After Hyperliquid and Lighter, Paradex is emerging as a dark horse in the Perpetual DEX space, backed by proprietary technology from Paradigm.co.

With the XP program currently live and no official token yet, this is a strong window to accumulate points before the snapshot. This guide walks through how users can approach the Paradex airdrop in a clear and practical way.

About Paradex Perp DEX

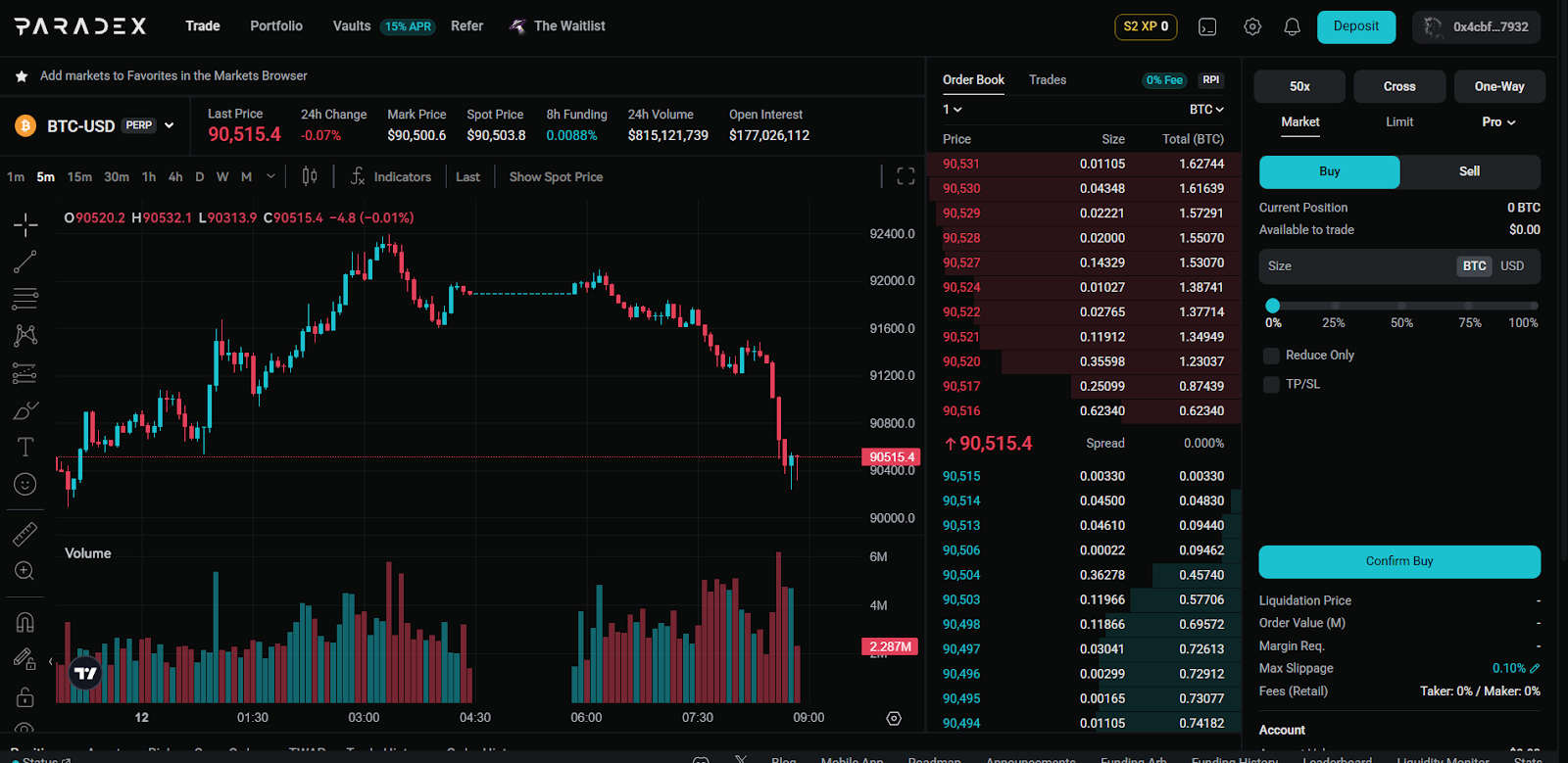

Paradex is a decentralized perpetual derivatives exchange built on Starknet, an Ethereum’s Layer 2 powered by ZK-Rollup technology.

