Aztec's public sale concluded with an implied FDV of approximately $400M-$410M, which is 15-50 times lower than zkSync or Starknet at their TGE. The project has taken a distinctly different approach by not providing a community airdrop, which removes one variable from the FDV equation at TGE.

The biggest question now is: Where will AZTEC's FDV close one day after TGE, and which bets on Polymarket are mispriced?

Aztec Overview

Aztec Definition

Aztec is a Layer 2 using zkRollup, focused on "programmable privacy," allowing developers to write smart contracts that can execute publicly while also supporting functions that hide sensitive data, all while inheriting full security from Ethereum.

Aztec's architecture is a hybrid public-private ZK Rollup where:

- Private transactions are encrypted, aggregated into a single zk proof, and then submitted to Ethereum.

- This approach significantly reduces gas fees compared to L1, while opening up many use cases that public L2s struggle to serve, from payroll and private DeFi to identity and enterprise payments.

Aztec's long-term goal is to become the private execution layer for Web3, where developers can write private smart contracts while remaining compatible with the existing EVM ecosystem.

Aztec Funding & Public Sale

According to CryptoRank, Aztec has raised a total of $117M across two main funding rounds:

- Series A: $17M, led by Paradigm.

- Series B: $100M, led by a16z, along with funds like A Capital, Variant, SV Angel, and HashKey.

Additionally, the project raised funds from the community through a public token sale using an auction mechanism with an initial floor FDV of approximately $350M. Results:

- Raise: 19,476 ETH (approximately $61M at ETH price of $3,140).

- Tokens sold: 1.547B AZTEC, representing 14.95% of the total supply of 10.35B.

- Average price: approximately $0.039 to $0.04 per token. Implied FDV from sale: approximately $400M to $410M.

"We're decentralized because we need to be."@Zac_Aztec on why programmable privacy meant building Aztec from scratch.

— Aztec (@aztecnetwork) January 9, 2026

Full episode from @epicenterbtc👇https://t.co/SHsWlHxQha

What will Aztec's FDV be one day after TGE?

Selling pressure at TGE

Aztec's tokenomics are designed to minimize short-term sell pressure. Below is the allocation structure and lock/unlock status for each group:

| Group | % of Total Supply | Status at TGE |

|---|---|---|

| Public sale | 14.95% (1.547B AZTEC) | Circulating immediately |

| Uniswap V4 LP pool | 2.64% (273M AZTEC) | Initial on-chain liquidity |

| Sequencer/Prover rewards | ~0.3% (~30M AZTEC) | 100% of accumulated rewards become transferable immediately when TGE triggers |

| Investors / early supporters | ~27.26% | 1-year lock, gradual vest over next 2 years. No staking/governance in first year |

| Team / Foundation | Long-term similar | Long-term lock, does not create significant float in early phase |

Potential float in the early phase will be approximately 18% of total supply, primarily from public sale, LP pool, and rewards.

Another important point:

- Aztec has confirmed there will be no retro airdrop for users before TGE.

- Token distribution is entirely through public sale, staking, and rewards. This means the project's selling pressure at TGE will be less than many L2 projects in 2024.

With $61M raised for 1.547B tokens, the average sale price is approximately $0.039-$0.04 per token. Multiplying by the total supply of 10.35B gives an FDV of approximately $400M-$410M.

Therefore, most of the short-term float has a cost basis of approximately $0.04(not airdrop "cost = 0"), and profit-taking behavior will be different from past Layer 2 projects like Starknet or zkSync:

| FDV Day +1 | FDV Day 1 vs Sale Price | Expected Behavior |

|---|---|---|

| < $300M | Loss of approximately 25%+ | Buyers are at a loss; loss-cutting behavior will be very unpredictable as beliefs and actions differ across Aztec investors |

| $300M–$400M | Slight discount to at-cost | Fluctuation of ±10% to 15% around cost basis |

| $400M–$600M | Light profit to approximately 1.5x | Base case, natural trading range; profit-taking pressure will exist |

| $600M–$800M | 1.5x to 2x | Psychological profit-taking ceiling for most holders; public sale participants begin to realize decent profits in a bear market |

Generally, as long as FDV is above $400M, regardless of how much, it will create profit-taking selling pressure to prioritize holding cash in a market that is currently unstable in terms of macroeconomics and geopolitics.

Additionally, the value of infra projects like Aztec also needs time to prove itself, the market needs to enter a maturation phase, and upsizing through capital inflows based solely on narratives, fundraising amounts, and project backers is now nearly obsolete and out of meta.

