Even though edgeX generates revenue four times higher than Lighter and nearly on par with Aster, Polymarket still prices only about a 40% probability that its FDV will exceed $2B within the first 24 hours after launch.

edgeX Overview

edgeX is a perpetual DEX built on StarkEx ZK-rollup architecture, designed to deliver fast, stable, and low-cost trading. The platform matches orders off-chain and submits only cryptographic proofs to Ethereum. This approach reduces network load while maintaining transparency and full asset control for users.

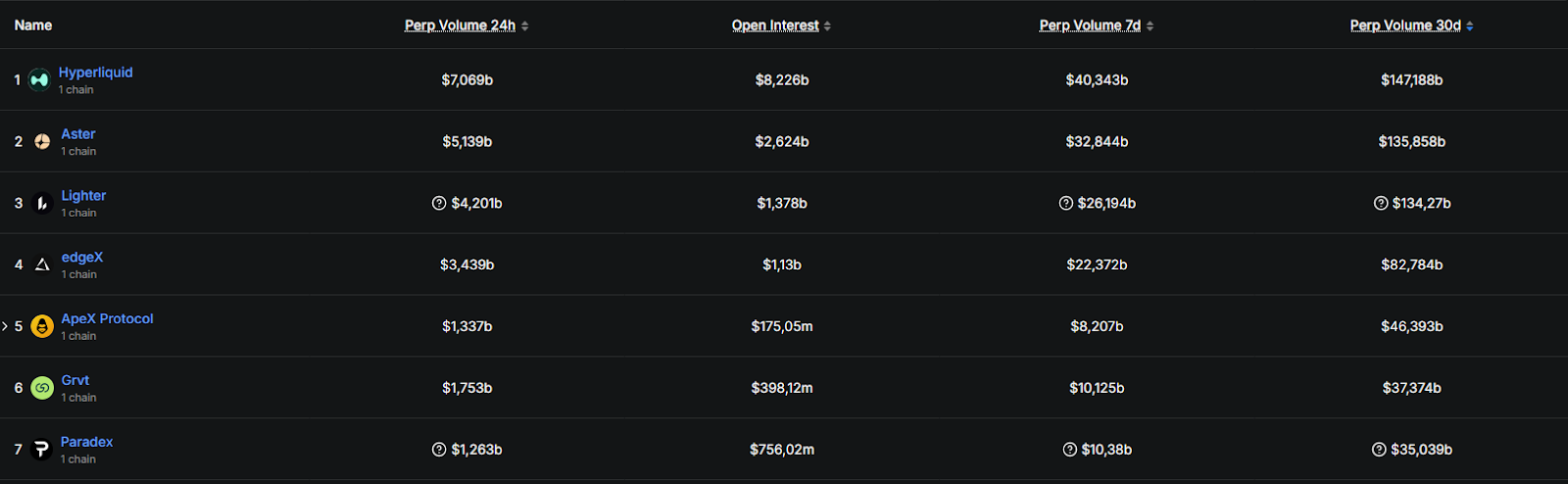

Despite increasing competition among perp DEXs, edgeX has shown clear traction in activity metrics. According to 30-day data from DefiLlama, as of January 13, 2026, the platform currently ranks fourth in trading volume, an important signal when assessing real demand ahead of listing.

As edgeX enters the Pre-TGE phase, also known as Season 2, this period becomes a key observation window before launch. User activity and liquidity flows during this phase help the market form early expectations around the token.

At this point, the question is no longer whether edgeX will attract attention after launch. The real question is which valuation level will be reflected on day one.

What will edgeX FDV be one day after launch?

To answer this realistically, edgeX needs to be viewed through direct comparison with Perp DEXs that already have tokens on the market, rather than relying solely on expectations or narrative-driven assumptions.

