Flying Tulip has drawn attention in DeFi due to its variable supply model and built-in capital protection. Unlike traditional token launches driven by fixed supply and speculation, Flying Tulip ties valuation directly to actual capital raised.

This article examines FT’s potential FDV one day after launch using fundraising progress, token mechanics, market conditions, comparable public sales, and sentiment signals from Polymarket.

Flying Tulip Overview

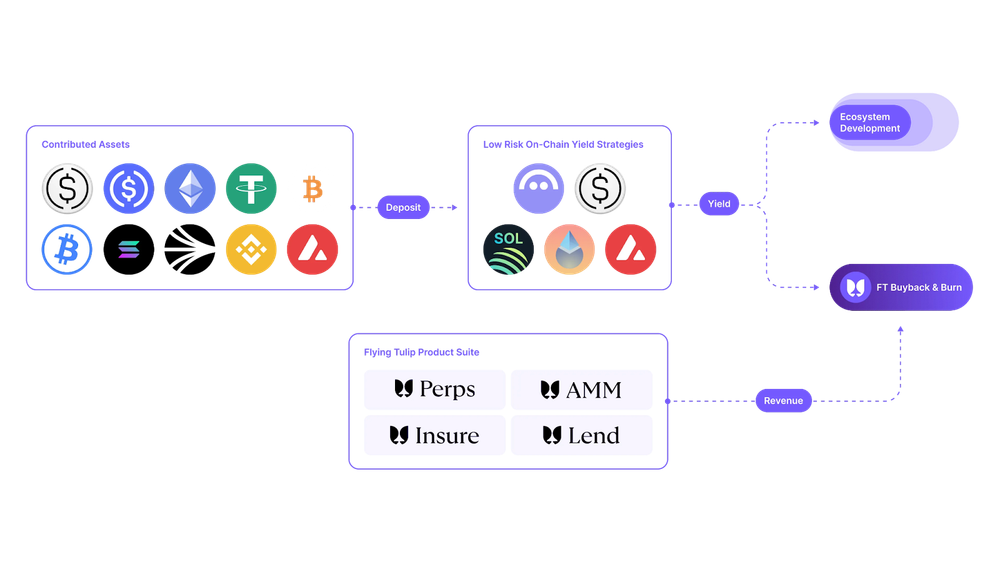

Flying Tulip is a newly launched DeFi protocol spearheaded by Andre Cronje, best known for creating Yearn Finance and Sonic. The project aims to raise up to $1B from the community and institutional investors, with a fully diluted valuation of $1B corresponding to 10B FT tokens.

The raised capital will be deployed into Flying Tulip’s own yield strategies, primarily low-risk DeFi strategies estimated to generate approximately 4% yield per year. Only the yield generated will be used for bootstrapping, marketing expansion, launchpad incentives, token liquidity provision, and token buybacks.

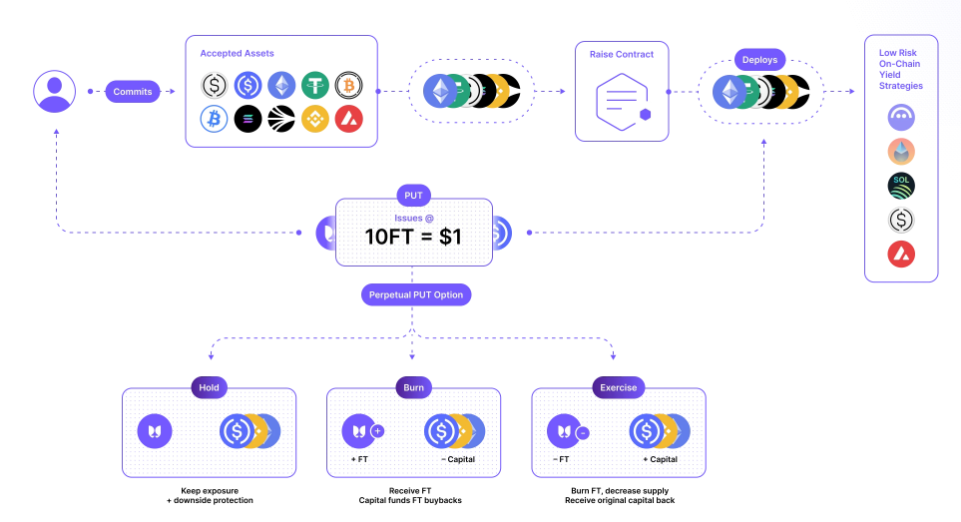

What sets Flying Tulip apart is its distinctive Perpetual Put mechanism, an ongoing put option embedded directly into the token’s architecture. When participants take part in the raise, they do not receive FT tokens outright. Instead, their FT is packaged inside a dedicated NFT, which grants them the right to recover their original contribution at any time.

