As the crypto market moves from hype to real adoption, airdrops are no longer easy profits. Experienced users now focus on protocols with real usage, strong revenue, and sustainable growth, and LI.FI stands out as a notable multi-chain liquidity aggregation protocol in cross-chain infrastructure.

Although LI.FI has not announced a token yet, its strong fundamentals and growing adoption suggest a potential airdrop in the future

Overview of LI.FI

LI.FI is a multi-chain liquidity aggregation protocol that allows users and decentralized applications (dApps) to swap and bridge assets quickly, efficiently, and securely across more than 60 blockchains, including Ethereum, Solana, Bitcoin, and many other EVM networks.

Recently, LI.FI has recorded several notable updates, including:

- Series A Extension funding round worth $29M: In December 2025, LI.FI completed a Series A Extension round led by Multicoin Capital and CoinFund, bringing the total funding to more than $50M.

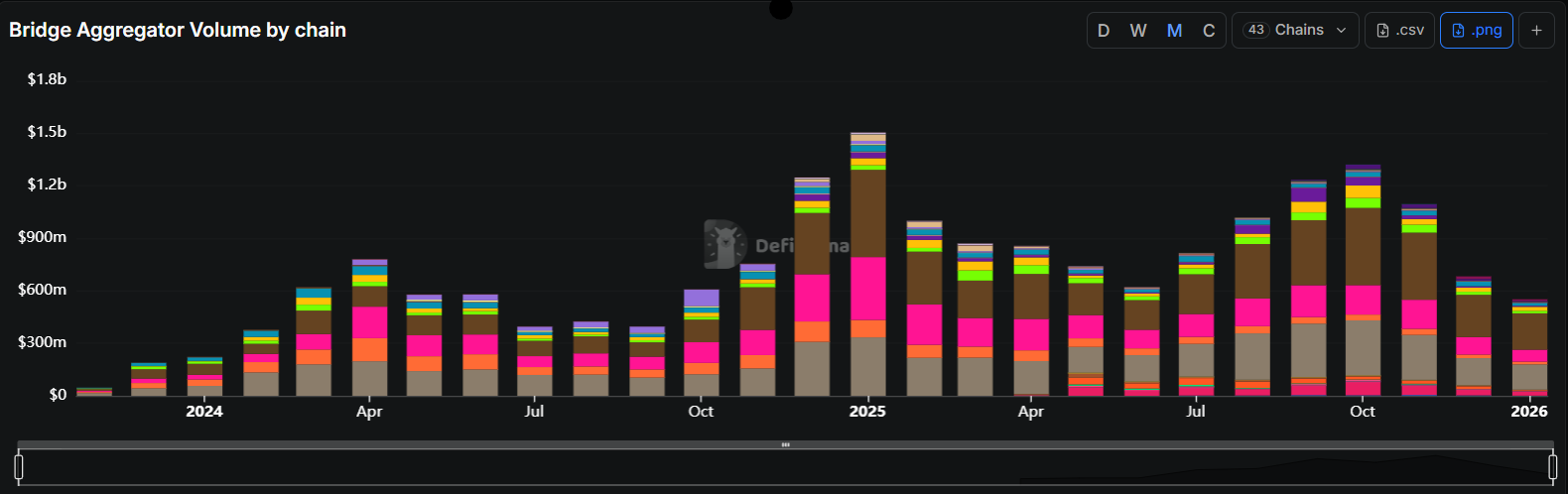

- Volume growth: According to LI.FI, by the end of 2025, LI.FI reached a lifetime volume exceeding $60B, with monthly volume peaking at $8B in October 2025 and $5.2B in November 2025. Volume on newly launched chains such as Monad reached $68M within just a few days after launch.

- New product launches: In early 2026, LI.FI introduced LI.FI Deposit, a new transaction type for DeFi, and LI.FI Composer, along with support for multi-step transactions on Solana using Jito Bundles. These features optimize routing, enhance security, and improve usability for both retail and institutional users.

Why Does The LI.FI Airdrop Have Potential?

Similar to LayerZero and Wormhole, actively spending fees to hunt for airdrops from projects carries significant risks, especially in the current market context when:

- Airdrops are gradually cooling down, and burning fees in the hope of receiving large airdrops has become increasingly difficult.

