If users have been following the crypto market during 2024–2025, Polymarket is almost impossible to miss. It is currently the world’s largest prediction market platform, allowing users to bet on real-world outcomes, from U.S. presidential elections to Bitcoin’s year-end price.

What truly sets Polymarket apart is not just its massive trading volume. It is the concept of “mindshare,” the level of influence the platform holds in the collective awareness of the crypto community and even mainstream media. So where does Polymarket’s mindshare stand today, and how far can it go?

What Is Mindshare and Why Does It Matter?

Mindshare can be understood as “share of mind,” meaning when people think about a specific topic, which platform or brand comes to mind first. In crypto, mindshare is often measured through indicators such as:

- Number of social media mentions.

- Community engagement levels.

- Search trends.

- Sentiment analysis (positive or negative discussions).

Kaito is one of the leading platforms specializing in crypto mindshare measurement. It uses AI to analyze millions of conversations across Twitter/X, Discord, Telegram, and blockchain forums.

In crypto, attention could be everything. A project with strong mindshare typically:

- Attracts more developers and top talent.

- Finds it easier to raise capital from major VCs.

- Builds powerful network effects.

- Often leads future market share trends.

Polymarket’s Rise to the Top

Polymarket is the world’s largest prediction market, enabling users to profit from their understanding of upcoming events. Through market mechanisms, the platform aggregates collective opinions to generate objective probabilities that are continuously updated.

Founded in 2020 by Shayne Coplan, who was just 21 years old and had recently dropped out of college, Polymarket started as a small application during the crypto winter. Everything changed rapidly from 2024 onward:

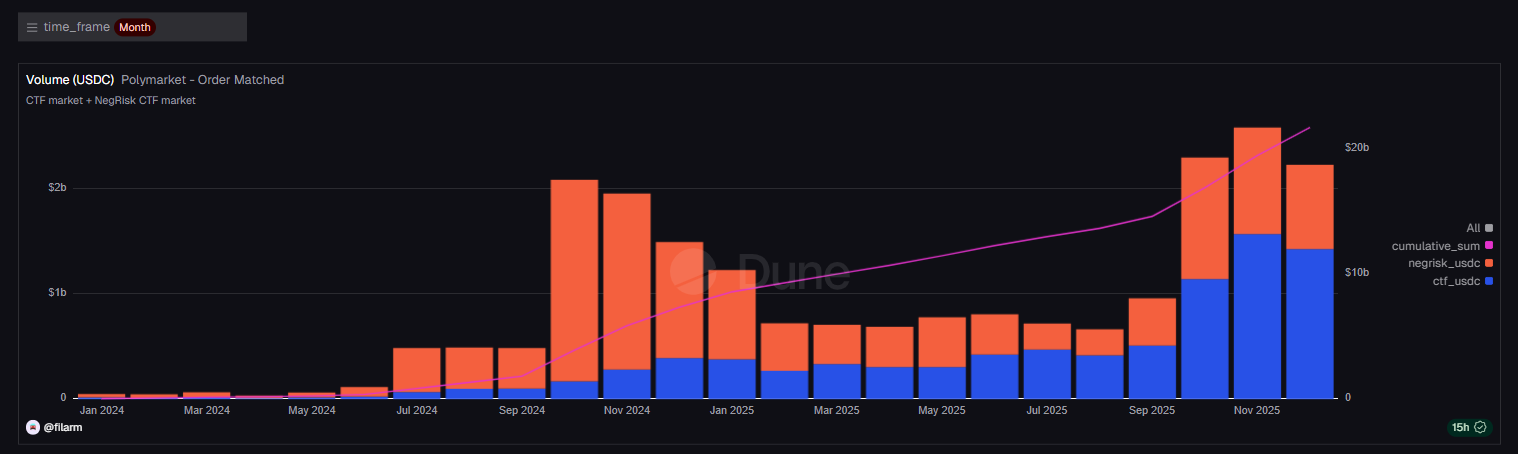

- January 2024: Monthly trading volume at $50M.

- November 2024: Volume surged to $1.9B per month driven by the U.S. election.

- Full year 2024: Total volume reached nearly $9B.

- October 2025: Monthly volume hit an all-time high of $4.1B.

- Q4 2024: Nearly $11B in volume generated in just three months.