- As long as the FT remains locked within its associated NFT, holders can redeem their full initial deposit in the same asset they originally contributed.

- This redemption right is available at any time and carries no expiration or additional conditions. This built-in downside protection represents the core innovation behind Flying Tulip.

- Once a holder chooses to unwrap the NFT and allow the FT to become freely tradable, the redemption guarantee is permanently forfeited. Under this structure, participants explicitly choose between maintaining liquidity or preserving capital protection.

Below is a simple example that explains how this mechanism works in practice.

Read the article below for a step by step example showing how Flying Tulip protects principal while still allowing upside potential.

Read more: Flying Tulip - Is Andre Cronje’s DeFi Masterpiece Truly Perfect?

It is important to note that FT purchased on the secondary market (DEXs or exchanges after TGE) does not include the redemption right.

- Primary buyers (direct from the project): Principal protection & redemption at par value

- Secondary buyers: No redemption right & full exposure to market risk

This two-layer structure further explains why Flying Tulip’s valuation remains tightly linked to the number of FT tokens sold during the initial fundraising phase.

Factors Influencing the $FT Price at TGE

FT sells out completely

In reality, only a handful of projects operate in the same niche as Flying Tulip. This lack of direct comparables makes it difficult to establish reliable benchmarks or derive a precise valuation. As such, this analysis should be considered purely as a reference.

Flying Tulip’s valuation challenge largely comes from its operational design. While the model introduces several improvements on paper, its true effectiveness can only be assessed once real capital starts flowing through the ecosystem.

Because Flying Tulip employs a highly distinctive fundraising mechanism, this structure will play a key role in determining FT’s valuation at TGE.

- FT will be 100% unlocked at TGE

- Total supply: 10B FT

- If $1B is raised and all tokens are sold

- Initial circulating supply = 10B FT

Note: Flying Tulip uses a variable supply model. The total amount raised across all rounds directly determines the FDV. There are no unsold tokens, as tokens are minted only in proportion to the actual capital raised.

Example: If $500M is raised, 5B FT are minted, resulting in an FDV of $500M.

The probability of a full sell-out remains high because participants can redeem FT at a 1:1 ratio with their initial deposit at any time. This mechanism provides strong capital protection and significantly boosts investor confidence.

This makes Flying Tulip fundamentally different from traditional FDV-based token launches, where valuation depends heavily on factors such as:

- Token unlock percentage at TGE.

- Airdrop selling pressure.

- Token allocation distribution between team, users, and investors.

If the entire FT supply is sold, the market cap or FDV is expected to remain in the $1B-$1.3B range. This valuation is likely to stay relatively stable for several reasons:

- Most FT participants understand the mechanism and recognize that their initial capital is protected. At a minimum, they avoid losses and only need time for the Foundation’s strategies to generate returns.

- In the early stage, the protocol is not expected to generate outsized revenue. With an estimated 4% annual yield, revenue accumulation requires time. As a result, buying pressure from the secondary market is expected to be low or negligible at TGE.

- The project does not distribute any token rewards to partners or early investors, meaning default selling pressure from airdrops at TGE is virtually nonexistent.

As a result, the $FT is unlikely to experience aggressive speculative activity, and market cap is more likely to trade above $1B (project’s valuation floor).

Unless unexpected events or new information emerge before TGE, a valuation above $1B at launch appears reasonably likely if Flying Tulip successfully sells 100% of its FT tokens.

FT does not sell out

If the sale does not reach full allocation, Flying Tulip’s valuation will scale directly with the percentage of FT sold.

Example outcomes:

- 50% sold → FDV: $500M-$600M

- 70% sold → FDV: $700M-$800M

- 80% sold → FDV: $800M-900M

Note: Flying Tulip follows a variable supply model, meaning FDV always equals the actual capital raised. No unsold tokens exist, as tokens are minted only based on real deposits.

Why does this analysis focus heavily on the number of tokens sold in the public sale?

