Recently, many projects launched on platforms like Kaito, Buildpad, and Echo are delivering very attractive profits for participants.

Falcon Finance ($FF - ATH ROI 17.13x), Limitless ($LMTS - ATH ROI 6.34x), Lombard ($BARD - ATH ROI 3.38x), and upcoming projects like MegaETH ($MEGA), which is already trading at around 3x its implied FDV on Echo, have all fueled interest in pre-market strategies

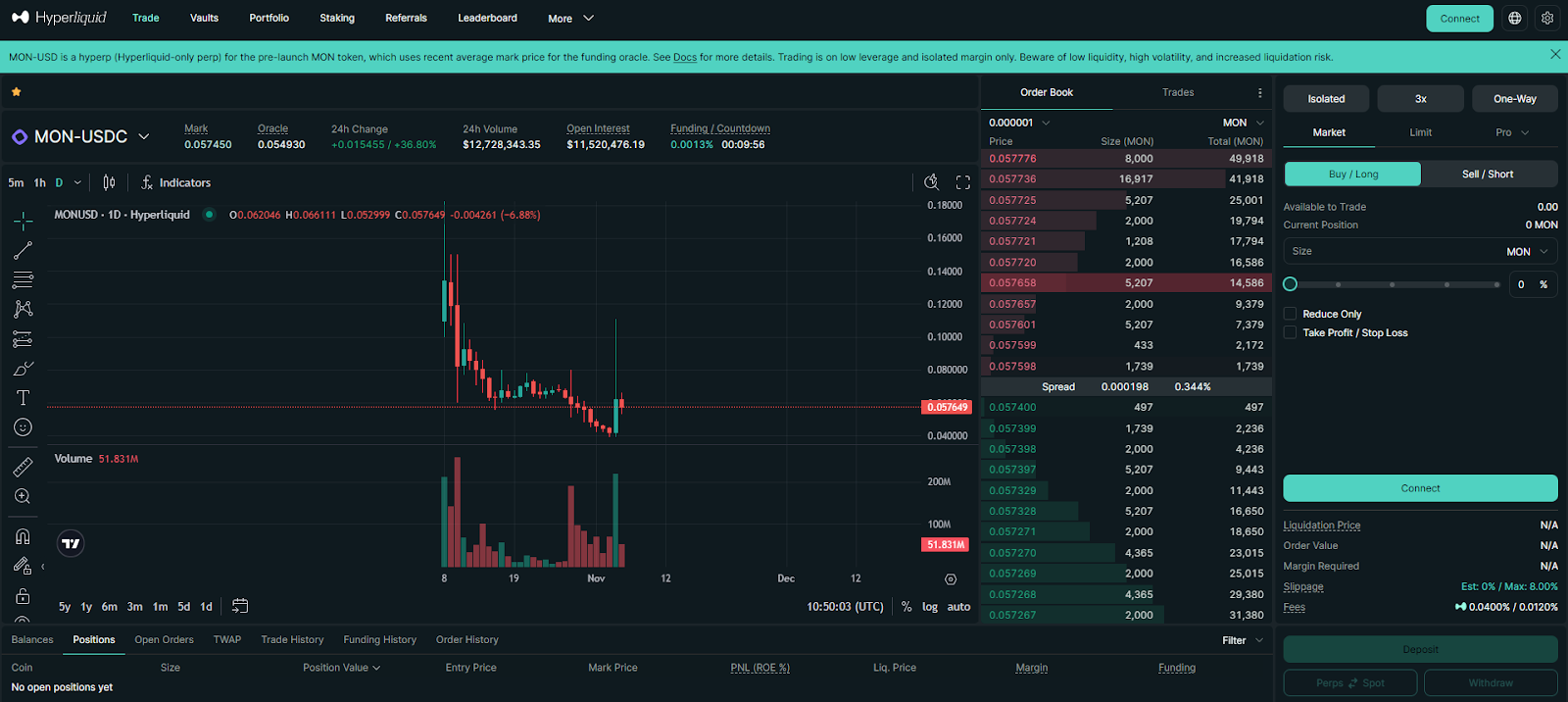

This has led to a high demand for hedging on pre-market perps among investors aiming to protect their profits. Some cases also involve hedging when receiving airdrops, with Monad being an example.