Key Milestones That Shaped Polymarket’s Mindshare

U.S. Election 2024 – The Golden Moment

Polymarket correctly predicted Donald Trump’s victory at a time when most polls suggested a 50/50 race. This accuracy led to widespread coverage on CNN, Bloomberg, The New York Times, and hundreds of major media outlets.

June 2025 – Partnership With X (Twitter)

Polymarket became the official prediction market partner of X and xAI, Elon Musk’s AI company. Polymarket data was integrated directly into the feeds of over 500M X users through X Cards, combined with Grok for real-time AI analysis.

October 2025 – Mega Deal With ICE

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), invested $2B into Polymarket at a $9B valuation. Just four months earlier, Polymarket was valued at $1B, representing a 9x increase in under half a year.

December 2025 – Return to the U.S. Market

After nearly four years of being restricted in the U.S. following a $1.4M CFTC fine in 2022, Polymarket officially returned. Its app climbed to #1 in the Free Sports category on the App Store.

How High Will Polymarket’s Mindshare Go?

Polymarket’s Current Mindshare on Kaito

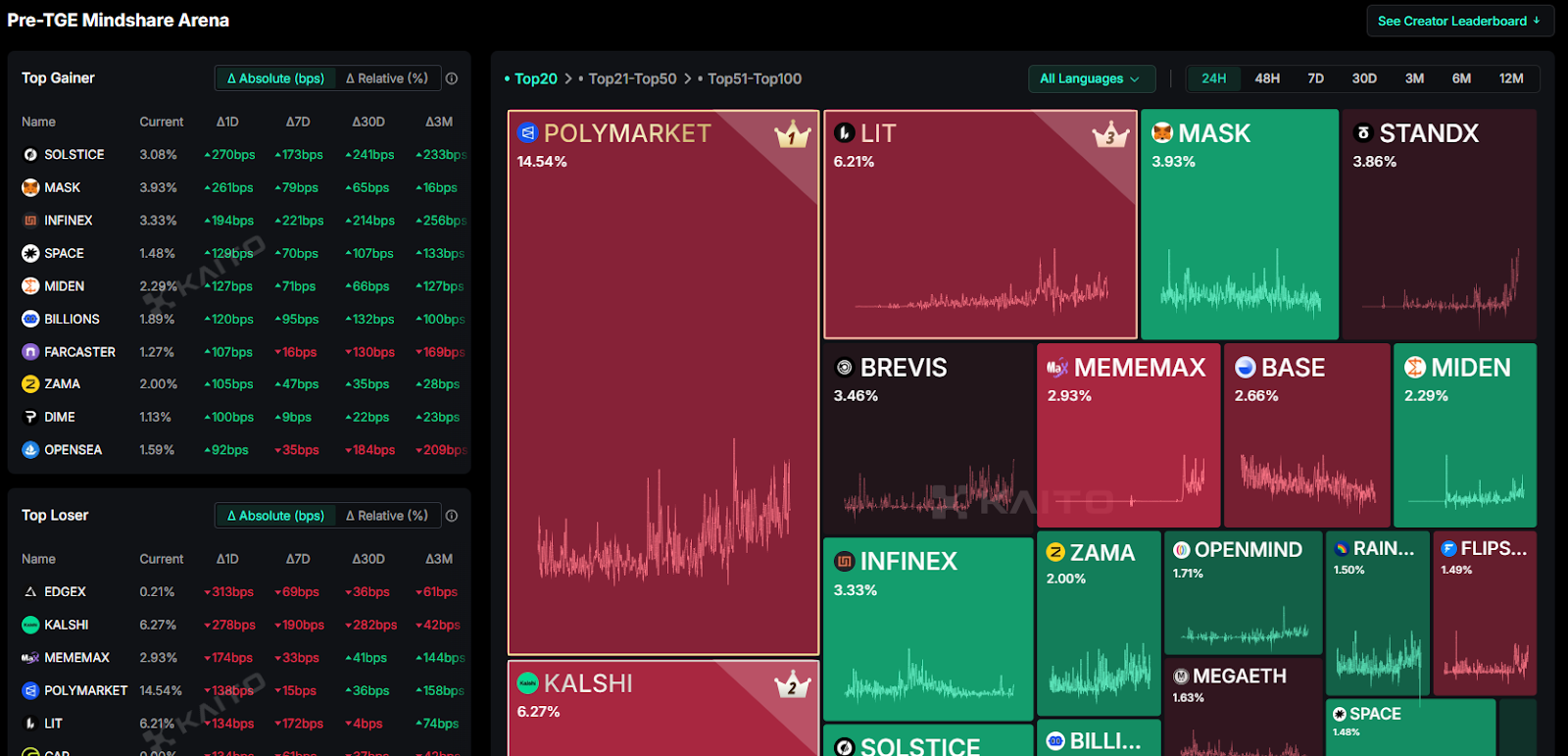

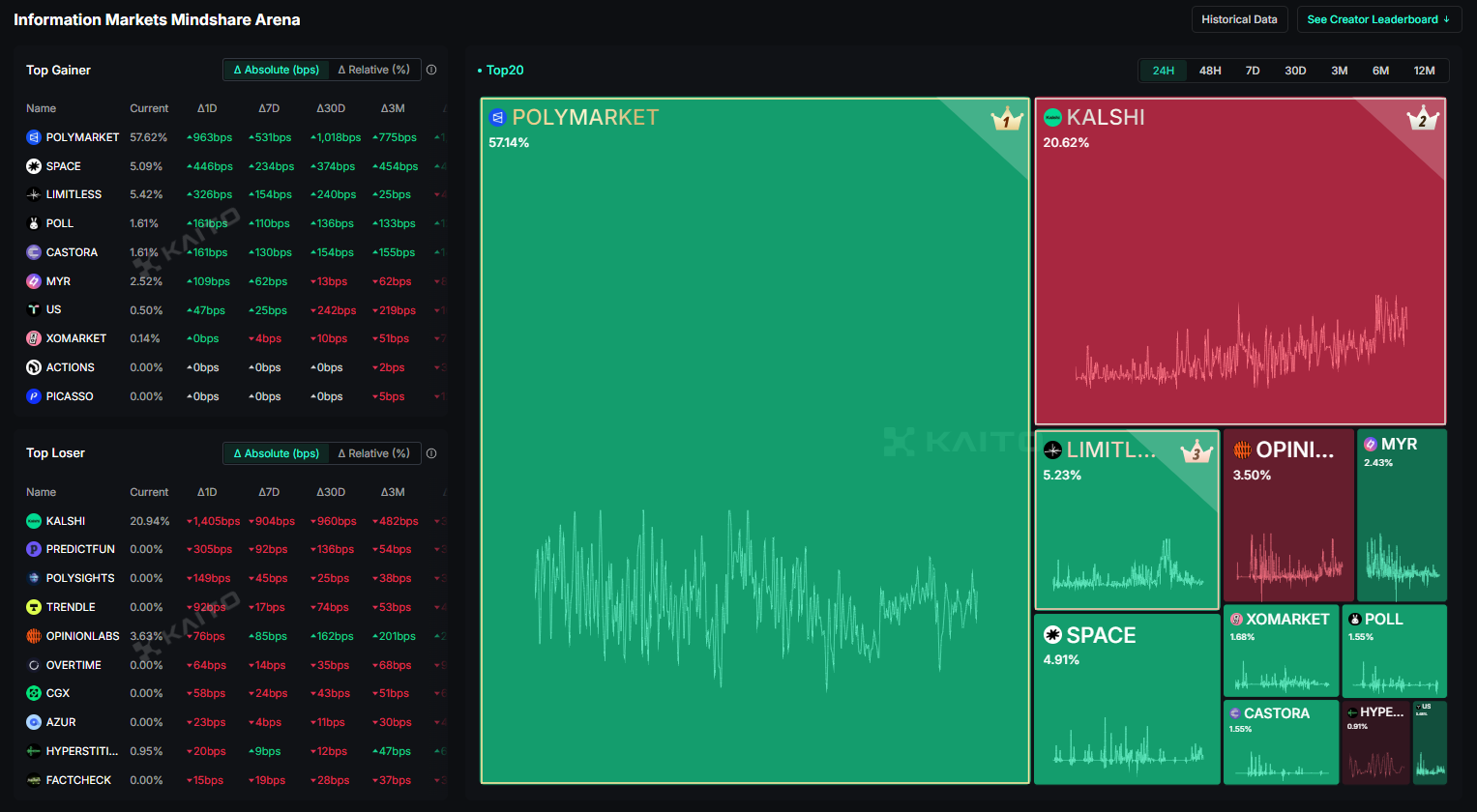

According to Kaito’s data, Polymarket currently leads the Prediction Market sector in mindshare as of December 26, 2025:

- 12M: 48%

- 6M: 47%

- 3M: 49%

- 30D: 47%

- 7D: 52%

- 48H: 53%

- 24H: 57%

There is little debate that Polymarket has been the most mentioned prediction market platform over the past year. Despite the emergence of new competitors, its mindshare has consistently captured nearly half of the market.

