In an increasingly heated Perp DEX race, Variational is emerging with its unique peer-to-peer trading model and a commitment to allocate 50% of tokens to the community. If Hyperliquid was missed before, this could be a second opportunity worth paying attention to.

Variational Overview

Variational is a decentralized derivatives trading protocol (Perp DEX) built on Arbitrum. The key difference between Variational and other Perp DEXs such as Hyperliquid or dYdX lies in its use of the Request-for-Quote (RFQ) model instead of a traditional orderbook.

With the RFQ model, when a position is opened, the system requests a quote from the Omni Liquidity Provider (OLP), a professional market maker operated directly by the Variational team. This approach helps optimize spreads and reduces concerns around slippage.

Variational currently offers two main products. Omni is designed for retail traders, supporting hundreds of perpetual futures pairs. Pro is tailored for institutions, offering customized OTC derivatives products.

Current Variational Metrics Update

The latest data indicates that Variational is entering a phase of clear and relatively healthy growth, both in terms of capital inflows and user behavior.

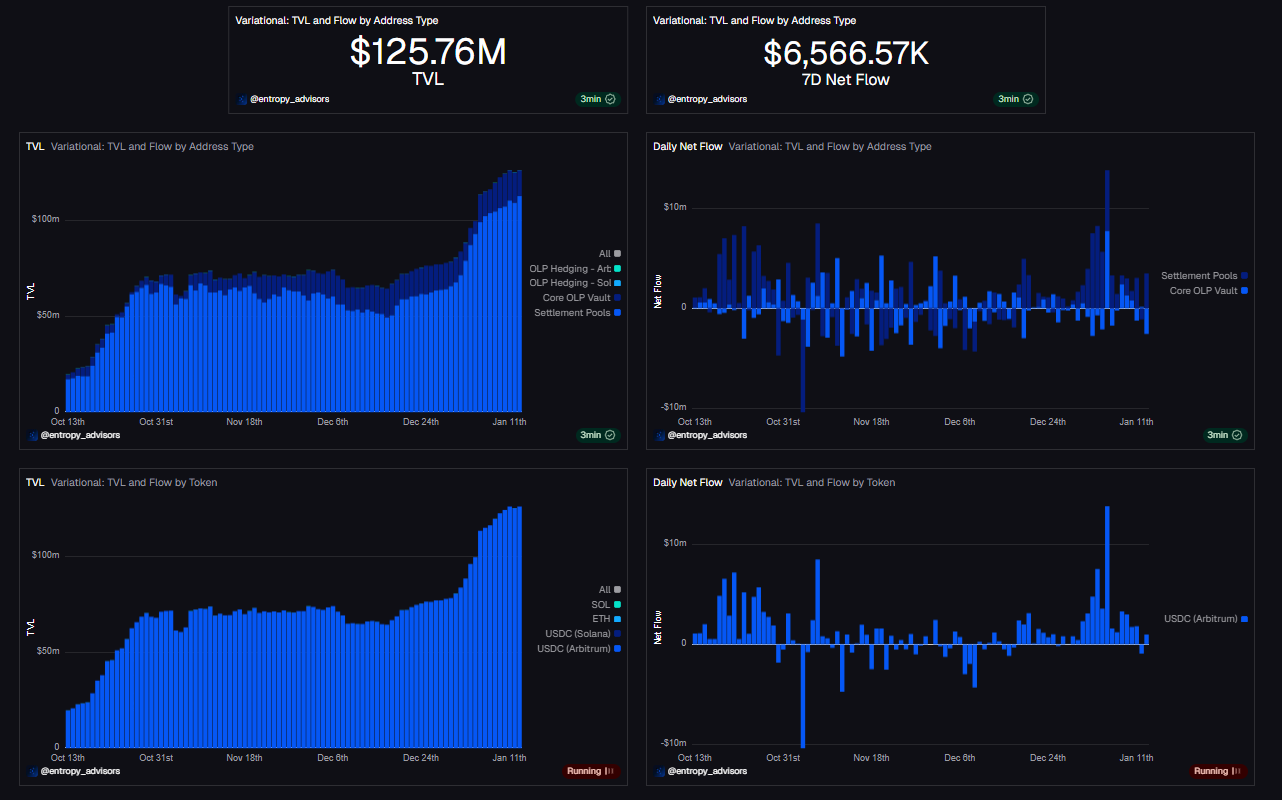

TVL And Capital Flow Trends

From a TVL and capital flow perspective, this Perp DEX showing very positive momentum:

- Current TVL stands at approximately $125.8M, increasing sharply compared to earlier periods and accelerating noticeably since late December.

