While most Perp DEXs still revolve around familiar crypto markets, another direction is gradually gaining attention: bringing traditional financial markets on-chain. Ostium enters at the right moment, as demand for flexible, transparent trading without intermediaries becomes clearer.

The project is currently running Season 2 of its Airdrop campaign, creating a solid opportunity for users interested in Perp DEX airdrops, especially those with a strong interest in TradFi-focused products.

Ostium Overview

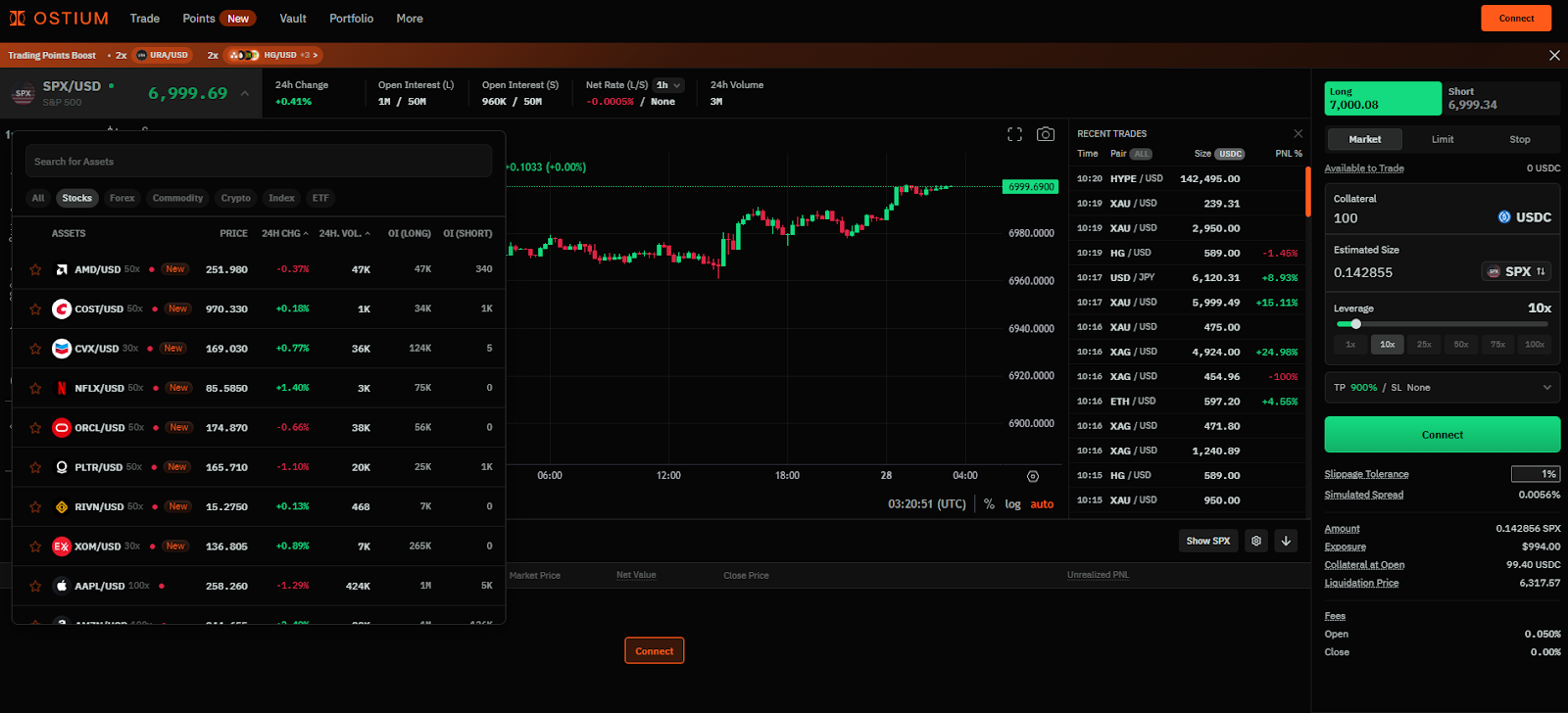

Ostium is a decentralized perpetual exchange (Perp DEX) built on Arbitrum, enabling users to trade real-world assets (RWAs) directly on-chain. The key difference between Ostium and other Perp DEXs such as Hyperliquid or dYdX lies in its broader market coverage, extending beyond crypto into stocks, commodities, forex, and indices.