However, hedging also comes with many risks that investors often overlook. So what are they? Let's explore through the article below!

What is Hedging on Pre-Market Perps?

Hedging is a risk management strategy in investing, aimed at minimizing potential losses by opening opposing positions to offset each other. For example, if users are holding an asset and fear a price drop, they can open a short position to compensate for the loss if the price actually decreases.

For pre-market, the story unfolds similarly, as Hyperliquid allows trading perps on unreleased tokens (pre-market). This helps investors predict and protect their profit positions before events like airdrops or TGE.

Benefits of Hedging on Pre-Market Perps

Hedging tokens before TGE on pre-market perps is something investors often do to protect their profits. Where does this upside come from?

- From buying tokens in public sale rounds at a low FDV, while the same tokens are trading at a much higher implied valuation on pre-market.

- From airdrop allocations, where investors are satisfied with the pre-market valuation and worry that the price may drop once the project officially TGEs. In these cases, hedging is understandable.

The basic mechanism works like this:

- The investor believes the pre-market valuation is reasonable and is already “holding” tokens on paper (allocation confirmed but not yet claimable until TGE).

- The investor opens a short position on pre-market perps for the same token with leverage and holds this position until they receive the tokens.

- If the pre-market price drops, the profit from the short position helps cover the loss in value of the unreceived tokens from the airdrop or launchpad.

- When the investor officially receives the tokens at TGE, they close the short position and sell the tokens at the market price.

Example:

- You buy 10,000 tokens in a public sale at $1.

- On pre-market perps, the token is trading at $3. You think this price is fair but are afraid of a dump at TGE.

- You open a SHORT order of 10,000 tokens at $3.

By TGE, the market can’t hold $3:

- The spot price after TGE is only $1.5.

- You claim and sell 10,000 tokens at $1.5 → spot profit = (1.5 - 1) × 10,000 = $5,000.

- At the same time, you close the short from $3 down to $1.5 → perps profit = (3 - 1.5) × 10,000 = $15,000.

- Total profit = $20,000, which is almost like “selling” at around $3 per token, even though the actual market price at TGE is only $1.5.

- If the token instead trades above $3 at TGE, the short position would lose money, so the hedge would cap your upside even though it protects you on the downside.

So, hedging with perps helps investors:

- Avoid depending entirely on the TGE price to decide.

- Actively lock in their profit within a desired range.

Risks of Hedging on Pre-Market Perps

Although hedging to protect profits is something many investors do, and it can be effective, risks still exist, especially with illiquid assets like pre-market tokens.

Typically, risks decrease with highly liquid assets that are hard to manipulate. For pre-market tokens, it's a very different story, one full of additional risks:

- High liquidation risk if the market experiences strong volatility, especially with leverage, which can lead to losing the entire margin if the price moves in the opposite direction.

- Funding fee costs can accumulate significantly if the position is held for a long time, reducing overall profits from hedging. Especially in the case of the $MEGA token, where the pre-market price is already around 3x the implied public sale valuation, but the project will not TGE until January 2026. Holding a hedge that long can significantly erode profits through funding fees.

In the past, there have been many case studies highlighting the risks of hedging on pre-market. A notable one is the case of Plasma - $XPL:

- At the end of August 2025, the $XPL market on Hyperliquid had thin liquidity because the token had no real supply yet, with prices mainly based on internal exchange activity. Many traders shorted $XPL with leverage to hedge.

- When trading on Hyperliquid, traders' liquidation prices could be seen, creating conditions for "hunting" events from whales.

- A group of whales started depositing USDC and opening large long positions with 3x leverage, quickly clearing the order book. $XPL price surged from ~ $0.60 to $1.80 in just 1-2 minutes (an increase of over 200%). This created a short squeeze situation.

- Whales earned profits of about $46M (the main whale pocketed $16 million in just 1 minute, with other addresses sharing the rest).