- 7D Net Flow is close to $9M, suggesting that new capital continues to enter the protocol rather than simply circulating internally.

- TVL growth has been relatively steady over time, avoiding short-term speculative spikes.

Looking deeper into the TVL structure, the data shows improving balance.

- USDC, particularly on Arbitrum, is the primary contributor to TVL, aligning well with hedging and risk management needs.

- TVL distribution across address groups is not heavily concentrated in a small number of large wallets.

- The share of TVL held by the top 10 and top 100 addresses is gradually decreasing. Medium and smaller wallets are contributing an increasing portion of total TVL.

This reflects an ecosystem expanding horizontally, reducing reliance on whales and improving long-term sustainability.

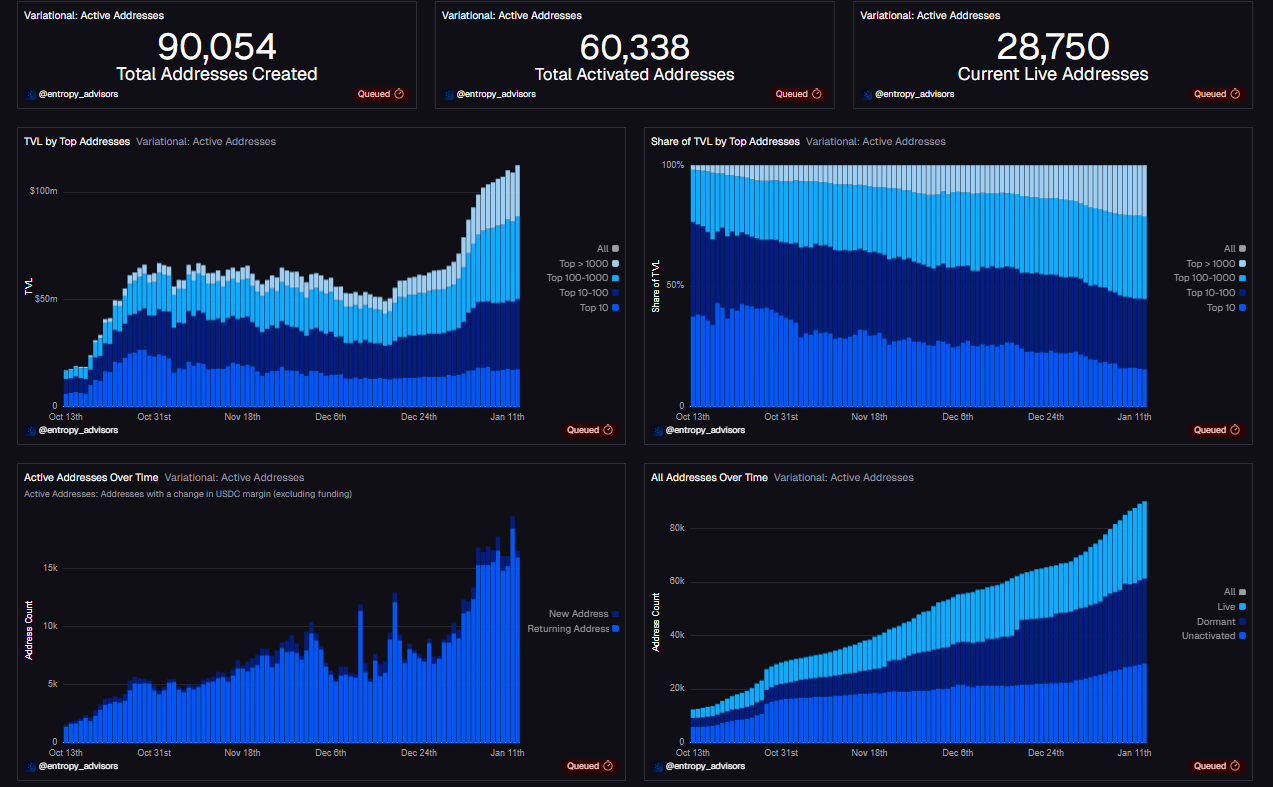

User Activity And Engagement

From a user and activity standpoint, Variational is also showing clear growth signals:

- Total addresses created exceed 90,000.

- Activated addresses are over 60,000.

- Currently active addresses are around 28,750.

- Active addresses over time have increased significantly in recent periods.

- The composition of active users includes both new and returning users, indicating improving user retention.

Taken together, these data points show that Variational is not only growing in size but also improving the quality of its growth:

- Capital inflows remain stable.

- Capital distribution is becoming healthier.

- User growth is accompanied by real on-chain activity.

If this trend continues, Variational shows signs of being a Perp DEX operating steadily, with capital and users increasing due to real usage demand rather than purely market cycles.

