Flying Tulip's approach challenges long-standing assumptions about token fundraising and yield generation in decentralized finance. However, no model is perfect. Every innovation comes with certain trade-offs, and Flying Tulip is no exception.

So, what makes Flying Tulip special, and what risks or considerations should investors be aware of before participating?

Let's dive deeper to understand the mechanics behind this "tulip flower" that's capturing the attention of the entire DeFi ecosystem.

Flying Tulip Overview

Flying Tulip is the latest DeFi project from Andre Cronje, the creator of Yearn Finance and Sonic. But this time, the direction is completely different. Instead of relying on external investment capital, Flying Tulip operates on real yield genuine profits from protocol activities, an innovation that's creating significant waves in the DeFi space.

This is one of the few projects that brings truly innovative thinking, standing out in a market flooded with uncreative "copy-paste" clones. Flying Tulip isn't just different in its model but also in its approach to sustainable and more transparent capital management.

With the motto “Better Yield, Better UX,” Flying Tulip seeks to solve DeFi’s fragmentation problem by creating a more efficient, capital-optimized, and secure ecosystem for both individual and institutional users.

Learn more: What is Flying Tulip ($FT)?

What are the key innovation of Flying Tulip?

Innovation in Capital Raising and Utilization Mechanism

The key innovation in this Flying Tulip product lies in its capital raising and utilization mechanism. It stems from the common issue where current projects, after raising funds, often sell their native platform tokens to sustain operations such as paying employee salaries, ecosystem incentives, marketing, and more.

Here are some examples of projects, ranging from large to small:

- The Ethereum Foundation sells ETH to maintain operations.

- Optimism uses OP to attract builders to build on the OP chain.

- Arbitrum uses ARB as post-airdrop incentives and funds for sectors like Gaming/DeFi.

- Sui uses SUI for incentives in programs like Bull Shark Quest.

- ...

