Based has quickly emerged as one of the most discussed builder projects on Hyperliquid, driven by strong early revenue, a broad product suite, and growing expectations around its upcoming token launch.

As speculation builds ahead of TGE, a key question for traders and investors is how the market will price Based shortly after launch, particularly in the context of current market conditions and comparable projects.

Based Overview

Based Definition

Based is a comprehensive DeFi platform focused on trading, prediction markets, and real world crypto spending. With the slogan Trade Everything, Spend Everywhere, the project aims to build a Super App by integrating 24/7 perpetual and spot crypto trading together with prediction markets into a single product.

Beyond being a trading platform, Based offers a wide range of products, including

- Based Core: This is the core platform of Based One, operating as a trading frontend on Hyperliquid. It allows users to access fast and secure trading tools across multiple channels such as web, mobile apps, desktop, and even Telegram.

- Based Cloud: Launched in 08/2025, this tool enables users to choose designs such as logos, colors, and layouts, add features like custom trading fees or plugin integrations, and deploy immediately.

- Based App Store: Launched in 09/2025, this product allows users to use or customize these tools flexibly, while builders share revenue from fees, enabling personalized trading experiences without writing code.

- Based Streams: Launched in 10/2025, this is the first livestreaming platform integrated directly on Hyperliquid.

- Based Cards: This feature allows users to load crypto onto virtual or physical Visa cards and spend at more than 90M merchants worldwide without being tied to the traditional banking system.

