Premarket crypto trading is an over-the-counter (OTC) process where investors can trade tokens before they are officially listed on public exchanges. Unlike traditional stock pre-market trading, the crypto version isn't limited to specific hours, as the market operates 24/7. Instead, it’s a peer-to-peer (P2P) marketplace where investors can buy or sell pre-TGE tokens, gaining early exposure to projects before their Token Generation Event (TGE).

What Is Premarket Crypto?

Pre-market trading in crypto (sometimes called OTC pre-market) is the direct exchange of ownership claims for tokens before the project officially launches its token on a public exchange (the Token Generation Event or TGE). This allows specific investors to gain exposure to a new digital asset at its earliest stage.

Key Terms to Understand

- Pre-Market Trading: The buying and selling of tokens, allocations, or points before their official public launch on an exchange.

- Token Generation Event (TGE): The official moment a new cryptocurrency is created and introduced to the public. It is the critical milestone that marks the transition from pre-market to public trading.

- Over-the-Counter (OTC): A method of trading conducted directly between two parties without the supervision of a central exchange.

The Assets Traded in Pre-Market

To avoid the confusion between "pre-TGE token allocation" and "private sale allocations," it's clearer to categorize the assets being traded:

- Token Allocations (Private Sale Claims): Claims representing the right to receive tokens from a project’s private funding rounds (Seed, Strategic, etc.). These are typically bought by venture capitalists or large investors and are often sold at a pre-TGE valuation that is significantly lower than the expected launch price.

- Future Token Airdrop Claims: Earned through community participation. Sellers who have actively farmed these rewards and know their estimated allocation trade this claim to monetize their effort instantly, rather than waiting for the official TGE and airdrop distribution.

How Whales Market Facilitates Both

Whales Market is designed as a decentralized marketplace to allow the secure trading of both these types of claims through its smart contract escrow system:

- For Token Allocations: It provides a trustless environment for Private Sale participants to sell their future vested tokens to buyers who are looking for a discounted entry compared to the public listing price.

- For Airdrop Claims: It enables a liquid market for active community members and airdrop farmers who know their estimated token allocation to trade this claim, securing immediate profit from their farming activities while transferring the risk of the post-TGE token price to the buyer.

In essence, the platform connects those who secured early access (whether through capital investment or community effort) with investors seeking early exposure to the project.

Why Are Decentralized pre-markets Growing?

Before platforms like Whales Market, early token trading relied on informal OTC pre-market networks. Traders faced:

- High fraud risk: Transactions were often done via chats or social groups with no guarantees, leading to scams or non-delivery of tokens.

- Limited access to buyers/sellers: Early allocations were difficult to find or trade without trusted contacts.

- Lack of global liquidity: Trading was constrained to local or private networks, making it hard to buy or sell at fair crypto pre-market prices.

Whales Market changes this by offering:

- Smart contract–secured settlements: Every trade is conducted on-chain, locking collateral for both buyers and sellers to ensure safe delivery and accurate crypto pre-market prices.

- Multi-chain access (Solana, Base, Ethereum, Arbitrum, and more): Users can trade premarket crypto across different blockchains with seamless settlement.

- No KYC requirements: Users can participate in premarket crypto trading without sharing personal information, maintaining privacy and accessibility.

- Cross-border participation: Traders from anywhere in the world can safely access OTC pre-market opportunities, expanding liquidity and reach.

Decentralized premarket crypto platforms now serve as trustless, global marketplaces, improving liquidity, transparency, and price discovery before a token’s public launch.

How Crypto Pre-markets Work

Here’s a simplified breakdown of how pre-market crypto trading works on platforms like Whales Market:

