Automated portfolio management is becoming a notable area within DeFi, and Glider operates in this segment with support from a16z CSX, Coinbase Ventures, and Uniswap Ventures. In 2025, the project is often referenced in airdrop research.

So how can users position themselves to farm the Glider airdrop effectively?

Glider Overview

Glider is a decentralized platform designed to support automated crypto portfolio management across multiple blockchains. The platform allows users to define investment strategies in advance, after which Glider executes portfolio rebalancing, token swaps, and allocation adjustments automatically. This approach reduces the need for continuous manual monitoring while maintaining onchain execution and user-controlled assets.

Key features:

- Non-custodial: Users retain full control of assets at all times, without depositing funds to third parties.

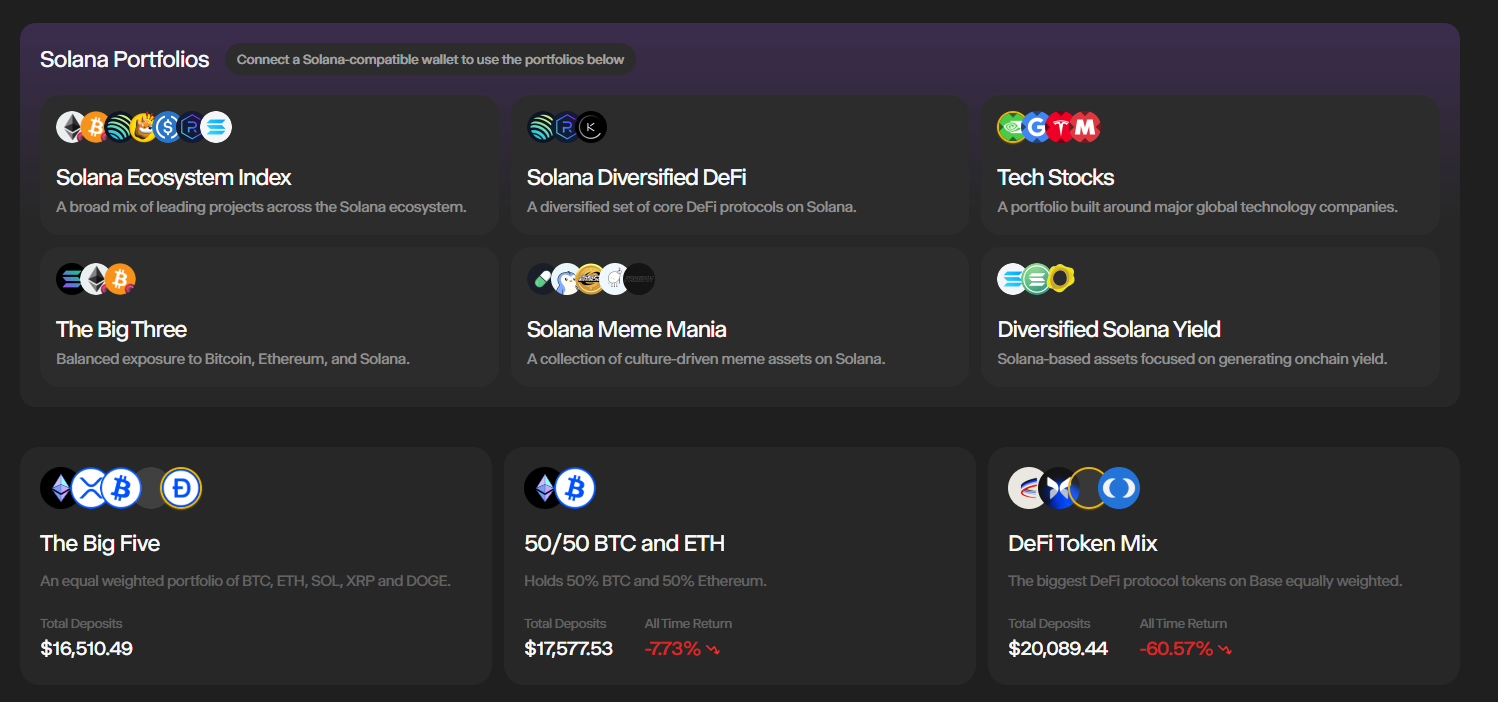

- Multi-chain: Supports Ethereum, Base, Arbitrum, Linea, Optimism, and most recently Solana (since December 18, 2025).

- Automation: Portfolio rebalancing, DCA, and complex strategies are executed automatically.

- No-code: A beginner-friendly interface that requires no coding knowledge.

Why Participate in the Glider Airdrop?

