Since launching in 2020, Polymarket has evolved into the world’s most active prediction market, turning real-world events into tradable assets. Billions are wagered on elections, crypto, and global trends, but only a few know how to consistently win.

This guide breaks down the proven strategies that help users increase their win rates and stay ahead in the world’s fastest-moving prediction market.

What Is Polymarket?

Polymarket is a prediction market platform built on the Polygon blockchain, where users can “bet” on real-world outcomes. It allows speculation on almost anything, from presidential elections and sports results to crypto prices or major global events.

Think of it as a smart, decentralized betting exchange that uses crypto instead of traditional money. No middlemen, no banks, no companies controlling the system, everything runs transparently on-chain. Founded in 2020 and based in New York, Polymarket has become one of the leading names in the space.

Why Do Users Choose Polymarket?

- Decentralized and transparent: All activity is recorded on the Polygon blockchain. Every trade is public and verifiable, reducing fraud and manipulation.

- Diverse markets: Users can bet on politics, crypto, sports, and even stock movements.

- Simple onboarding: No complicated KYC. All it takes is a Web3 wallet and USDC. There’s no fee for placing a bet, only a small fee when winning.

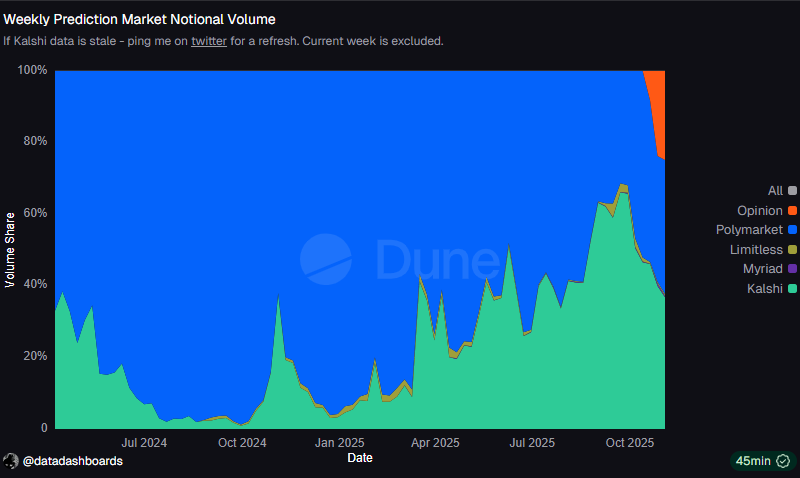

- Massive trading volume: DefiLlama data shows that since its launch, Polymarket’s total trading volume has exceeded $22 billion as of November 2025, outpacing every other prediction market platform.This milestone highlights Polymarket’s dominant position and the explosive growth of the prediction market industry worldwide.

- Strong backers: The platform has raised over $2.28B, including $2B from ICE (the owner of the New York Stock Exchange), valuing it at $9B. Other notable investors include Founders Fund, Coinbase Ventures, Dragonfly, and Vitalik Buterin.

Read More: How to Predict on Polymarket: Complete Beginner's Guide

Top Strategies to Win More on Polymarket

Betting on Near-Certain Outcomes

This strategy involves wagering on events that are almost guaranteed to happen (80%+ probability), or on extremely unlikely ones that are nearly impossible.