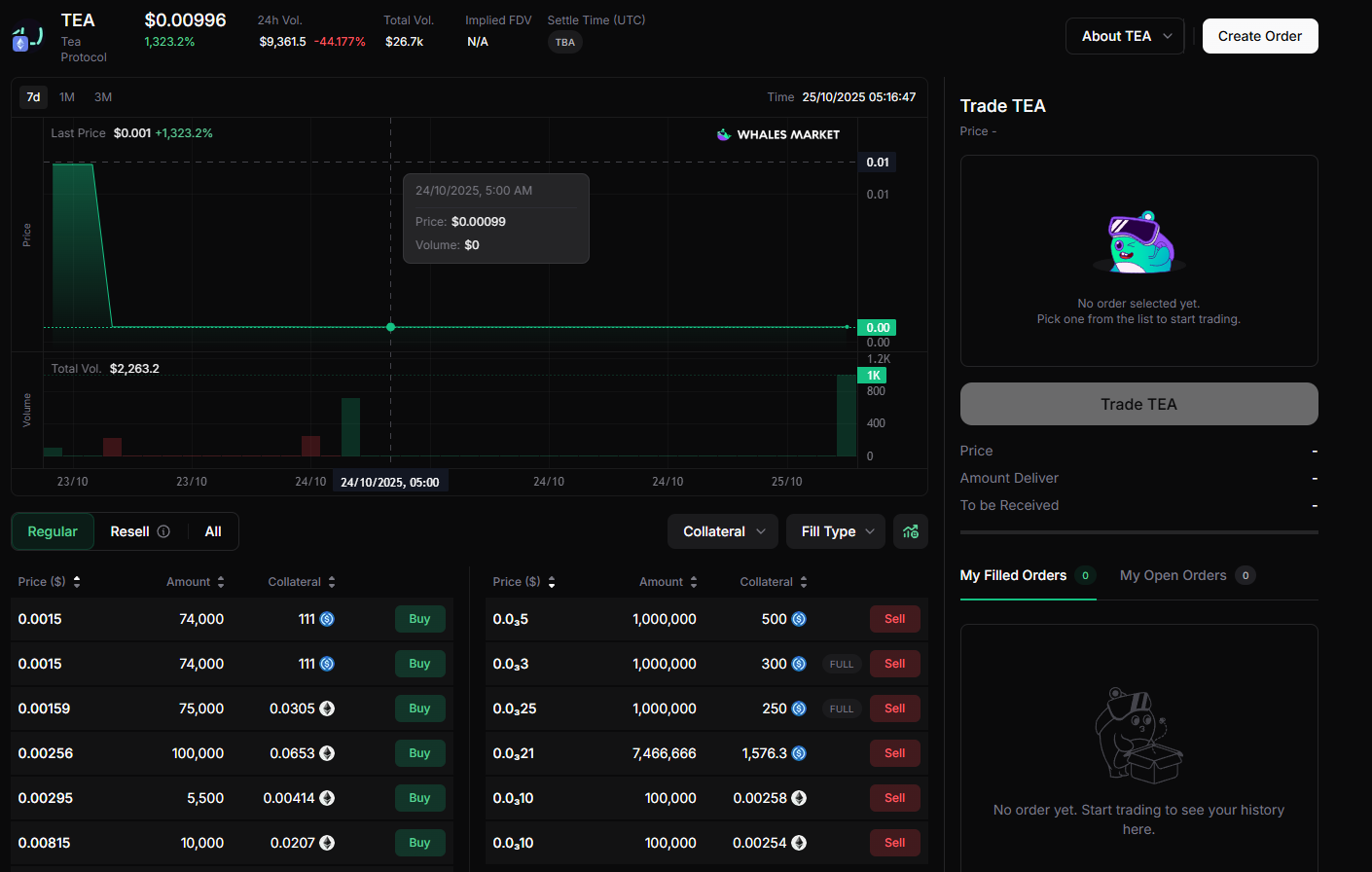

- Seller Lists Token Allocations: A project participant or early investor lists their pre-TGE token allocations on the Whales Market premarket interface.

- Buyer Accepts the Order: A buyer selects a listing and confirms the trade. Both sides lock collateral into smart contracts, ensuring accountability.

- Collateral & Escrow: The seller’s collateral protects the buyer in case of non-delivery. The buyer deposits the agreed payment, held in escrow until settlement.

- Settlement After TGE: Once the Token Generation Event (TGE) occurs, the system automatically transfers tokens to the buyer and releases funds to the seller. All on-chain, without intermediaries.

- Protection from Default: If the seller fails to deliver, their collateral is forfeited to compensate the buyer, ensuring capital protection for both sides.

Advantages and risks of trading pre-market before launch

Trading digital asset claims before the official Token Generation Event (TGE) offers a unique set of advantages and risks compared to conventional spot trading.

Advantages

- Early Access to Tokens: Participants gain early exposure to high-potential projects before they list on exchanges, securing an entry point that is often unavailable to the general public.

- Valuation Insight (Price Discovery): Pre-market prices offer valuable insights into a project’s expected launch valuation and investor sentiment, helping the wider crypto pre-market gauge initial demand.

- Liquidity for Early Investors: Seed or private investors can utilize OTC pre-market platforms to sell their token allocations before TGE to lock in profits, hedge their risk, or rebalance portfolios.

Risks

While engaging in pre-market crypto offers significant opportunities, it carries elevated risks specific to this early stage:

- High Volatility: Crypto pre-market prices can swing dramatically before and immediately after the TGE due to limited information and speculative trading.