Ostium uses synthetic perpetual contracts instead of tokenized assets. This means users do not own the underlying assets but gain price exposure. Pricing is supported by a custom oracle system for RWAs and Chainlink Data Streams for crypto markets.

With the continued growth of Perp DEXs, Ostium has shown strong traction:

- Cumulative trading volume has exceeded $33B, with metals such as gold and silver contributing more than $5B, according to BusinessWire.

- Open interest currently stands above $290M, with 95% coming from traditional markets such as stocks, commodities, and FX, according to CoinDesk.

- The platform has surpassed 15,000 traders.

Ostium is currently ranked 13th among Perp DEXs. While not a top position, it remains notable given the large number of competing platforms.

Why You Shouldn’t Miss the Ostium Airdrop

Next Hyperliquid Potential for the RWA Market

Ostium is often compared to Hyperliquid due to several similarities:

- Both are Perp DEXs built on Arbitrum, with Hyperliquid later moving to its own L1.

- Both operate points programs with potential token conversion.

- Both target high-leverage derivatives markets.

- Founding teams come from top universities and leading financial institutions.

However, Ostium holds a unique advantage through its focus on RWAs such as gold, oil, forex, and equities, a segment that Hyperliquid has only recently begun to explore. According to Airdrop Alert, this airdrop could reach 6-7 figures for early and highly active participants.

Targeting the $10T Monthly CFD Market

This is Ostium’s largest differentiator compared to other Perp DEXs. While most competitors focus mainly on crypto, Ostium targets the global CFD market, estimated at $10T in monthly Traditional CFD markets face several issues that DeFi can address:

- Lack of transparency, as brokers control pricing, liquidation, and spreads.

- No self-custody, with user funds held by brokers.

- Counterparty risk, including frozen accounts or blocked withdrawals.

- Hidden fees, such as unclear spreads and overnight charges.

Ostium addresses these problems through blockchain infrastructure, which the project’s CEO, Kaledora Kiernan-Linn, has described as a textbook use case for this technology, according to The Block.

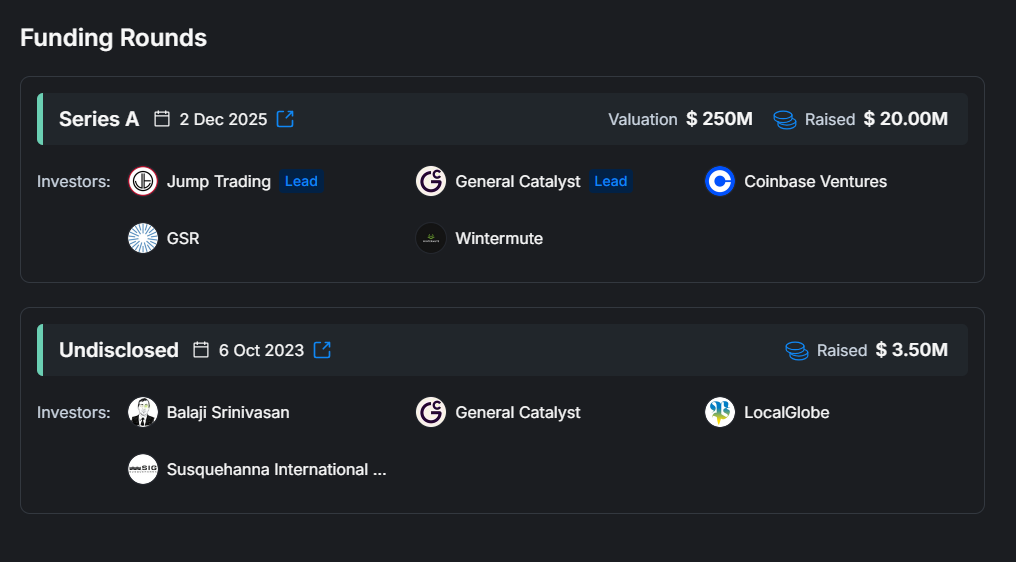

Raised $23.5M & Invested by Coinbase Ventures

Ostium closed its Series A round on December 2, 2025, raising $20M at a $250M valuation. The round was co-led by Jump Trading and General Catalyst, with participation from Coinbase Ventures, GSR, and Wintermute.

Previously, the project raised $3.5M from reputable angels and funds, providing a solid foundation for its next growth phase.

Understand Points Mechanism to get Ostium Airdrop

The Ostium Points program officially launched on March 31, 2025, with 10M points distributed retroactively to traders active on mainnet, testnet, and pre-testnet.

