While CT hunting for the next Lighter or Hyperliquid, or at least focusing heavily on airdrops from platforms such as Polymarket, there is still a very clear product-market-fit trend that is being overlooked.

That trend is the Payments sector, where RedotPay has emerged as a notable case study after successfully raising $194M and reaching a $1B valuation.

RedotPay Overview

RedotPay is a crypto focused fintech payment platform founded in 2023. It allows users to spend stablecoins such as USDT and USDC through both virtual and physical cards.

The project bridges digital assets with everyday transactions, enabling fast and secure crypto payments and conversions on a global scale.

Key features include:

- Crypto cards, both virtual and physical, supporting ATM withdrawals in fiat, in store payments, online shopping, subscriptions, travel expenses, and international transfers.

- A multi currency wallet for managing stablecoins and local fiat currencies.

- A P2P marketplace for buying and selling stablecoins with competitive rates and real time settlement.

- Crypto backed credit options that do not require credit checks and allow flexible repayment.

- RedotPay also supports passive income opportunities, crypto backed lending, and token swaps within the application.

Overall, RedotPay operates in a model that closely resembles the emerging Neobank trend.

Read more: Top 7 Neobank Projects in Crypto

Why Does The RedotPay Airdrop Have Potential?

FOMO Concentration in Other Narratives

In reality, most projects currently attracting investor attention fall into two main narratives:

- Perpetual DEXs: After Lighter’s highly successful TGE, many traders have shifted toward perpetual DEXs that are rumored to have upcoming airdrops such as Variational, EdgedX, and Paradex, hoping for a Lighter 2.0 scenario.

- Prediction Markets: With massive funding rounds from Kalshi and Polymarket, it is understandable why this sector has attracted strong FOMO. In addition, CZ has also entered the space through multiple prediction platforms on the BNB Chain.

Data from KaitoAI over the past 30 days shows that the most discussed projects are primarily prediction market platforms.

As a result, going against the crowd in this cycle is not without justification. Payment represents a logical alternative, as it is a blockchain application segment with massive scale and strong real world demand.

According to a McKinsey report, global payment revenues are expected to continue growing and could reach approximately $3T by the end of 2029. This leaves less than three years for products in this sector to scale and capture users.

Participation From Large Institutions

Another factor that makes payment a trend worth watching is the increasing involvement of major institutions.

- Circle is expected to successfully raise $1.1B through its IPO.

- Tempo recently raised $500M at a $5B valuation.

- Figure has raised a total of $2.5B and was valued at over $3B as early as 2021.

In addition, there are many notable payment focused projects such as AlloyX, Zerohash, Raincards, Raise App, and BON Network.

Although the market’s attention is currently drawn to many other narratives, the payments sector is steadily taking shape. Choosing a project with strong funding fundamentals like RedotPay to position for this trend is far from an unreasonable decision.

How to get RedotPay Airdrop?

To get the RedotPay airdrop, users need to download the application and use it as a real user. Since the platform offers many features similar to an exchange or a DeFi integrated digital bank, allocating idle funds, especially stablecoins, is a reasonable approach.

To get started, follow these steps.