- Low Liquidity: Fewer participants and the specific nature of trading claims (Token Allocations, Airdrop Claims) can result in lower liquidity, making large trades harder to execute at the desired pre-market price.

- Counterparty and Settlement Risk: Traditional OTC pre-market deals often rely on trust, carrying the risk that the seller fails to deliver the tokens after TGE.

Whales Market addresses the final risk by mitigating these issues through collateralized smart contracts, ensuring that both buyer and seller are protected throughout the process and minimizing counterparty risk inherent in typical pre-market crypto transactions.

How Whales Market Popularized the premarket crypto concept

The term Pre-Market was first introduced and popularized in crypto by Whales Market, now recognized as the leading decentralized pre-market DEX platform with over $300M in trading volume.

Before Whales Market, pre-market trading mostly occurred through private groups and chats, where deals were risky and relied purely on trust. Fraud, failed deliveries, and scams were common.

Whales Market revolutionized the OTC pre-market by introducing audited smart contracts that enable:

- On-chain collateral locking

- Secure token settlements post-TGE

- Transparent, non-custodial transactions

This innovation eliminated the need for trust between counterparties and brought institution-grade security to pre-market crypto trading.

Why Choose Whales Market for premarket crypto trading?

- Leading Pre-Market DEX: Over $300M in total trading volume and thousands of verified on-chain transactions.

- Trustless Escrow System: Fully smart contract–based, ensuring security and transparency.

- Capital Protection: Collateralization safeguards against counterparty defaults.

- No Middlemen, No KYC: Trade globally, directly from your wallet.

- Token Allocations: Trade various pre-TGE tokens on Whales Market.

With Whales Market, users can trade premarket crypto assets safely, unlocking global liquidity for allocations that were once trapped in private OTC networks.

Getting Started with Whales Market

- Connect Wallet on Whales Market: Visit Whales Market, connect your wallet, and select the token you want to trade in the premarket crypto section. This gives you access to verified pre-TGE listings and real-time pre-market prices.

- Create or Fill an Order: Choose whether you want to buy early allocations or sell your tokens before TGE. Simply click “Create Order” to list your offer or browse existing OTC pre-market orders to fill.

- Set Price and Deposit Collateral: Define your price and amount, then lock collateral equal to the order value. This ensures every crypto pre-market trade is secure and trustless.

- Order Execution and Visibility: Once confirmed, your order becomes public on the platform, buyers and sellers can view, match, and execute trades instantly through on-chain smart contracts.

- Settlement After TGE: When the token officially launches, the settlement phase begins. Sellers must deliver tokens within the specified window, or their collateral is forfeited to the buyer, guaranteeing fairness across all pre-market crypto transactions.

Tips for beginners

- Start small: Begin with small trades to gain experience with premarket trading without significant risk.

- Research thoroughly: Before committing funds, check the crypto project's fundamentals, tokenomics, and community buzz.

- Use trusted platforms: Work with reputable CEXs or DEXs that provide structured premarket features, like Whales Market.

Conclusion

Premarket crypto trading marks the next evolution in early-stage investing. It bridges private markets and public trading, giving users access to pre-launch opportunities once reserved for insiders.

Through decentralized escrow, on-chain settlement, and cross-chain support, Whale Market has become the trusted platform that defines the crypto pre-market era, offering transparency, security, and freedom in early token trading.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What is premarket crypto?

Premarket crypto refers to the trading of promising tokens before they officially launch on exchanges. This early-stage trading, also called crypto pre-market or OTC pre-market, gives traders the chance to access new projects ahead of the public, potentially benefiting from favorable crypto pre-market prices.

How does premarket crypto work on Whales Market?

On Whales Market, sellers list their token allocations, and buyers participate by locking collateral in a smart contract. Once the trade conditions are met, settlement occurs on-chain, ensuring a secure and transparent transfer of tokens. This process guarantees that the buyer receives the tokens safely at the agreed crypto pre-market prices.

How does Whales Market reduce risks in P2P premarket crypto trading?

Whales Market enhances the OTC pre-market experience by leveraging smart contracts. By conducting transactions on-chain, it dramatically lowers the risks of fraud, scams, and non-delivery that are common in traditional P2P trading.

What is collateral in premarket crypto trading?

Collateral is an asset that both the buyer and seller lock in a smart contract. It serves as security for the trade, protecting both parties until the crypto pre-market transaction is successfully completed.

What happens at the TGE (Token Generation Event)?

After the TGE, settlement is automatically executed on-chain. Tokens are sent directly to the buyer’s wallet according to the agreed terms, finalizing the OTC pre-market trade and reflecting the correct crypto pre-market prices.