Paradex blends the strengths of centralized and decentralized exchanges. It offers fast execution similar to CEXs while preserving full self-custody. Instead of using the AMM model, Paradex relies on a traditional orderbook, giving traders an experience closer to centralized platforms like Binance or Bybit.

Key features include:

- Full self-custody, with assets always remaining in user wallets.

- Leverage up to 50x across BTC, ETH, and multiple altcoins.

- Very low fees, with maker fees at 0.02% and taker fees at 0.05%.

- Cross-margin, allowing shared margin across positions.

- ZK-Rollup on Starknet, enabling off-chain execution with Ethereum-level security.

- Support for multiple perpetual pairs such as BTC-USD, ETH-USD, SOL-USD, and WIF-USD, with more being added.

Why you should farm Paradex airdrop?

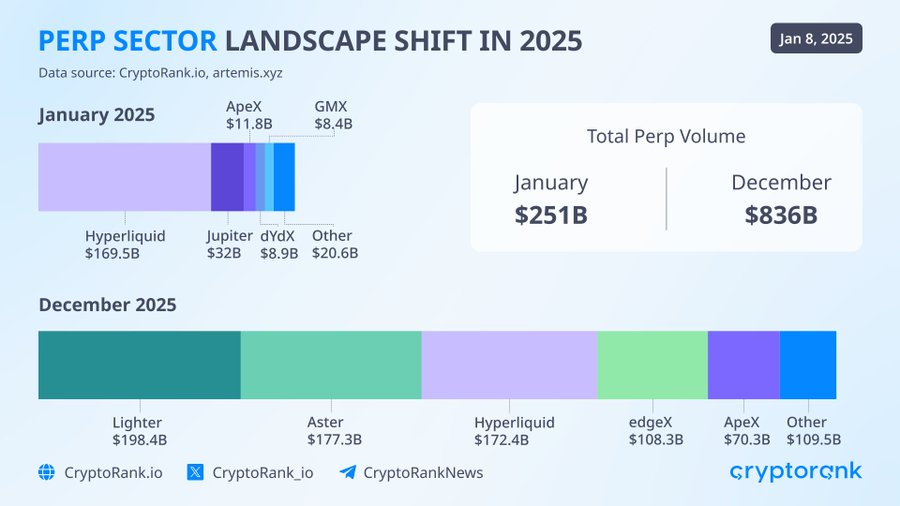

As the Perp DEX market continues to expand, with monthly volumes exceeding $1T for three consecutive months, Paradex is gaining attention due to several competitive advantages.

Strong Growth with a Top 5 Perp DEX Position

After nearly 2 years of development since Open Beta on Mainnet in February 2024, Paradex has posted notable growth metrics (DefiLlama, January 15, 2026):

- TVL of approximately $205M, cumulative volume more than $200B, and open interest around $620M.

- TVL increased from roughly $25M at the start of 2025 to over $140M by year-end, representing nearly 6x growth in one year.

- 30-day trading volume of about $34.374B.

- Recently, Paradex led the market in 24-hour volume with $1.58B, surpassing Hyperliquid, Lighter, and Aster (January 14, 2026).