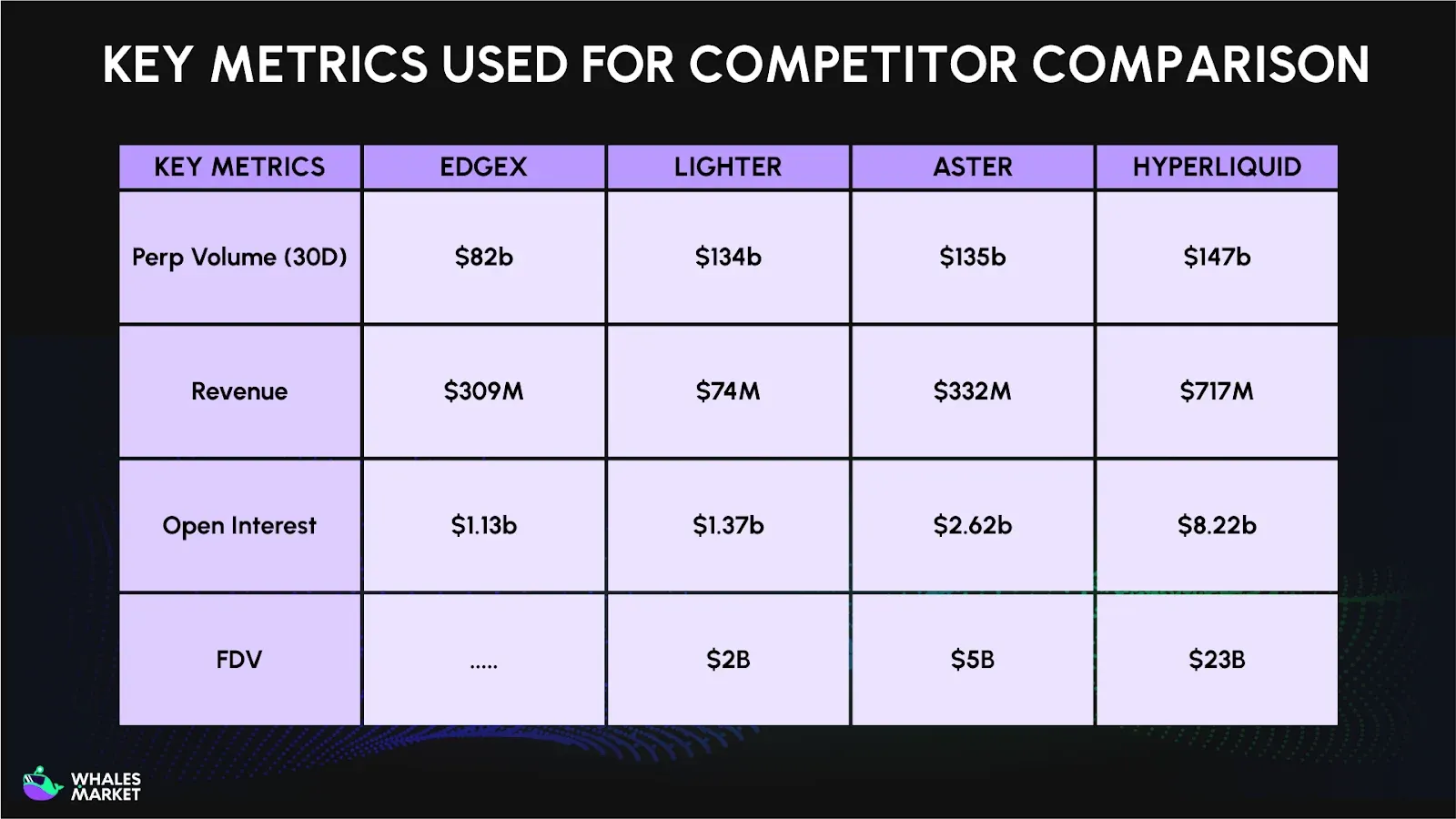

Key metrics used for competitor comparison

When edgeX is evaluated using familiar valuation metrics within the perp DEX sector, the picture becomes clearer.