Based Current Performance

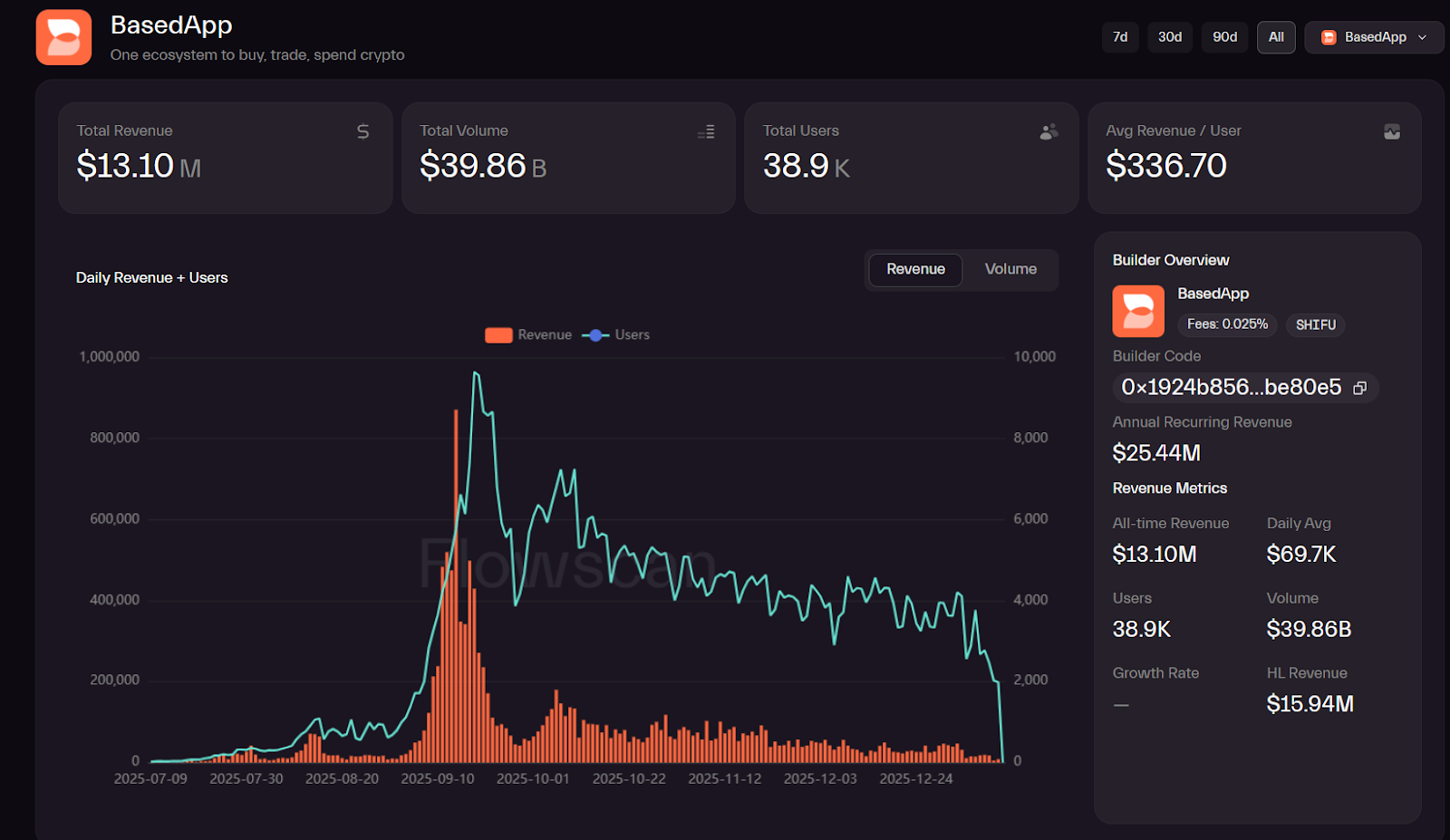

Before moving to valuation, it is important to assess the project’s overall health. Based was previously the number one project by revenue among builder codes on Hyperliquid. As of 12/1/2026, it ranks second, with the top position held by Phantom Wallet.

Despite this, Based still shows several impressive metrics:

- Total lifetime revenue stands at $13.9M.

- Total lifetime trading volume is $39.82B.

Based’s volume, revenue, and fees only surged strongly during September and October 2025, peaking at $1.8B in daily volume on 14/9. From October 2025 onward, both volume and user activity declined steadily.

This trend can be explained by several factors:

- In 09/2025, Based received a strategic investment from Ethena Labs, the protocol behind USDe. The investment was described as million dollar sized. At that time, Ethena was heavily FOMO driven, with USDe TVL exceeding $6B, which likely acted as a catalyst for users joining Based to farm airdrops.

- October 2025 also marked the start of Phase 2 of Lighter’s Point Campaign, the most FOMO intensive phase of that project. This likely caused some traders to shift capital away from Based toward Lighter to farm airdrops.

- Aster’s successful TGE, supported by CZ and accompanied by point farming programs, was another contributing factor.

- The Blackswan event on 10/10 significantly impacted the broader market, making capital more selective. With limited backing from major VCs or large institutions, it is understandable why traders preferred trading on perp DEXs perceived as better capitalized.

- Additionally, on 6/10/2025, Based ended Season 1 and transitioned into Season 2 of its airdrop program. From a psychological perspective, the lack of a Season 1 airdrop while moving into Season 2 may have caused frustration, with some users viewing it as excessive fee extraction. This likely contributed to the sustained decline in volume from October 2025 onward.