get used to Paradex at #1

— Paradex (@paradex) January 11, 2026

zero fees AND privacy 24/7 pic.twitter.com/kwKuCCiLUP

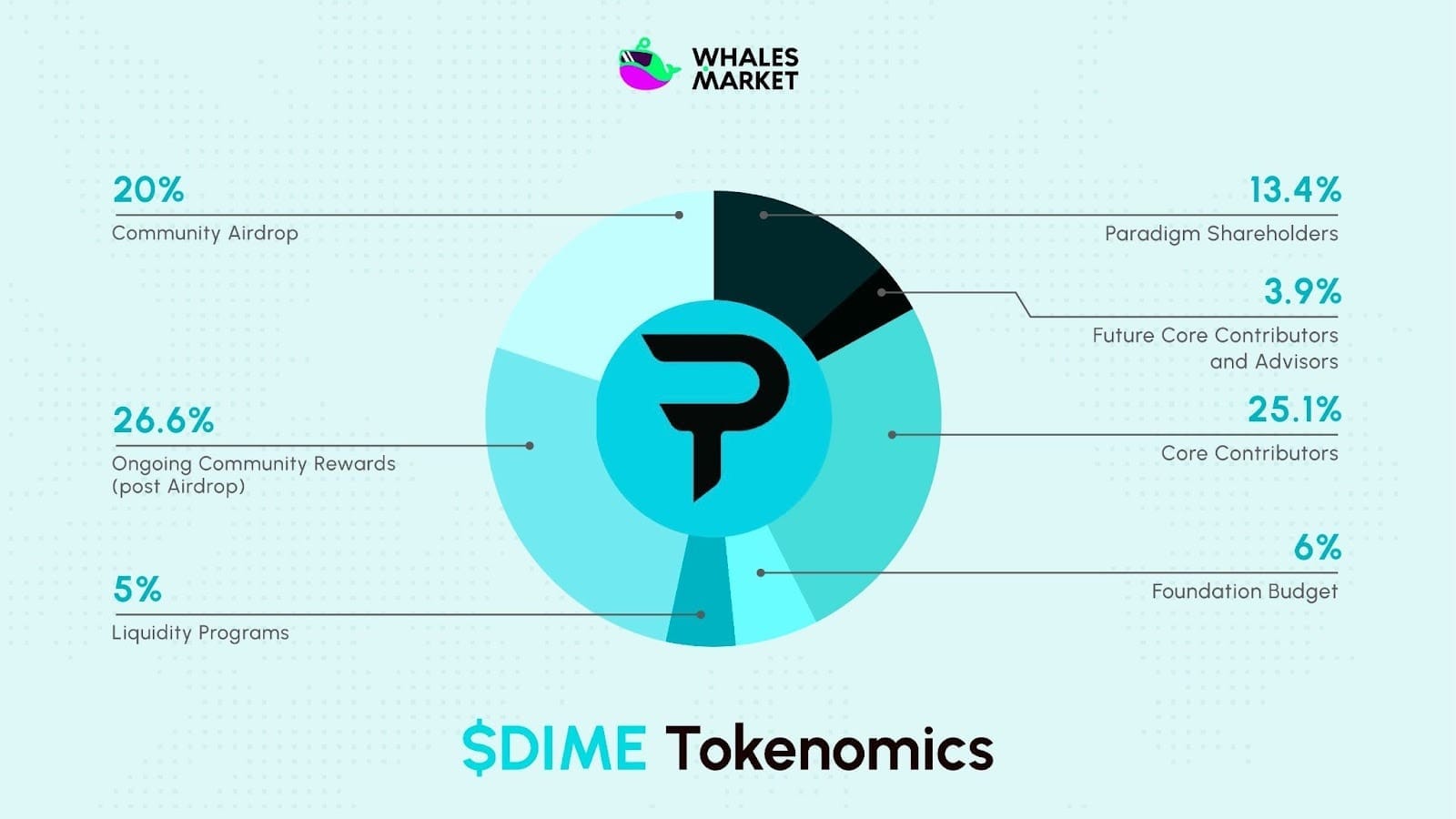

Paradex Tokenomics: 20% Allocated for Community Airdrop

On December 18, 2024, Paradex introduced its native token $DIME, with transparent tokenomics: 20% for Community Airdrop at end of Season 2, fixed supply of 1 billion with 57.6% for community, no inflationary emissions. Season 2 was extended by 6 months (July 2025), you still have time to accumulate XP.

- 20% of total supply allocated to the community airdrop, to be distributed at the end of Season 2.

- One of the largest DeFi derivatives airdrops to date.

- Fixed total supply of 1B tokens, with 57.6% allocated to the community.

- No inflationary emissions.

In late July 2025, the Paradex Foundation extended Season 2 by an additional six months to ensure optimal conditions for the $DIME listing. This extension leaves users with more time to accumulate XP.

Paradex XP Airdrop Program

The Paradex XP program is designed to track and reward genuine user contributions across the platform. Each week, Paradex distributes 4M XP, which will later be used to determine $DIME airdrop allocations.

Season 2 started on January 3, 2025, with XP distributed consistently every Friday.

Users can earn XP through the following activities:

- Trading and maintaining open positions on Paradex.

- Providing high-quality two-sided liquidity, with XP calculated based on Quote Quality.

- Depositing assets into Paradex Vaults, including protocol, VTF, and community vaults.

- Staying active through trading, referrals, and community participation.

Linking X and Discord accounts helps the system identify real users, reduce Sybil activity, and ensure fair XP distribution.