Glider is currently running a public beta on the Base chain, with DRIP Season 1 active since November 2025. Accumulating points through liquidity provision and referrals is the primary way users can prepare for possible future rewards.

Official updates are regularly shared by the team.

Glider’s world is expanding.

— Glider (@glider_fi) November 10, 2025

Season 1 of DRIP is now live.

Our community earns, collects, and grows together.

Join us on Discord and be part of what’s next. pic.twitter.com/ETR5r9XuCR

Below are the key reasons participation is worth considering.

Strong Backing From Major Investors

Glider has raised $4M from leading investors including a16z Crypto, Coinbase Ventures, Uniswap Labs, and GSR. This level of backing reflects a strong foundation, an experienced team, and long-term growth potential. Few DeFi projects receive this kind of support, which helps reduce risk and increase potential value at mainnet launch.

Attractive Points Program With Multipliers

Users earn 1 Beta Point per day for every $1 of liquidity provided. For example, depositing $1,000 generates 1,000 points per day. Several new portfolios on Base currently feature a 2x points multiplier, accelerating accumulation.

The referral system provides additional rewards, including 30% from direct referrals, 5% from level 2, and 3% from level 3. Since November 2025, DRIP Season 1 has been live, featuring Discord quests that unlock extra levels and multipliers.

Time to start compounding points

— Glider (@glider_fi) July 26, 2025

Refer friends to earn points and...

Earn revenue share across three referral tiers

Read through our Referrals FAQ blog below to get up to speed on the basics ⬇️ pic.twitter.com/qVM6dCxSza

Easy to Join

The beta phase is fully open, with no invite code required. Participation only requires connecting a wallet and depositing assets. Gas fees on Base are low, and activity can begin with a relatively small amount such as $100 to $200. The Discord and X communities remain active, with frequent updates from the team that help users track progress and optimize point strategies.

Overall, joining Glider is not only about potential airdrops but also about participating in a project that genuinely improves DeFi by automating and optimizing onchain investing. For users seeking passive income opportunities in crypto, Glider represents a compelling option.

How to Earn Beta Points

Beta Points are considered the primary metric used to determine airdrop eligibility.

Points Mechanics:

- Users earn 1 Beta Point per $1 of liquidity provided each day.

- Points are calculated automatically and displayed on the dashboard.

- No manual claiming is required, as all activity is recorded in real time.

- Points tracking began on July 1, 2025.

For example, a $100 deposit generates 100 Beta Points per day. After 30 days, this results in 3,000 points.

How to Get the Glider Airdrop?