Ostium Points Distribution

Points are distributed weekly every Sunday at 00:00 UTC, based on activity from the previous week.

Season 1 has ended, and Season 2 is currently live, starting January 5, 2026, with a hard cap of 25M points. Season 2 introduces Boost Windows, rotating weekly periods offering 2x points and 50% fee discounts for selected markets.

Points Season 1 is complete. Season 2 starts today!

— Ostium (@OstiumLabs) January 5, 2026

With the new season, we’re introducing Boost Windows: rolling week-long periods where a group of assets will be incentivized. pic.twitter.com/6vlPGafETu

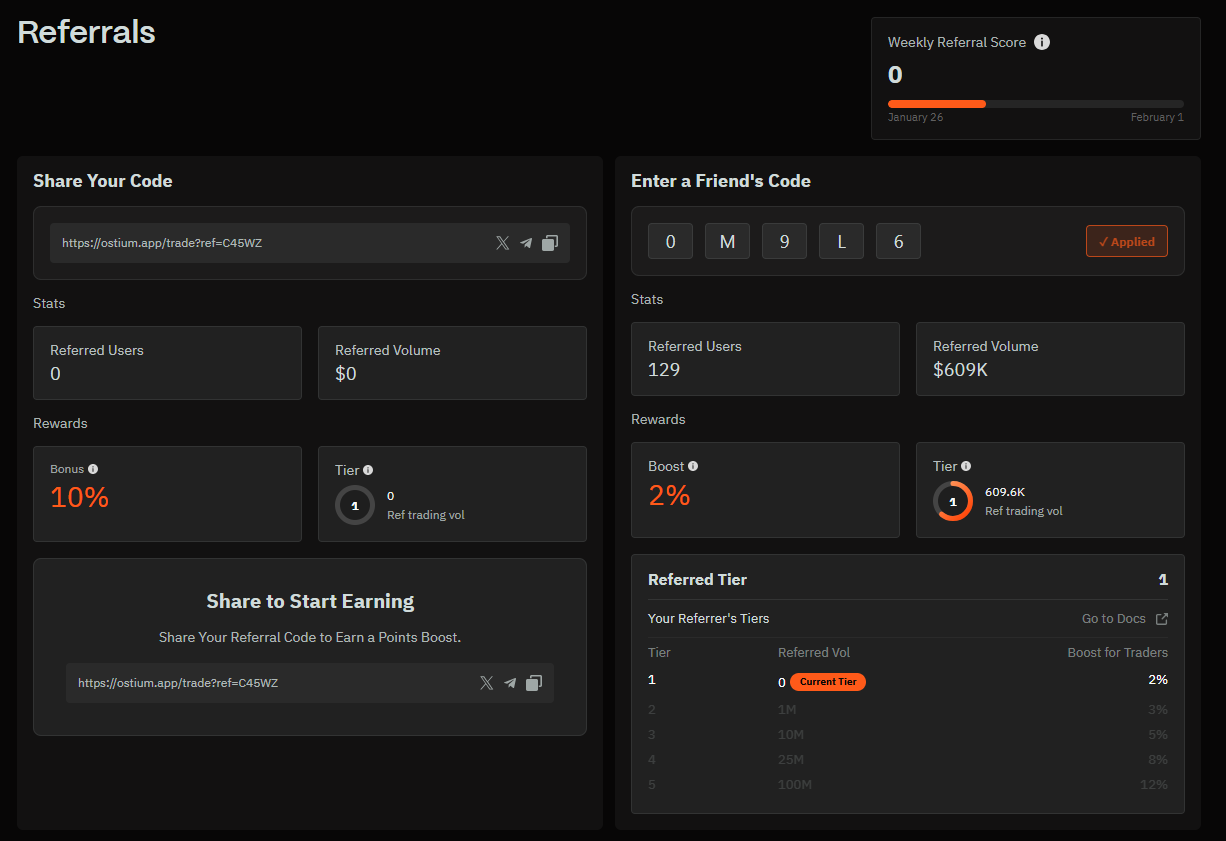

Referrers earn 1 trading point for every 5 points earned by referred users. Users signing up with a referral code receive a 5% boost on all trading scores.