Based on current data, edgeX is slightly behind Hyperliquid, Lighter, and Aster in terms of 30-day trading volume and Open Interest. However, when looking at annualized revenue, edgeX outperforms Lighter and ranks below Aster and Hyperliquid. This suggests stronger cash flow generation relative to its current scale.

This distinction matters because post-launch FDV often reflects expectations around revenue scalability, not just early hype.

If edgeX is assumed to be valued around a $2B FDV, several comparisons stand out clearly:

- At the same FDV level as Lighter, edgeX generates four times more revenue.

- Compared to Aster, edgeX has nearly equal revenue, while its FDV would be only about 40%.

- Compared to Hyperliquid, edgeX generates lower revenue, but the assumed FDV would be only around one tenth.

Put differently, using the Price-to-Sales (P/S) ratio, a standard valuation metric for assessing how efficiently revenue supports valuation, edgeX appears structurally undervalued.

Each $1 of FDV at edgeX currently generates more revenue than comparable tokenized Perp DEXs, despite those peers already being priced by the market.

Applying competitor valuation multiples to edgeX makes this even clearer:

- If edgeX were valued using Aster’s multiples, a reasonable FDV range would be around $4–5B.

- Using Lighter’s multiples, FDV could be meaningfully higher than $2B.

- Hyperliquid represents a very optimistic scenario and is unlikely to be reflected immediately after TGE.

These figures do not imply that edgeX will reach such FDV levels right at launch. They do show, however, that around $2B is a relatively easy level to justify based on current revenue generation. In a more optimistic market environment, $3–4B is not out of the question.