- Bear markets are sensitive periods for token launches, and continuously burning fees over a long time can cause users to waste time and effort while ROI remains uncertain.

Furthermore, LI.FI is a project with real users and real revenue, its cumulative bridge volume has surpassed $19.5B, with average monthly volume consistently around $1B.

LI.FI has gradually built a loyal user base with genuine usage demand. This indicates strong product market fit, and whether the airdrop is large or small does not significantly impact the long-term development of LI.FI.

Instead of placing excessive expectations on airdrops, users should approach the LI.FI airdrop with a reasonable mindset and treat it as a bonus during regular usage. For frequent on-chain users, choosing LI.FI instead of LayerZero or Wormhole, which have already completed their airdrops, helps optimize capital efficiency while continuing to trade and accumulate reward opportunities.

Previously, Jumper Exchange, the front-end product developed by LI.FI for end users, announced the end of Season 2. However, the Loyalty Pass will continue to operate, recording points, interaction history, and future reward mechanisms.

May we have your attention, please? 👀

— Jumper - Earn is Live (@JumperExchange) July 4, 2024

Seasons were an amazing springboard to welcome more users to Jumper but those are a thing of the past.

Thanks to our users for believing in us, we have something for y’all:

• Season 1 Users (March 1 Dec 31 ' 23) – Get a 25% boost

•… pic.twitter.com/voa0F8w78Z

Currently, the project has not issued a token. Therefore, the most reasonable strategy is to integrate LI.FI into daily DeFi activities. This supports regular trading activities and increases the probability of receiving additional bonuses when the token is officially launched.

LI.FI Airdrop Guide: 3 Simple Steps

To hunt for the LI.FI airdrop, users can follow the steps below:

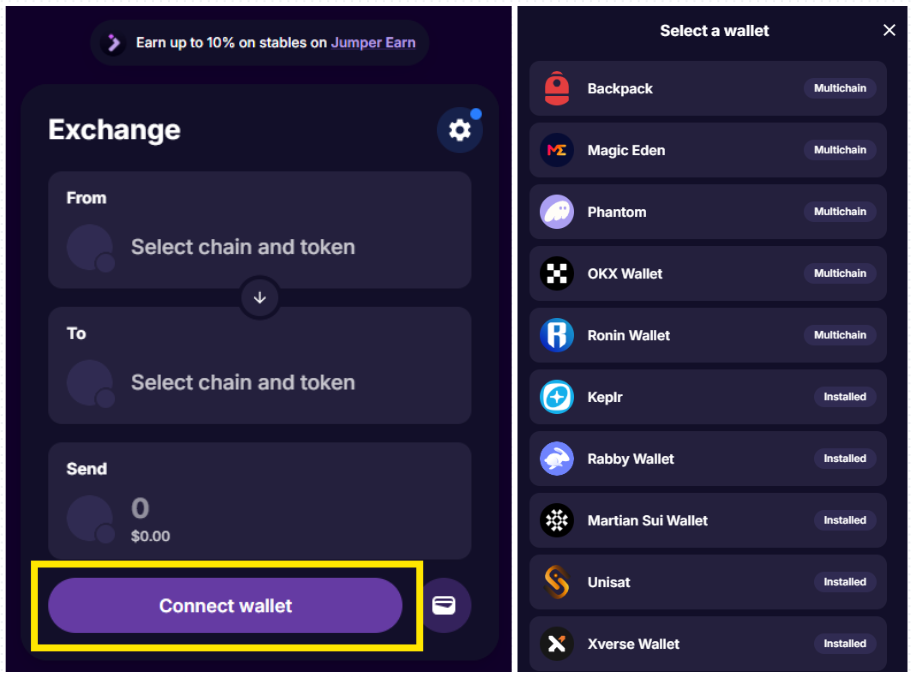

Step 1: Connect Wallet to LI.FI

Visit the Jumper website at https://jumper.exchange/. Then connect your available wallet.