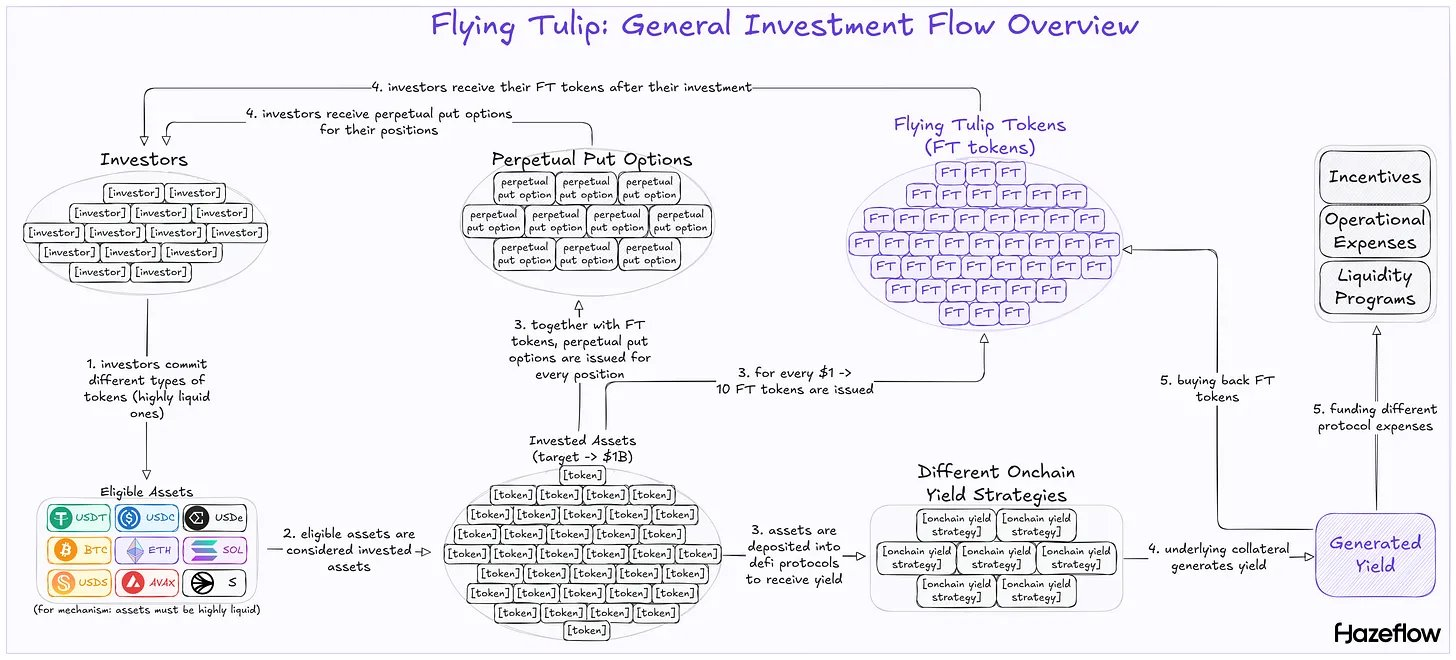

Flying Tulip takes a distinctly different path by:

- Capital Raising: Targeting $1B from investors and the community. The raised assets will include high-liquidity coins such as BTC, ETH, SOL, AVAX, and stablecoins.