Polymarket Odds Analysis

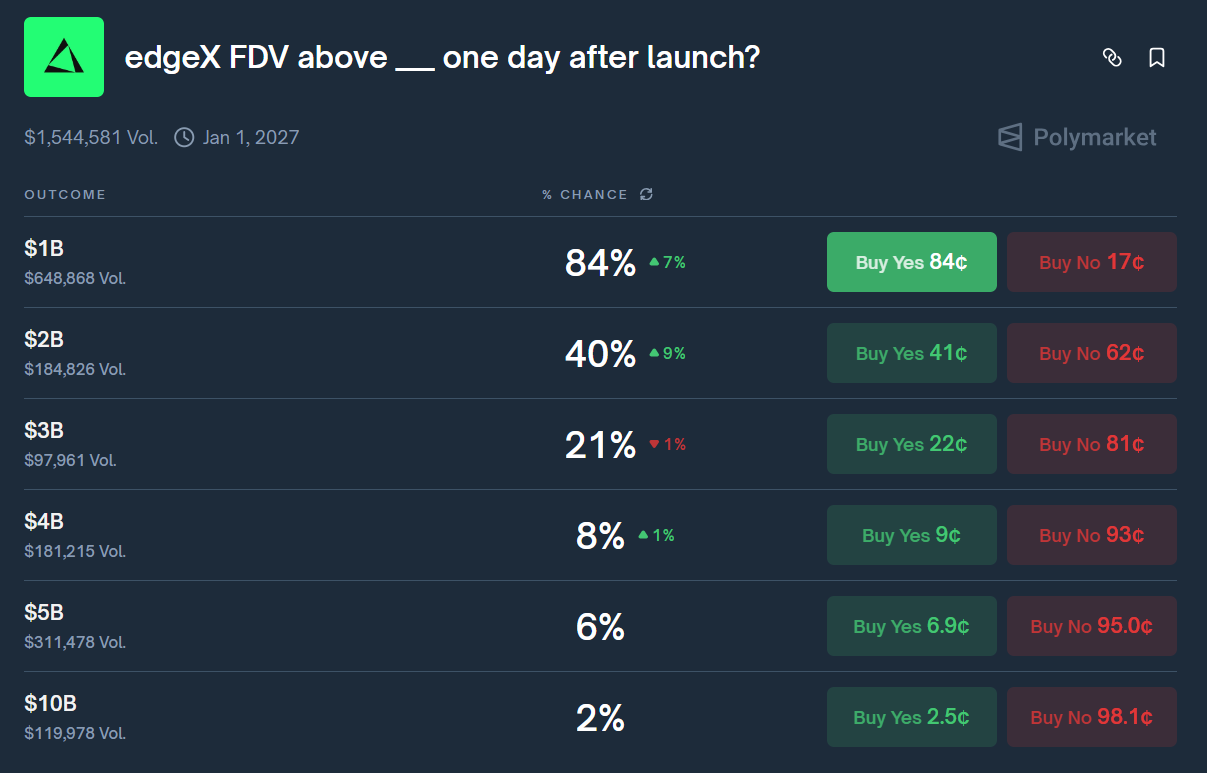

Based on the “edgeX FDV above ___ one day after launch?” market on Polymarket, several important signals can be derived from how different FDV thresholds are currently being priced.

At the moment, as of January 13, 2026, the market shows strong consensus around lower FDV levels.

- The scenario of FDV above $1B is priced at 84% and has the highest trading volume, making it the baseline expectation.

- At the $2B level, probability drops sharply to 40%, reflecting clear hesitation around this valuation zone.

- Higher thresholds are quickly discounted, with $3B at 21%, $4B at 8%, $5B at 6%, and $10B at just 2%. This indicates that the market does not expect an aggressive valuation spike on day one.

Polymarket’s conservative pricing above $3B is understandable.

- The edgeX team has not yet announced a clear revenue distribution mechanism for the token, especially regarding buybacks or explicit value accrual plans.

- Even in a scenario where buybacks exist, such catalysts are unlikely to appear immediately after TGE and are more likely to be announced later.

- In addition, first-day FDV is often heavily influenced by selling pressure from airdrop recipients and early users. Meanwhile, longer-term narratives around revenue growth take time for the market to fully absorb.

As a result, factors that could push FDV significantly higher usually do not get reflected within the first 24 hours.

In practical terms, a $1B-$2B range appears relatively safe for conservative positioning. Levels above $3B may still be considered with smaller capital allocations if there is strong belief that edgeX can support price levels, implement buybacks after TGE, and benefit from a broadly optimistic market without heavy sell-offs.

Conclusion

In the current environment, edgeX is most likely to be valued in the $1.5-2.5B FDV range immediately after its first day of listing. This range fairly reflects proven activity levels while still leaving long-term revenue potential underpriced.

Expansion into higher FDV zones will depend on post-TGE tokenomics, particularly value accrual mechanisms and real capital flow reactions, rather than short-term expectations or narrative-driven hype.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any investment decisions.

FAQs

Q1. Why does high revenue not immediately translate into first-day FDV?

FDV during the first 24 hours tends to reflect market sentiment and tokenomics structure rather than long-term business performance. Revenue takes time to be translated into token value, especially when value accrual mechanisms are not yet clearly defined.

Q2. How does Open Interest affect edgeX valuation after launch?

Open Interest reflects capital commitment and trader confidence in the platform. In the short term, markets often anchor valuation to OI because it signals liquidity and real usage more quickly than revenue metrics.

Q3. How does airdrop selling pressure impact first-day FDV?

Airdrop recipients and early users often take profits early to realize gains. This selling pressure makes it difficult for first-day FDV to fully reflect long-term potential, even when operational metrics are strong.

Q4. What role does tokenomics play in expanding FDV after TGE?

Tokenomics determines whether revenue actually flows back to support token value. Without clear buyback, staking yield, or value accumulation mechanisms, FDV tends to remain conservative in the early stages.

Q5. What does Polymarket reflect differently from on-chain data analysis?

Polymarket reflects short-term trader expectations and is heavily influenced by risk perception and defensive sentiment. On-chain data highlights platform potential but requires time for the market to fully price in.

Q6. When could edgeX be re-rated above its initial valuation range?

Re-rating typically occurs after the market observes sustainable revenue flows, stable tokenomics, and positive liquidity reactions post-TGE. This is a gradual process and rarely happens on the first day of listing.