- Conversely, short hedgers suffered heavy losses: Address 0xC2Cb lost $4.59M, 0x64a4 lost $2M, with total liquidations exceeding $17M mainly from the short side.

This case shows that in thin, pre-market environments, hedging with perps can backfire badly, especially when whales can see liquidation levels and trigger short squeezes. It's not a “safe by default” tool for cautious investors.

By heavily longing $XPL and driving the price up to $1.8, 3 whale wallets wiped out others' positions and profited nearly $38M in under an hour — an insane profit!https://t.co/RWIAPwnfKOhttps://t.co/w3ME8SVeAJhttps://t.co/rBQtbCLtbX pic.twitter.com/2zy1Nbb46c

— Lookonchain (@lookonchain) August 27, 2025

Lookonchain has already provided concrete on-chain evidence for this case.

Pre-market Trading: A safer strategy for Hedging

So, if investors don't want to hedge, how can they ensure profits before the project actually reaches TGE?

Instead of hedging, investors can sell directly on platforms that allow pre-market spot trading like Whales Market. Some advantages include:

- Locking in profits: Users can sell their allocation at a pre-market price that is higher than the airdrop farming cost. This helps avoid the risk of a sharp price drop after TGE (dump), instead of hedging which might result in losses if the market squeezes.

- Transparency: On-chain transactions with smart contracts, immutable trade history for tracking and backtesting, reducing scam risks compared to traditional OTC or hedging on unregulated exchanges.

- Broad accessibility for all investors: No need to be a big whale; anyone can participate without requiring high capital like hedging with leverage. This helps reduce opportunity cost (capital to protect positions).

- Flexible liquidity before launch: Provides a market to sell points or pre-tokens without waiting for TGE, allowing quick capital diversification instead of being locked in long-term hedging.

- Lower costs and less complexity: No funding fees or liquidation risks like perps hedging; just simple collateral.

This is a relatively optimal solution for most investors if they want early profits before the project's TGE but with less risk than hedging.

However, investors will also bear some risk if the TGE price is higher than expected, preventing them from maximizing profits.

Nevertheless, selling directly on pre-market is also a solution that investors can consider. The rest will depend on each investor's strategy and risk appetite.

Read more: How to Trade on Whales Market.

Conclusion

Hopefully, this article has helped readers understand the benefits of hedging with perps on pre-market, while noting that hedging pre-market tokens carries higher risks.

A safer alternative strategy is trading pre-market spot on Whales Market. Remember, the choice of strategy should align with your individual risk appetite and this article should be used for reference purposes only.

FAQs

Q1. Should I hedge on Pre-Market Perps?

- Yes, if you clearly understand and accept the risks involved, can monitor positions closely, and are comfortable tolerating ongoing funding costs.

- No, if you struggle with monitoring the position or feel anxious about the potential risks.

Q2. What are the biggest risks when hedging on Pre-Market Perps?

- Liquidation from volatility/leverage.

- Funding fees that compound over time.

- Thin liquidity and potential manipulation/short squeezes.

Q3. How much leverage is “safe” for a hedge?

The lower the better. Hedging is insurance, not a profit-maximizing bet. High leverage turns insurance into speculation.

Q4. How do funding fees impact returns?

If you hold for weeks/months (e.g., waiting until Jan 2026 for $MEGA’s TGE), funding accrues and can eat a large share of your profit. Always model time to TGE and net profit after fees.

Q5. What’s the downside of selling on Pre-Market spot?

You may miss upside if the token lists higher at TGE compared to your pre-market price. For example: If the TGE price is more than 2x your pre-market sell level, you can still cancel the sell order and lose the collateral, but overall you’d remain in profit because the TGE price is significantly higher than your pre-market entry.

Q6. How do I choose between hedging and selling spot?

Before deciding, take a moment to check: how much risk you’re comfortable with, whether you can actively monitor positions, what other opportunities your capital could go to, and how long it is until TGE.

If you prefer things simple and low-stress, selling spot is usually the cleaner option; only consider small, low-leverage hedges if you’re confident you can manage them closely.