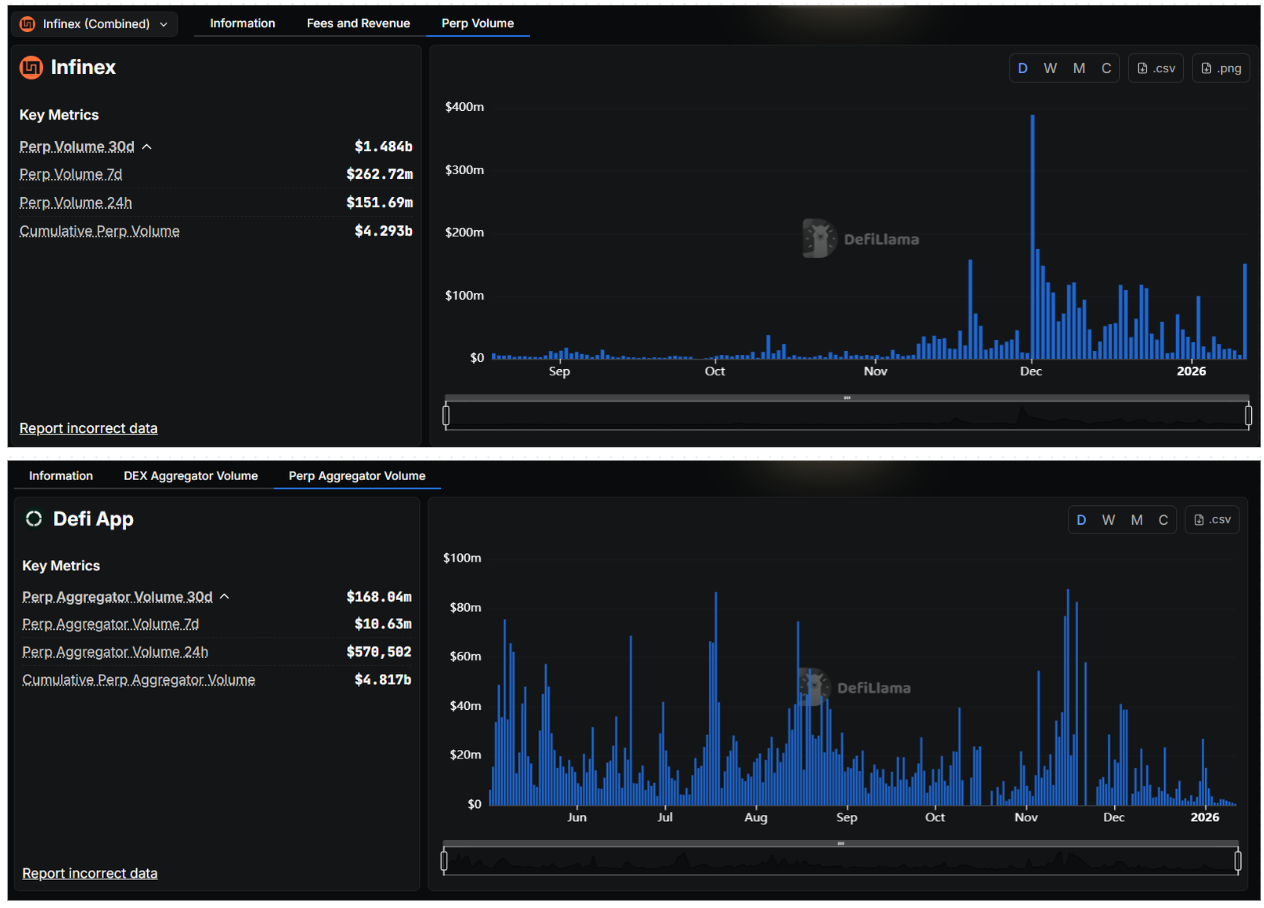

Overall, Based shares a similar operating model, product lineup, and strategic direction with many existing projects such as Phantom, MetaMask, Infinex, and DeFi App…

- These projects all offer mobile apps to improve onboarding and user experience.

- They integrate features such as perpetual and spot trading and prediction markets.

- They operate as self-custodial wallets with DeFi integrations.

- Both MetaMask and Based issue physical cards that allow direct crypto payments.

All of these projects are moving toward the long discussed vision of a super app or super interface, which only truly began to materialize in 2025 as liquidity layers matured with the emergence of Hyperliquid.

What will Based’s FDV be one day after launch?

What is a reasonable valuation for Based?

Selling pressure at TGE is inevitable due to XP from Season 1 and Gold from Season 2. However, since tokenomics have not yet been announced, users currently lack sufficient data for deeper evaluation. Once tokenomics are disclosed, odds on Polymarket are likely to shift.

From a branding perspective, Based clearly cannot be compared to MetaMask or Phantom. The project also lacks backing from major investment funds. As a result, despite similarities in business models, the market position and accumulated fees of MetaMask and Phantom create a significant gap that Based cannot easily close.

Therefore, Infinex and DeFi App are more reasonable comparables. This comparison becomes even more convincing when considering that Based’s metrics as of 12/1/2026 are not particularly strong.

- In terms of volume, revenue, and product diversity, Based outperforms both Infinex and DeFi App. It is also currently the second highest revenue generating builder on Hyperliquid, trailing only Phantom.

- Based’s main weakness lies in funding. Infinex has raised over $65M, while DeFi App raised $6M.

Given the current bear market and extremely low liquidity, an FDV range of $200M to $300M appears realistic and reasonable for Based.

One factor that could alter this valuation is the disclosure of the exact size of Ethena Labs’ strategic investment. If the figure is large enough, market expectations and Polymarket odds could shift.

If not, an FDV range of $200M to $300M one day after launch remains the most reasonable scenario.