LI.FI supports many Web3 wallets, including popular options such as Metamask, Phantom, OKX Wallet…

Step 2: Swap, Bridge & Refuel Gas on LI.FI

After completing Step 1, users proceed to use the product. There are two available modes to choose from:

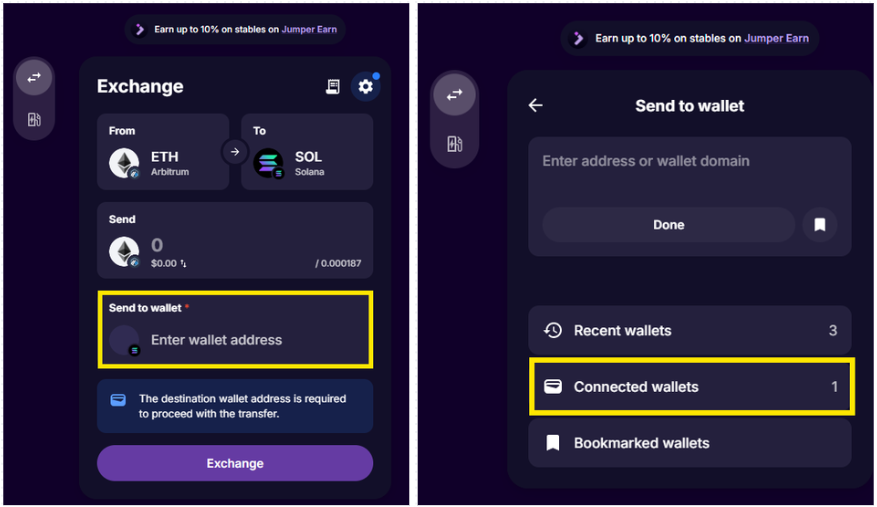

1. Exchange Mode

Exchange Mode allows users to swap and bridge tokens across more than 60 blockchains in a single transaction. LI.FI automatically finds the optimal route based on price, fees, and speed. Users can perform cross-chain swaps without manually executing multiple steps.

In the example below, the user transfers ETH from Arbitrum to SOL on Solana, moving from an EVM chain to a non-EVM chain. The important point to note is the “Send to Wallet” section.

- If user wants to send to a Connected wallet, the system will send the assets to the corresponding Solana wallet address linked to the connected wallet in Step 1.

- If user wants to send to a different wallet, simply paste the destination wallet address into the field below and click Done to complete the process.

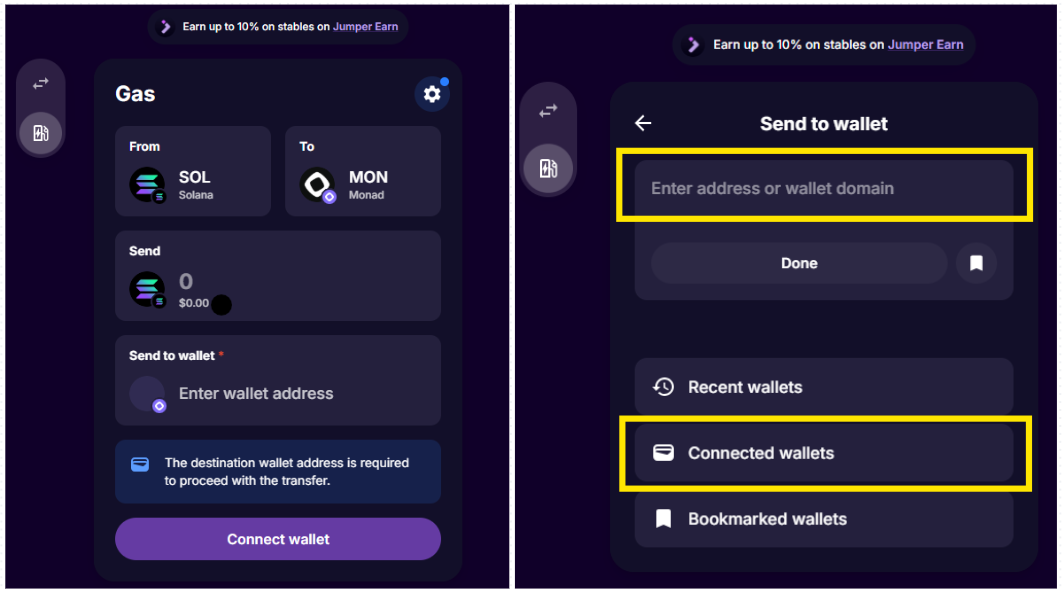

2. Gas Mode (Gas Refuel)

With Gas Mode, users can top up gas tokens for any chain directly from another chain, even when the wallet has no remaining gas. This mode supports gasless transactions and reduces friction when moving across blockchains.