XP Season 2: Week 53

— Paradex (@paradex) January 9, 2026

+ 4M XP was distributed across 18,933 wallets for activity during the period of Jan2-Jan8 (+35.7% w-o-w)

+ 457K XP was distributed to referral codes and affiliates of which 190K XP was distributed to referred users

+Fee-paying volume was overweighted this… pic.twitter.com/k0KETEv2X1

In summary, Paradex combines tier-1 backing, differentiated technology, clear tokenomics with 20% allocated to airdrops, and strong growth momentum. This phase is well suited for accumulating XP ahead of the $DIME launch.

How to Get the Paradex Airdrop

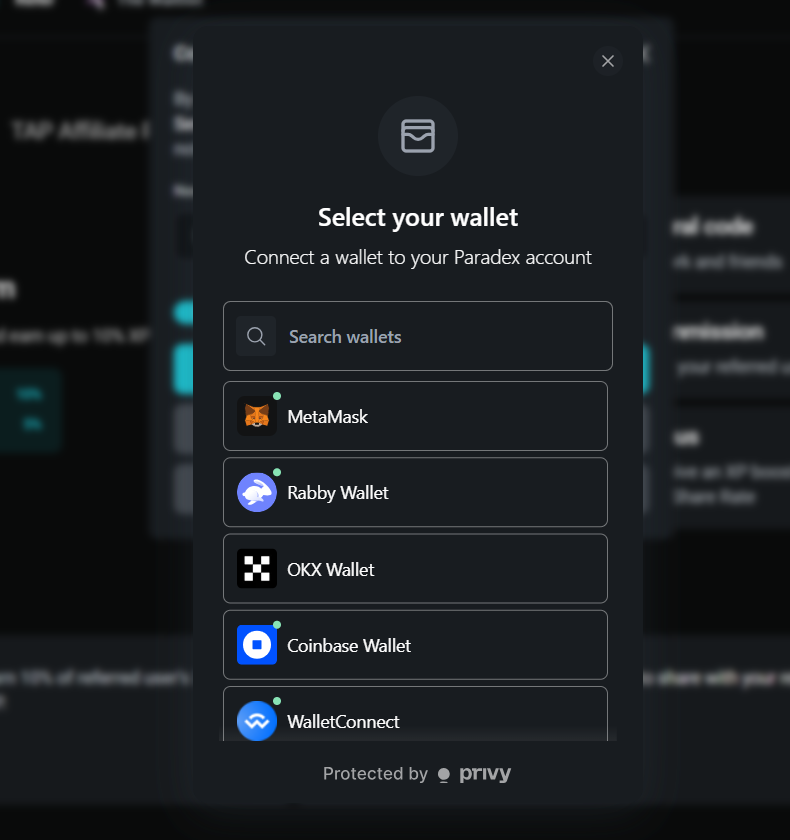

Step 1. Create an Account

- Visit the Paradex

- Select Login.

- Choose Wallet and connect an EVM wallet.

- Account creation is completed.

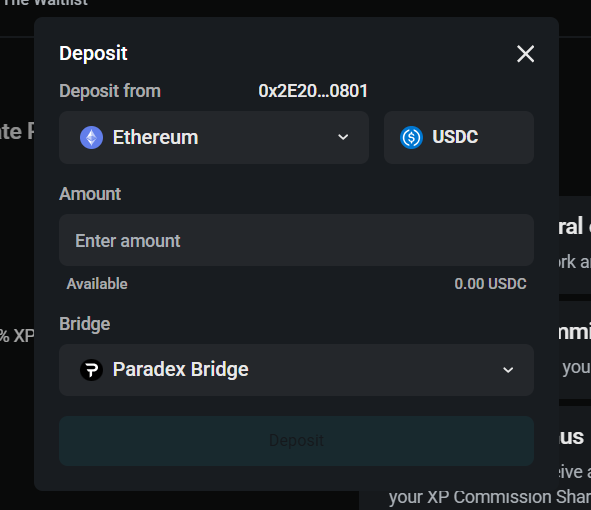

Step 2. Deposit Funds

- Navigate to the Deposit section.

- Select the desired network.

- Enter the amount of USDC.

- Choose Bridge and confirm Deposit.