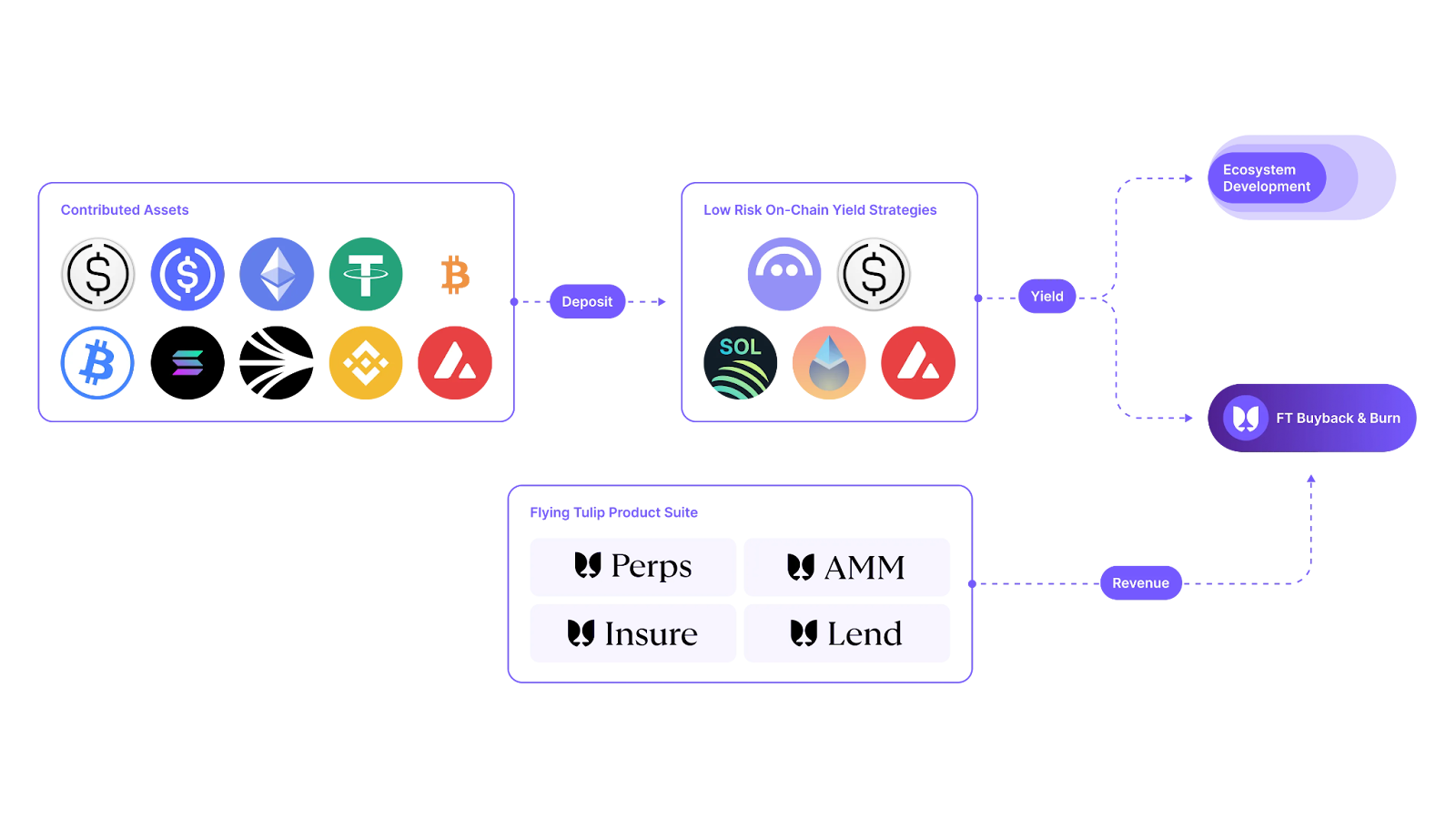

- Capital Utilization: These assets won't be sold off but will be deployed to earn yield in DeFi through low-risk strategies, such as Aave v3 for stablecoins (USDC/USDT/USDS), stETH ~ ETH, jupSOL ~ SOL, AVAX staking for AVAX, or sUSDe for USDe. Notably, no leverage or bridging is used to ensure safety and liquidity.

- Estimated Profits: According to data from Flying Tulip's Docs, with a $1B treasury, the average annual yield is estimated at $44.27 million (~4.427% per year).

- Purpose of Use: The entire yield is prioritized for the ecosystem budget, covering salaries, marketing, infrastructure, and operations. Additionally, it includes buybacks of FT, with more details on the buyback factor explained below.

Is Raising $1B Feasible?

Flying Tulip aims to raise $1B from the community and investors, a highly ambitious target. The project has already raised $200M from major investment funds and is aiming to reach $1B, Flying Tulip must offer something truly compelling, right?