When users explore or scroll through prediction market content on X, Polymarket is almost always the first name to appear on the feed.

Factors That May Influence Polymarket’s Mindshare

Bullish Factors That Could Push Mindshare Higher

- $POLY Airdrop: This is likely the largest catalyst for 2026. The CEO previously hinted at the $POLY token in a public post. With an estimated FDV above $9B, higher than the most recent funding round, this could become one of the biggest TGEs of 2026.

- ICE Partnership and Global Data Distribution: This collaboration enables Polymarket data to reach global financial institutions, improving credibility and adoption while pushing mindshare higher within the broader financial ecosystem.

- Incentives for Yappers: If Kaito and Polymarket launch a structured reward program for content creators discussing Polymarket, it could significantly boost mindshare by encouraging continuous and organic discussion.

- Major Events and Announcements: Mindshare often peaks around high-attention events such as elections, the Super Bowl, or AI development rumors. In 2025, Polymarket recorded 33 days with mindshare above 70%, largely driven by election-related hype.

$BTC$ETH$BNB$SOL$POLY 🤔 https://t.co/HmMobU6nBh

— Shayne Coplan 🦅 (@shayne_coplan) October 8, 2025

Bearish Factors That Could Reduce Mindshare

- Competition From Rivals: Platforms like Kalshi (approximately 11–28% mindshare), Limitless (2–3%), and Space are gaining traction through strong funding and new products. Kalshi alone raised up to $1B at an $11B valuation and expanded into tokenized markets on Solana. When competitors secure major partnerships or outperform Polymarket in certain quarters, overall mindshare becomes increasingly fragmented.

- Regulatory Risks and Trust Issues: Negative events such as insider trading allegations or regulatory pressure from the CFTC or FBI can reduce positive discussion. If Kaito’s algorithm is suspected of data manipulation, even with ZK proofs, or if Polymarket faces regional restrictions, mindshare could decline rapidly.

- Market Volatility and Lack of Major Events: Mindshare depends heavily on attention-grabbing events. During crypto winters or quieter periods without major narratives like elections, organic discussion naturally declines. After November 2025, mindshare did not exceed 70%, despite previously reaching this level on 33 occasions.

- Internal Platform Limitations: If Polymarket fails to improve core user experiences, such as low liquidity in smaller markets or insufficient incentives for creators, mindshare may stagnate and struggle to grow sustainably over time.

Why you should read the rules carefully before betting?

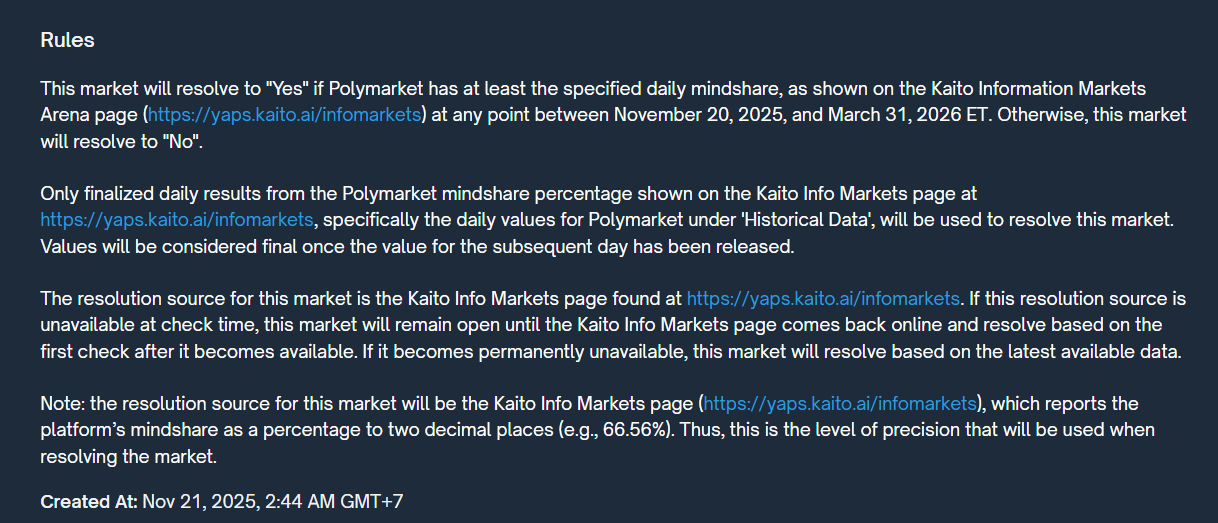

Before analyzing strategies and participating in betting, users should carefully review the rules of this market.