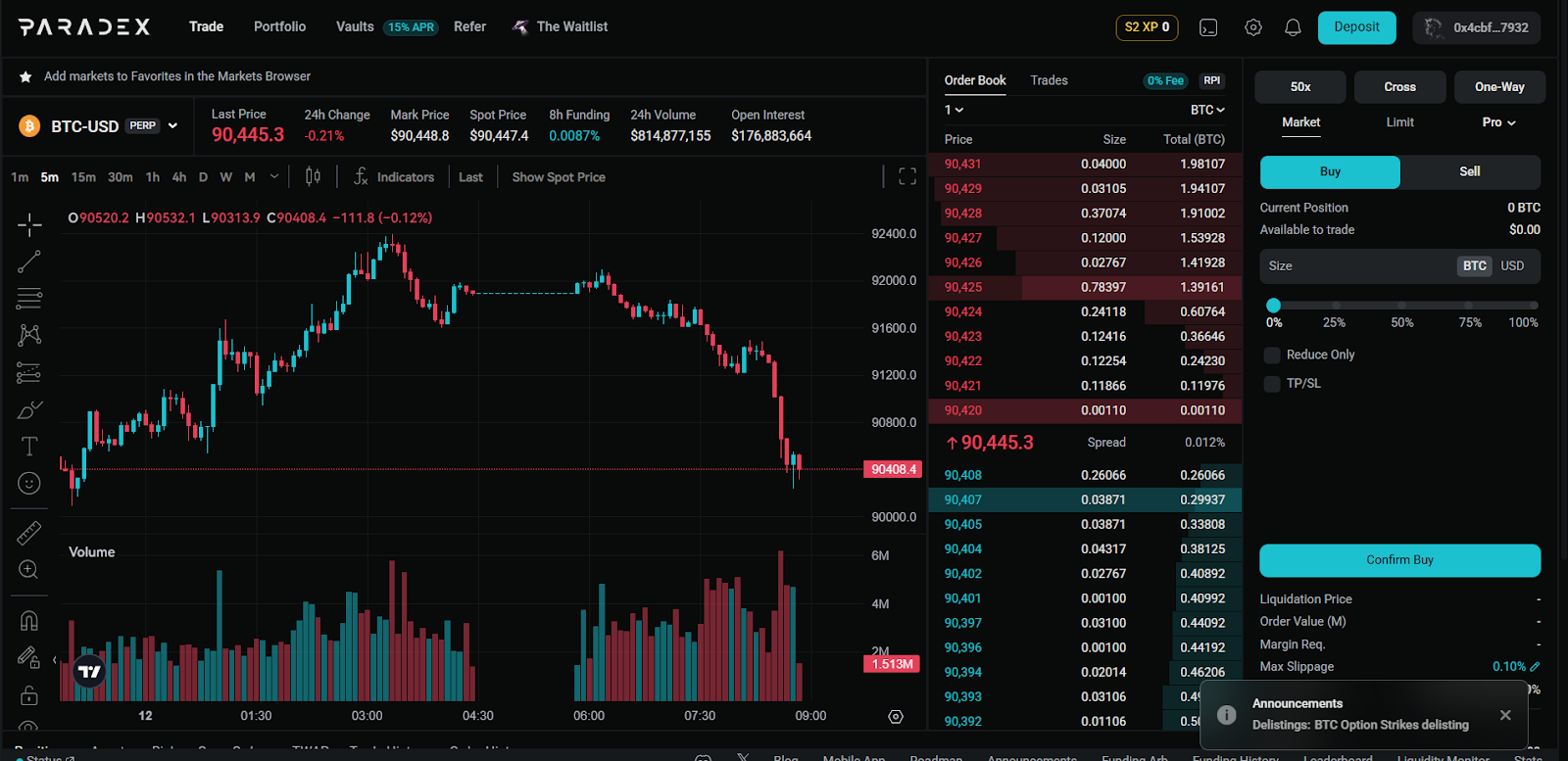

Step 3. Trade on Paradex

Now go to the Trade section and select a trading pair, with BTC-USD-PERP being the most common.

The interface is familiar for users experienced with CEX platforms.

Key actions include:

- Long, when expecting price appreciation.

- Short, when expecting price declines.

- Leverage selection, with 2x to 5x recommended for risk control.

- Order types, including Market for instant execution or Limit for price targeting.

Tips to optimize XP when trading on Paradex Perp DEX:

- Prioritize limit orders to qualify as maker trades.

- Keep positions open for several hours instead of closing immediately.