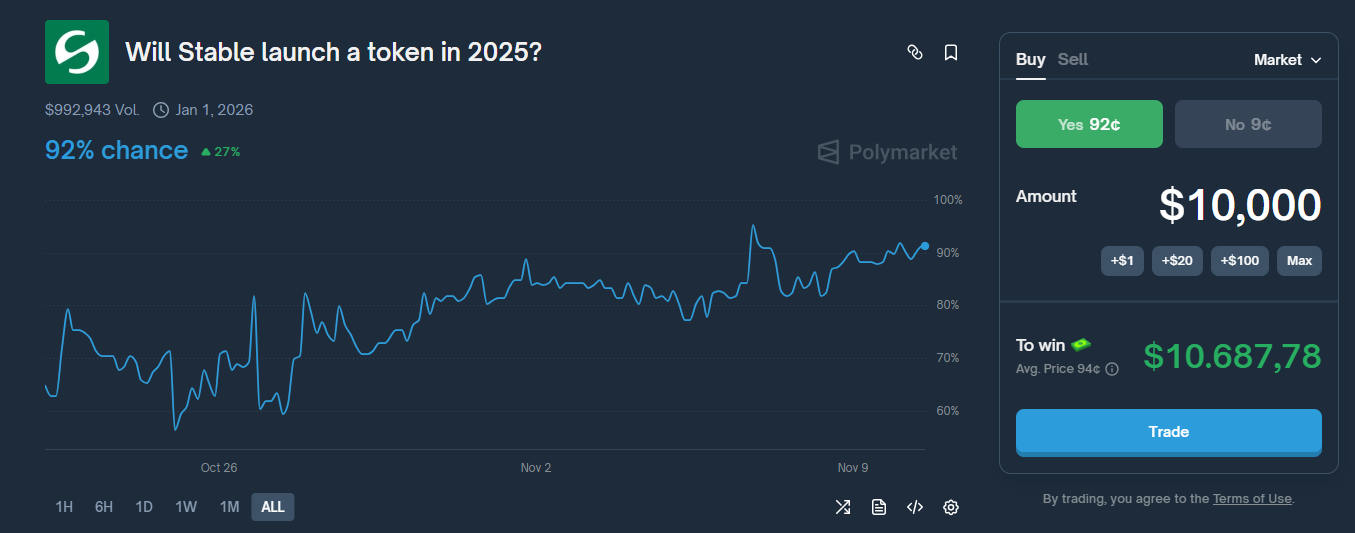

Example: The market predicts that Stable will launch in 2025 with a 92% probability. The token is currently trading at $0.48 on Whale Market (Pre-TGE), reflecting strong market confidence, but this information should be treated as reference data, not a guaranteed outcome.

With two months left in 2025, the trade looks promising, however, outcomes in prediction markets can still shift unexpectedly.

A $10,000 bet could return around $680 in profit.

Pros:

- Very high win rate if timing correctly.

- Good for those seeking low-risk, steady returns.

- Can generate consistent income with disciplined capital use.

Cons:

- Small profit margin; requires large capital.

- Even a 1–2% reversal can wipe out the position.

- Not ideal for users chasing fast, high-risk plays.

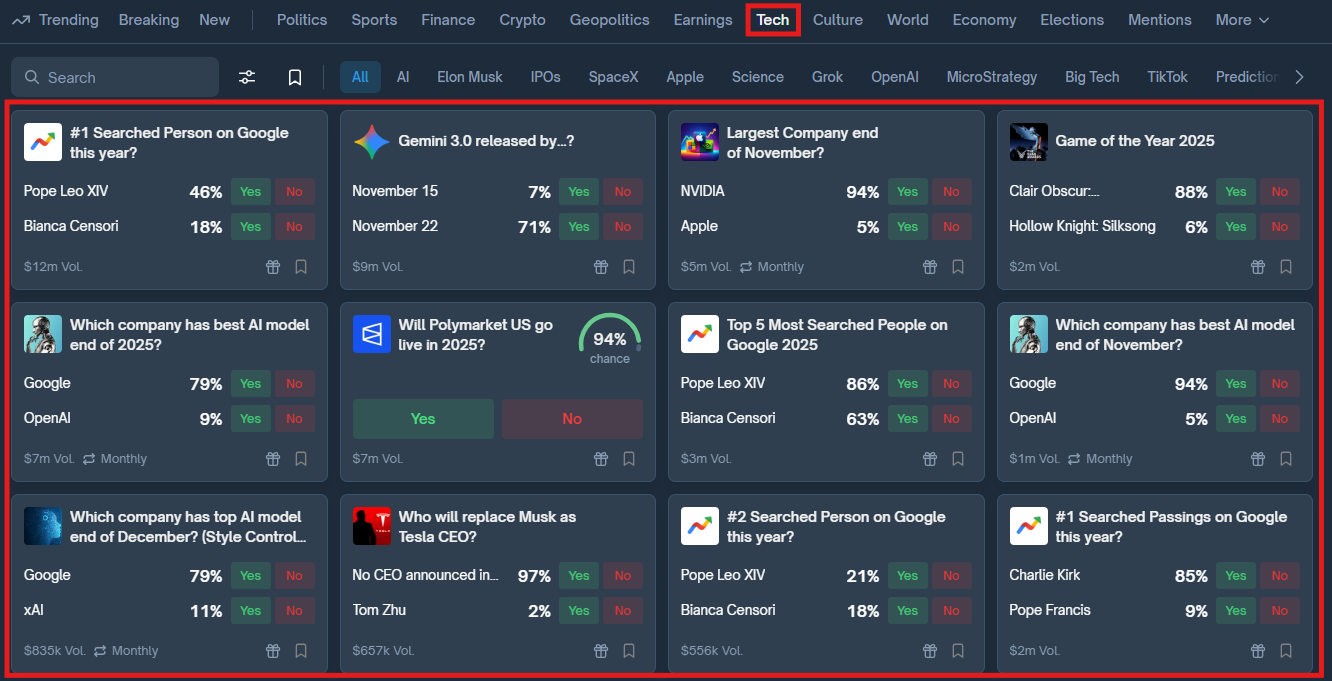

Specializing in One Market (Niche Trading)