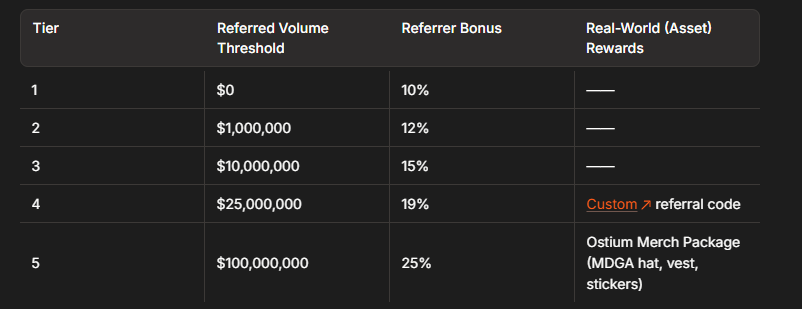

Ostium Referral Tier System

Ostium has introduced Referral Boosts and Bonuses with five tiers:

- Tiers are determined by cumulative trading volume generated by referrals.

- Higher tiers unlock larger bonus percentages from referral activity.

- Bonuses can reach up to 25% at the highest tier.

How to Get the Ostium Airdrop

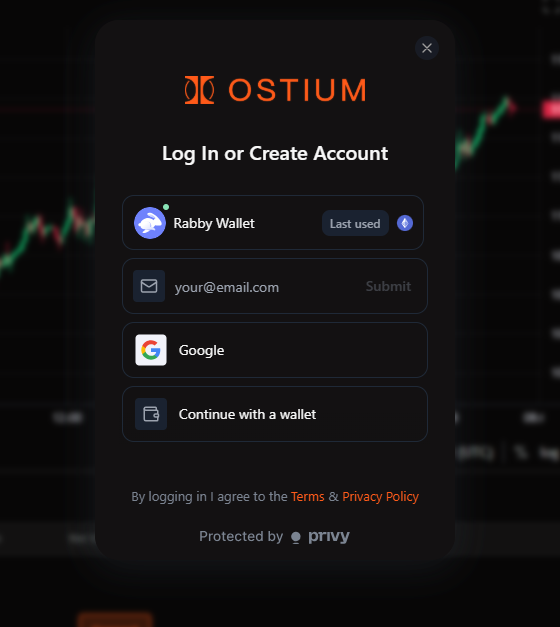

Step 1: Create an Account

- Visit Ostium via this link.

- Select Connect Wallet or sign in using email or Google.

- Choose an EVM-compatible wallet such as MetaMask, Rabby, or Coinbase Wallet.

- Agree to the terms of use.

- Sign the confirmation message to create an account.

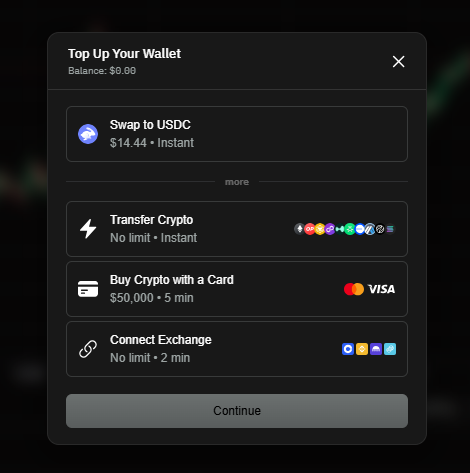

Step 2: Deposit Funds

- Select Add to deposit.

- Transfer USDC on the Arbitrum network to the wallet.

USDC can be bridged from other networks, purchased via card or bank transfer, or withdrawn from a CEX such as Binance or Coinbase.