Building a Strategy to Earn Points

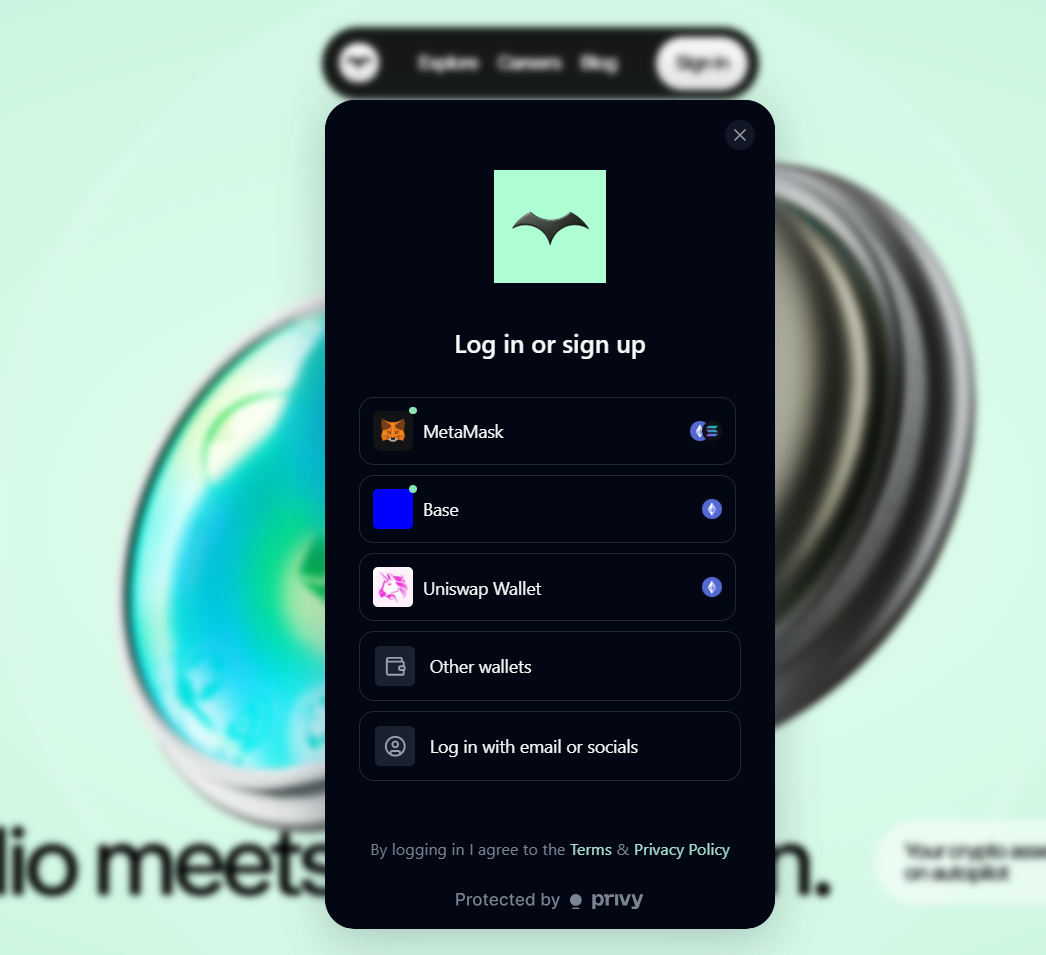

Step 1: Connect a Wallet

- Visit the official website at Glider.fi.

- Select Sign in to register using a Web3 wallet or log in via Google, Email, or X.

Step 2: Create an Account

After connecting a wallet, select Create your account to complete the registration process.