The usage method is similar to Exchange Mode, but Gas Mode is specifically optimized for refilling gas on other chains.

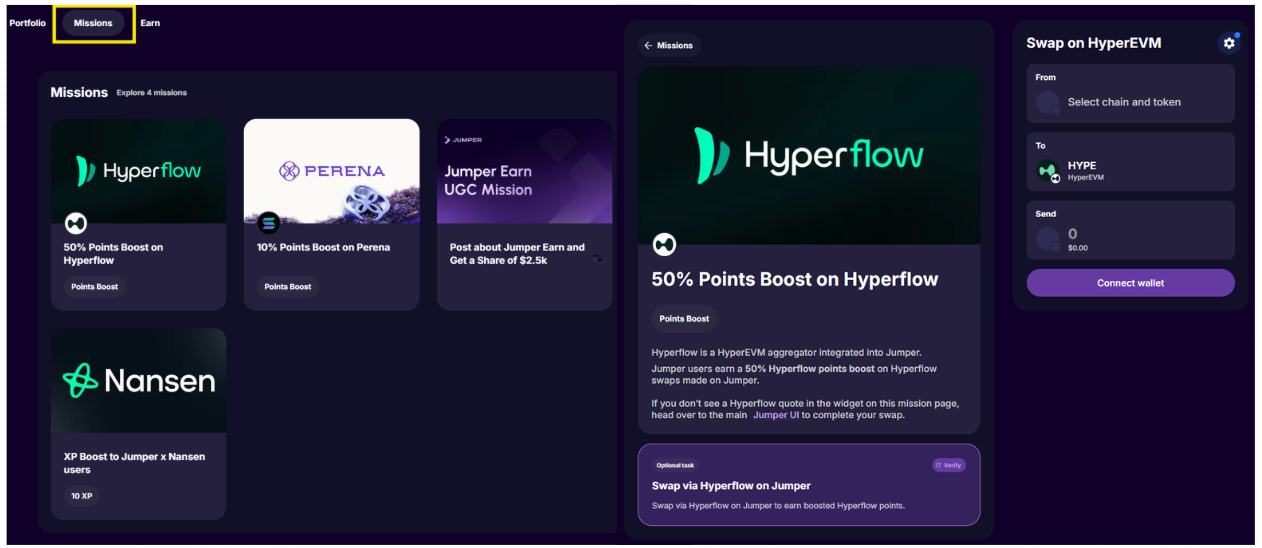

Step 3: Complete Missions to Earn LI.FI Points

This section is designed to help users earn additional bonus points. The missions mainly focus on bridging funds to chains targeted by the project’s development strategy.

Conclusion

As a core infrastructure protocol with real users, strong volume growth, and continuous product development, LI.FI is suitable for users who prefer combining daily DeFi usage with long-term reward opportunities rather than burning excessive fees with uncertain returns.

By integrating LI.FI into regular trading and bridging activities, users can build interaction history while benefiting from optimized routing and better capital efficiency, minimizing risk while maximizing potential upside when the token is eventually launched.

FAQs

Q1. Is LI.FI planning to launch a token in the future?

LI.FI has not confirmed a token launch yet, but its strong funding, growth, and ecosystem activity suggest a token release is likely in the long term.

Q2. What activities increase eligibility for a LI.FI airdrop?

Regular cross-chain swaps, bridging, gas refills, and completing missions on Jumper Exchange help build on-chain history that may improve eligibility.

Q3. Does using multiple wallets increase LI.FI airdrop chances?

Using multiple wallets can increase interaction volume, but focusing on consistent and genuine usage on one main wallet is usually more effective and safer.

Q4. Are Loyalty Pass points important for the LI.FI airdrop?

Loyalty Pass points track user activity and may play a role in future reward distribution if an airdrop is announced.

Q5. Is hunting LI.FI airdrop expensive compared to other projects?

LI.FI optimizes routing and fees, making regular usage more capital efficient than aggressive fee-burning strategies on other airdrop farms.