Flying Tulip has several unique characteristics that anchor valuation to the amount of FT distributed:

- The project commits to protecting downside via a perpetual put option.

- Secondary market participants can already observe the protocol model and estimated annual revenue of $40M-$50M.

- Fully validating capital efficiency and revenue flow requires a longer observation period.

This level of transparency makes it easier for investors to assess the overall valuation framework.

Comparison with other projects

When placing Flying Tulip alongside other community-focused public offerings, Monad and MegaETH emerge as the most comparable references.

To better understand the differences, it’s useful to examine their core fundraising structures:

| Comparison Factor | Monad | MegaETH | Flying Tulip |

|---|---|---|---|

| Valuation | $2.5B | $999M | $1B |

| Sale Platforms | Coinbase | Sonar | Impossible Finance |

| Target Raised | $187.5M | $49.95M | $800M |

| Purchase Requirements | KYC required on Coinbase | KYC required on Sonar | Stake $IDA and complete KYC |

- MegaETH completed an aggressively oversubscribed sale, reaching 27.8x demand with total commitments of approximately $1.39B.

- Monad, meanwhile, has completed its $187M fundraising goal by raising $269M, exceeding the target though the level of oversubscription fell short of some early community expectations.

Flying Tulip benefits from a structurally different approach. By allowing contributors to redeem their original capital, the project significantly lowers perceived risk, making a successful $800M raise far more achievable.

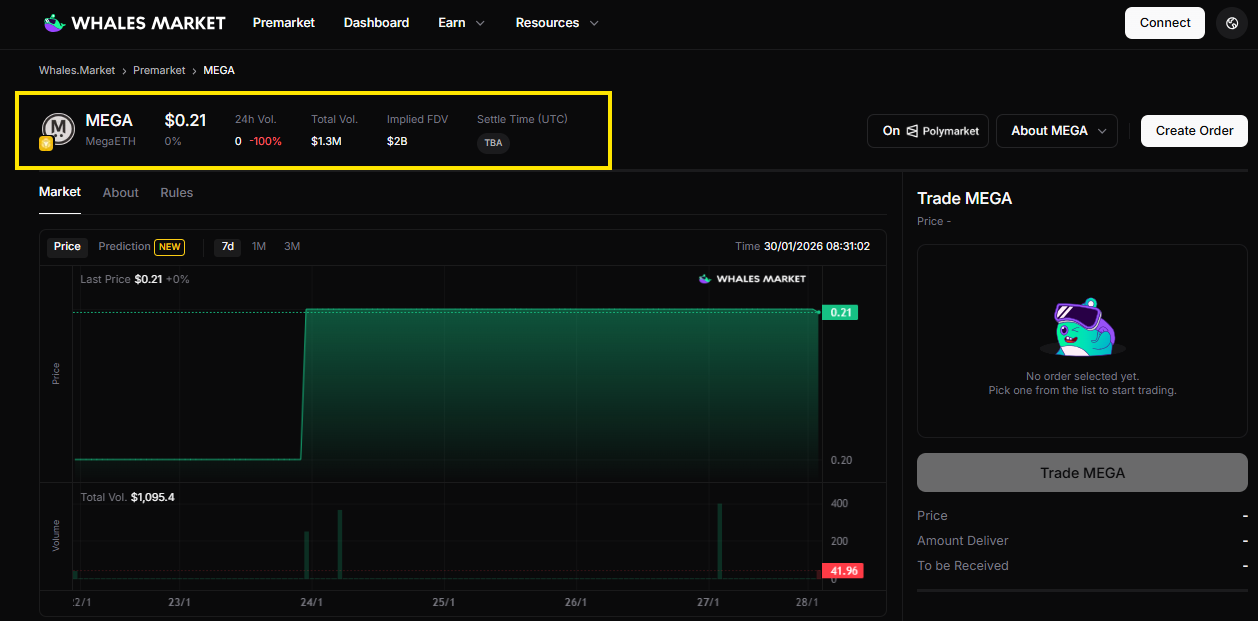

According to pre-market data from Whales Market, known as the best pre market trading platform as of 30/01/2026, the following valuation references can be observed:

- MegaETH raised at a $999M FDV and is currently trading near a $2B valuation in the pre-market. Previously, the project reached an FDV of $3B on Whales Market during a more favorable market phase.