This market is designed to determine whether Polymarket reaches a specific daily mindshare threshold within a defined period, based solely on public data from Kaito Info Markets. The outcome is determined under the following principles:

- The market resolves to Yes if Polymarket’s daily mindshare meets or exceeds the required level at least once during the period from November 20, 2025 to March 31, 2026 (ET).

- If no day meets the condition, the result is No.

- Data is sourced exclusively from Kaito Info Markets.

- Only finalized daily mindshare data under Historical Data is used.

- A day is considered finalized once the following day’s data is published.

- If Kaito Info Markets is temporarily unavailable, the market remains open until access is restored.

- If the site becomes permanently unavailable, the most recent available data will be used.

- Mindshare is displayed as a percentage with two decimal places, such as 66.56%, and this precision is used for settlement.

These are the key rules and data points users should understand when tracking Polymarket’s mindshare for betting purposes.

Once the rules and factors affecting Mindshare are clear, let's go over the betting market strategies on Polymarket.

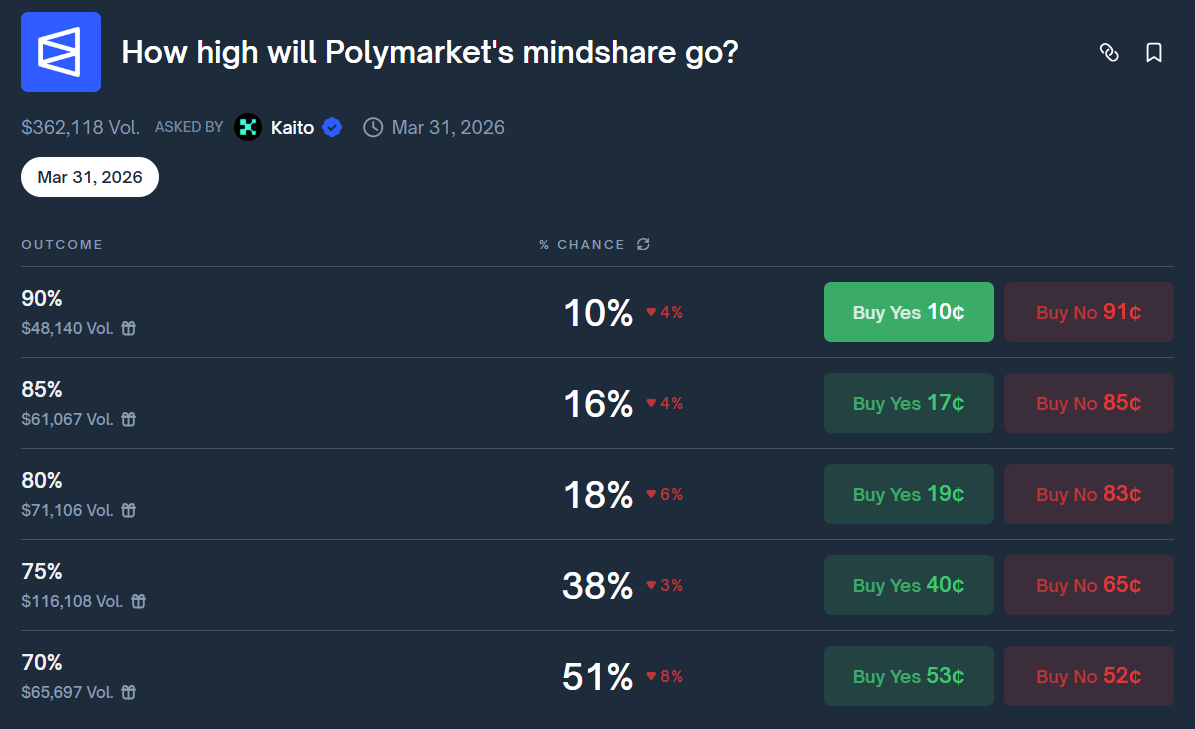

Strategy 1: Lower Risk

As of December 2025, there are nearly three months remaining before the market closes. According to the rules, Polymarket’s daily mindshare only needs to meet or exceed a selected threshold once during this period for that option to resolve as Yes.