Why Participate In The Variational Airdrop?

- Community-first token allocation: According to official documentation, around 50% of the total $VAR token supply is allocated to the community through multiple distribution programs. Compared to the broader market, this is a relatively high ratio and reflects a clear focus on rewarding early participation & product usage.

- Clear buyback and burn mechanism: The $VAR token is designed to be directly linked to protocol activity. At least 30% of protocol revenue is used to buy back and burn tokens, gradually reducing supply over time and creating a direct connection between platform performance & token value.

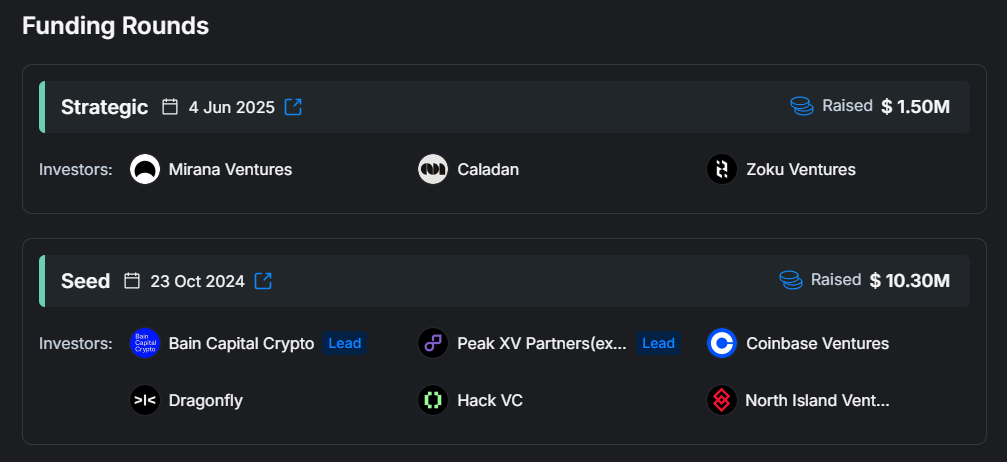

- Backing from major VC: Variational has raised $11.8M from well-known VCs, including Bain Capital Crypto, Coinbase Ventures, Dragonfly, Peak XV, Mirana Ventures, Caladan, and Hack VC.

What is Variational Points Mechanism?

The Omni Points program officially launched on December 17, 2025, with 3,000,000 points distributed retroactively to existing traders.

Points Distribution

Points are distributed weekly on Fridays at 0:00 UTC for activity from the previous week. The program is expected to end no later than Q3 2026. With an estimated 150,000 points distributed per week over the remaining 42 weeks, total points supply may reach 9–10M.

Referral Points

Users receive 1 additional point for every 10 points earned by referred users.

Early Trader Boost

Accounts that traded before the points program launch receive a +10% boost on all points earned.

