Crypto has spent years trying to make DeFi feel practical for everyday users. Neobanks - One of the clearest paths toward that goal because they package core financial actions into a simple interface, then connect it to real-world payment rails through cards and bank-like accounts

This article rounds up the most notable crypto neobank projects today and breaks down what actually matters: custody model, card reach, yields, fees, and whether stablecoins can truly work for everyday spending

Neobank Overview

Neobank is a digital-first banking provider that delivers financial services through apps and websites, rather than through a network of physical branches. Customers open accounts, verify their identity, move money, and manage day-to-day banking entirely online.

Most neobanks start with core banking basics like checking or current accounts, savings tools, cards, transfers, bill payments, and budgeting. It then expands into lending, wealth products (including investing or crypto access in some markets), and small business features like invoicing, expense management, and multi-user accounts.

What sets neobanks apart is the operating model: fewer branches and more automation can lower costs, speed up onboarding, and enable simpler pricing with fewer fees. Depending on regulation, some neobanks are fully licensed banks, while others partner with licensed banks to hold deposits and provide regulated services.

Learn more: How Web3 Neobank works

7 Notable Neobank Projects in Crypto

Plasma One

Plasma One is a stablecoin-focused neobank platform built on the Plasma L1 blockchain, combining crypto debit cards to integrate saving, spending, depositing, and earning yield from digital dollars within a single application.

Launched in September 2025, Plasma One has seen rapid adoption, with the broader Plasma network attracting over $4B in DeFi deposits within its first day and reaching $5.69B in TVL within the first week.

Main Features:

- Self-custody stablecoin wallet: Users hold private keys and maintain full ownership of their assets.

- High yield: 10%+ APY on stablecoin balances (e.g., USDT), with interest compounding and spendable directly from the yield-bearing balance.

- Card issued by Signify Holdings, a Visa partner: Spend stablecoins directly at merchants accepting Visa in over 150 countries, with virtual cards available instantly and premium physical cards orderable in-app.

- Cashback up to 4% per transaction: Rewards paid in XPL tokens, with boosts at select partners depending on user tier.

- Instant stablecoin payments: Free global on-chain USDT transfers.

- DeFi integration: EtherFi Liquid Restaking has transferred more than $500M of ETH from its vault to Plasma, creating native liquidity for weETH. This allows Plasma to offer stablecoin-based yield strategies, such as farming or lending, with high speed and low fees. Plasma also integrates with Aave and Ethena to generate additional yield for users.

- Security and app functionality: Biometric sign-in, advanced encryption, instant card freeze/unfreeze, customizable limits, real-time alerts, and fraud monitoring.

Fees:

- No fees for stablecoin transfers or spending.

- No monthly or maintenance fees.

- No minimum deposit required, and users can spend directly from the yield-bearing balance.

- Withdrawal fees only apply if required by third-party partners, varying by region and off-ramp.