FDV Comparison with Other ZK L2s

Below is a comparison table of L2s using ZK-Rollup technology at launch:

| Project | Launch Time | Total Supply | FDV at Listing | FDV After Adjustment |

|---|---|---|---|---|

| Starknet (STRK) | 02/2024 | 10B tokens | $22B to $35B (peak) | "Reasonable" range approximately $20B–$22B |

| zkSync (ZK) | 06/2024 | 21B tokens | approximately $6.5B | Decreased to $4B–$6B |

| Aztec (AZTEC) | approximately 02/2026 | 10.35B tokens | approximately $400M–$410M (sale) | Not yet launched |

Aztec's sale FDV of approximately $400M is about 15 times lower than zkSync and about 50 times lower than Starknet, despite sharing the same zk/L2 narrative.

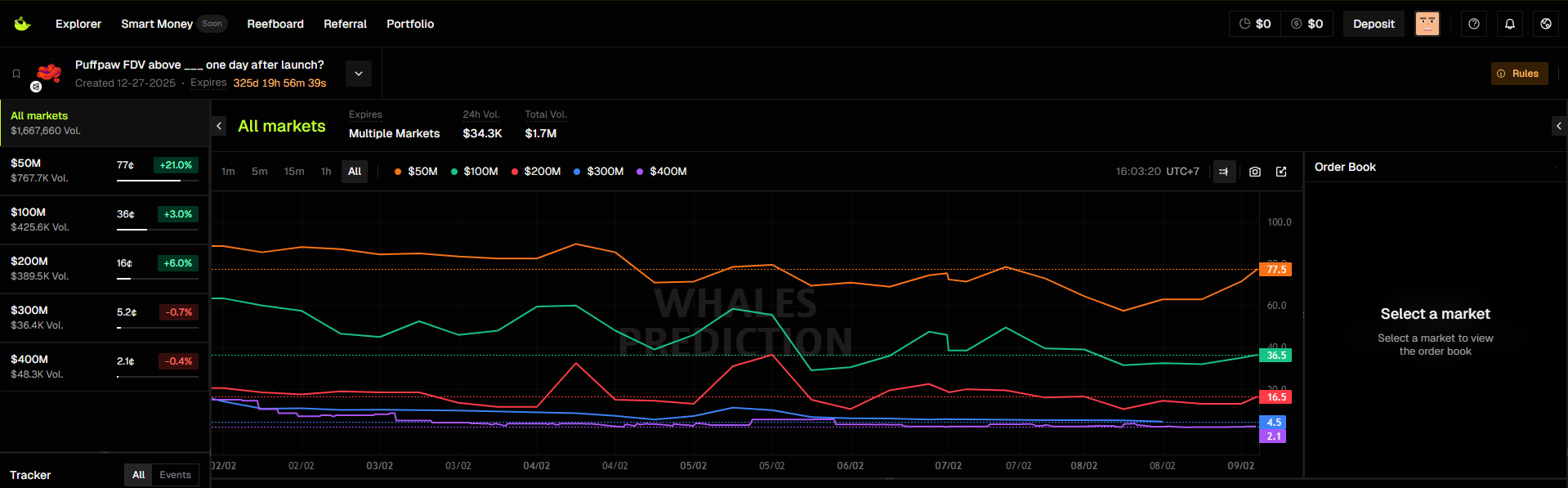

Polymarket Odds Analysis

Data from the "Aztec FDV above ___ one day after launch?" event on Whales Prediction shows that the market's current expectations are quite pessimistic about Aztec. The $300M threshold is only priced at 32%, meaning the majority of traders believe that FDV on day +1 could drop below $300M, significantly lower than the sale FDV of $400M.

This discrepancy and pessimism is heavily influenced by:

- Market conditions as Bitcoin just had a rapid decline to the $60K mark.

- Sentiment about Layer 2 due to Vitalik's recent statements that L2s are no longer very important to Ethereum.

- Aztec's ecosystem and value capture model for token holders is still not very clear, making the incentive to hold tokens limited for investors. Therefore, if TGE is above the sale FDV there will be profit-taking pressure, if below, many investors will likely cut losses (relatively speaking).

Are these odds reasonable?

With a base case of $300M to $600M based on the analysis above, subjective probabilities can be estimated for each threshold and compared with market prices:

| FDV Threshold | Polymarket Odds (Yes) | Estimated Probability | Difference |

|---|---|---|---|

| $150M | 81% | ~100% | ~+19% |

| $300M | 32% | ~80% | ~+48% |

| $500M | 11% | ~35% – 45% | ~+24% to +34% |

| $800M | 7% | ~10% – 15% | ~+3% to +8% |

| $1B | 2% | ~5% – 10% | ~+3% to +8% |

| $1.5B | 1% | < 2% | ~flat |

| $2B | 1% | < 1% | ~flat |

The two thresholds with the largest discrepancies are $300M and $500M.