Polymarket Odds Analysis

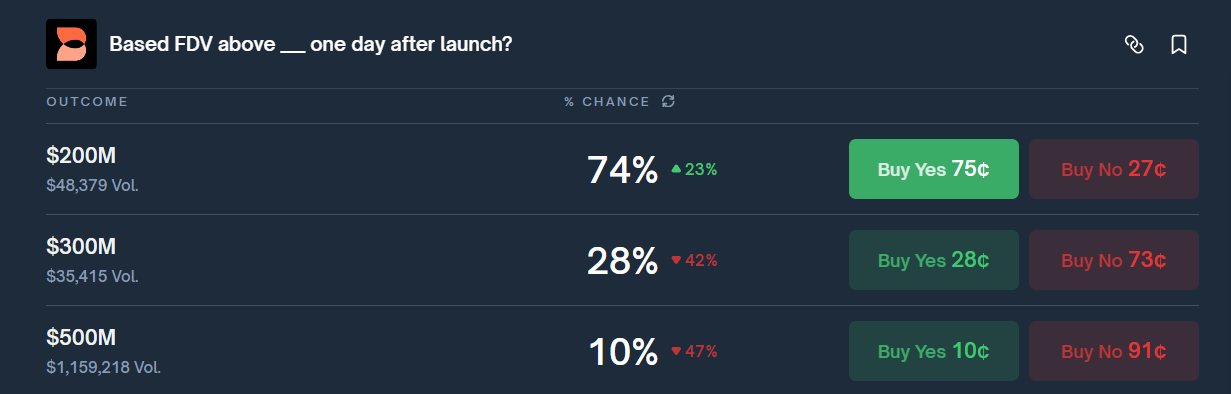

Polymarket currently reflects a valuation framework that aligns closely with the analysis above:

- Above $200M is considered reasonable, with the market pricing a 74% probability. This offers the clearest risk to reward profile among all options.

- Above $300M is a more sensitive range, as it depends on airdrop allocation and listing strategy. Buying NO above $300M offers similar ROI to YES above $200M but with higher risk, making YES above $200M the preferable choice. Traders seeking additional exposure may consider a small position in YES above $300M as a hedge.

- Above $500M remains a high threshold, especially given the presence of an airdrop at TGE.

Valuations above $800M are extremely unlikely given current metrics and would only occur under two scenarios:

- The market enters a euphoric phase where projects list at irrational valuations supported by abundant liquidity.

- Based deliberately lists at a high valuation to manipulate Polymarket outcomes.

This is highly unlikely, as listing at an inflated valuation would result in immediate losses for the project due to airdrop dumping at an unsustainably high FDV.

Buying NO as a hedge in this scenario is also not particularly attractive due to the extremely low probability. Participation, if any, should be treated as lottery sized exposure due to very high risk.

Proposed Strategy

- YES above $200M as the primary position.

- YES above $300M with a small size as a hedge.

- If FDV exceeds $300M, traders may profit from both positions.

Conclusion

Considering product strength, revenue generation, market positioning on Hyperliquid, and current market conditions, Based is a fundamentally solid project that remains constrained by the bear market, airdrop selling pressure, and undisclosed tokenomics. Expecting an excessively high valuation immediately after TGE is unrealistic.

As a result, a reasonable FDV for Based one day after launch falls within the $200M to $300M range. Valuations above $300M should be treated as lower probability upside scenarios and approached primarily as hedge opportunities.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What is Based Price Prediction on Polymarket?

Based Price Prediction on Polymarket refers to market driven probabilities on Based’s FDV after launch, reflecting trader expectations rather than fixed forecasts.

Q2. Why is Polymarket useful for Based price prediction?

Polymarket aggregates real capital bets, making it a useful tool to gauge consensus sentiment and risk appetite around Based’s post launch valuation.

Q3. What factors most influence Based price prediction?

Key factors include market liquidity, airdrop selling pressure, tokenomics disclosure, comparable project valuations, and overall market conditions.

Q4. Is Based Price Prediction reliable in a bear market?

In a bear market, price predictions tend to be more conservative, with lower upside expectations and stronger focus on realistic valuation ranges.

Q5. How should traders use Based Price Prediction data?

Traders should use price prediction data as a reference for probability and risk management, not as guaranteed outcomes.