- Monad raised at an FDV of $2.5B and traded one day after TGE at approximately $3.3B FDV under relatively strong market conditions.

Given that Flying Tulip is raising at a $1B FDV, a post-raise valuation in the $1B-$1.3B range appears reasonable under current market conditions, which remain weak as BTC declined from $97K-$81K.

However, this outcome still depends heavily on whether the project successfully sells out.

Analyzing Odds for Flying Tulip’s FDV on Whales Prediction

Based on the event “Flying Tulip FDV above _ one day after launch?”, several key signals can be observed from how FDV levels are priced.

Market sentiment appears relatively pessimistic regarding Flying Tulip’s FDV as of 30/01/2026.

- The probability of FDV exceeding $1.5B is priced at only 7%. For $2B and $2.5B, the probabilities fall to 3% and 1%, respectively.

- Uncertainty is most evident at the FDV above $800M level, which carries a 49% probability.

- The probability for FDV exceeding $1B stands at only 29%.

Are these odds incorrect? Not necessarily, as markets reflect trader sentiment. However, the odds appear undervalued for scenarios above $800M and $1B, offering potential upside if the outcome is correct.

To assess this, consider Flying Tulip’s actual fundraising status as of 30/1/2026.

- Institutional funding totals $225.5M, including $200M from a 2024 Seed Round and $25.5M from a 2025 Series A Round involving funds such as Amber Group, Fasanara Digital, Paper Ventures, and newer backers including Brevan Howard Digital, CoinFund, FalconX, Lemniscap, Nascent, Selini, Sigil Fund, and Susquehanna Crypto.

- Community funding exceeds $50M through Impossible Finance Curated.

Milestone Reached: $50M+ Deposited

— CURATED (@curated_hq) January 29, 2026

The Flying Tulip ($FT) sale on CURATED has officially crossed $50,000,000 in total deposits.

This milestone highlights the strong conviction and momentum behind @flyingtulip_ , powered by incredible community support.

Huge thanks to everyone… pic.twitter.com/YbU8Z7cyf0

Commitments exceed $1.36B, indicating strong oversubscription. However, remaining allocation available for deposits is approximately $400M, as the project caps total fundraising around $1.32B to prevent over-dilution.

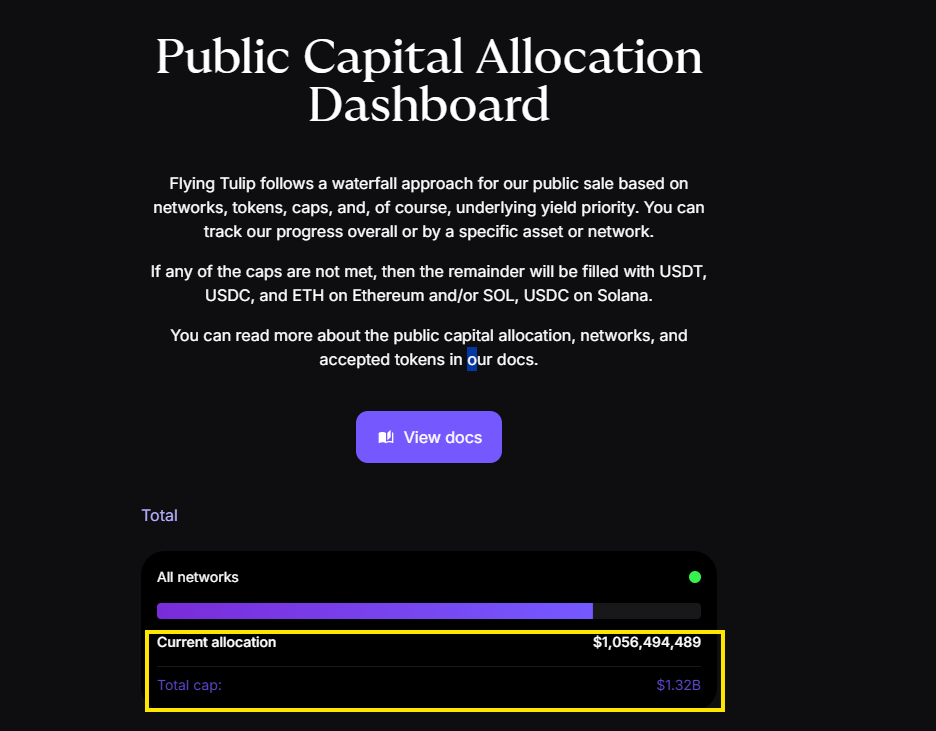

- Dashboard PCA (Public Capital Allocation) shows current allocation on Ethereum at approximately $1.057B. These figures represent allocated commitments via the waterfall mechanism rather than actual deposits. The total project cap across networks, including Ethereum, Avalanche, Base, BNB, and Sonic, is approximately $1.32B.