- At $300M, the market is only pricing 34% while the reasonable probability could be up to approximately 80%, a difference of nearly 46 percentage points.

- At $500M, the discrepancy is also significant: 9% vs 35% to 45%.

Logic behind this:

- Sale FDV is already $400M.

- The no-airdrop structure and long VC lock mean short-term sell pressure is lower than normal.

- Most holders have a clear cost basis of approximately $0.04, so selling pressure below cost still has many unknowns.

Trading strategy for Aztec FDV prediction market

Based on odds analysis and token structure, here are positions to consider:

- Yes > $150M: For a project that raised over $200M with a Privacy narrative, having an FDV below $150M is relatively low, making this strategy a bet with good R:R, with stable profit and low risk.

- Yes > $300M: Yes price is only approximately $0.32 (implied 32%), while the probability of FDV exceeding $300M is estimated at around 80%. This is the threshold with the biggest edge. With sale FDV already at $400M and a "clean" supply structure, for FDV to drop below $300M would require heavy FUD, major technical errors, or a macro crash. Risk is not too high, reward is very stable, suitable as a main position.

- Yes > $500M: Yes price is only approximately $0.10 (implied 11%), but if FDV lands in the upper half of the $300M to $600M range or touches the $600M to $800M zone, the actual probability could be 35% to 45%. This is where risk-reward is most attractive. This is a position where you can go small volume, prioritize high risk but in return the profit is also extremely high. Especially when the market can bounce after a sharp decline.

Avoid thresholds Yes > $800M / > $1B / $1.5B and $2B. For FDV to close day +1 above $1.5B to $2B with a sale FDV of $400M, the market would need a mini super-cycle specifically for Aztec. The actual probability is very low, not worth the risk unless you accept near-total loss.

Sentiment about Aztec FDV

The community is divided into two distinct viewpoints.

The bullish camp believes that a sale FDV of approximately $400M is "cheap" when compared to Starknet/zkSync, which reached $6B to $20B in the early phase, and the token structure with no airdrop and long VC lock is the "cleanest" among L2s in 2025 to 2026.

The bearish camp emphasizes the risk of "no product/revenue yet": The ecosystem does not yet have many flagship applications, actual revenue is still limited, so an FDV of $400M to $600M is still quite a high pricing if looking purely at revenue multiples. Additionally, not providing an airdrop means a portion of old users do not own tokens, which may weaken community strength in the early phase.

This polarization explains why Polymarket odds for the $300M and $500M thresholds are at 32% and 11%, with the market lacking clear consensus.

Conclusion

Aztec enters TGE with a sale FDV of approximately $400M to $410M, initial float of approximately 18% of total supply, no retro airdrop, and VC/team locked for at least 1 year. Compared to Starknet (FDV $20B to $22B) and zkSync (FDV $6.5B at listing), the valuation is much lower but comes with the risk that the ecosystem is still in a very early phase.

Within a reasonable range of $300M to $600M for day +1 FDV, Polymarket odds are significantly underpricing at thresholds of $150M and $300M (32%). This is an opportunity to build a Yes betting strategy with positive EV, while keeping sizing small for thresholds above $500M (11%) as a supplementary tail bull bet.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. What makes Aztec price prediction different from other Layer 2 launches?

Aztec’s price prediction is unique because it launched without a retroactive airdrop and with long investor lockups, resulting in a cleaner initial supply and more predictable early-stage selling behavior.

Q2. How does Aztec’s sale FDV affect short-term price expectations?

Since most circulating tokens have a clear cost basis around $0.04, Aztec price prediction depends heavily on whether FDV trades above or below the $400M sale valuation, which directly impacts profit-taking dynamics.

Q3. Can Aztec’s privacy narrative justify a higher valuation?

Aztec’s focus on programmable privacy may support a higher long-term valuation, but short-term price prediction still depends on market sentiment, macro conditions, and adoption progress rather than narrative alone.

Q4. Is Aztec price prediction more sensitive to market downturns?

Yes. As an infrastructure project without immediate revenue dominance, Aztec’s price prediction is more sensitive to broader crypto market volatility, especially during the early post-TGE period.

Q5. How reliable are prediction markets for Aztec price prediction?

Prediction markets reflect crowd sentiment rather than fundamentals. Large discrepancies between implied odds and estimated probabilities suggest potential mispricing, but outcomes still depend on real trading behavior after TGE.

Q6. What factors could invalidate current Aztec price prediction models?

Unexpected technical issues, regulatory shocks, macro crashes, or sudden shifts in Ethereum Layer 2 narratives could significantly alter Aztec’s short-term price trajectory.