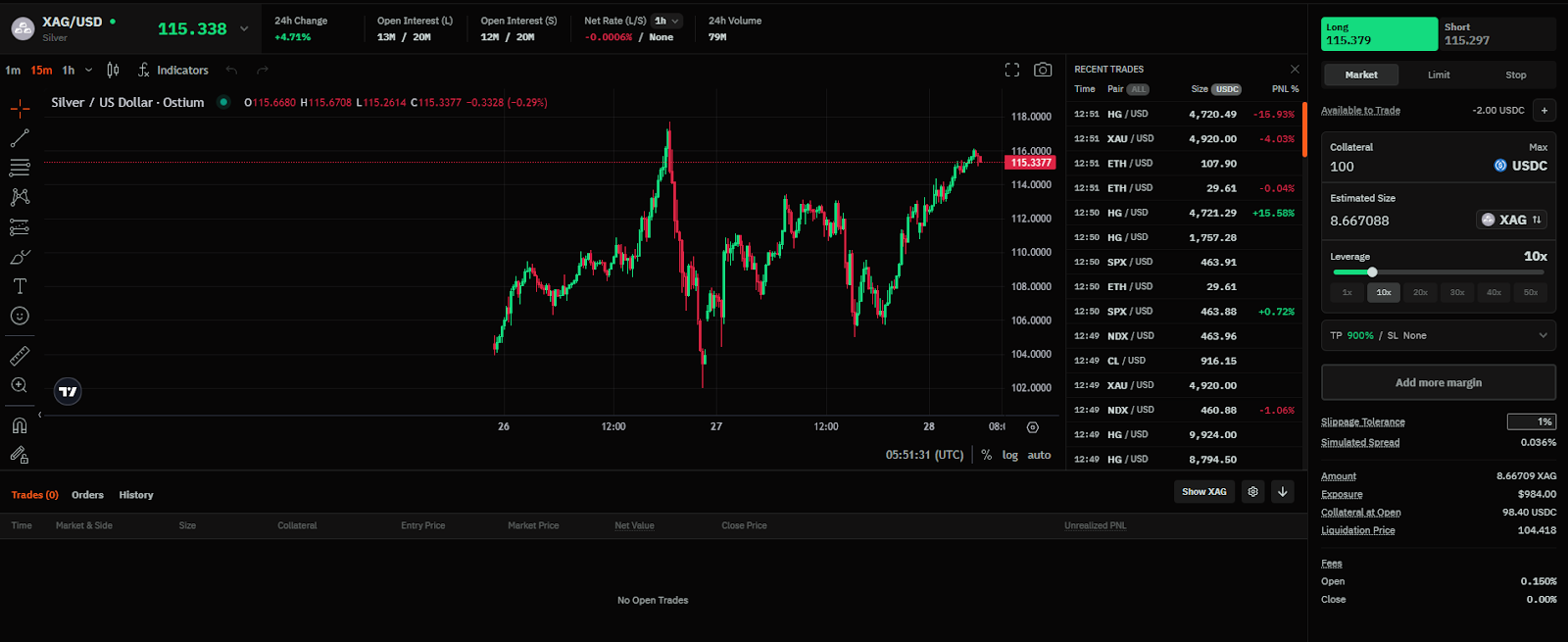

Step 3: Start Trading

- Navigate to the Trade section.

- Choose a category and select a trading pair such as SPX or BTC.

- Select leverage, up to 200x depending on the market.

- Enter position size and open the trade.

- Monitor Boost Windows to earn 2x points and receive 50% fee discounts.