- Trade consistently over time rather than concentrating volume in a single day.

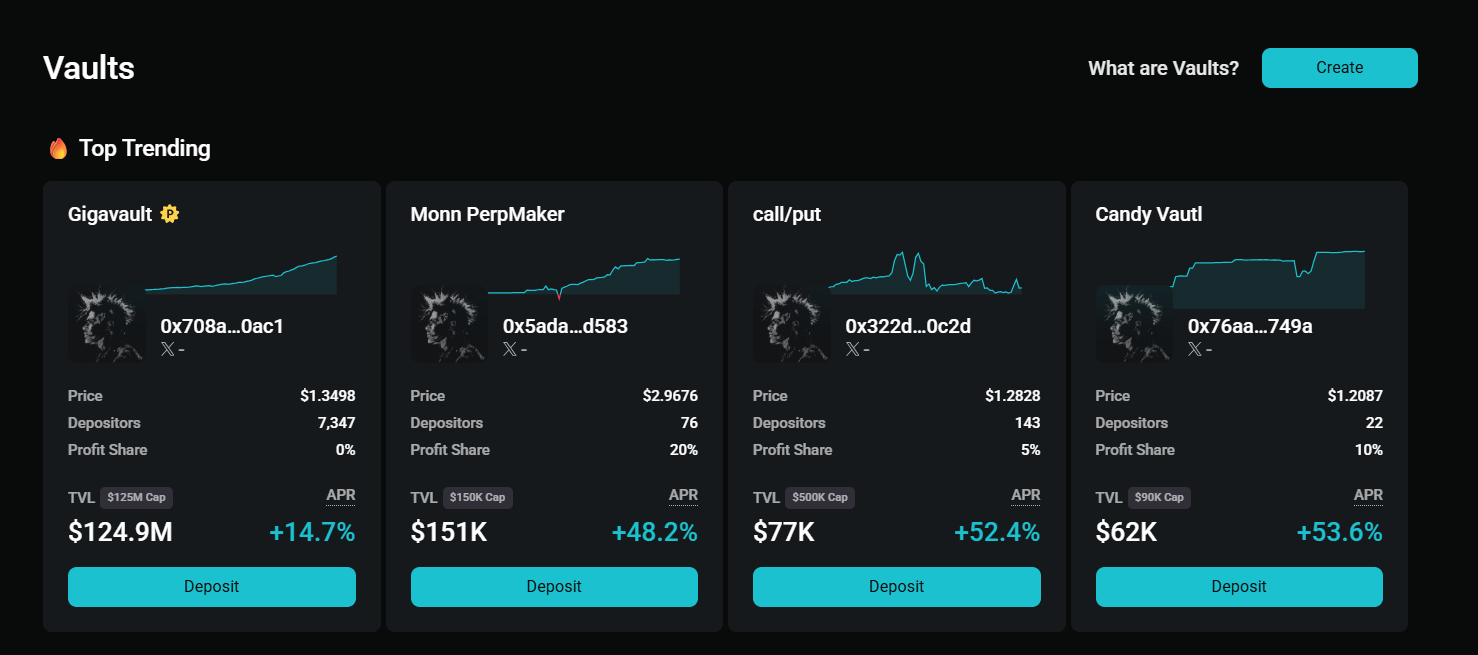

Step 4. Join Vaults to Earn Yield and XP

- Navigate to the Vaults section.

- Select vaults that align with risk preferences.

- Choose Deposit and allocate funds.

Vault participation should be evaluated carefully, as not all vaults guarantee positive returns.