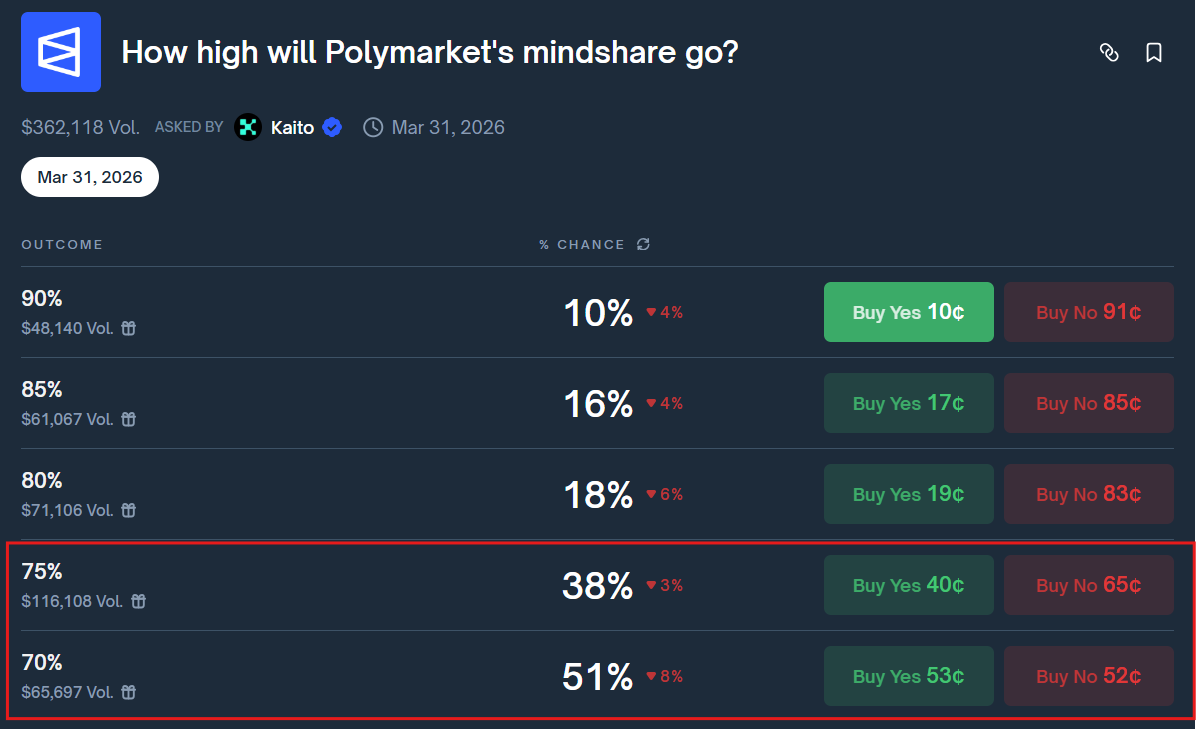

Given Polymarket’s current dominance, the 70% and 75% thresholds are considered lower-risk options for the following reasons:

- Current mindshare already accounts for roughly half of the prediction market sector, placing it just 20–25% below these levels.

- The team has hinted at the $POLY, a narrative the community is likely to continue discussing throughout the first half of 2026.

- Prediction markets are expected to remain relevant for years, with Polymarket positioned as the first name users think of.

- No KYC requirements, simpler onboarding than competitors, and supportive regulatory positioning provide strong momentum for continued dominance.

If users enter at current prices:

- 70% (51 cents): approximately 2x profit

- 75% (38 cents): more than 2.3x profit

For risk management, allocating more capital to the 70% option is generally safer than focusing heavily on 75%.