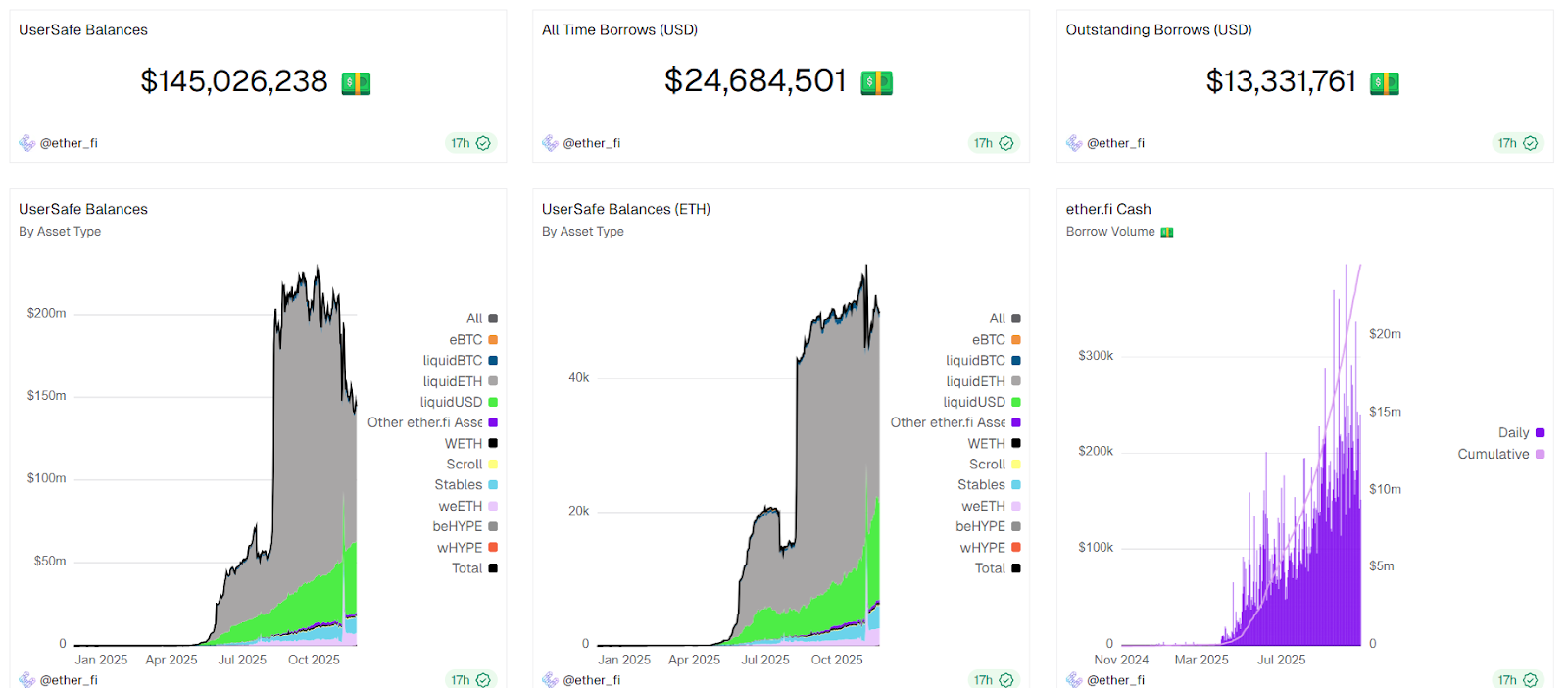

EtherFi Cash

EtherFi Cash is a self-custody crypto neobank with a Visa card, allowing users to spend, borrow, and earn on ETH, BTC, and stablecoins while maintaining full ownership of assets.

Because it is built by the EtherFi team, the largest restaking protocol by TVL, users of EtherFi Cash gain easy access to staking and restaking to generate additional returns.

Since launching in mid 2025, EtherFi Cash has become one of the widely used crypto card products on the market. The platform manages more than $145M in deposits and supports over 5,000 daily active card users. Previously, its peak asset level exceeded $222M.

Main Features:

- Visa credit card collateralized by crypto: Use crypto as collateral to borrow and spend without selling. The card works like a normal credit card but is integrated with DeFi and can be used at over 100 million locations worldwide.

- 2%-3% cashback: All transactions earn 2%-3% depending on tier (Core: 2%, Luxe: 3% at 10K points, Pinnacle: 3% at 50K points, VIP: invite-only with extras); currently 3% for all users through December 31, 2025, with some promotions reaching 20% in bonuses or yield. Additional 1% on referrals and membership points (3000 per $1000 spent).

- Spend directly from DeFi vaults while retaining yield: Users spend based on assets deployed in DeFi, with stablecoins earning around 9.8% APY.

- Self-custody: Users control assets on-chain, not via third parties.

- Automatic debt repayment using staking yield: Pay down debt with DeFi or staking rewards.

- Virtual and physical cards: Includes virtual cards (multiple per tier), physical cards supporting Apple Pay, Google Pay, and contactless payments.

- Cards for businesses or DAOs: Allows teams to use shared treasury funds as collateral, with spending controls and limits.

- Optional DeFi insurance through Nexus Mutual.

- Exclusive perks: Airport lounge access, concierge, hotel discounts up to 65%, event passes, purchase protection up to $10K, extended warranty, auto rental insurance, and baggage coverage.