This is one of the safest and most consistent approaches. The idea is simple: focus on one topic and master it, whether it’s politics, crypto, and tech,...

By studying how that market behaves, who trades there, what influences prices, and how sentiment shifts, users gain an edge. Recognizing when to enter or exit becomes easier, reducing emotional mistakes and improving long-term performance.

Pros:

- Deep knowledge leads to more accurate predictions.

- Creates a long-term competitive advantage.

- Enables data-driven and confident decisions.

Cons:

- Requires time and patience to research deeply.

- Some niche markets lack liquidity, making trades slower.

- Capital may get stuck if the market goes quiet.

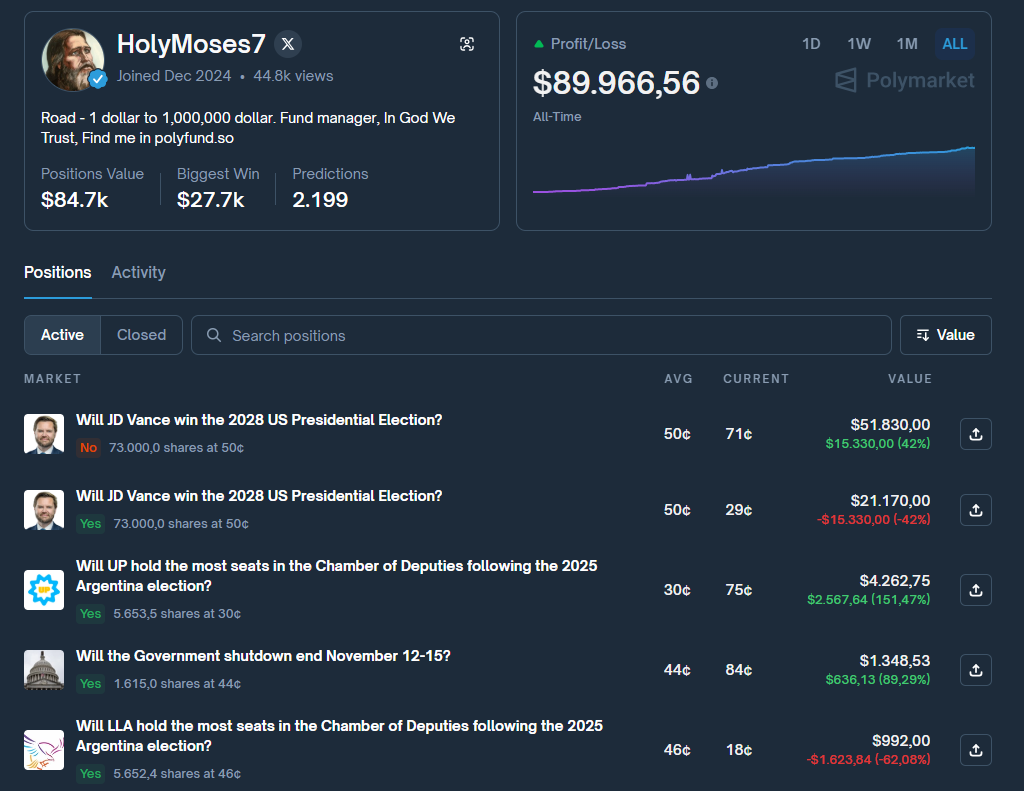

Copytrading (Following Expert Wallets)

This strategy focuses on mirroring top traders’ moves.Instead of doing all the analysis, users track experienced wallets and replicate their trades, manually or with bots.

Pros:

- Saves research time, perfect for beginners.

- Helps learn how experienced traders think and act.

- Following “whale wallets” can reveal early market signals.

Cons:

- Blind copying without context often leads to losses.

- Even top traders can make mistakes or mislead.

- Overreliance on others limits independence and learning.