- There is no detailed breakdown of individual commitments due to privacy considerations. Commitments come from institutional investors and community whitelists, including Supporter participants based on on-chain activity and Intent participants via form submission and quizzes.

Active fundraising rounds include:

- Active fundraising rounds include a $200M public sale on CoinList from 02-06/02/2026 at $0.1 per token, with a minimum purchase of $100 and acceptance of USDC and USDT on ERC-20.

- Whitelist rounds include Supporter, which has been finalized, and Intent, which remains open for accredited investors.

Only around $400M of the remaining $1.08B in commitments can still be filled due to the cap, with any excess being prorated or rejected. Since commitments already exceeded $1.36B before CoinList, the project has a high chance of surpassing $1B in total raise if this allocation is filled, implying an FDV of roughly $1B-$1.3B.

Although actual raised capital is still $275M+, strong commitments suggest meaningful FDV upside as deposits accelerate after CoinList opens.

Under the variable supply model, FDV equals funds raised, and filling the remaining $400M could push FDV above $800M or even $1B. Current pricing reflects launch and post-TGE risk, but the put mechanism and low-risk DeFi deployment at around 4% APY help mitigate these concerns.

Trading Strategies for Flying Tulip FDV event on Whales Prediction

The following strategies outline how traders can position around different FDV outcomes based on current odds, fundraising progress, and remaining allocation.

- Yes >$800M, with odds of approximately 52% and a Yes price around $0.52. This is the safest and most undervalued option. With current raised capital at $275M+ and roughly $400M of remaining allocation, FDV can exceed $800M if CoinList and whitelist rounds fill 50% to 70%, which is highly achievable.

- Yes >$1B, with odds around 30% and a Yes price near $0.30. This offers strong value for more optimistic participants. Commitments exceeding $1.36B suggest the total cap of approximately $1.32B could be fully filled. This outcome appears undervalued due to bearish market sentiment, although recent activity on X indicates improving momentum.

- Avoid bets above $1.5B or higher, where odds range between 7% and 4%. These scenarios carry excessive risk, as the total cap is only around $1.32B and oversubscription alone is unlikely to push FDV beyond that level due to proration.

Monitoring the dashboard in real time is recommended. If commitments continue to rise after the CoinList sale opens on 2/2, the Yes >$1B position could present a strong edge.

Conclusion

Flying Tulip’s FDV is driven by real capital raised rather than speculative supply dynamics. While actual funding stands at $275M+, commitments above $1.36B and $400M of remaining allocation suggest FDV could exceed $800M and potentially reach $1B-$1.3B if deposits materialize.

Whales Prediction currently reflects cautious sentiment, particularly for higher FDV outcomes, but the put mechanism, lack of airdrop pressure, and low-risk yield deployment help establish a clearer valuation floor than most recent token launches.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What is the main driver behind Flying Tulip’s price prediction?

Flying Tulip’s price is primarily driven by the amount of real capital raised. With a variable supply model, FT’s FDV directly reflects actual deposits rather than fixed token supply or speculative demand.

Q2. How does the variable supply model affect FT price forecasts?

Because tokens are minted only when capital is raised, there are no unsold tokens or hidden dilution. This makes FT price predictions more closely tied to fundraising progress than to market hype.

Q3. Can FT price drop below its initial valuation after launch?

For primary buyers, downside risk is limited due to the built-in perpetual put mechanism. However, secondary market prices can fluctuate based on liquidity, sentiment, and broader market conditions.

Q4. Why is Whales Prediction relevant to Flying Tulip price prediction?

Whales Prediciton provides a real-time view of market sentiment by pricing probabilities for different FDV outcomes, offering an additional data point beyond traditional valuation models.

Q5. Is Flying Tulip price prediction more reliable than typical token launches?

Compared to traditional launches, Flying Tulip offers a clearer valuation framework because FDV depends on actual capital raised, reduced sell pressure, and transparent token mechanics.