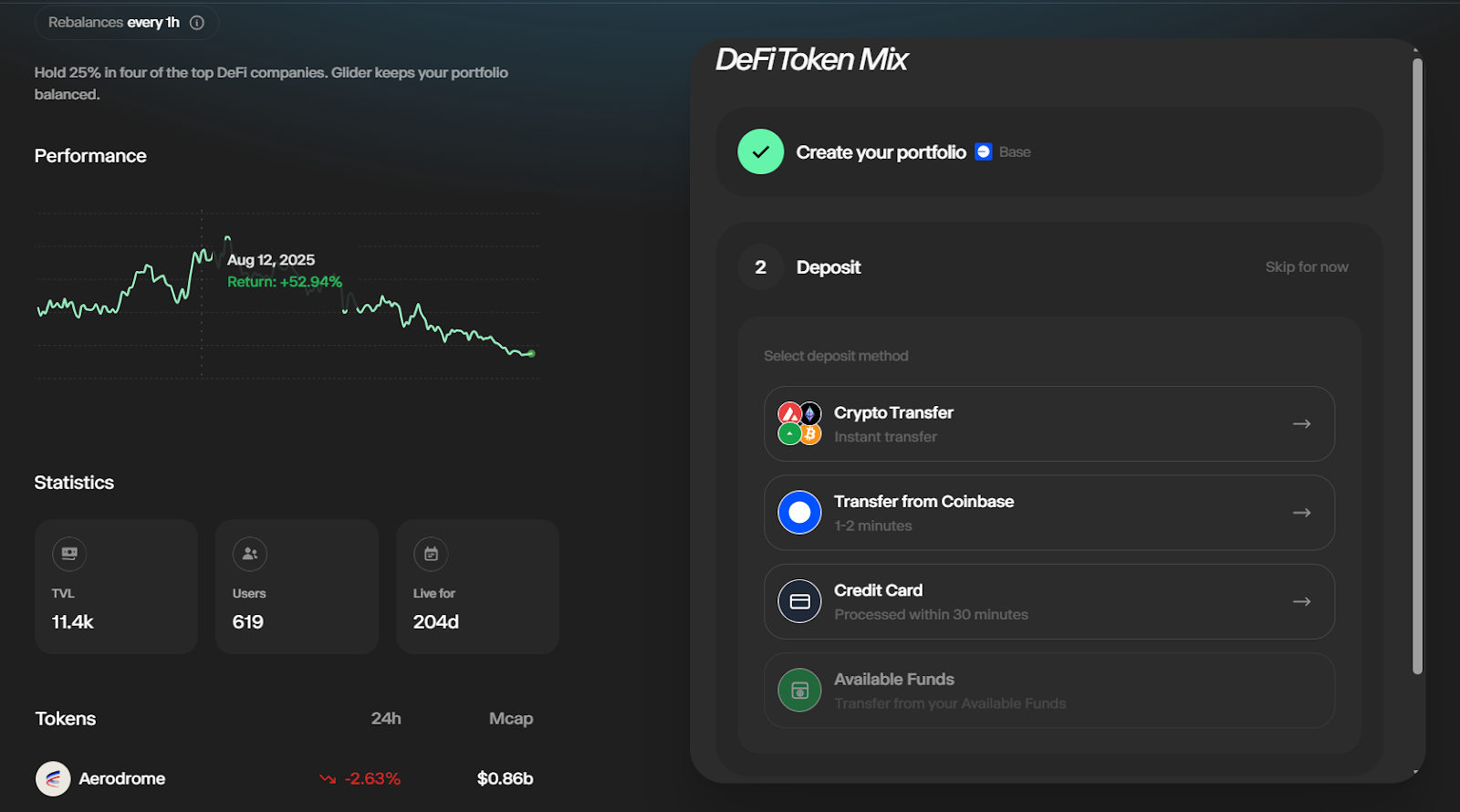

Step 3: Deposit and Choose a Strategy

- Glider supports deposits on multiple chains, including Ethereum, Base, Arbitrum, Linea, Optimism, and Solana.

- ETH or SOL is required to pay gas fees, depending on the chain.

- Users can select an existing portfolio or create a custom one.

- A transaction is signed to activate the vault, with no activation cost.

Step 4: Build an Automated Investment Strategy

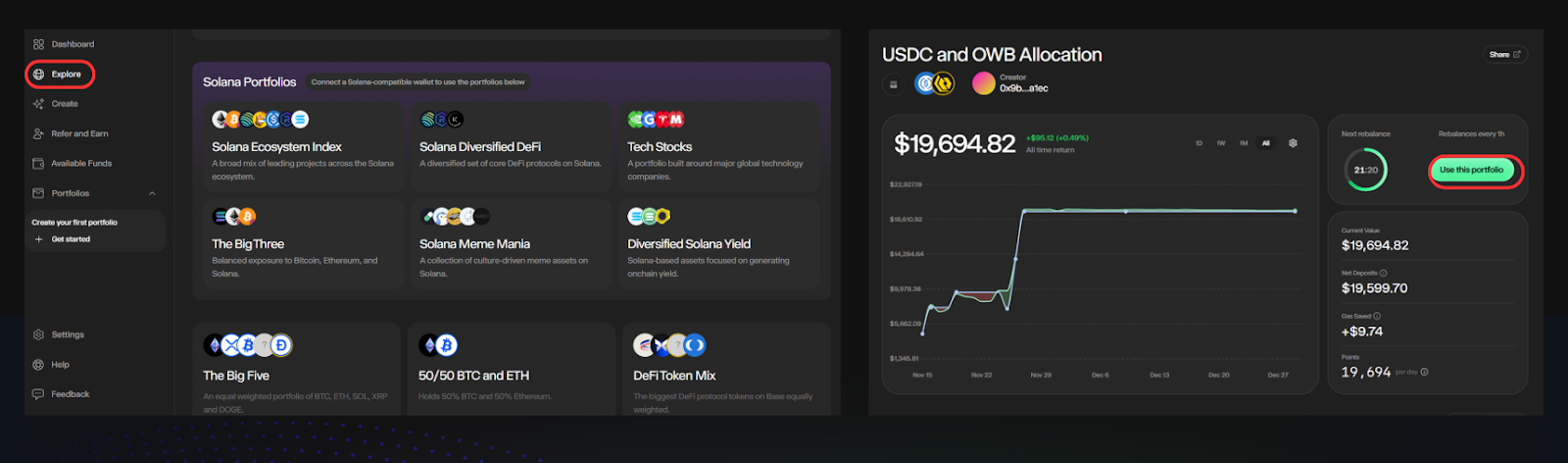

- In the Explore section, automated strategies created by other users can be reviewed.

- Each strategy should be evaluated carefully to ensure it aligns with individual risk preferences.After selecting a suitable strategy, choose Use this portfolio and sign to invest.

- Alternatively, a custom portfolio can be created by selecting Create and defining a personalized strategy.