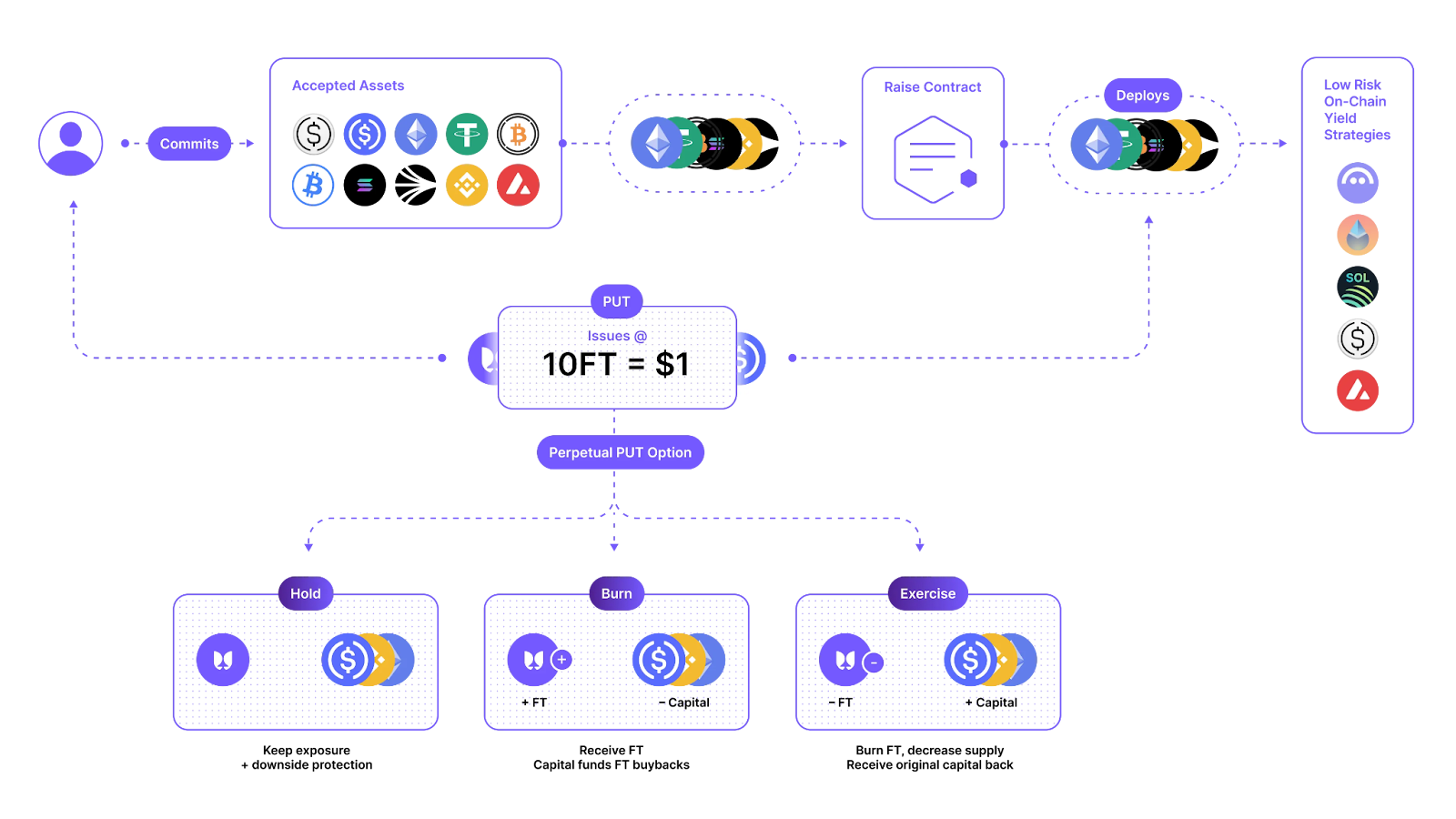

This leads to another innovative mechanism of Flying Tulip. The mechanism works as follows:

The Core of FT Token Issuance Mechanism: Perpetual Put Model

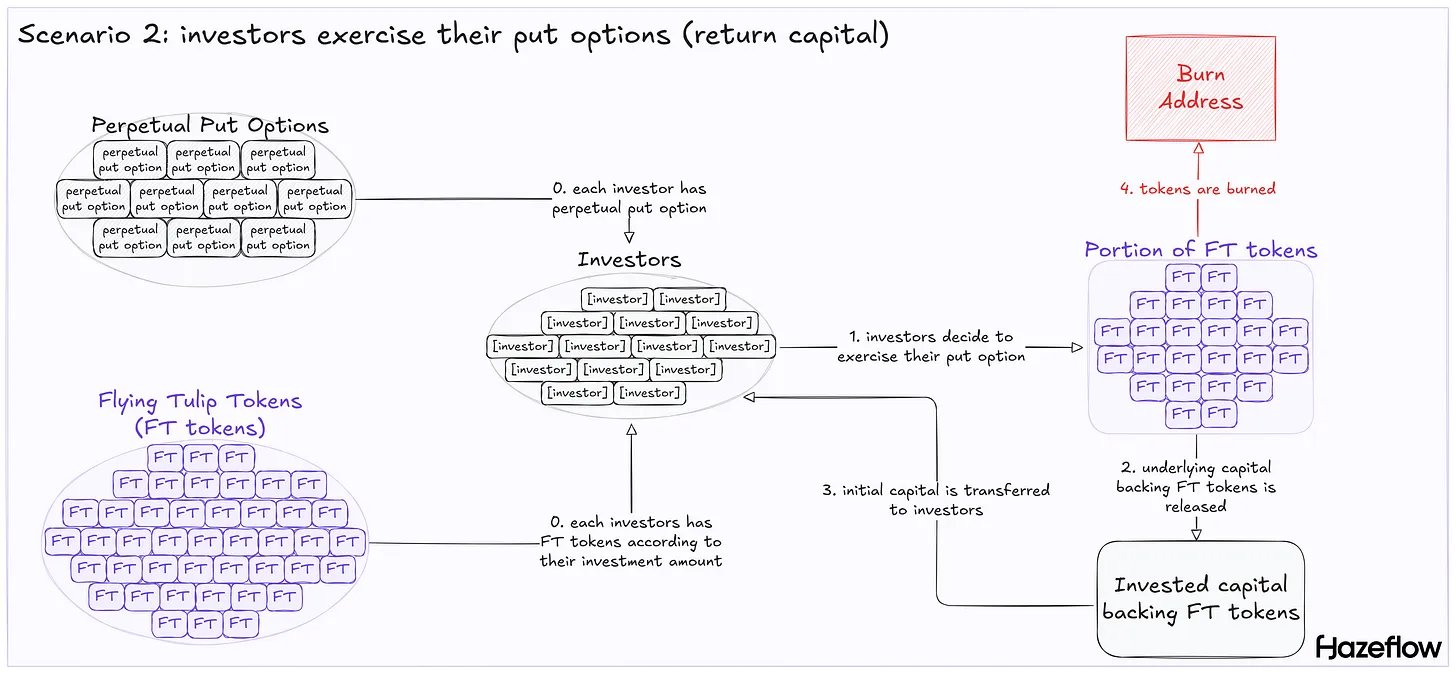

At the heart of Flying Tulip's, FT token issuance mechanism is the Perpetual Put model, a type of "perpetual put option" directly embedded in the token. When participating in the fund raise, investors not just receive FT tokens, they receive them packaged within a special NFT that represents the right to redeem their capital at any time.

As long as the FT tokens remain inside this NFT, the holder can redeem the full initial capital in the exact same asset they deposited, with no time limits or conditions.

However, the moment the tokens are "unwrapped" from the NFT for trading or selling on the market, this redemption right immediately expires.

Simple Example:

- An investor deposits 1,000 USDC and receives 10,000 FT (equivalent to $0.1 per FT).

- If the price drops to $0.05 per FT, they can redeem the NFT to recover the full 1,000 USDC, and the corresponding FT tokens will be burned.

- Conversely, if the price rises to $0.5 per FT, they can unwrap the NFT to sell for 5,000 USDC, but the put option right is lost at that point.

This mechanism reassures holders that their assets can always be recovered at their original value. Additionally, the NFT containing the FT tokens is transferable, meaning the redemption right can be freely bought and sold between parties.

As a result, the FT market is divided into two layers:

- Guaranteed Layer (NFT-FT) - Safe, with capital redemption rights.

- Open Layer (Regular FT) - No PUT rights, higher speculation.

=> This is also an extremely clever factor that Andre Cronje has brought to Flying Tulip. The "safety" of the Perpetual Put mechanism is expected to be the key factor attracting large capital inflows from the community.

However, this investor protection mechanism also creates liquidity risks for the protocol. This will be further clarified by the Whale Market team below.

How Will Flying Tulip Utilize Revenue?

Cash Flow from Backing Assets

After understanding the capital raising mechanism, here's how Flying Tulip will utilize its revenue.

With an estimated annual profit of approximately 4.427%, this revenue stream will be used by Flying Tulip as follows:

First Call: Ecosystem Development Budget (E)

- The entire yield is prioritized for the ecosystem budget, covering: salaries, marketing, infrastructure, operations, and other ecosystem development expenses.

- There is no specific percentage allocation for each category; the E budget is variable, depending on actual needs (Example: from $0-40Myear or more). If the yield is insufficient for E, there will be no surplus.

Surplus Yield (Y) → 100% for Buyback and Burn FT

- This portion is 100% used to buy back FT on the open market and burn them, increasing token scarcity.

- Buybacks from this yield DO NOT trigger unlocks for Foundation/Team/Ecosystem/Incentives (unlike revenue from DeFi activities).

