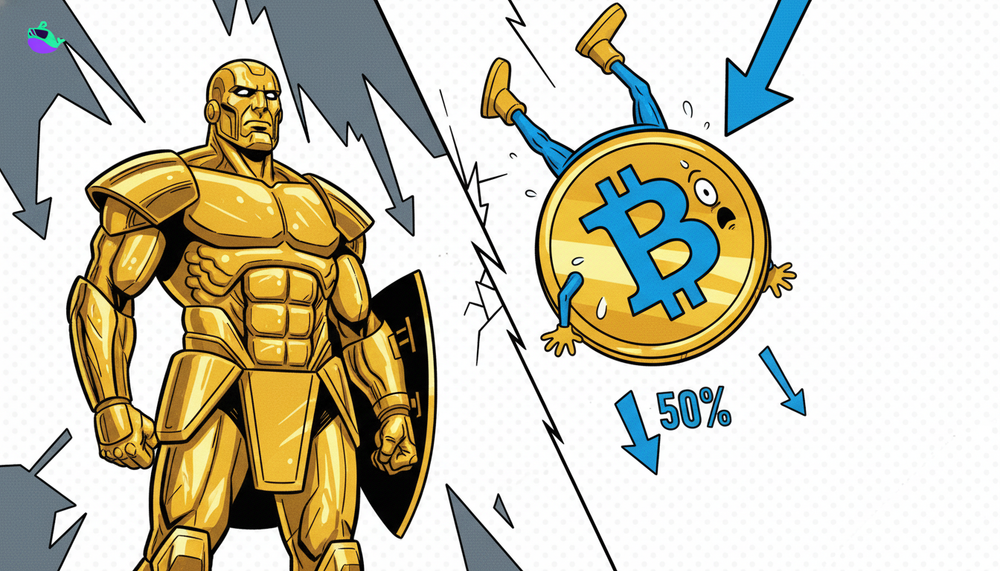

The Bitcoin-to-gold ratio, which represents the number of gold ounces needed to purchase one Bitcoin, has experienced a significant decline, settling around 20 ounces per BTC. This is half the value of approximately 40 ounces recorded in December 2024.

This adjustment doesn't indicate a decrease in Bitcoin demand, but instead reflects the unique macroeconomic environment of 2025, where gold has outperformed the cryptocurrency in terms of asset performance.

Gold's Ascendancy as a Store of Value in 2025

In 2025, gold emerged as the premier choice for global value preservation, demonstrating a year-to-date growth of 63% and surpassing the $4,000/ounce mark for the first time in the fourth quarter. Remarkably, this surge occurred despite persistent tight monetary conditions.

Throughout much of the year, interest rates in the United States remained elevated, with the Federal Reserve only initiating rate cuts in September. Ordinarily, this environment would exert pressure on non-yielding assets like gold. However, gold's strong performance indicates a structural shift in market demand.

Central banks played a pivotal role in this trend. The total gold purchased by the official global sector reached 254 tons by October, with the National Bank of Poland leading the way by adding 83 tons to its reserves. Concurrently, global ETF holdings of gold increased by 397 tons in the first half of 2025, reaching a record 3,932 tons in November. This represents a complete reversal of the outflow trend observed in 2023.

Inflows into gold persisted despite an average real yield of 1.8% in developed markets during the second quarter, a period when gold still rose by 23%, indicating that gold has decoupled from its traditional inverse relationship with yields.

Increased instability further bolstered gold's appeal. The average VIX volatility index reached 18.2 in 2025, up from 14.3 the previous year, while geopolitical risk indices rose by 34% year-over-year. Gold's stock beta fell to -0.12, the lowest level since 2008, confirming its role in hedging risk and long term asset allocation. Consequently, amidst tight U.S. financial conditions and delayed easing policies, gold served not only as an inflation hedge but also as "insurance" for entire investment portfolios in 2025.

Bitcoin's Relative Underperformance

Bitcoin still experienced impressive growth in 2025, reaching six figures for the first time and benefiting from investment inflows into spot Bitcoin ETFs. However, compared to gold, Bitcoin's performance was weaker due to softened demand in the latter half of the year.

Spot Bitcoin ETFs began the year with strong momentum, with total assets under management (AUM) increasing from $120 billion in January to a peak of $152 billion in July 2025. Afterwards, AUM gradually decreased to approximately $112 billion over the next five months, reflecting capital outflows due to price corrections and slower new capital raising. This contrasted with the consistent inflows into gold ETFs during the same period.

On-chain data also revealed substantial distribution activity. According to Glassnode, long-term holders (LTH) realized profits exceeding $1 billion per day (7-day average) for most of July, marking one of the largest profit-taking periods on record. While realized profits decreased in August, selling activity surged towards the end of the year.

In October alone, long-term holders sold approximately 300,000 BTC, valued at $33 billion, representing the largest distribution since December 2024. As a result, the BTC supply held by this group decreased from 14.8 million on July 18 to approximately 14.3 million at the time of publication.

High real yields for much of 2025 increased the opportunity cost of holding Bitcoin, while Bitcoin's correlation with the stock market remained high. In contrast, gold benefited from safe-haven demand and central bank reserves. This disparity in demand regimes explains the narrowing BTC-to-gold ratio, reflecting a cyclical revaluation rather than a structural breakdown in Bitcoin's long-term investment thesis.

Bitcoin underperformed stocks significantly in Q4, opening a positive outlook for January.

FAQs

Why has the Bitcoin-to-gold ratio decreased in 2025?

The Bitcoin-to-gold ratio has decreased because gold has significantly outperformed Bitcoin in 2025 due to its role as a premier store of value amid macroeconomic uncertainty. While Bitcoin still grew, gold saw stronger demand driven by central bank purchases and ETF inflows.

What factors contributed to gold's strong performance in 2025?

Gold's strong performance in 2025 was driven by central bank buying, increased ETF holdings, and its appeal as a hedge against rising geopolitical risks and market volatility. Despite high interest rates, gold decoupled from its traditional inverse relationship with yields, acting as "insurance" for investment portfolios.

How did Bitcoin ETFs perform in 2025, and how did that impact Bitcoin's price?

Spot Bitcoin ETFs started strong in 2025, but experienced AUM decreases in the latter half of the year due to price corrections and slower new capital raising. This softened demand contributed to Bitcoin's relative underperformance compared to gold, even though Bitcoin reached six figures.

You've got the context, now make it count. Capitalize on your newfound knowledge and explore the opportunities available on Discover the top crypto premarket platform Whales Market.