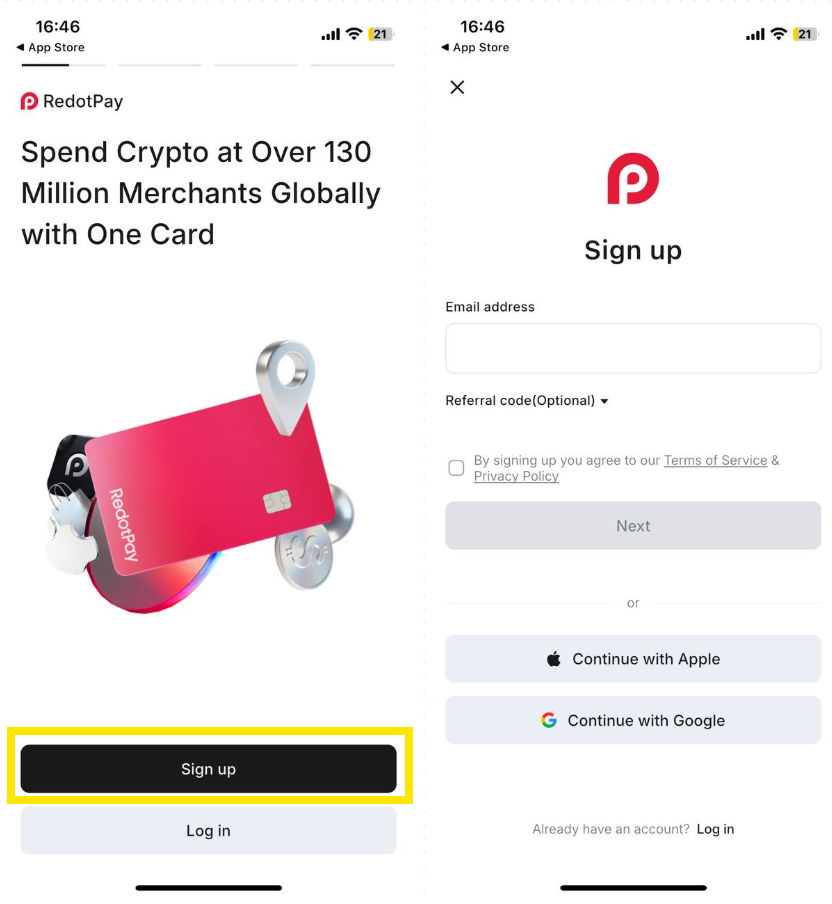

Step 1: Download the RedotPay App and Sign Up

- Users can access the official website to download the app. RedotPay is available on both the App Store and Google Play.

- Accounts can be created using Gmail or Apple ID.