Fees:

- No issuance fees and no monthly maintenance fees.

- Foreign exchange fee of 1%.

- ATM withdrawal fee of 2%.

- 0% interest during promotional periods, afterward based on DeFi borrowing rates (often low or zero).

- No inactivity fees or hidden charges.

Gnosis Pay

Gnosis Pay launched in 2023 as a self-custody payment network built on Gnosis Chain, aiming to connect traditional finance and DeFi. The project provides a Visa debit card linked directly to a Gnosis Safe Smart Account, enabling stablecoin spending like cash at more than 80 million stores globally.

Since launch, Gnosis Pay has processed over 1.9 million payments with a total volume exceeding $120M, steadily growing in transaction count and active users. The platform currently supports more than 25,000 funded addresses and averages roughly $2.5M in weekly payment volume, primarily from European users spending EURe.

Main Features:

- Visa debit card (virtual and physical): Accepted at over 80 million Visa merchants in 130+ countries, supporting Apple Pay, Google Pay, and global ATM access.

- Self-custody: Managed through Gnosis Safe, with users holding private keys and full control. Supports multi-chain usage across Gnosis Chain, Ethereum, and Polygon.

- Direct stablecoin spending: Payments using EURe, GBPe, USDCe, USDC, and EURC, with instant on/off-ramps and hidden gas fees.

- Cashback in GNO up to 5%: 1%-4% based on GNO holdings, plus 1% for owning an OG NFT, with a weekly cap.

- Personal IBAN under SEPA: Receive and send EUR bank transfers via partner Monerium, bridging traditional banks and on-chain wallets.

- DeFi compatible and business-friendly treasury flows: Connects to DeFi protocols for yield strategies, DEXs, lending (e.g., sDAI for idle capital). Supports automated payroll, scheduled deposits, and 1:1 fiat-to-stablecoin conversion.

- White-label infrastructure: For wallets/neobanks to launch branded cards via APIs (e.g., create cards in 3 API calls).

- Operating regions and compliance: Live in the EU/EEA, UK, Brazil, and expanding to Latin America (Argentina, Mexico, Colombia), APAC (Philippines, Thailand, Japan, Singapore). Complies with KYC/AML, MiCA, PSD2; cards issued by Monavate Limited (FCA-licensed, FRN 901097) on Visa network.

Fees:

- No monthly or annual card fees.

- One-time physical card issuance fee of about €30.23.

- No FX markup or standard transaction fees, though some may incur stabilization fees of around 1.5%.

- ATM withdrawals free up to five times per month, then 2% from the sixth onward.

- On-chain gas for card spending covered by Gnosis Pay.

- Free user plan has no fixed fees; Startup and Enterprise plans have custom pricing for businesses.

Coinbase One Card

Coinbase One Card is a crypto credit card from Coinbase on the American Express network, allowing spending like a normal credit card while earning up to 4% BTC back on every purchase (tiered: 2%-4% based on assets on Coinbase, capped at $10,000/month at higher tiers then 2%).

Users also get 3.5% APY on USDC (unlimited), boosted staking rewards for ETH, SOL, and others, and Amex benefits like travel protections.

Funds are custodial with Coinbase, USD deposits FDIC-insured. No annual fee (requires Coinbase One membership at ~$49.99/year). Launched in fall 2025; no public stats on users or volume.

MetaMask Card

MetaMask Card is a mastercard debit card linked directly to the MetaMask wallet, enabling self-custody spending of crypto (e.g., mUSD, wETH, USDC, USDT) anywhere Mastercard is accepted.

Funds stay in the wallet until checkout with on-chain conversion to fiat. Earn 1% cashback on virtual card or 3% on premium Metal Card (no foreign TX fees on Metal); points for every $1 spent, plus yield from aUSDC via Aave.

Perks include travel benefits, boosted yield, waived ATM fees. Available in Argentina, Brazil, Colombia, Mexico, EEA, Switzerland, UK, US (excluding NY/VT); more regions coming. No public stats on users or volume.

Gemini Credit Card

Gemini Credit Card is a crypto rewards credit card for U.S. users, processing spending in fiat but paying rewards in crypto (Bitcoin or 50+ options, changeable anytime).