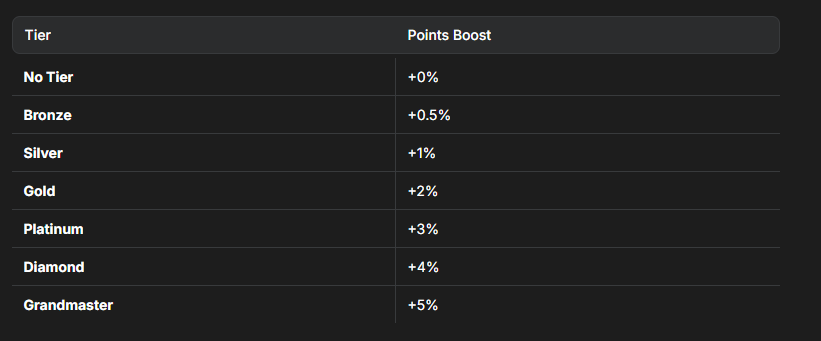

Tier Points Boost

Depending on reward tier, users can receive an additional bonus ranging from 0.5% to 5%.

How to get Variational Airdrop?

The Variational community estimates that 1 point could be worth around $10–30, or potentially more if the project reaches an FDV above $1B. The Omni Points program only launched on December 17, 2025. This means participation at the current stage is still considered very early.

ASTER: 22K✅

— dTfN✨ (@deTEfabulaNar_) December 31, 2025

LIGHTER: 40K✅

MY GOAL FROM VARIATIONAL IS TO EARN A MINIMUM OF 20K!

10 TIPS FOR EARNING HIGH POINTS ON @variational_io (UPDATED)

👇https://t.co/vuN6ErNZac

OMNI2PSKHNCT

(cc, image: dear @Absoluto92)

1⃣ Pairs other than BTC and ETH yield higher multipliers. Of… pic.twitter.com/csswPdTUYC

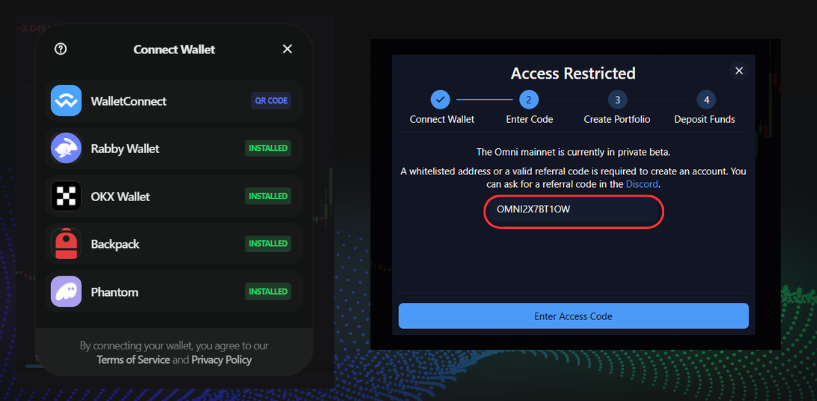

Step 1: Create An Account

- Access the Variational platform.

- Select Connect Wallet.

- Choose an EVM-compatible wallet to connect.

- Enter the referral code OMNI2X7BT1OW to gain access.

- Sign the wallet to confirm account creation.

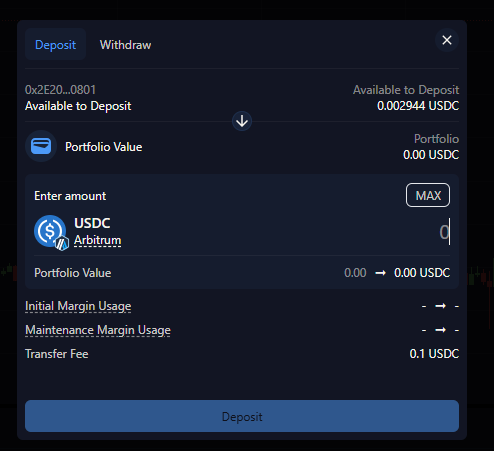

Step 2: Deposit Funds

- Select Deposit Funds.