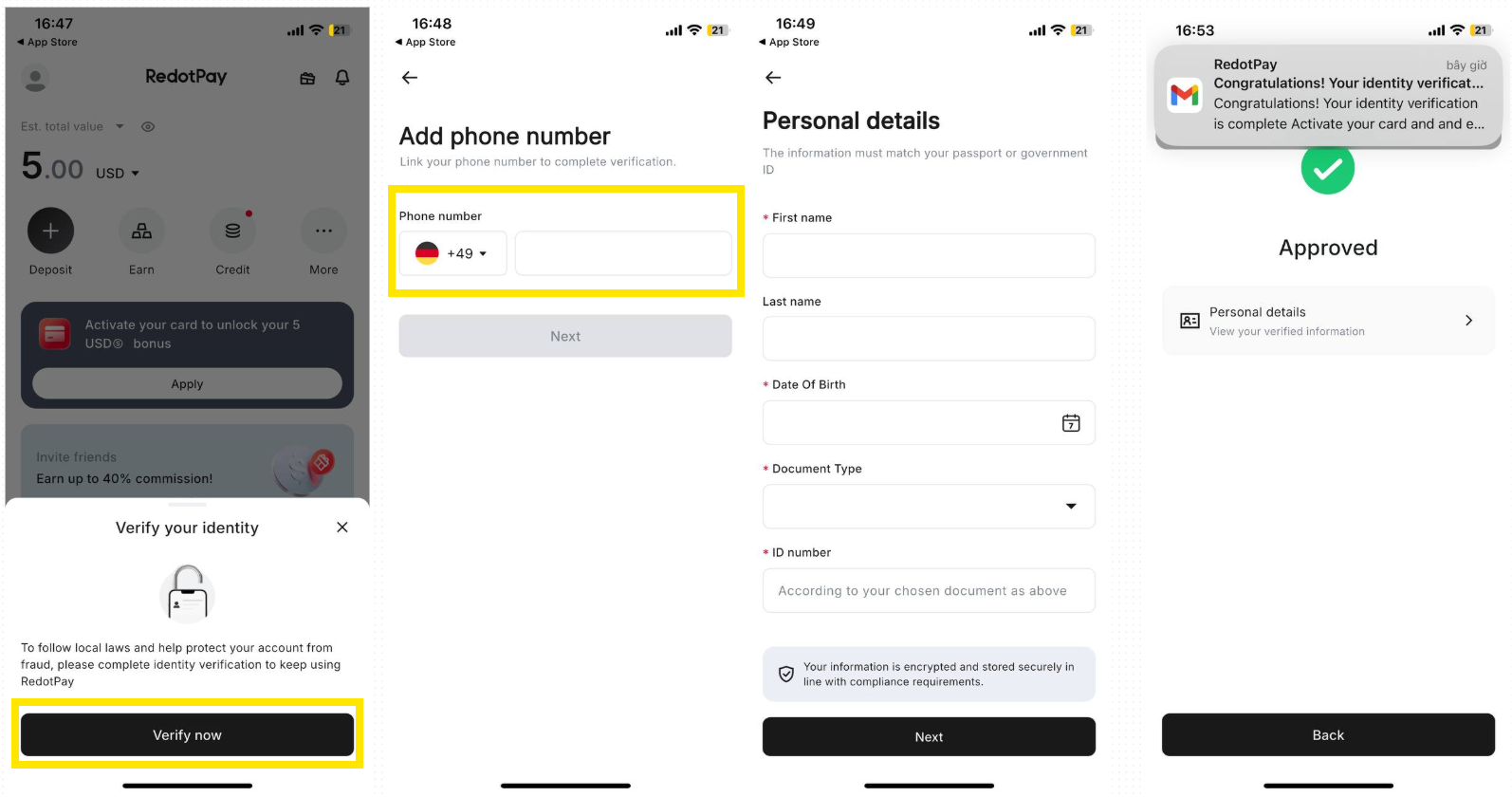

Step 2: Phone Number and Identity Verification

- At this stage, users verify their phone number and personal information using a passport or valid identification document.

- This step helps prevent money laundering and ensures safer access to P2P trading features.