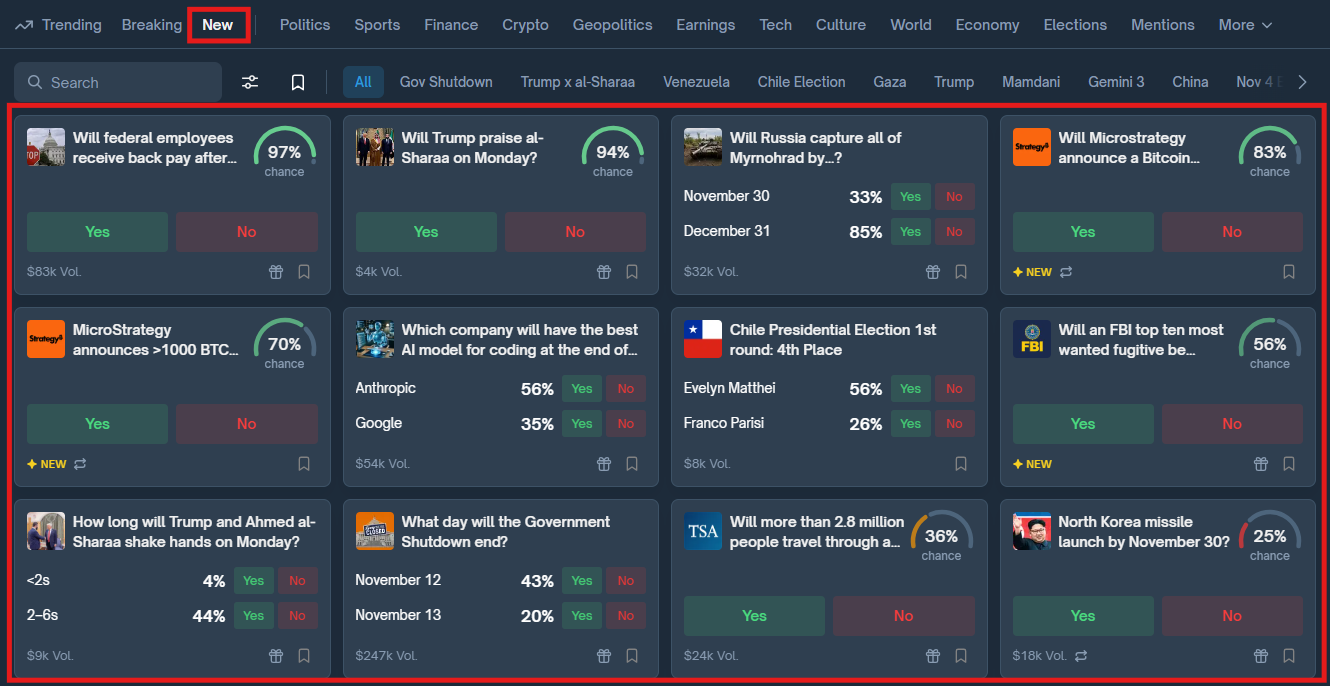

Trading on News Events

This strategy rewards speed and attention. Users monitor live sources like Bloomberg, X (Twitter), or political feeds to act before the rest of the market. If executed quickly, profits can be significant.

Pros:

- High potential gains from being first to act.

- Markets often move sharply right after big news.

- Ideal for users who love fast-paced trading.

Cons:

- Requires constant monitoring, mentally demanding.

- Even a few minutes’ delay can kill the opportunity.

- Risk of reacting to false or misleading information.

Conclusion

Every strategy on Polymarket has its own “winning style.” Those who prefer safety might stick with near-certain bets or niche trading, while fast reactors thrive with news trading. For beginners, copytrading can be a good starting point to observe market behavior and learn from others.

Above all, success comes from understanding how markets move, managing risk carefully, and staying emotionally neutral.

Disclaimer: This article is for informational purposes only and not financial advice. Whales Market is not responsible for any investment decisions.

FAQs

Q1. How can users find trending markets on Polymarket?

Check the Trending tab on the homepage or follow top traders to spot active, high-volume markets.

Q2. Should users rely on trading bots?

Yes, but only if they understand how the bot works. Beginners should trade manually first to learn the basics.

Q3. How can users reduce risks when trading on news?

Always verify the reliability of sources and avoid acting on unconfirmed or speculative headlines.

Q4. Is it smart to go all-in on a “sure-win” bet?

No. Even with high probabilities, it’s best to diversify and spread out capital to avoid total loss.

Q5. What’s the best starting strategy for beginners?

Start with copytrading or niche trading using small amounts to understand how different markets behave.