- Transfer USDC on the Arbitrum network into the wallet.

- Transfer fee is 0.1 USDC.

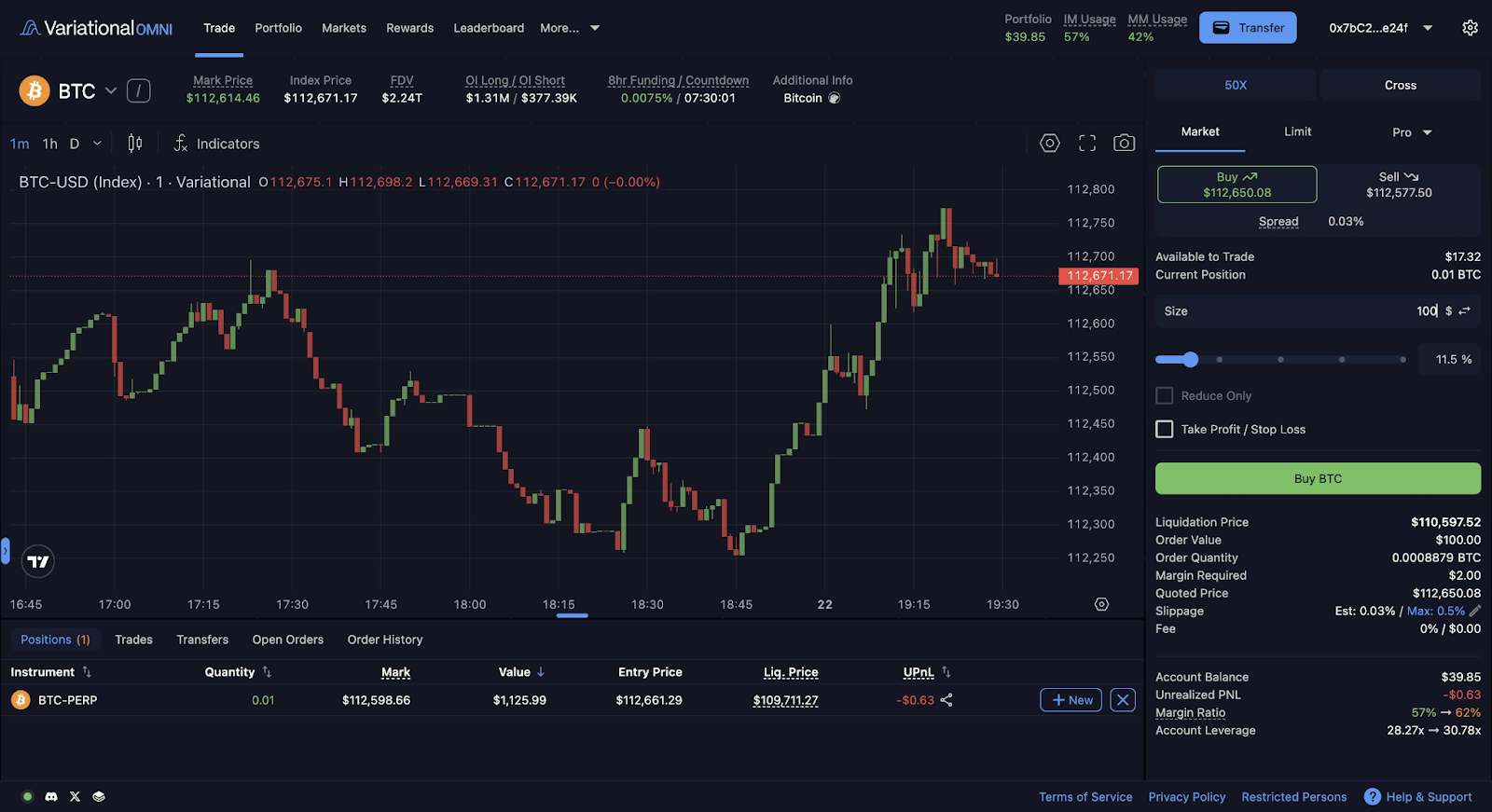

Step 3: Start Trading

- Navigate to the Trade section.