Cash Flow from Flying Tulip

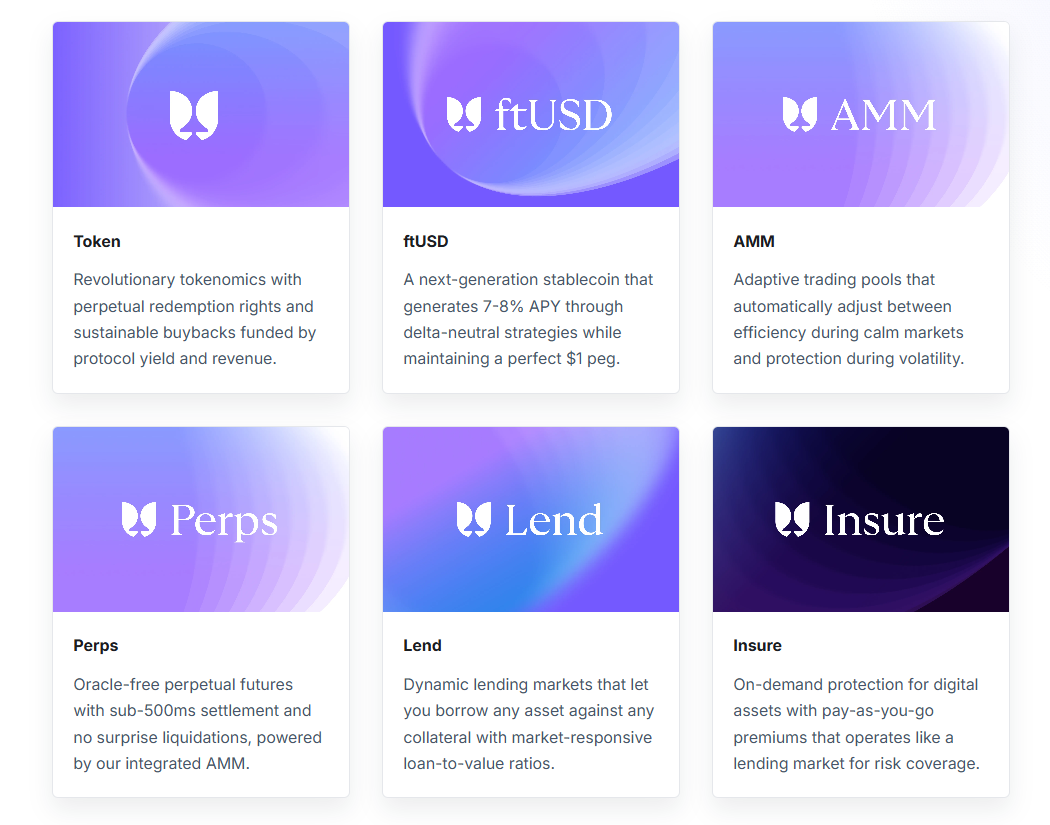

In addition to yield from backing assets, Flying Tulip features an all-in-one DeFi ecosystem that includes spot trading, perpetuals, lending, stablecoin ftUSD, and more—all operating on a single platform.

100% of revenue is used for buyback and burn FT. According to the project's financial design, all profits generated after token buybacks are distributed in fixed proportions:

- 40% to the foundation fund

- 20% to the development team

- 20% for ecosystem expansion

- 20% for community rewards

Each allocation comes with a corresponding token burn action, ensuring that the total circulating supply does not increase despite revenue growth. This means that for every token issued to these groups, an equivalent amount is permanently burned at the same time.

As a result, the total circulating supply of FT remains constant, while revenue continues to be redistributed to maintain development incentives.

=> The development team does not receive pre-launch token allocations but only earns FT through the protocol's genuine profits.

This aligns protocol development directly with the development team's benefits, creating a natural incentive to work effectively.

How Flying Tulip Creates Value for Holders/Users

With these two cash flow utilization methods, Flying Tulip establishes the following mechanisms to create value for FT:

- Buyback and Burn Mechanism: Excess yield and released principal capital (when investors withdraw FT or exercise the put option) will be used to buy back FT on the market and burn them, reducing the circulating supply. With a fixed maximum supply of $10B FT (minted only based on actual capital raised, no inflation), reducing supply creates scarcity pressure, supporting price appreciation over time.

- Price Appreciation Potential from Holding: Investors can hold FT to wait for price increases driven by buybacks, while having downside protection (redeeming original capital if FT price is at or below $0.1).

- For Initial Investors: Downside protection through the perpetual put option, uniform purchase price ($0.1/FT), and upside potential from buybacks.

- For External Users: They can use withdrawn FT to participate in DeFi opportunities on the platform, such as trading, lending, or earning from various products. The project can use a portion of indirect yield (through ecosystem budget) and directly 20% of product fees for incentives. This encourages external users to utilize the DeFi system to generate revenue, which in turn supports buybacks and FT price appreciation.

Is Flying Tulip Truly Perfect? What Are the Risks?

