The race to secure the newest tokens before their official launch - the TGE, which is one of the most high-stakes forms of premarket crypto. This crucial window, where investors engage in trading pre-market crypto assets or track crypto pre-market prices, is fundamentally split between two different models: Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs), like Whales Market.

While both offer premarket crypto opportunities, the underlying mechanics, risks, and benefits are vastly different. For sophisticated traders and those who prioritize self-custody, the DEX model offers a superior, trustless path to early asset acquisition.

What Are CEXs and DEXs?

Centralized Exchanges (CEXs)

CEXs are the traditional, user-friendly crypto trading platforms run by a single company or entity. They serve as intermediaries, offering high liquidity, fast transactions, and a robust range of financial services like futures trading, staking, and easy access to convert fiat currency (like USD) into crypto.

The core trade-off for a CEX is custodial risk: while they are easy to use, you must trust the exchange to safeguard your assets, making them vulnerable to hacks or insolvency events.

Key Features of CEXs:

- High Liquidity: Deep order books ensure you can execute large trades quickly with low slippage.

- User-Friendly: Designed with simple interfaces, making them the top choice for beginners.

- Full Service: Offer extra features such as margin trading, staking, and fiat on/off-ramps.

- Custodial risk: Users trust the exchange to protect their assets, but these funds remain at risk of hacks or financial failure.

Decentralized Exchanges (DEXs)

DEXs operate directly on blockchain technology, enabling peer-to-peer (P2P) trading without the need for any central company or intermediary. Their primary focus is on autonomy and transparency.

The key benefit of a DEX is self-custody: you maintain full control of your private keys and your assets. However, they typically require more technical knowledge to use and are exposed to risks related to the underlying smart contract code.

Key Features of DEXs:

- Self-Custody: Users maintain ownership of their private keys, removing the risks associated with third-party custody.

- Transparency: All transactions are publicly recorded on the blockchain, promoting full accountability.

- Decentralization: Functions independently of any central authority, minimizing the potential for censorship or control.

- Technical Barriers: Demands greater technical knowledge and familiarity with blockchain systems.

The Core Mechanism: CEXs vs. DEXs premarket

The biggest difference between these models lies in how a premarket crypto trade is secured.

Centralized Exchanges (CEX) Pre-Market

The CEX model relies on custody and trust.

- Custodial Model: The CEX acts as the central intermediary and custodian. Both the buyer's funds and the seller's collateral are held in the exchange's private, centralized wallet.

- The Risk: If the exchange is hacked, subject to regulatory freezing, or mismanaged (the "not your keys, not your coins" risk), your funds and collateral are at risk. You are completely reliant on the CEX's security and solvency.

- Asset Focus: CEX pre-market often focuses narrowly on tokens earned through their own launchpad programs.

Decentralized Exchanges (DEX) Pre-Market (Whales Market Model)

The DEX pre-market model, as implemented by Whales Market, is trustless, non-custodial, and transparent.

- Smart Contract Escrow: All funds and collateral are locked in audited, on-chain smart contracts. The exchange never holds your assets.

- Security by Code: The trade is guaranteed by immutable code, not by a company’s promise.

- OTC Pre Market Replacement: Whales Market replaces the risks of traditional OTC pre-market deals by ensuring every transaction is secured and settled automatically on-chain.

- Broader Asset Access: DEX pre-markets like Whales Market can list pre-TGE tokens, vested tokens, providing deeper crypto pre-market exposure.

Accessibility and KYC Requirements

Access to premarket crypto is another major differentiator.

For a true crypto native, the anonymity and control offered by the DEX are key. Knowing you can access pre-market info and execute trades without sacrificing privacy makes the DEX the preferred gateway.

Transparency, Price Discovery, and Market Info

DEXs provide open access to crypto pre-market prices, making every trade verifiable on-chain.

- DEX Transparency: Every fund lock, collateral deposit, and settlement is visible on the blockchain.

- CEX Opacity: Prices and trades occur off-chain and depend on internal reporting.