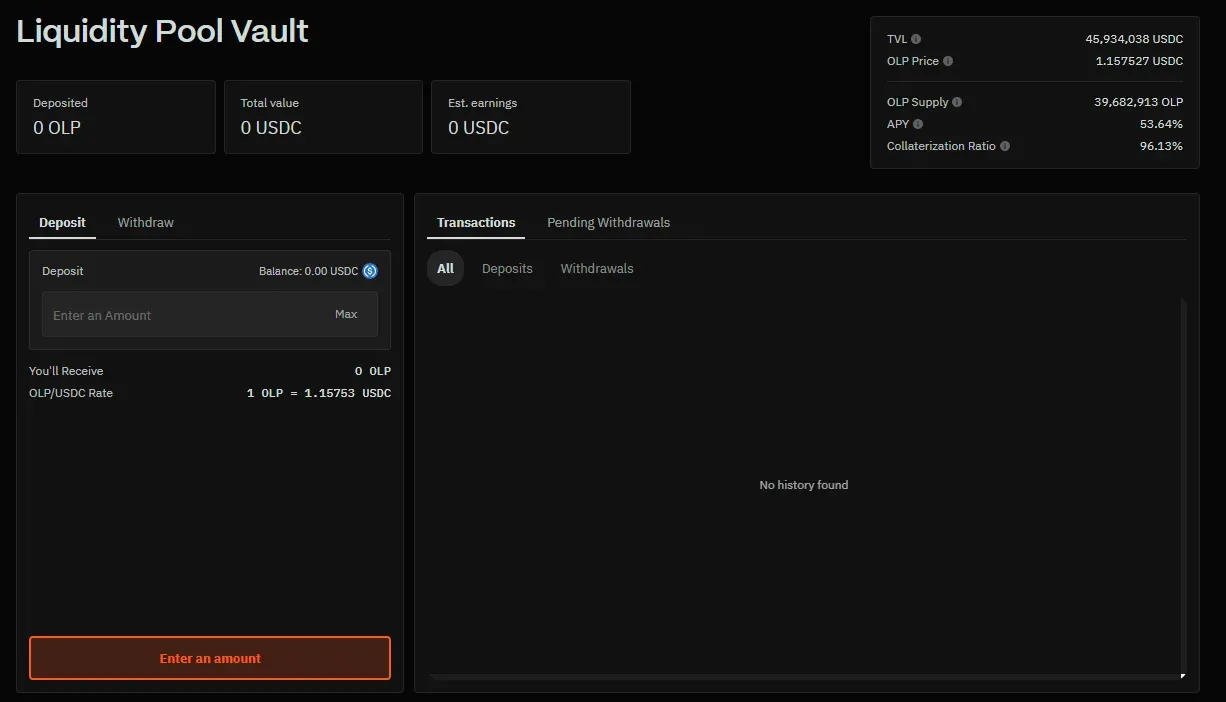

Step 4: Provide Liquidity (Option)

Ostium’s Vault functions as a unified liquidity pool where LPs deposit USDC to support all markets, including RWAs, forex, and crypto. By consolidating liquidity instead of isolated AMMs, the system improves capital efficiency, delivers more stable spreads, and generates yield from trader fees.

LPs act as the house, earning when traders lose and taking losses when traders win, with risk managed through collateral ratios and an additional MM Vault buffer. Depositing also earns Season 2 points, but users should note impermanent loss risk during high volatility periods.

To provide liquidity on Ostium:

- Go to the Vault section.

- Deposit USDC into the OLP liquidity pool.

- Users receive OLP tokens, which can be redeemed back to USDC at any time by selecting Withdraw and entering the amount.

- Earn APY, currently around 53% as of January 28, 2026.

Step 5: Referral

- Access the Referrals section.

- Copy the referral code or link.

- Share code with friends to earn additional points.

Simple Tips to Get More from the Ostium Airdrop

Volume and Trading Strategy

- Focus on trade quality and avoid wash trading.

- Maintain consistent activity rather than concentrating volume into a single session.

- Track Boost Windows to trade boosted markets with 2x points and 50% fee reductions.

- Trade RWAs during their active market hours for better spreads.

Points Optimization

- Monitor the leaderboard at https://app.ostium.com/points.

- The dual scoring system combines Trading and Referral scores with Liquidity Provision scores into total points.

- Scores reset weekly and convert into points every Sunday at 00:00 UTC.

Security and Risk Management

- Use a dedicated wallet for farming activities.

- Always verify URLs to avoid phishing attacks and only use app.ostium.com.

- Be cautious with high leverage, as liquidation can happen quickly.

- Never share seed phrases.

- Diversify capital and avoid allocating all funds to a single airdrop opportunity.

Conclusion

Ostium is not just another Perp DEX. It represents a different approach to on-chain derivatives, particularly through its focus on RWAs. For those who believe in the shift from traditional CFD markets toward DeFi, Ostium offers a compelling opportunity to participate early with a structured strategy.

FAQs

Q1: How does RWA trading on Ostium differ from traditional CFDs?

Unlike traditional CFDs, Ostium operates fully on-chain with transparent pricing and liquidation, without brokers. Users retain self-custody of funds, reducing risks related to account freezes or spread manipulation.

Q2: Is large trading volume required to optimize Ostium points?

Not necessarily. Ostium rewards consistent activity, correct market selection during Boost Windows, and a balance between trading and liquidity provision. Sustainable strategies often outperform short-term volume spikes.

Q3: What is the main risk of participating in the Vault to get Ostium Airdrop?

The primary risk comes from LPs acting as counterparties to traders. If traders achieve significant profits, the Vault may incur losses. Monitoring collateral ratios and allocating capital carefully is essential.

Q4: What long-term advantage does Ostium have over other Perp DEXs?

Ostium’s core advantage lies in its exposure to RWAs and the global CFD market, an area largely untouched by crypto-native DEXs. If on-chain adoption of traditional finance accelerates, Ostium is well positioned.

Q5: Is prior derivatives trading experience required to use Ostium?

Experience is not required, but beginners are encouraged to start with smaller positions or the Vault. With high leverage and volatility, understanding liquidation mechanics and risk management helps reduce unnecessary losses.

Q6: Is it better to split capital between trading and the Vault?

Yes. Splitting capital diversifies point sources and lowers overall risk. Trading can optimize points more quickly, while the Vault provides steadier yield with less dependence on market timing.