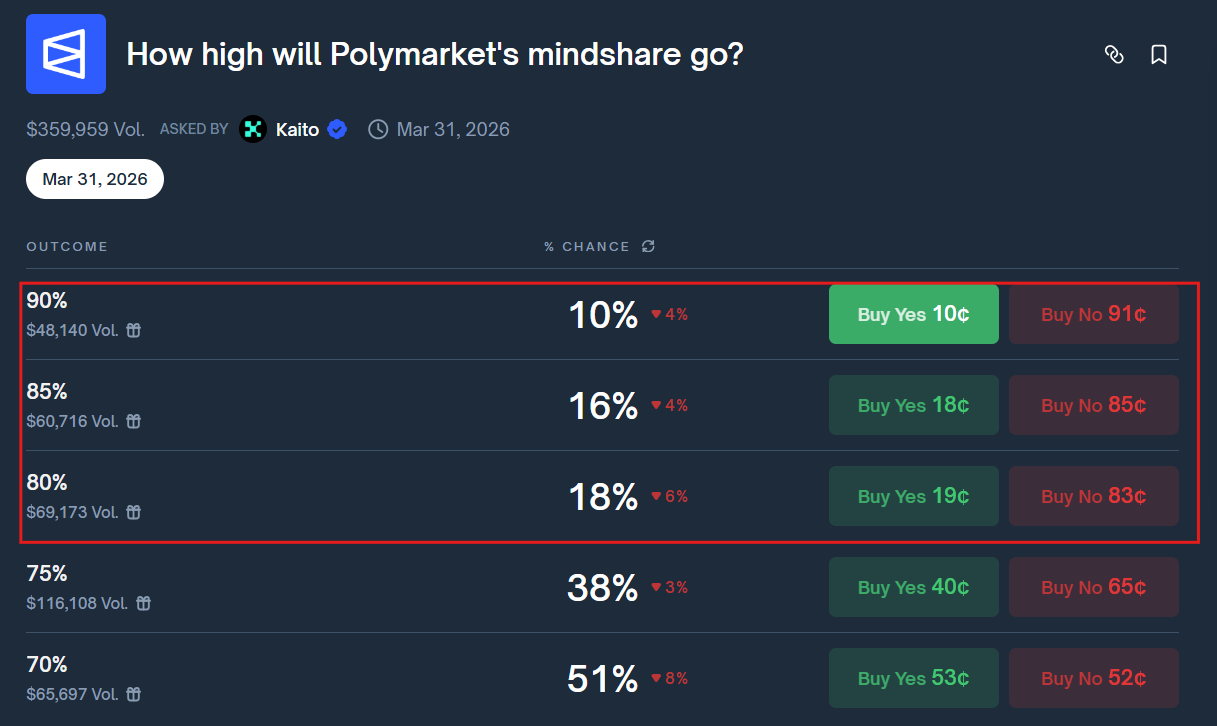

Strategy 2: Higher Risk

Thresholds of 80% and above are considered significantly riskier. While Polymarket remains the leader, other platforms continue to grow, fragmenting mindshare. Bearish factors can also emerge unexpectedly.

Users who strongly believe in Polymarket’s continued dominance and the bullish catalysts outlined above may consider allocating a smaller portion of capital to these higher-risk options.

Conclusion

For users participating in mindshare betting, it is important to understand that mindshare reflects market attention at specific moments, not long-term guarantees. Narratives can shift rapidly due to new events, regulatory changes, or market volatility.

Capital should be managed carefully, positions should be diversified, and all-in strategies should be avoided. Daily data monitoring and disciplined execution matter more than being right once.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1: Does high mindshare guarantee higher betting profits?

Not necessarily. Mindshare only reflects how much attention a topic or platform is receiving at a given time. Betting profitability also depends on entry timing, odds efficiency, market positioning, and disciplined capital management rather than attention alone.

Q2: Is Kaito’s mindshare data updated in real time?

No. Kaito tracks mindshare on a daily basis. A day’s data is considered finalized only after the following day’s dataset is published, meaning short-term intraday changes are not reflected immediately.

Q3: Why does Polymarket’s mindshare fluctuate so sharply?

Mindshare is highly sensitive to events. Major news, partnerships, regulatory developments, elections, or sudden narrative shifts can quickly amplify or reduce discussion volume, causing sharp short-term fluctuations.

Q4: Is mindshare betting better suited for long-term or short-term participants?

Mindshare betting is generally more suitable for users who actively follow short- to mid-term narratives and market attention cycles, rather than those applying long-term buy-and-hold strategies.

Q5: What other indicators should users track alongside mindshare?

Mindshare should be analyzed together with trading volume, odds movements, regulatory developments, and key catalysts such as token launches, airdrops, or major partnership announcements.

Q6: When should users avoid entering Polymarket mindshare bets?

It is usually safer to avoid entering when the market lacks major upcoming events, narratives are losing momentum, or regulatory and trust-related risks begin to dominate public discussion.