If you look at the description above, it seems that all investors need to do is "buy, hold, and chill." However, since it's a community fundraising model, not all investors will behave the same way.

This creates several systemic risks for Flying Tulip, as everything in the project operates in a tightly interconnected manner.

Risks from the Perpetual Put

Because investors are protected by the natural floor price of $0.1/FT and can WITHDRAW CAPITAL AT ANY TIME, this also creates invisible pressure on the entire Flying Tulip system.

If a crowd panic event occurs, everyone simultaneously exercising their PUT rights could cause temporary liquidity shortages when most backing assets are generating yield.

More critically, if Flying Tulip chooses native staking (like staking ETH without using liquid staking providers like Lido), withdrawing ETH could take from several hours to up to 16 days.

This could create panic psychology similar to bank runs that traditional banks face in conventional markets.

One thing users should note: If you participate using AVAX, ETH, SOL, or BTC, you will receive the exact same amount of those tokens back upon withdrawal.

Example: If you deposit AVAX, you will receive AVAX back, regardless of how the AVAX price changes.

Dependence on Interest Rates

The main driver for Flying Tulip to sustain operations and attract users to their DeFi ecosystem heavily depends on the estimated ~4% annual yield.

This yield is subject to many factors:

- Investors do not withdraw too much capital from FT.

- The DeFi market, particularly the prices of tokens like ETH, SOL, and AVAX, do not decline too sharply.

- Funding rates are also a critical factor as they directly impact the yield of USDe or even ftUSD. Bear markets are not favorable environments for these models due to negative funding rates.

A NEGATIVE LOOP can be triggered with:

Low yield → Low team benefits → Low ecosystem incentives → Low revenue from Flying Tulip → Simultaneously reduced buybacks for FT → Low value for FT holders → Increased likelihood of investors exercising PUT rights → Even lower yield again.

This can be considered a "death spiral" loop for the project, and it originates solely from the yield not performing as projected.

Risks from Related Projects

In addition to risks from the project's own model, the tight integration with other projects in its ecosystem also creates a systemic threat:

- DeFi/smart contract hack risks from lending protocols like Aave.

- Depegging/legal risks from stablecoins like USDe, USDT, USDC.

Any issues related to liquidity risks or third parties will erode investor confidence and lead to mass withdrawals.

And when capital is completely withdrawn, the negative loop, which Whale Market mentioned above will be triggered, resulting in massive losses for the project.

The project may not "collapse," but it will become unattractive in the eyes of investors and limp along in survival mode.

Conclusion

The above is a complete analysis of the Flying Tulip project - Andre Cronje's latest comeback. The innovation and efforts to address weaknesses by the team are undeniable. However, Flying Tulip's model also carries significant risks that users must acknowledge.

I hope this article has helped readers better understand Flying Tulip, enabling them to develop appropriate strategies when participating in the project's capital raise.

FAQs

Q1. What is Flying Tulip and who created it?

Flying Tulip is a new DeFi project by Andre Cronje (founder of Yearn Finance and Sonic) built on a real yield model, generating genuine profits from protocol activities.

Q2. How does the Perpetual Put model work?

Each FT token is wrapped in an NFT that allows holders to redeem their initial capital anytime. Once unwrapped for trading, the redemption right expires.

Q3. How does Flying Tulip generate profits?

It aims to raise $1B in assets (BTC, ETH, SOL, AVAX, stablecoins) and deploys them into low-risk DeFi strategies like Aave or staking, targeting around 4.4% annual yield for ecosystem growth and FT buybacks.

Q4. What benefits do FT holders get?

Holders enjoy price support through buybacks and burn, plus downside protection via the redemption right, creating long-term value stability.

Q5. What are the main risks?

Potential risks include liquidity stress during mass withdrawals, dependence on DeFi yield rates, and third-party protocol vulnerabilities (e.g., Aave or stablecoin issues).

Q6. What is $FT pre-market price?

Currently, $FT is listing upcoming on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300M in volume, no middlemen, trustless and on-chain.

Q7. What is the price of FT token today?

While $FT hasn't been listed yet, users can trade $FT pre-market on Whales Market before the TGE. Here you can trade $FT before the asset gets listed on leading CEXes like Binance, Bybit or OKX.