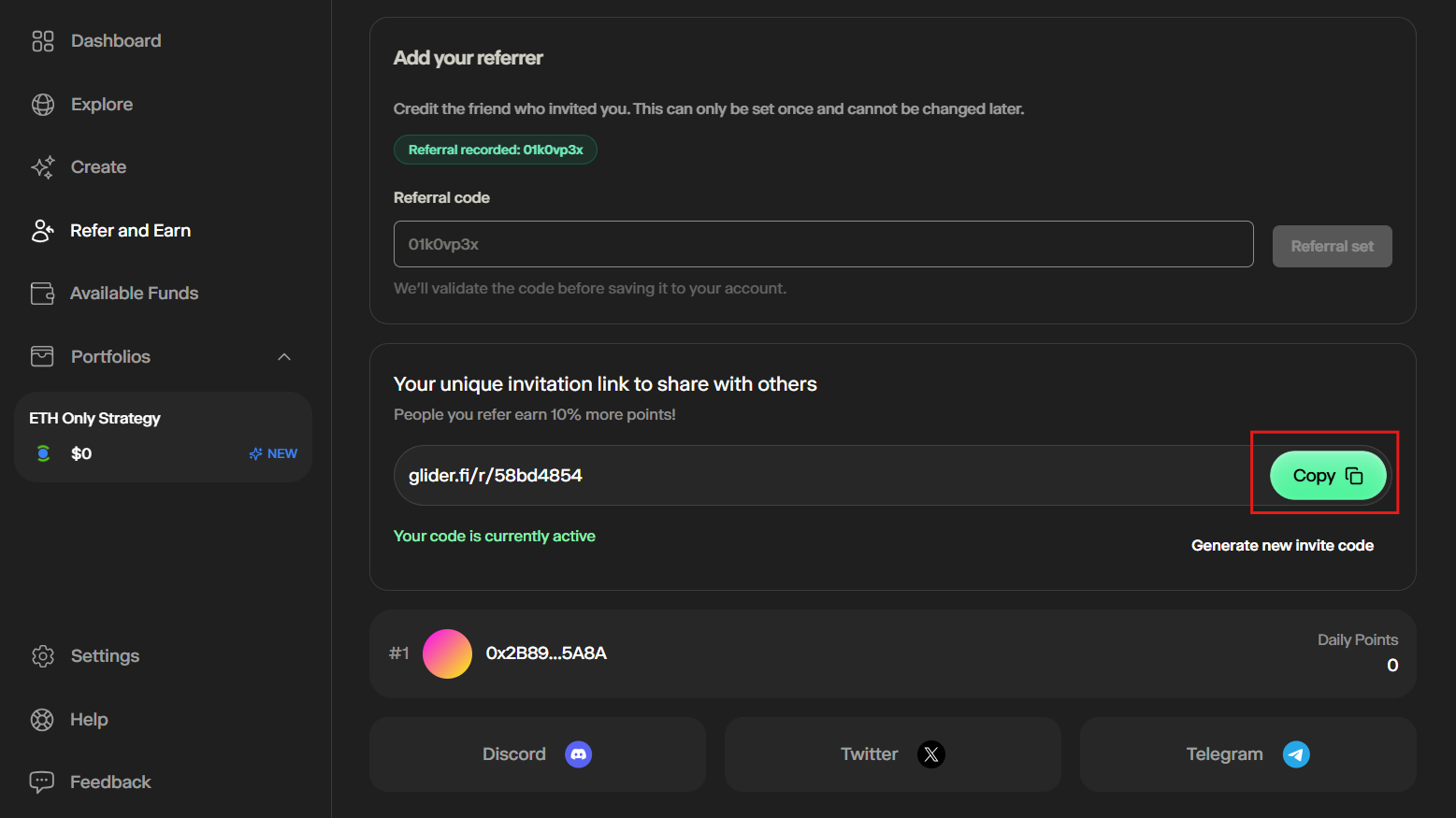

Invite Friends to Earn More Points

- Navigate to Refer and Earn.

- Scroll down to copy the referral code.

- Share the code to invite friends and earn additional points.

Conclusion

Glider not a fast, short-term airdrop play. Instead, it is a long-term opportunity designed for users who are patient and strategic. Early participation, consistent activity, and disciplined capital management help secure the strongest position when rewards are officially announced.

FAQs

Q1. Is long-term asset locking required to participate in Glider?

No. Assets can be withdrawn at any time, but longer participation helps build stable points and stronger positioning.

Q2. Can Beta Points be bought, sold, or transferred?

No. Beta Points are generated only through real platform activity and cannot be traded or transferred.

Q3. Does using Glider involve smart contract risk?

Glider is non-custodial, but standard DeFi risks still apply. Capital should be managed carefully, avoiding all-in strategies.

Q4. Does participating in referrals reduce personal benefits?

No. Referrals only add extra points from the network and do not reduce personal points or rewards.

Q5. Is Glider suitable for DeFi beginners?

Yes. The no-code interface, ready-made strategies, and simple workflow make Glider accessible to new users.

Q6. When is the best time to join Glider?

Earlier participation allows more time to accumulate points and improves positioning if an airdrop is launched.