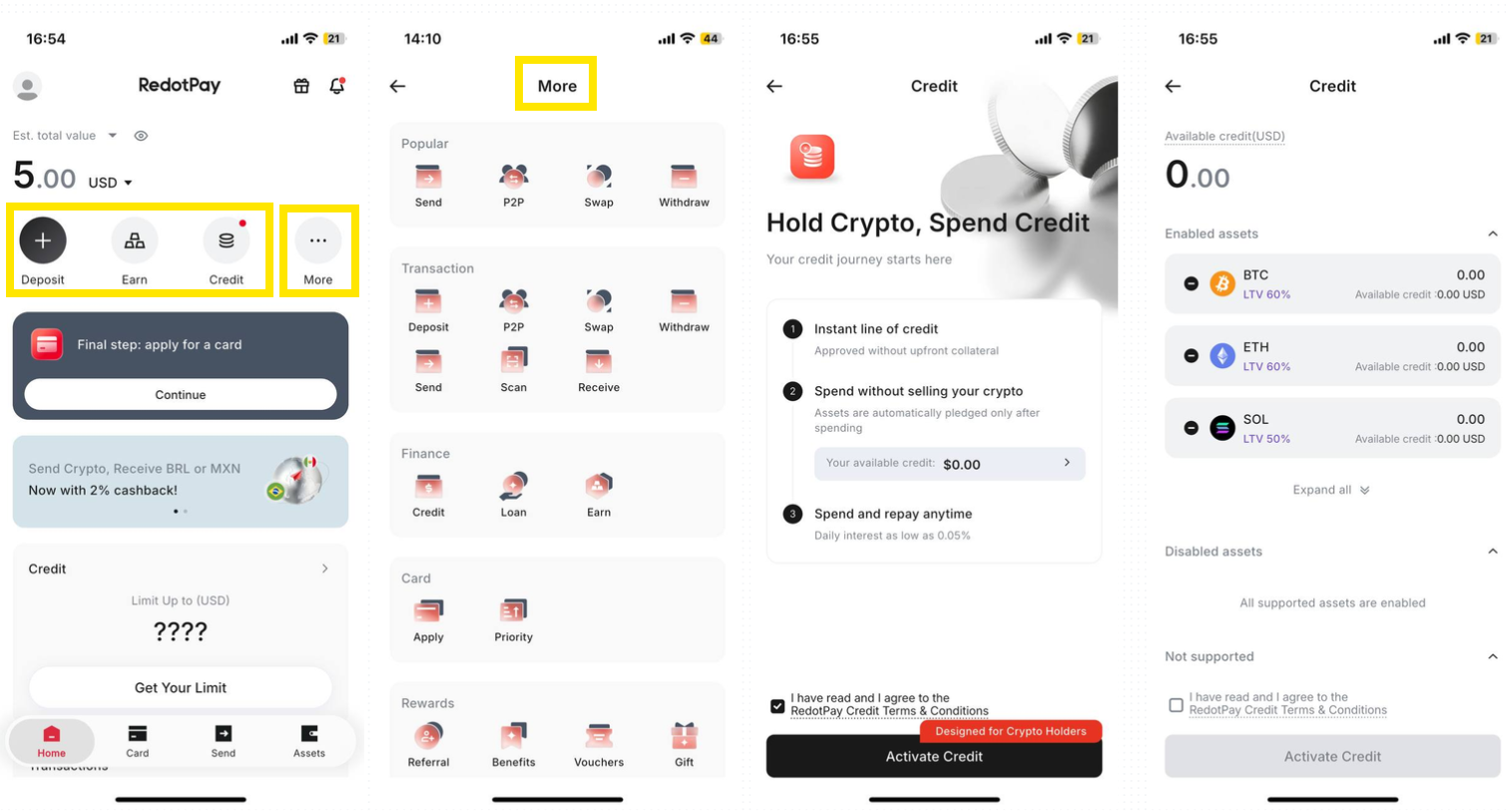

Step 3: Product Usage and Engagement

After completing all required procedures, users simply need to use the app naturally and focus on genuine product experience rather than over optimizing for airdrop farming.

Core features include:

- Deposit: Send and receive funds using wallet addresses across EVM and non EVM networks.

- Earn: Generate passive income by depositing USDT or USDC into the app.

- Credit: Use crypto as collateral to borrow cash or stablecoins for immediate in app usage.

In the More section, RedotPay also offers additional features such as token swaps and QR code payments for daily transactions.

Overall, RedotPay functions like a digital bank, allowing users to deploy idle stablecoins in a more productive way.

Note: Spamming or deliberately creating small transactions to inflate activity history is not recommended.

Conclusion

The RedotPay airdrop is gradually emerging as a differentiated and high potential opportunity, standing apart from the crowded perpDEX and prediction market narratives currently dominating market attention.

Rather than farming passively, using RedotPay as a genuine user and treating the airdrop as a bonus can help users develop better product understanding, stronger conviction, and improved long term positioning with the platform.

FAQs

Q1. What makes the RedotPay airdrop different from other crypto airdrops?

The RedotPay airdrop focuses on real payment usage rather than speculative trading or short term on chain actions.

Q2. Is the RedotPay airdrop confirmed or speculative?

The airdrop is not officially confirmed, but user activity and product engagement are commonly rewarded in similar payment focused platforms.

Q3. Do users need to trade actively to qualify for the RedotPay airdrop?

No, RedotPay emphasizes organic usage such as payments, deposits, earning yield, and credit features rather than frequent trading.

Q4. Does holding stablecoins increase the chance of receiving the RedotPay airdrop?

Using stablecoins within the app for deposits, earning, or payments aligns well with RedotPay’s core product design.

Q5. Is KYC required to participate in the RedotPay airdrop?

Yes, completing identity verification is required to unlock most features and demonstrates genuine user participation.