- Select the desired trading pair.

- Choose leverage, up to a maximum of x50.

- Enter the amount to open the position.

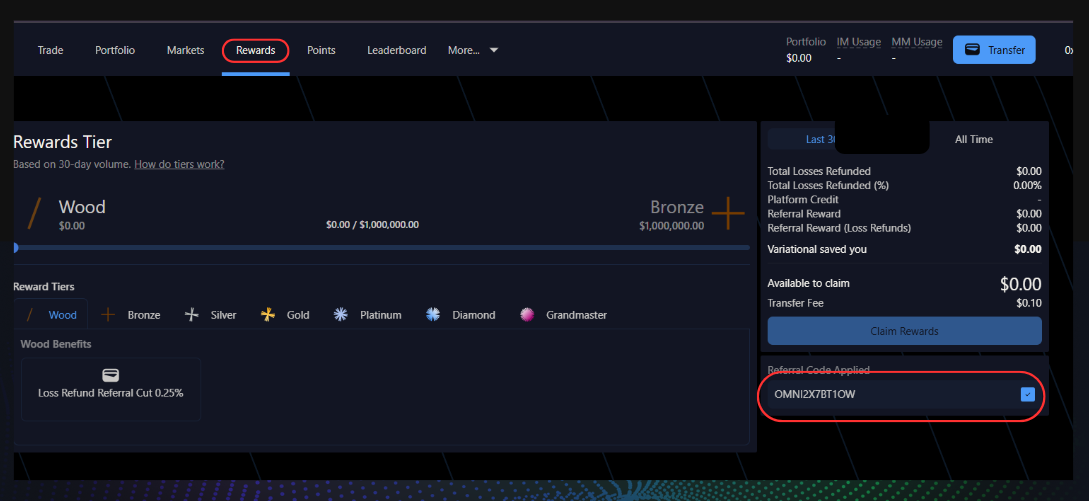

Step 4: Referral

- Go to the Rewards section.

- Copy the referral code to invite others and earn additional points.

Useful Participation Tips

Volume And Trading Strategy

- Focus on trade quality and avoid wash trading.

- Maintain consistent trading activity instead of concentrating volume in a single session.

- Consider altcoins with lower volume, while being aware of the trade-offs.

Loss Refunds

- Avoid intentionally losing trades to farm points, as this offers poor expected value.

- Split positions when closing losses to increase the number of refund chances.

- Monitor the Luckiness Multiplier, which can reach x2 during unfavorable outcomes.

Security And Risk Management

- Use a separate wallet dedicated to farming activity.

- Always verify URLs to avoid phishing attacks.

- Exercise caution when using high leverage.

Conclusion

Variational presents the profile of a protocol growing through real usage demand rather than short-term hype. With a clear product structure, stable capital inflows, and a points program still in its early stages, this stands out as one of the few opportunities where early participants still have meaningful room to optimize returns.

FAQs

Q1. Which type of users is Variational most suitable for?

Variational is best suited for traders familiar with derivatives trading, especially those prioritizing low spreads, stable execution, and minimal slippage. At the same time, airdrop-focused users can participate early to accumulate points through real trading activity.

Q2. What advantages come from joining the points program early?

Early participation allows users to accumulate points while competition remains relatively low and benefit from early-user boosts. This can lead to a significant difference in total points earned compared to users who join later.

Q3. Are Variational points tied to real usage behavior?

Yes. Points are distributed based on real trading activity, including volume and consistency. This design encourages natural user interaction and helps reduce unsustainable point farming behavior.

Q4. What is the main risk when farming points on Variational?

The primary risk comes from using high leverage in perpetual futures trading. Without proper capital management, losses can exceed the potential value of earned points.

Q5. How does Variational differ from other popular Perp DEXs?

Instead of relying on an orderbook, Variational uses an RFQ model operated by a professional OLP. This approach optimizes spreads, reduces slippage, and delivers a more stable trading experience for users.