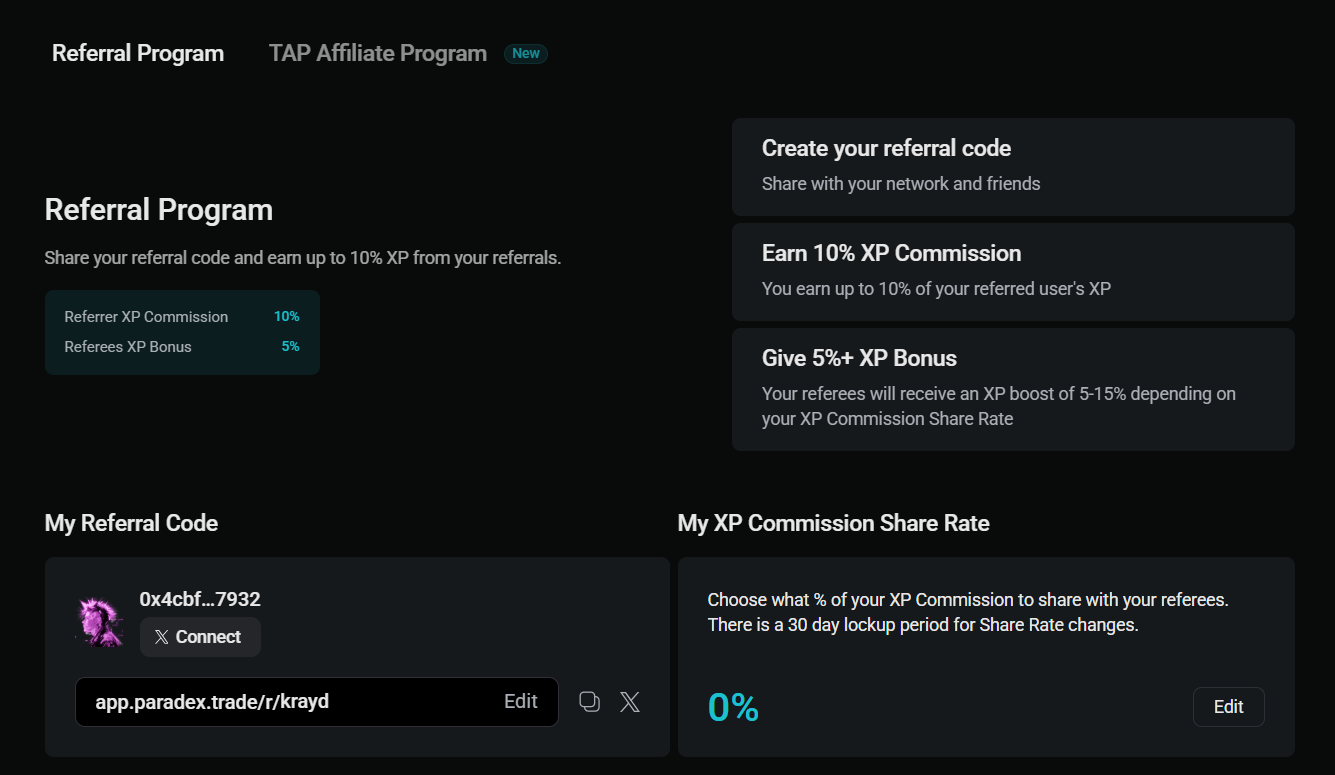

Step 5. Use Referrals and Invite New Users

- Go to the Refer section.

- Copy the referral code or create a custom one using the edit option.

- Share the code with friends or communities to earn additional XP.

- Track XP earned from referrals directly on the platform.

Conclusion

Paradex is not simply a short-term airdrop opportunity. It represents early participation in a Perp DEX that is steadily scaling. XP reflects real usage, so users who stay active and patient tend to gain a clear advantage. For those aligned with the long-term Perp DEX trend, this is a reasonable stage to begin engaging with Paradex.

FAQs

Q1. Does participating in the Paradex airdrop require large capital?

No. Paradex is accessible for users with smaller capital. Starting with tens or a few hundred USDC is feasible. Consistent trading, balanced position sizing, and the use of limit orders help manage risk while steadily accumulating XP over time.

Q2. Is daily trading required to maintain an XP advantage?

Daily trading is not mandatory. However, consistent activity improves XP efficiency. Paradex prioritizes genuine usage such as maintaining positions, providing liquidity, and participating in vaults, rather than short bursts of large trading volume.

Q3. Is accumulated XP reset after Season 2 ends?

XP is not discarded in the sense of contributions being ignored. Paradex treats XP as a long-term contribution metric. With the Season 2 extension, even later participants still have time to accumulate XP before $DIME distribution.

Q4. What risks exist when farming XP on Paradex?

The primary risks stem from derivatives trading, including price volatility and leverage exposure. Using lower leverage, managing position sizes carefully, and avoiding overtrading help mitigate risk. XP only matters if users remain active long enough in the market.

Q5. How can users tell if XP farming is effective?

Effective XP farming usually shows steady weekly XP growth combined with diversified activity such as trading, vault participation, and referrals. Sharp one-time XP spikes followed by stagnation often indicate short-term actions rather than sustainable engagement with Paradex.