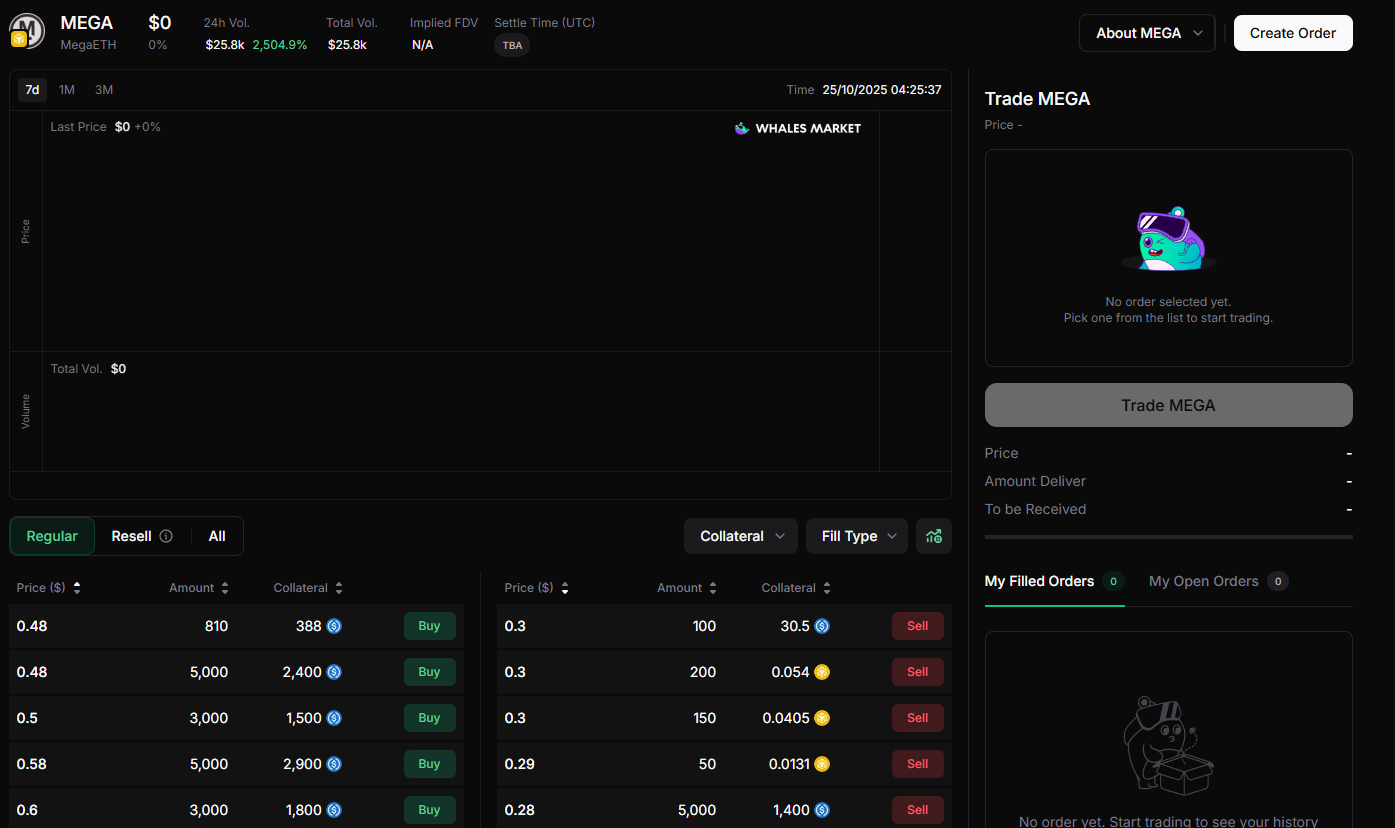

- Price Discovery: On Whales Market, crypto pre-market prices emerge organically from global buyer-seller interactions, which is a more accurate reflection of market sentiment than centralized pricing models.

The Whales Market Advantage: A Decentralized Approach for Early Crypto Exposure

Whales Market is the leading premarket crypto DEX platform, facilitating pre-TGE trading and token allocation swaps with over $300M in on-chain volume.

Built to solve the trust, custody, and fraud risks of centralized and OTC pre-market systems, Whales Market’s infrastructure is powered entirely by audited smart contracts across multiple blockchains, including Solana, EVM, Bitcoin, Starknet, and Aptos.

- Security by Code: Your capital and collateral are protected by immutable smart contract code, not by relying on the security or solvency of a central corporation.

- Capital Protection: Collateral ensures sellers deliver or forfeit funds to buyers.

- Multi-Chain Access: Seamless trading across major networks.

- Non-Custodial: When trading tokens before an official launch or TGE, you maintain full control of your private keys and assets throughout the process.

- Ecosystem Incentives: Stake $WHALES for trading fee discounts and earn from the referral program, rewarding users who bring liquidity and new traders.

- Comprehensive Dashboard: Manage orders, view settlements, and monitor pre-market activity in real time.

Conclusion

For serious investors seeking early crypto exposure, Whales Market is currently the optimal choice because it uniquely combines the high-reward potential of pre-market speculation with the superior security of a DEX. While CEX pre-markets restrict access and force users to relinquish control of their funds, Whales Market offers unparalleled access to a wide array of upcoming projects while maintaining the non-custodial, permissionless environment that is the hallmark of secure decentralized finance.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What is the biggest risk of CEX pre-market trading?

The biggest risk is custodial risk. Your funds are held by the centralized exchange, making them vulnerable to exchange hacks, solvency issues, or regulatory freezes, putting your premarket crypto assets at risk.

How does Whales Market minimize risk for pre-market trading?

All funds are held in non-custodial smart contract escrow. Sellers must post collateral, ensuring buyer protection during crypto pre-market trades.

Can I get better pre-market info on a DEX or a CEX?

DEXs like Whales Market provide transparent, on-chain data, giving you real-time insights into liquidity, activity, and crypto pre-market prices.

Does pre-market investing require KYC on a DEX?

No. Whales Market operates entirely permissionless. Simply connect your wallet to start trading securely in premarket crypto assets.