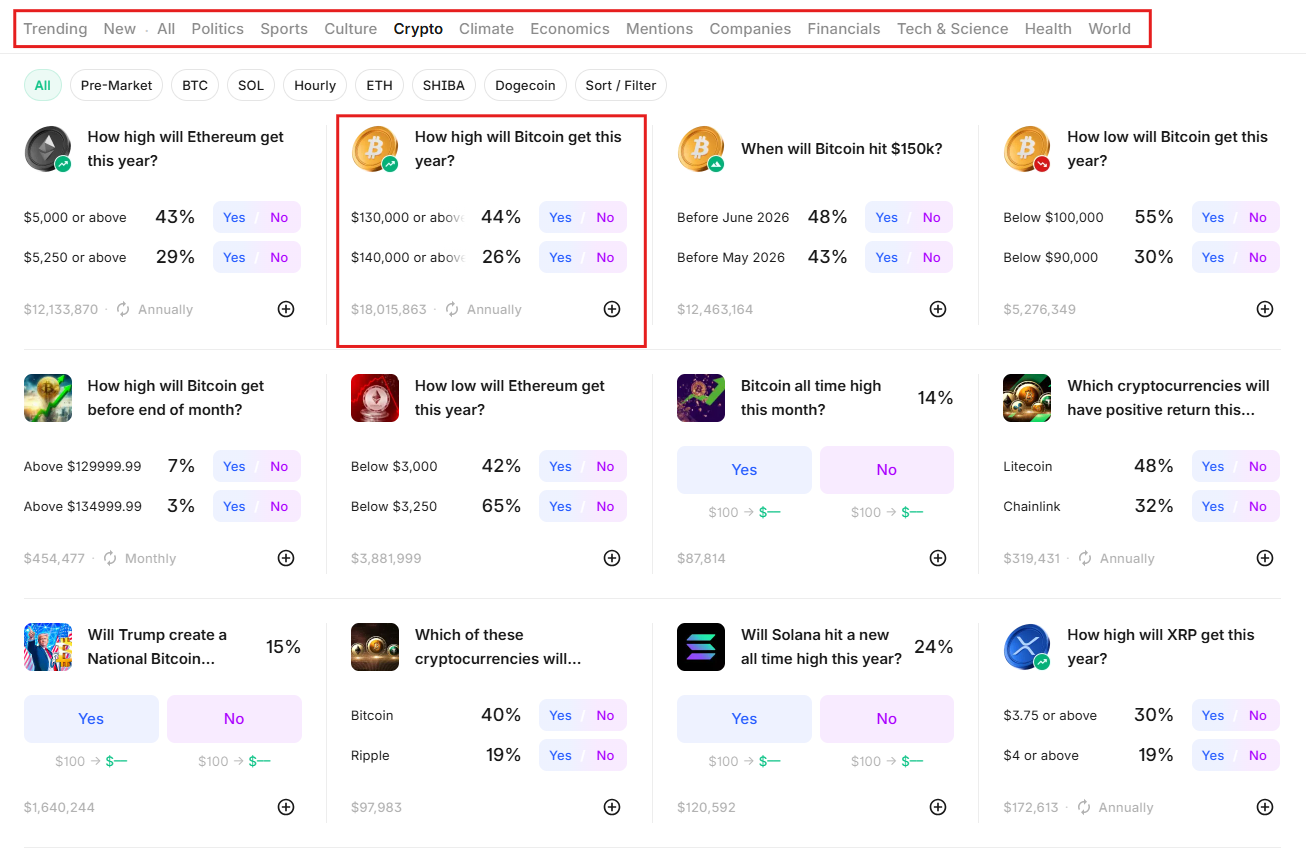

Kalshi offers various market categories: Sports (NFL, NBA, NHL, MLB), Politics (elections, Congress), Economics (Fed, inflation), Entertainment (Oscars), Weather, and Crypto.

Select the event you want to trade.

Step 3: Understanding Order Types

Kalshi provides two order types: Market Orders and Limit Orders. Each has its own advantages and disadvantages.

Market Orders (Quick Orders):

Execute immediately at the best available price. Ideal when you want to enter positions quickly.

How to use:

- Click "Buy Yes" or "Buy No"

- Enter the USD amount you want to invest

- Order fills instantly, you receive contracts

Example: "Yes" trading at 66 cent, you place a $66 market order. You receive 100 contracts immediately.

Limit Orders:

Allow you to set a specific price you're willing to buy/sell. Order only executes when market reaches that price.

How to use:

- Select "Limit" instead of "Market"

- Enter your desired price per contract

- Enter number of contracts needed

- Order appears on the order book

- Executes when someone matches your price

Benefits: Better price control. No fees if you're a maker order.

Example: "Yes" currently at 31 cent, only 250 contracts available. You want 1000 contracts but won't pay 32 cent.

You place a limit order for 1000 contracts at 31 cent. First 250 contracts fill immediately, remaining 750 wait on order book.

Important Notes

About Trading:

- Trading on Kalshi is heavily influenced by news. Consider carefully before participating.

- Some markets have low liquidity. Consider this before placing large amounts.

- Focus on high-liquidity markets like major political events, Fed decisions, or popular crypto predictions.

About Legality:

- Kalshi is legal in all 50 U.S. states. However, there are ongoing legal disputes in some states.

- Platform just expanded to 140+ countries in October 2025. Creating a unified global liquidity pool.

- 38 restricted countries include: UK, Canada, France, Poland, Russia, Singapore, Taiwan, Thailand, Venezuela.

About Security:

- Kalshi implements strong encryption, strict KYC, and 2FA. The platform has market surveillance systems to prevent fraud.

- Kalshi also has a risk management portal. Allows you to set deposit limits, trading breaks, and voluntary opt-outs.

Conclusion

Kalshi provides a CFTC-regulated prediction market alternative to blockchain-based Polymarket, establishing itself as a leading platform in the space. The centralized exchange offers accessible event-based trading with proven forecasting accuracy. However, users should understand inherent risks and never invest beyond their financial capacity.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Prediction markets involve risk of loss. Users are responsible for complying with local laws and regulations.

FAQs

Q1: Do I need crypto experience?

Not required. Kalshi allows deposits via bank transfer and debit card. Platform is beginner-friendly.

Q2: What's the minimum amount to start?

Minimum deposit is just $1. However, $10-$50 is recommended for learning and experience.

Q3: Will Kalshi launch a token?

Kalshi does not yet have an official token. However, there has been speculation about a potential KALSHI token launch and airdrop based on hints from the team. No official announcement has been made as of October 2025. If a token launches, it may be available for pre-market trading on platforms like Whales Market.

Q4: What is the Kalshi token pre-market price?

As of October 23, 2025, Kalshi has not launched a token yet. If it does, you may be able to trade it on Whales Market before CEX listings like Binance or Bybit.

Q5: How does it differ from Polymarket?

Kalshi is a centralized CFTC-regulated platform using USD. Polymarket is a decentralized platform on Polygon using USDC. Kalshi has more users and downloads in the U.S. Polymarket has a higher valuation due to token drop expectations.