Earn up to 4% on gas/transport (up to $300/month then 1%), 3% on dining, 2% on shopping, 1% on others; instant deposits. Special editions (e.g., Solana: auto-staking ~6.12% APRY on SOL rewards, XRP, Bitcoin).

No annual or foreign fees; Mastercard World Elite benefits. Rewards held 1+ year have appreciated ~277% on average (historical data to July 2025). Business version offers unlimited 1.5% BTC back. No public stats on users or volume.

THORWallet

THORWallet is a multi-chain self-custodial wallet integrated with a Swiss IBAN and virtual/physical Mastercard compatible with Apple Pay, Google Pay, and Samsung Pay in 100+ countries.

Users convert crypto to EUR, CHF, USD, or CNY and spend globally while maintaining custody until swap. Next-Gen Card (launching soon) offers zero top-up/FX/ATM fees on Pro tier, cashback based on $TITN staking, higher limits; Standard tier has 1% fees. Integrates cross-chain swaps (e.g., NEAR Intents, Stellar, Sui).

Monthly/card fees nearly zero; conversion fees reduced for Gold/Platinum (signup fees 1.5-15 ETH). No public stats on users or volume.

Bybit Card

Bybit Card is a mastercard debit card from the Bybit exchange, allowing users to spend BTC, ETH, USDT, USDC, and other assets with real-time conversion to fiat.

Available in virtual/physical forms, supports Apple/Google/Samsung Pay. Earn 2%-10% cashback (up to $150/month at 10% for select users) based on VIP tier, plus 8% APR on idle crypto via Auto-Earn.

Over 2 million cards issued as of July 2025. Free issuance/delivery, no annual fees, $100 free monthly ATM withdrawals (2% after). Not available in EEA. No public volume stats.

Neobanks are basically taking the “banking app” experience and rebuilding it with a crypto-native stack: self-custody (or hybrid custody), stablecoin rails, and cards that let users spend on-chain dollars like cash.

That said, the details matter. Some platforms lean heavily into stablecoins and “yield as default” (Plasma One), others focus on using crypto as collateral so users can spend without selling (EtherFi Cash), while solutions like Gnosis Pay push the strongest “bridge” narrative by pairing self-custody with real banking primitives such as IBAN and compliant on/off-ramps.

The broader set of cards (Coinbase, MetaMask, Gemini, Bybit, THORWallet) shows there is no single winner model yet, custodial vs self-custody, Visa vs Mastercard vs Amex or region-by-region compliance all shape adoption.

Conclusion

In the end, the neobank narrative will be decided by two things: distribution & trust.

- Distribution means getting into the daily spend loop with a card and clean UX.

- Trust means regulation, security, and reliable settlement during volatile markets.

The projects that can deliver both, while keeping fees low and yields sustainable are the ones most likely to move DeFi from “portfolio activity” to actual everyday finance.

FAQs

Q1. What makes a crypto neobank different from a regular crypto card?

A crypto neobank usually combines multiple functions in one place: a wallet, spending card, transfers, yield options, and sometimes borrowing or IBAN-style banking rails. A standalone crypto card is often just a payment layer on top of a wallet or exchange balance.

Q2. Why is self-custody a big selling point for Neobanks?

Self-custody means users control the private keys, so funds are not held directly by the card provider or a centralized exchange. This reduces platform custody risk, but it also puts more responsibility on the user to protect access.

Q3. Where does “stablecoin yield” come from, and why should users be cautious?

Yield typically comes from DeFi strategies such as lending, liquidity provisioning, or integrations with protocols that generate returns. Users should check whether the yield is sustainable, how it is generated, and what risks exist during market stress.

Q4. How can a card let users spend while keeping funds on-chain?

Most setups either route payments through a stablecoin balance, or they convert assets at the moment of purchase through an integrated swap and settlement flow. The user experience feels like normal card spending, but the backend uses crypto rails.

Q5. What is the main tradeoff between custodial and self-custody card models?

Custodial models are often simpler and can offer smoother compliance and support, but users rely on the platform to safeguard funds. Self-custody models improve user control, but can involve more complexity, network fees, and user-side security responsibility